Invesco DB Commodity Index Tracking Fund

Latest Invesco DB Commodity Index Tracking Fund News and Updates

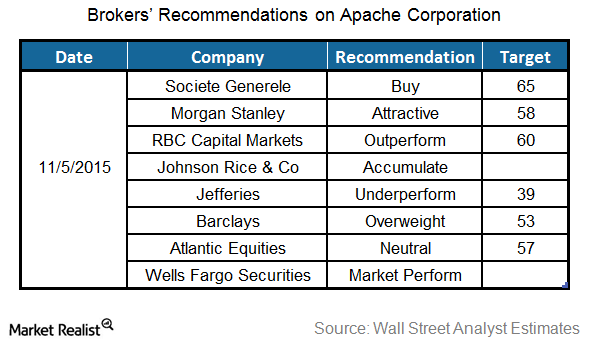

What Are Analyst Recommendations for Apache?

Wall Street analysts gave mixed recommendations after Apache’s quarterly results. Apache shares fell 5% on November 6, 2015, after the earnings release.

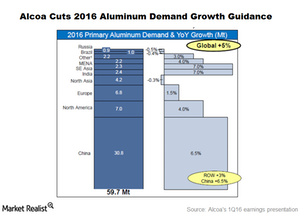

Why It’s No Surprise that Alcoa Cut Aluminum Demand Guidance

Alcoa has revised down its 2016 global aluminum demand growth projection to 5%.

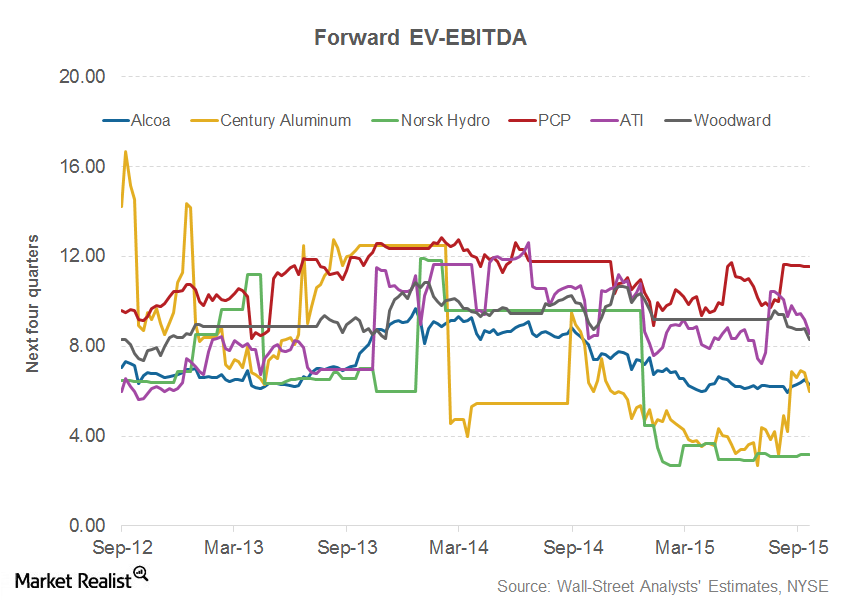

Could Alcoa’s Split Create Shareholder Value?

As an Alcoa (AA) shareholder, you might like to know whether the split will create value. The value, in this case, would basically mean whether the two separate companies would be worth more than the combined entity.

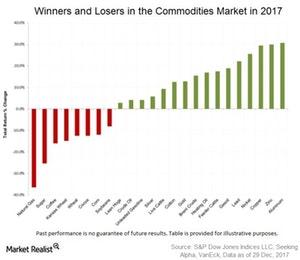

Where Will Commodities Head during Trump’s Term?

Donald Trump’s policies are aimed at strengthening job markets in the United States (VFINX) (IVV).

The Benefits of Real Asset Investing

In essence one of the things we have accomplished with these three products is to reduce the volatility inherent in all markets, and in particular very volatile markets like the real asset sectors.

