Sanchez Energy Corp

Latest Sanchez Energy Corp News and Updates

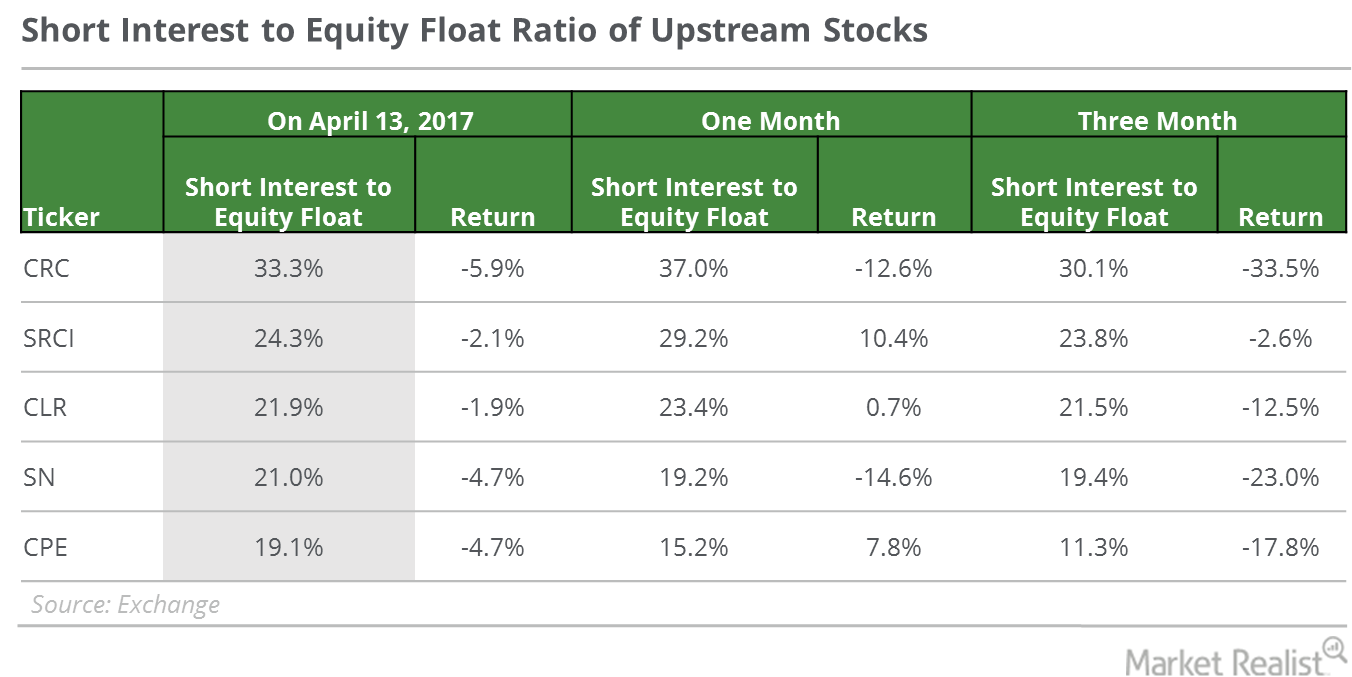

Why the Numbers Look Bearish for These Upstream Stocks

All these upstream companies have seen the short interest in their stocks rise—an potential indication of market skepticism in these companies’ abilities to profit from oil’s recent gains.

