What Are Analyst Recommendations for Apache?

Wall Street analysts gave mixed recommendations after Apache’s quarterly results. Apache shares fell 5% on November 6, 2015, after the earnings release.

Dec. 4 2020, Updated 10:53 a.m. ET

Analysts are bullish amid continued lower oil prices

Wall Street analysts gave mixed recommendations after Apache’s quarterly results. Apache shares fell 5% on November 6, 2015, after the earnings release. In the last year, Apache has corrected ~37%. In comparison, large-cap peer Halliburton (HAL) lost ~26% of its market value in the last year while Carrizo Oil and Gas (CRZO) fell more than 30%.

Consensus estimate

As per consensus estimates, Apache (APA) has an upside of 16.4% in a one-year period. This takes the price target of Apache to $55 per share. Among the total 36 analysts tracking Apache, 15 recommend a “buy,” 18 recommend a “hold,” and three recommend a “sell.”

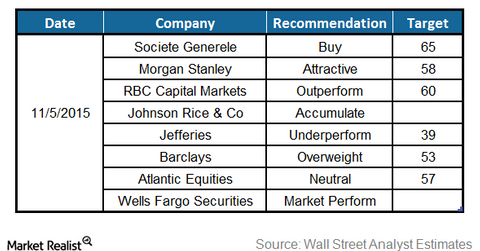

In terms of individual analysts, Societe Generele holds a pretty bullish target of $65, which results in a significant 38% upside. While looking at the bear trend, Jefferies expects Apache to continue its underperformance with a one-year price target of $39 per share.

Apache shares are trading at a 40% discount to its 52-week high of $77 and at a premium of 35% from a 52-week low of $35 per share. The low commodity (DBC) price environment has made life bleak for upstream oil players (XOP). Continued capital-efficient performance will bring them out of the tunnel and help them sustain until oil prices recover.