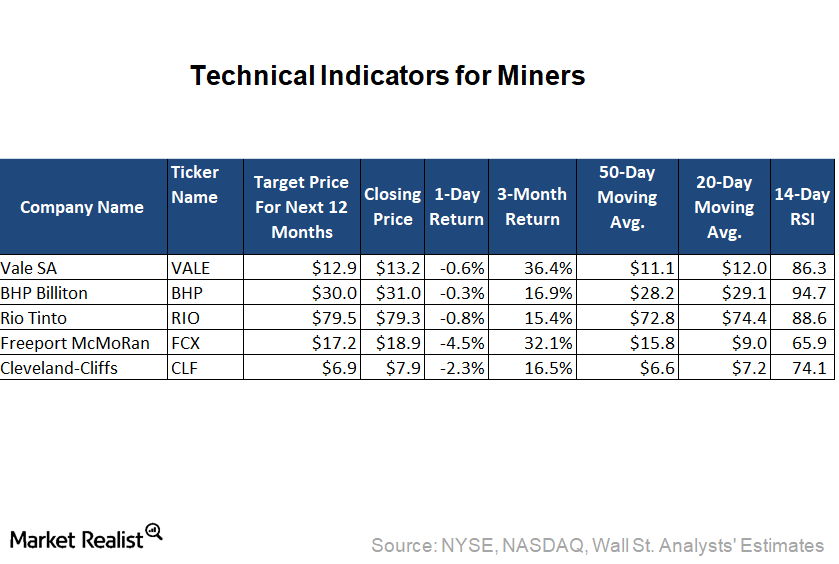

Is the Pullback in Iron Ore Miners Based on Technical Indicators?

Among the stocks under review in this series, Vale SA (VALE) has given the highest trailing-three-month return of 36.4%, while Rio Tinto (RIO) has generated the lowest return of 15.4%.

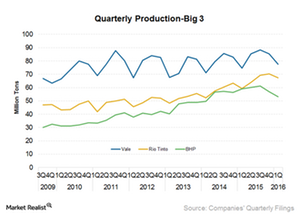

Why Rio Tinto Believes Iron Ore Prices Can Sustain

According to Bloomberg, Rio Tinto CFO Chris Lynch has suggested that iron ore prices will not collapse, as many expect.

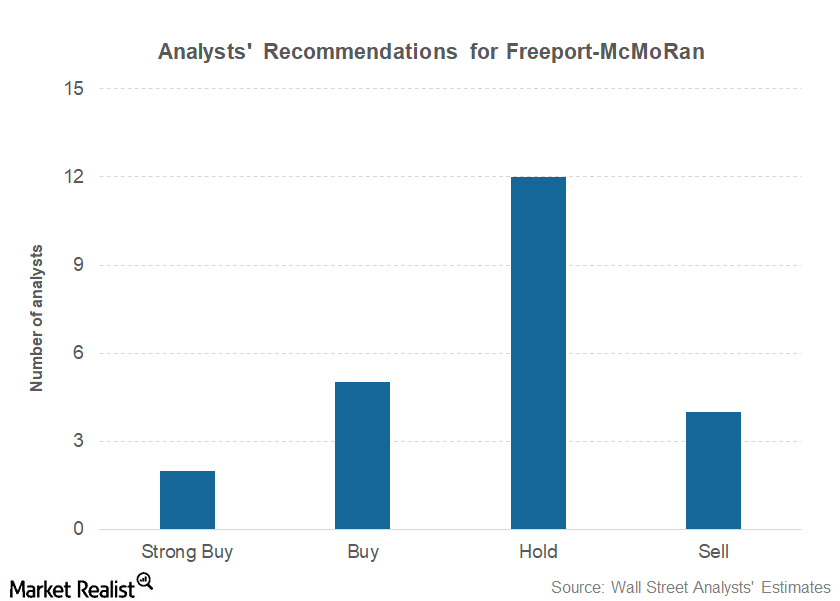

How Analysts View Freeport after Its 3Q17 Earnings Beat

Freeport-McMoRan released its 3Q17 earnings on October 25, posting revenues of ~$4.3 billion in 3Q17, compared with ~$3.7 billion in 2Q17.