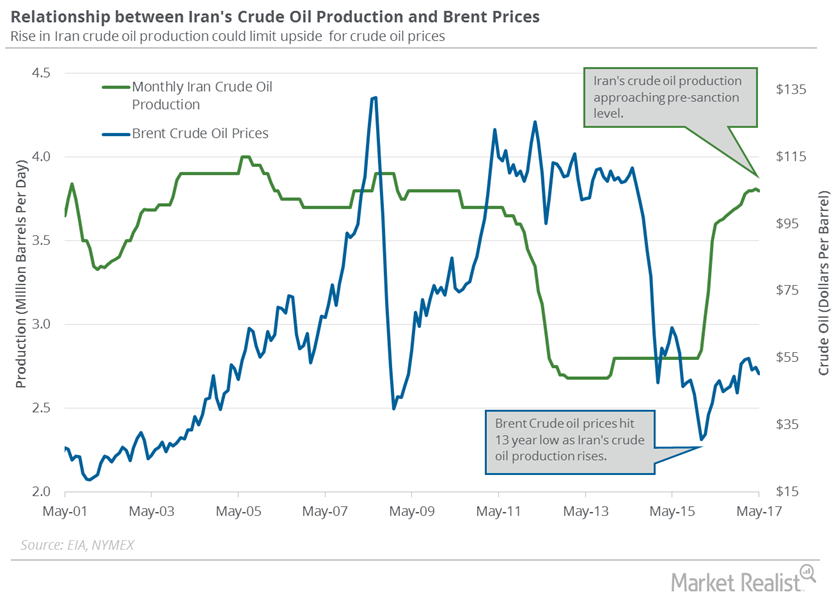

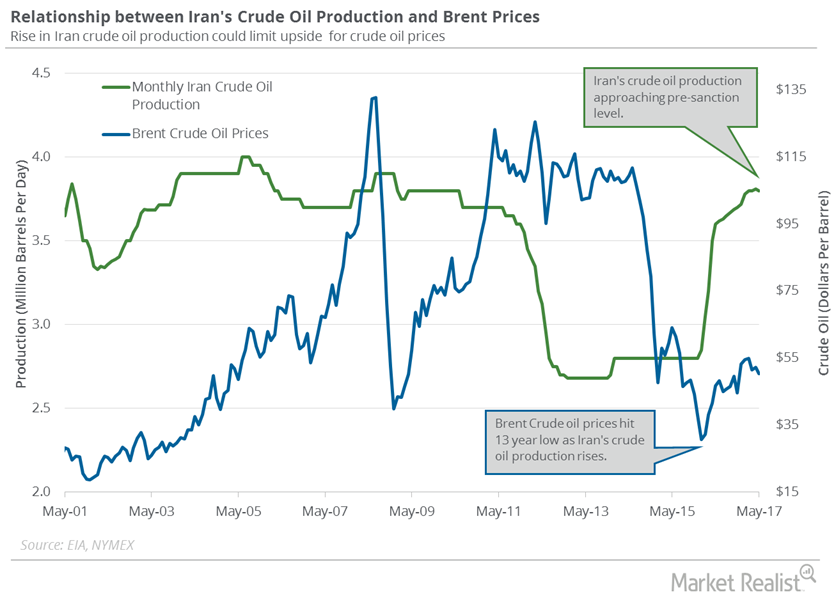

Iran’s Crude Oil Exports Could Impact Crude Oil Prices

The rise in crude oil export capacity suggests that Iran’s getting ready for a massive increase in crude oil production in 2018.

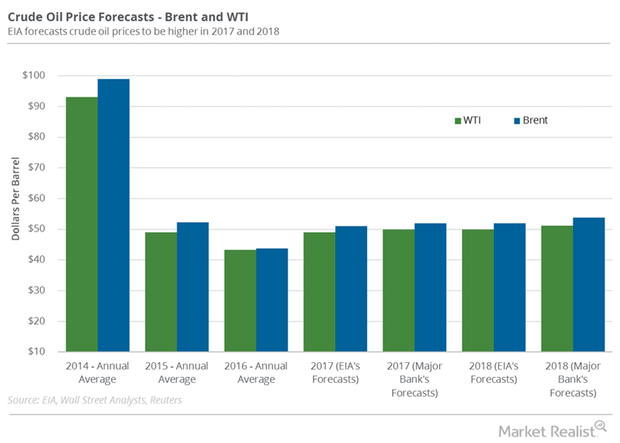

Crude Oil: Price Forecasts and Hedge Funds’ Position

Hedge funds increased their net long positions in US crude oil futures and options by 43,861 contracts or 18.4% to 282,362 contracts on July 25–August 1.

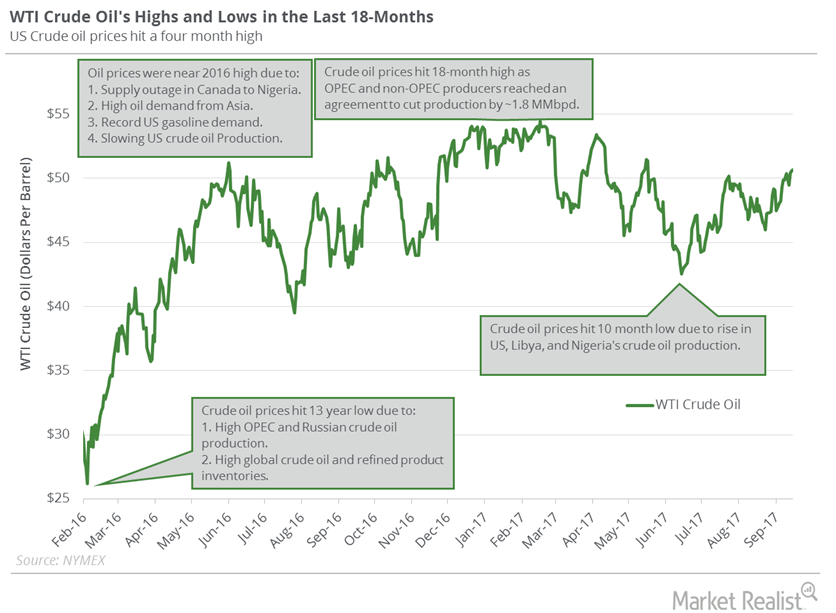

Will US Crude Oil Futures Fall from 4-Month Highs?