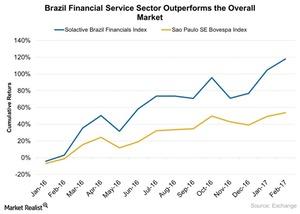

Why the Service Sector’s Contribution to Brazil Is Important

The service sector is the main contributor to Brazil’s GDP and job creation, but it’s currently suffering from structural weakness and poor international performance.

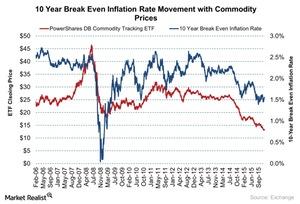

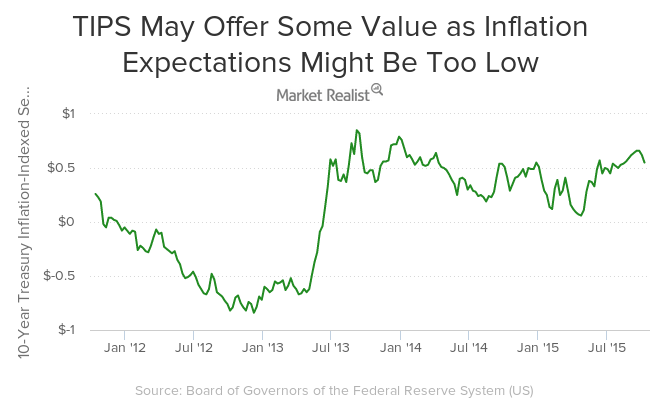

Why Treasury Inflation-Protected Securities May Offer Some Value

TIPS may offer some value as inflation breakeven seems modest. TIPS provide investors a hedge against inflation just like gold (GLD) and other commodities (DBC).

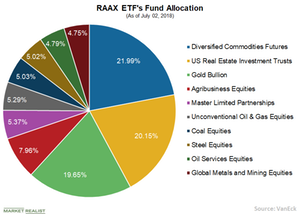

RAAX ETF: Capturing Real Benefits of Real Assets

RAAX’s allocation process provides exposure to segments with better returns profiles while managing overall portfolio risk.

How Analysts View Copper Miners amid the Market Carnage

The repercussions of the equity market carnage are evident in commodity markets. Copper, which some analysts see as an indicator of the global economy’s health, has come off its 2018 highs.

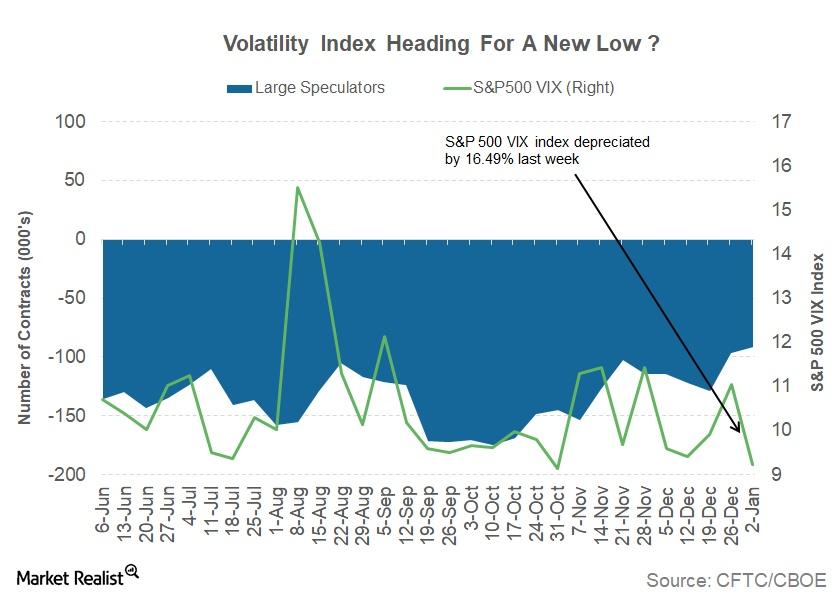

Why Volatility Fell 16% in Week 1 of 2018

Every segment of the global financial markets began 2018 on a positive note. The global equity rally extended in the first week of the year.

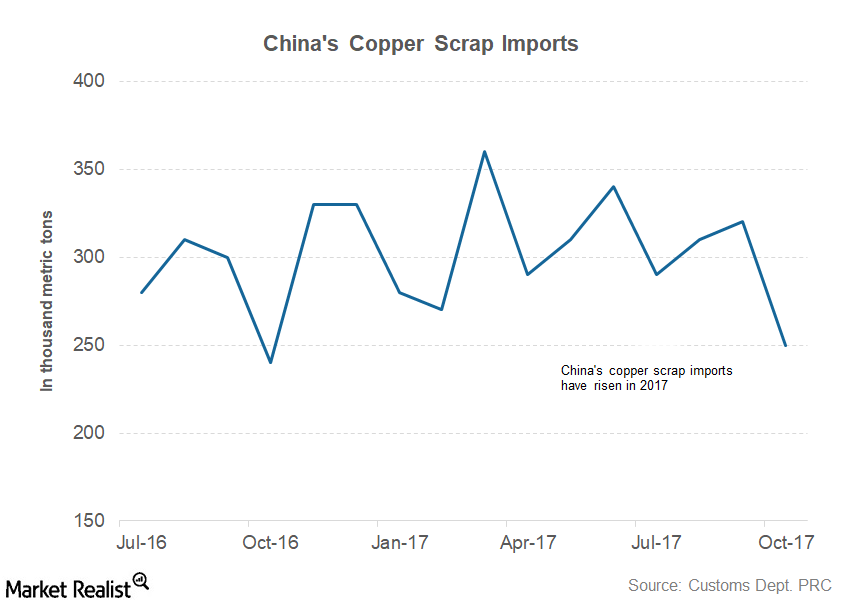

How the Secondary Market Could Impact Copper Prices in 2018

Copper, like other metals, is widely recycled. Last year, we saw improved scrap flows as copper prices moved to higher price levels.