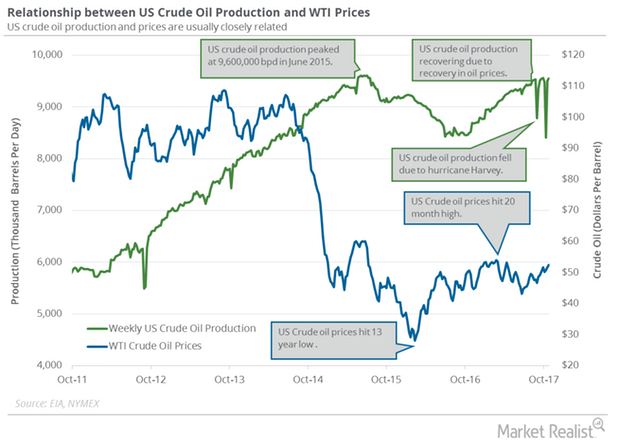

WTI (West Texas Intermediate) crude oil (RYE) (VDE) futures hit $26.21 per barrel on February 11, 2016—the lowest level in more than a decade.

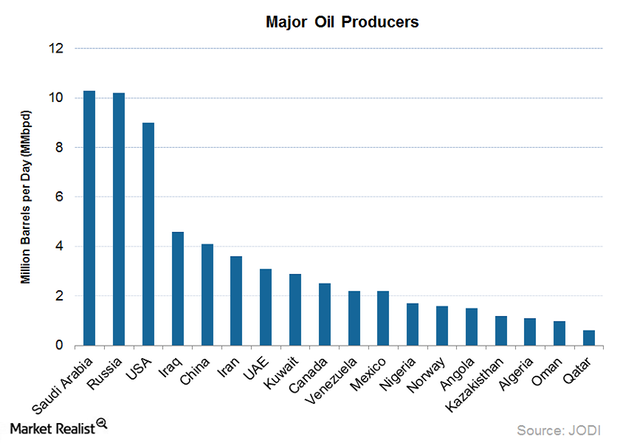

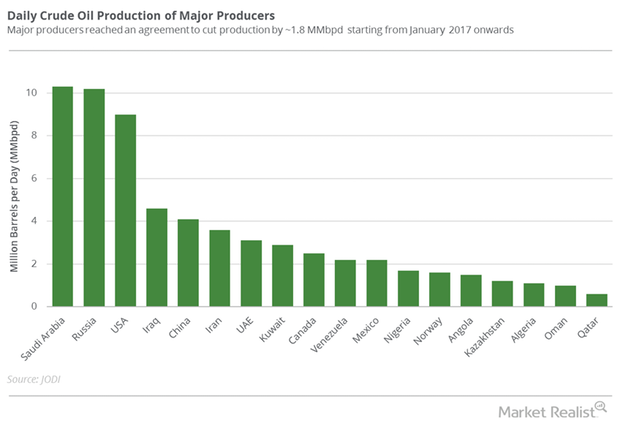

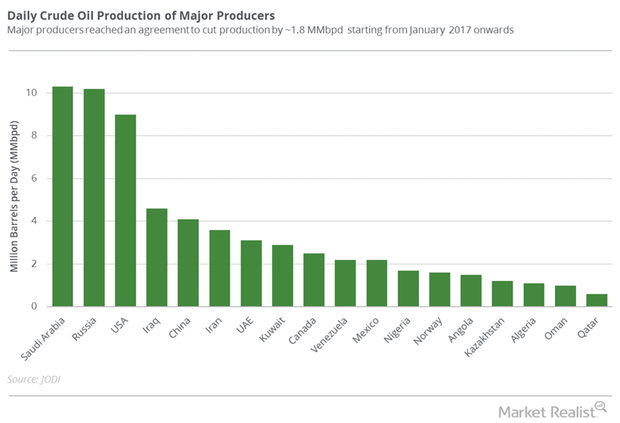

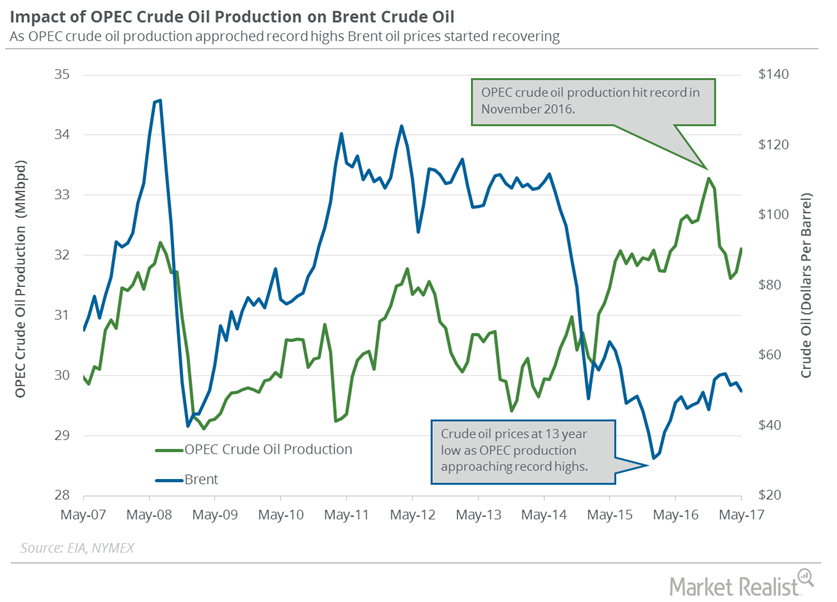

How OPEC and Non-OPEC Producers Affect Crude Oil Prices

Crude oil (BNO) (PXI) (USL) (USO) (UCO) prices were up ~4% between December 7, 2016, and December 19, 2016.

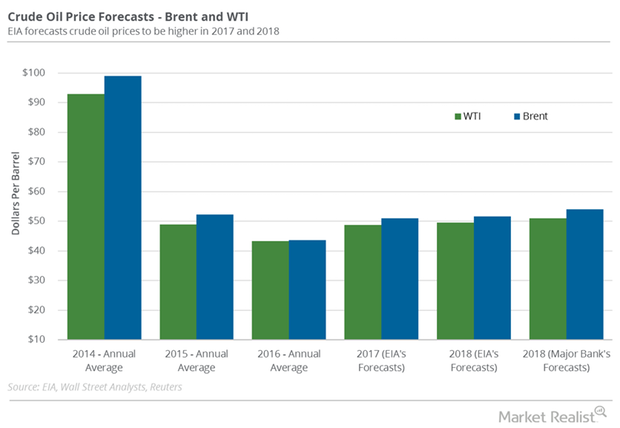

Will Brent and US Crude Oil Prices Rise in 2018?

November US crude oil (DWT)(UWT)(USO) futures are above their 20-day, 50-day, and 100-day moving averages at $49.25, $48.77, and $48.11 per barrel as of September 25.

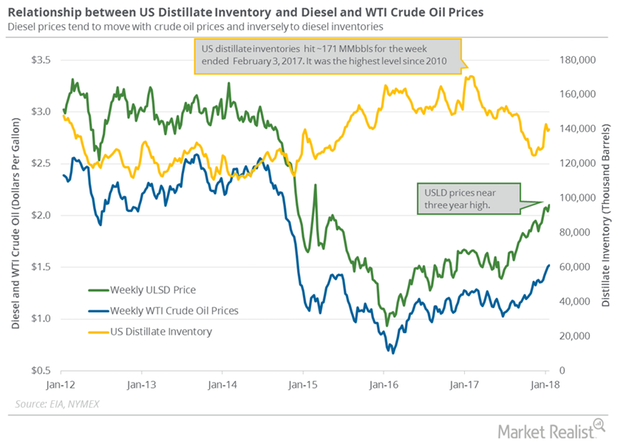

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

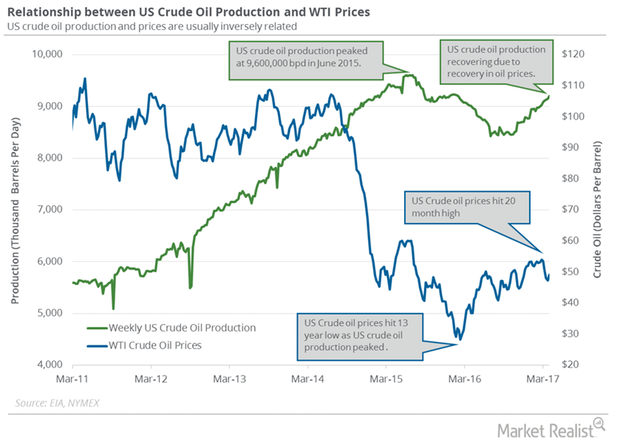

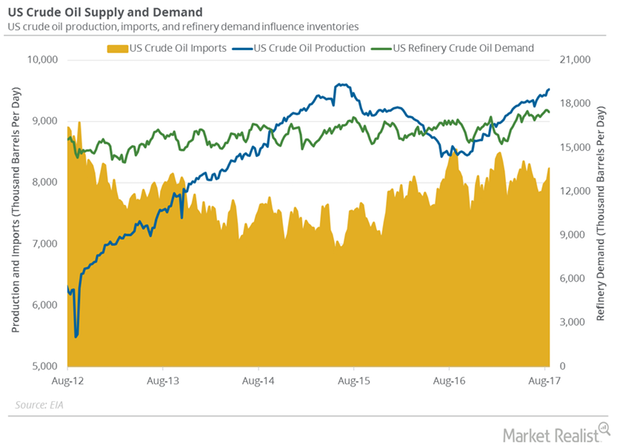

Why US Crude Oil Output Hit a High from January 2016

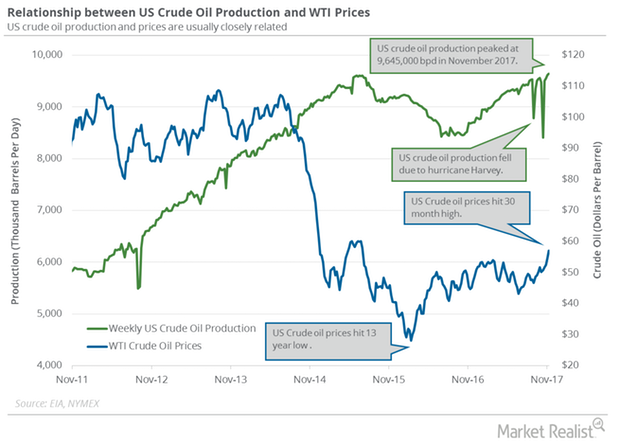

US crude oil output is at the highest level since January 25, 2016. The rise in crude oil output is the biggest bearish driver for crude oil prices in 2017.