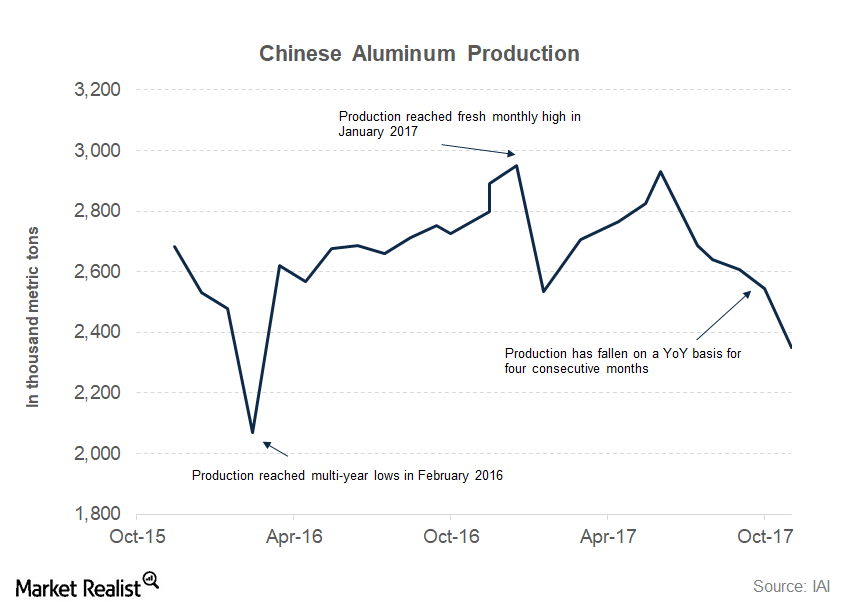

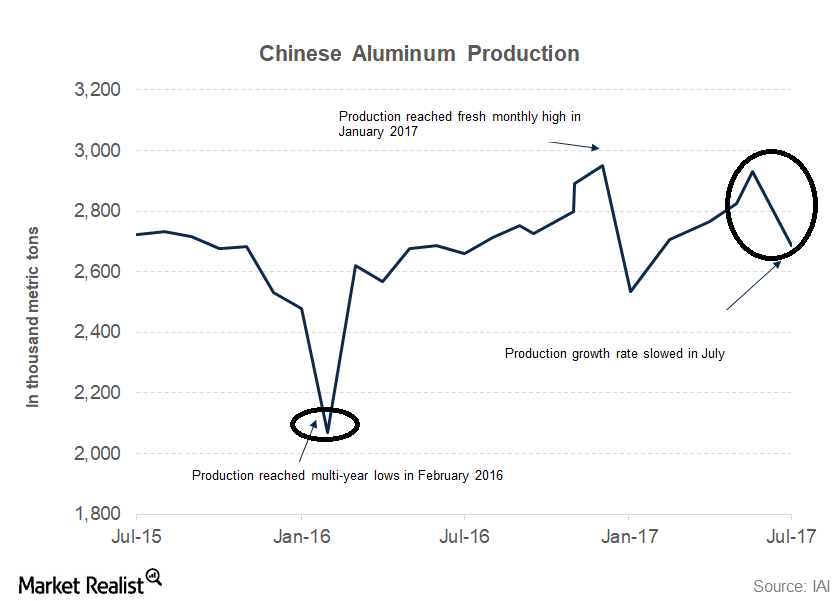

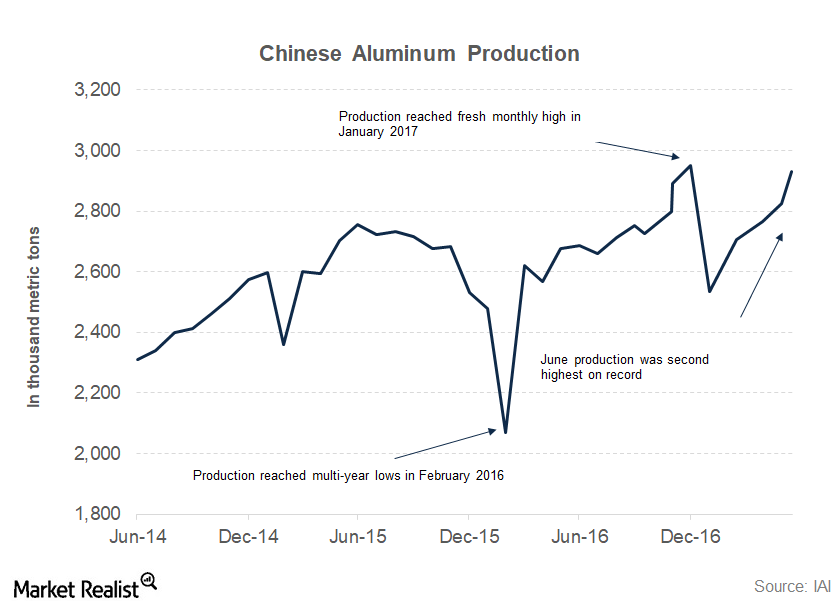

Aluminum Supply: What Investors Should Watch in 2018

After its split, Alcoa (AA) became a pure-play aluminum producer (S32) (CENX). Like other aluminum producers, Alcoa’s fortunes are tied to metal prices.