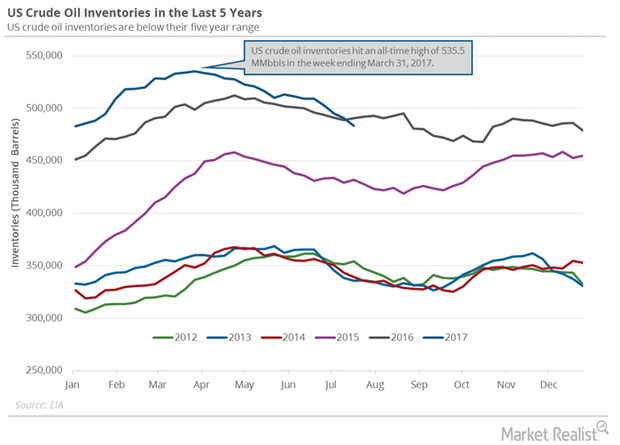

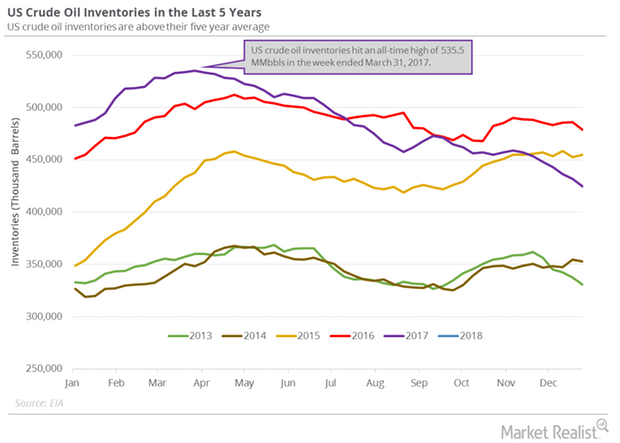

US Crude Oil Inventories Fell below the 5-Year Average

The EIA reported that US crude oil inventories fell by 7.2 MMbbls to 483.4 MMbbls on July 14–21, 2017. Inventories fell below the five-year range.

Will the OPEC and Non-OPEC Meeting Drive Crude Oil Futures?

September WTI (West Texas Intermediate) crude oil (RYE) (VDE) (UCO) futures contracts rose 1.1% to $49.58 per barrel on August 4, 2017.

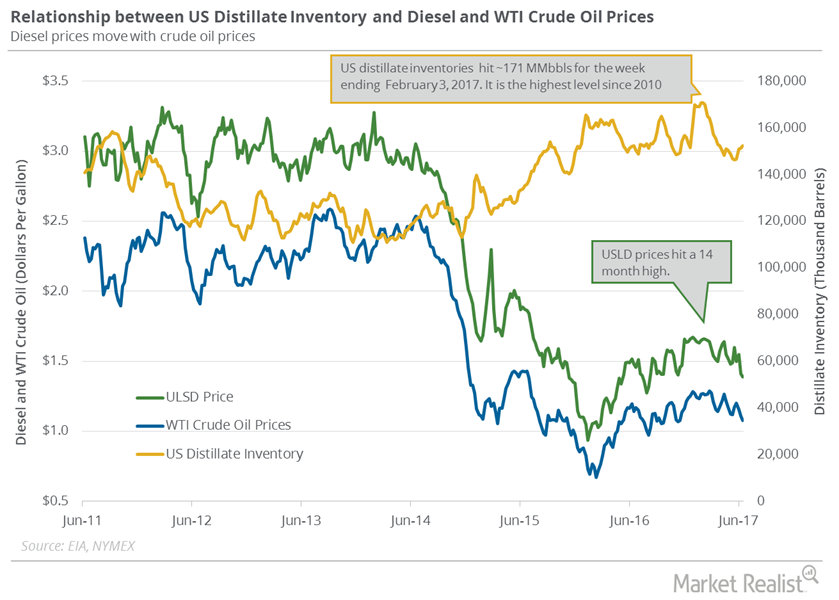

US Distillate Inventories Rose for the Fourth Straight Week

US distillate inventories rose by 1.1 MMbbls to 152.5 MMbbls on June 9–16, 2017. US distillate inventories rose for the fourth consecutive week.

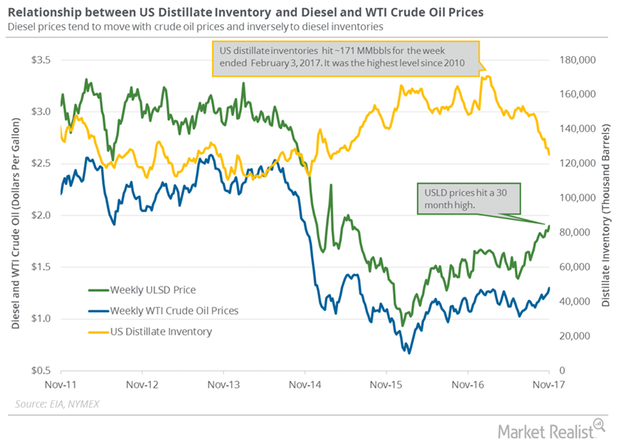

US Distillate Inventories Are at 32-Month Low

The EIA reported that US distillate inventories fell by 3,359,000 barrels to 125.5 MMbbls (million barrels) or 2.6% between October 27, 2017, and November 3, 2017.

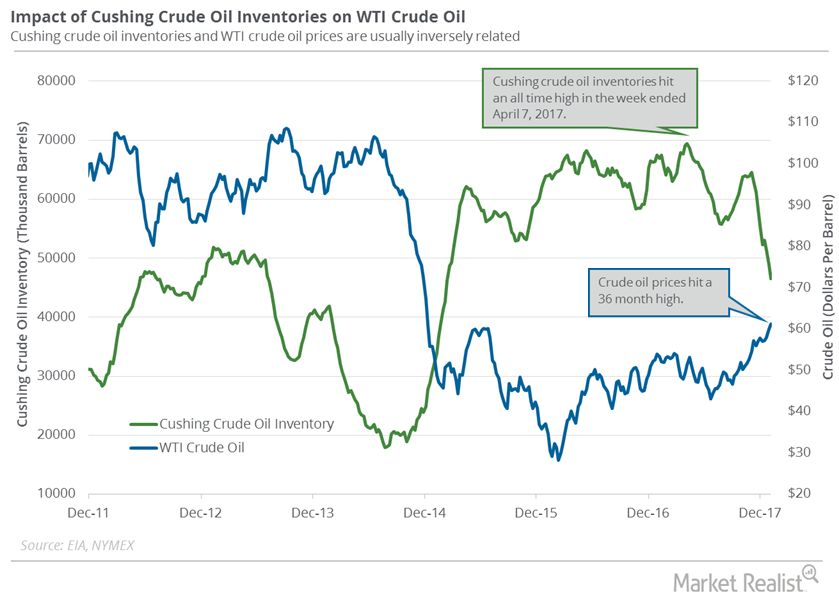

Cushing Inventories Fell 33% from the Peak

Analysts expect that Cushing crude oil inventories could have declined on January 5–12, 2018. A fall in Cushing inventories is bullish for oil prices.

Massive Fall in Crude Oil Inventories Pushed Oil Prices Higher

US crude oil inventories fell by 4.9 MMbbls (million barrels) to 419.5 MMbbls between December 29, 2017, and January 5, 2018.

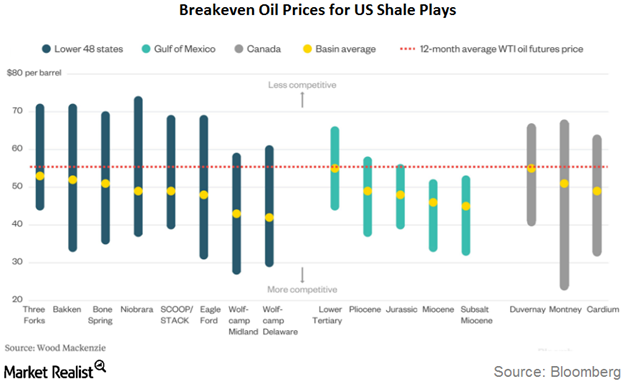

A Look at Breakeven Prices and Trends i n Eagle Ford Well

According to IHS, the top quintile wells are dominated by EOG Resources (EOG), Marathon Oil (MRO), and ConocoPhillips (COP).

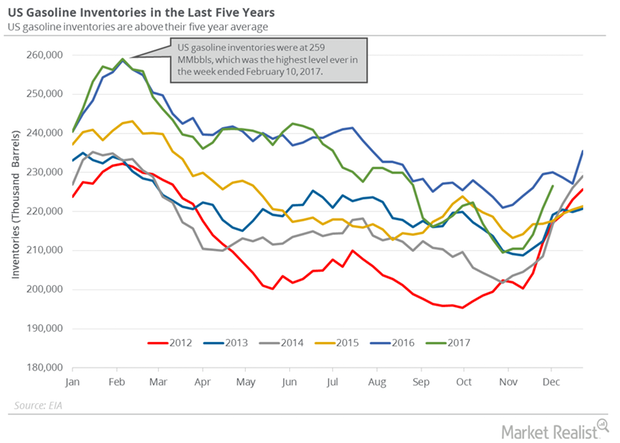

Analyzing the API’s Gasoline and Distillate Inventories

On December 19, 2017, the API released its crude oil inventory report. US gasoline inventories rose by 2 MMbbls (million barrels) on December 8–15, 2017.

US Crude Oil Production: Bearish Driver for Oil Prices

The EIA estimates that US crude oil production rose by 25,000 bpd (barrels per day) or 0.3% to 9,645,000 bpd on November 3–10, 2017.

Will Non-OPEC and US Crude Oil Production Impact Oil Prices?

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 46,000 bpd to 9,553,000 bpd on October 20–27, 2017.

Will Major Oil Producers Extend the Output Cut Deal past March?

October WTI (West Texas Intermediate) crude oil (USO)(UCO)(DIG) futures contracts rose 0.16% and were trading at $49.98 per barrel in electronic trading at 2:10 AM EST on September 18.

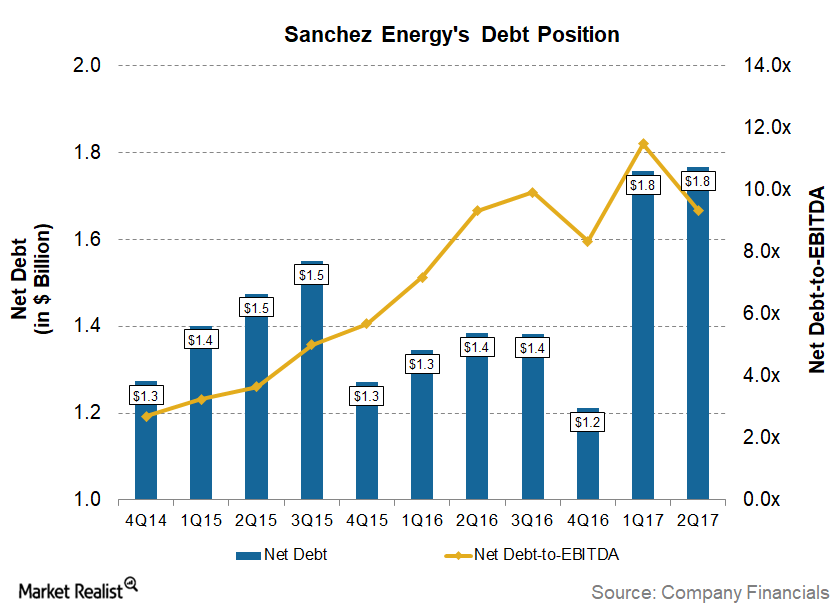

Is Sanchez Energy Repeating an Old Debt Mistake?

Since 1Q16, crude oil (USO)(SCO) prices have risen from lows of $26.05 per barrel to $49.30 per barrel as of September 13.

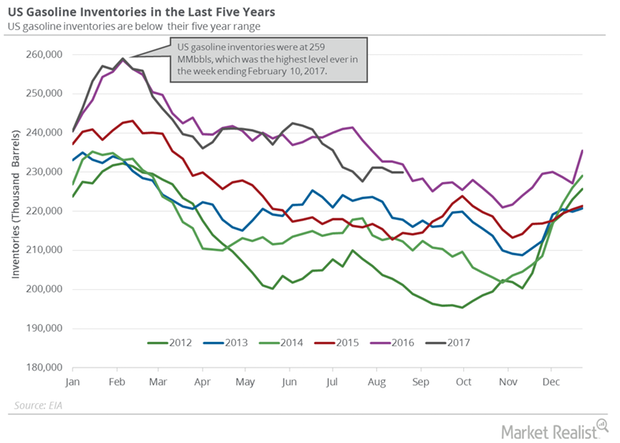

US Gasoline Futures Hit 2-Year High despite Inventory Rise

US gasoline inventories The U.S. Energy Information Administration reported that US gasoline inventories rose 35,000 barrels to 229.9 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell 2.1 MMbbls, or 0.9%, from the same period in 2016. For the third time in five weeks, inventories rose. A market survey estimated that US gasoline […]

Will US Crude Oil Futures Rise above Key Moving Averages?

Let’s track some important events for oil and gas traders between August 28 and September 1, 2017.

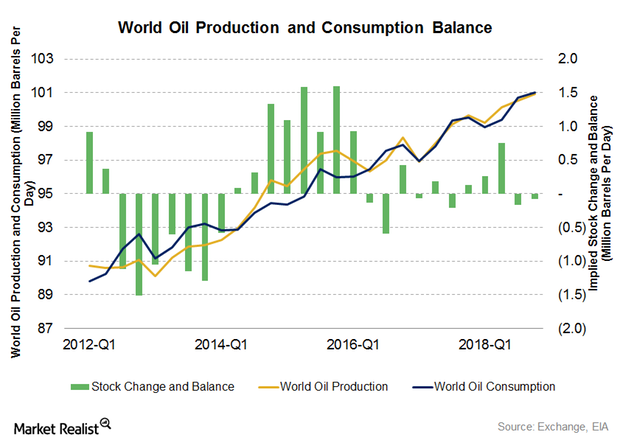

Will Global Oil Consumption Beat Production?

WTI (West Texas Intermediate) crude oil (PXI)(USL)(SCO) futures contracts for September delivery fell 0.1% and were trading at $48.78 per barrel in electronic trading at 2:00 AM EST on August 14, 2017.

Iran’s Crude Oil Exports and Production: Crucial for Oil Prices

Iran’s crude oil exports are expected to fall 7% in July 2017, according to Reuters. Exports are expected to fall to 1.86 MMbpd in July 2017.

OPEC’s Crude Oil Production Hit a 2017 High

OPEC’s production cut compliance was at 92% in June 2017. Lower compliance from OPEC members and Russia could pressure crude oil prices.

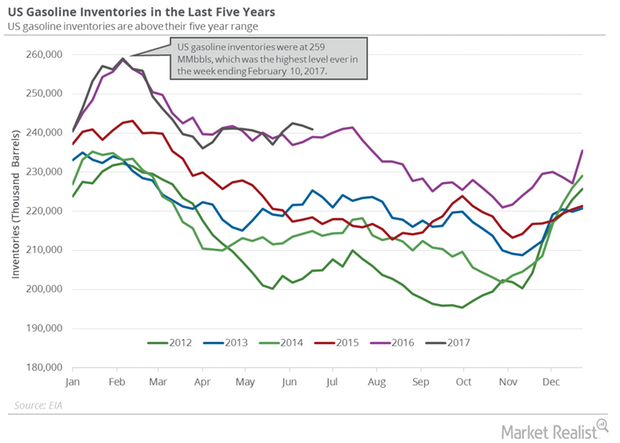

How Long Can US Gasoline Inventories Support Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories fell by 0.1 MMbbls to 241 MMbbls on June 16–23, 2017.

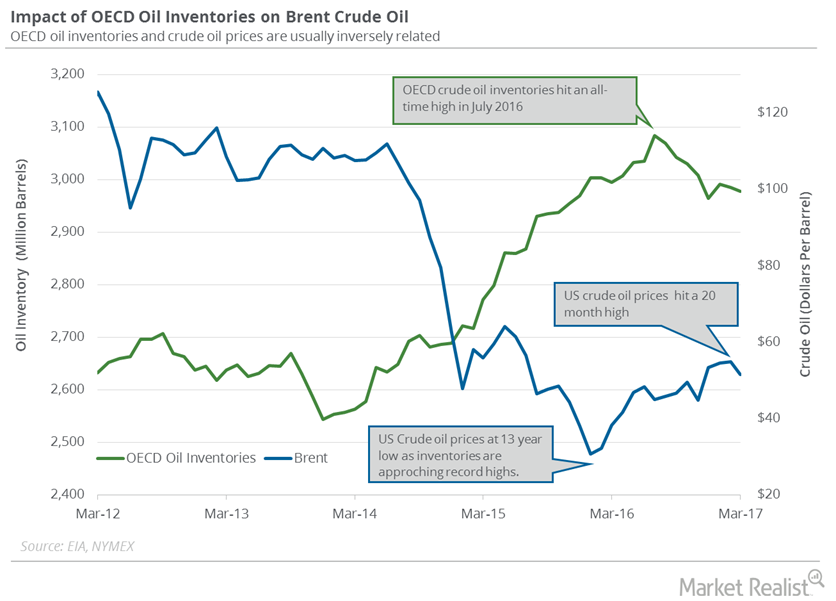

OECD’s Crude Oil Inventories Impact Crude Oil Futures

The EIA estimates that OECD’s crude oil inventories fell by 7.69 MMbbls (million barrels) to 2,977 MMbbls in March 2017—compared to the previous month.

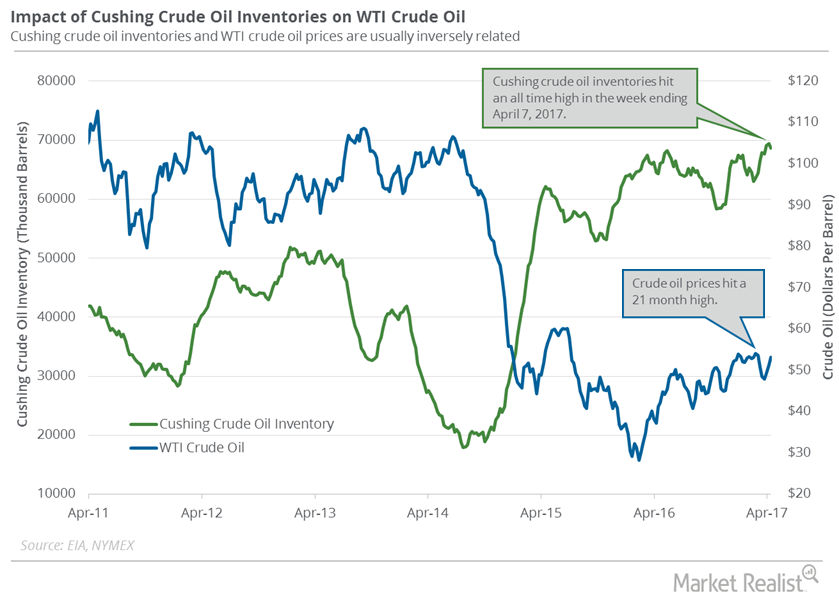

Cushing Crude Oil Inventories Fell from an All-Time High

For the week ending April 14, 2017, the EIA reported that Cushing crude oil inventories fell by 0.8 MMbbls (million barrels) to 68.6 MMbbls.

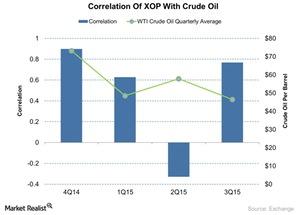

An Analysis of the Correlation between XOP and Crude Oil

Here we’ll present the results of a quarterly correlation analysis between crude oil and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).