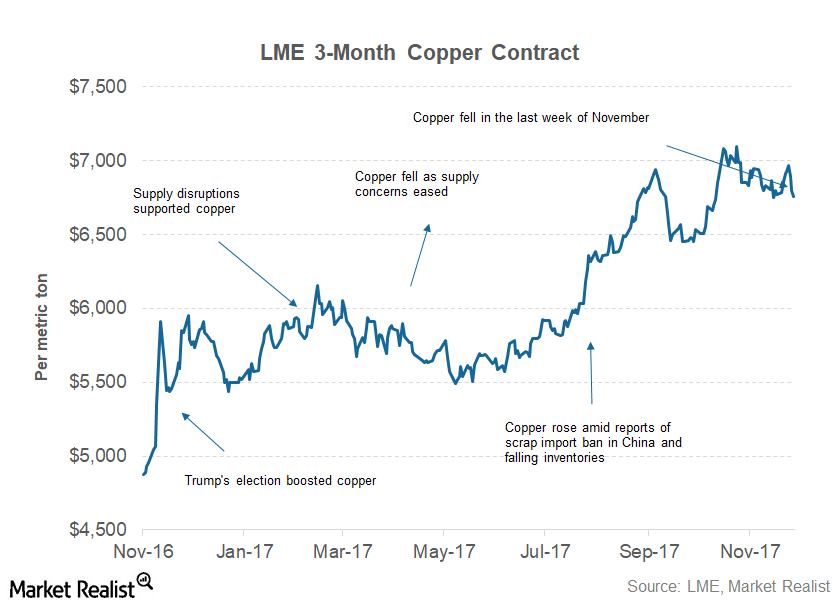

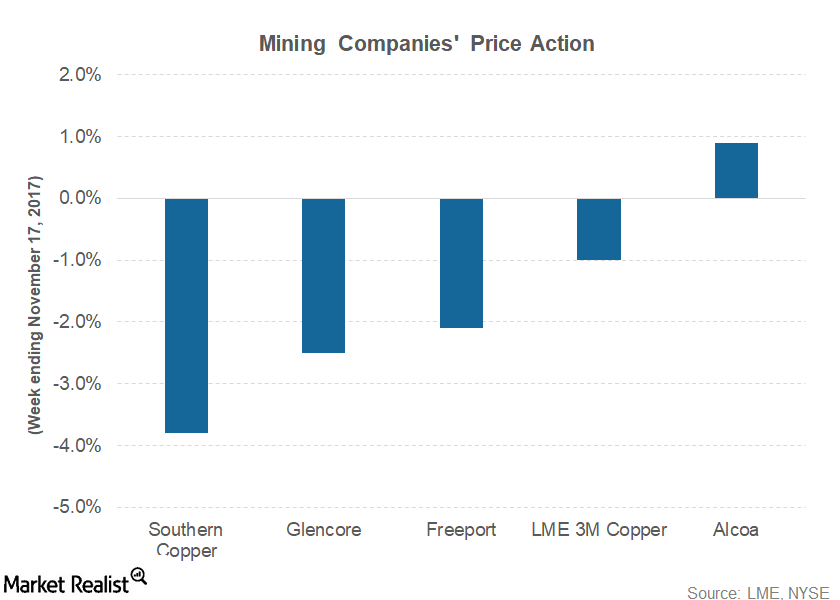

Copper Bulls Took a Back Seat in November

Copper bulls had a nice run since July. Copper underperformed several industrial metals in 1H17. However, copper has been on an uptrend in 2H17.

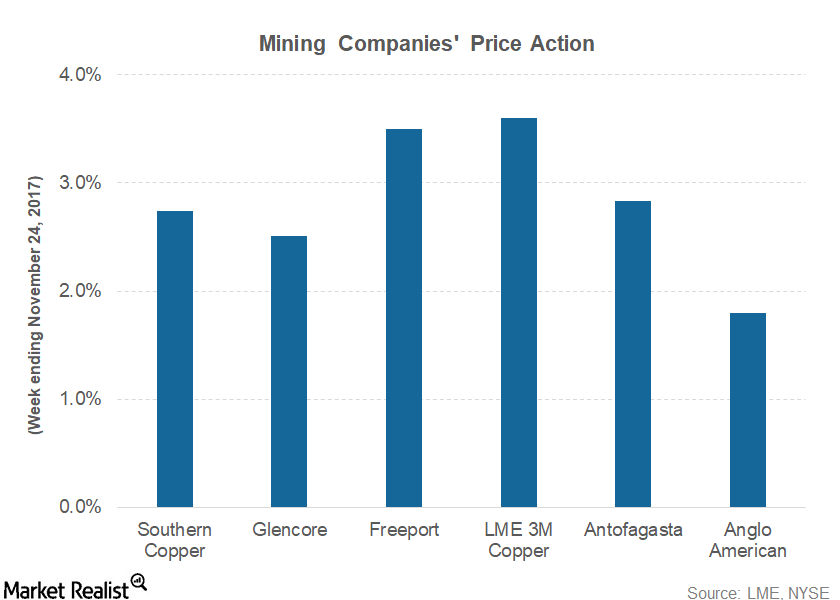

Copper Tests $7,000 as Industrial Metals Rebound

Last week was broadly positive for industrial metals (DBC). Copper rose 3.6%, while aluminum prices rose 1.3% in the week ending November 24.

Metal Prices Fell on Demand Concerns Last Week

In this series, we’ll look at the key developments that impacted mining companies last week. We’ll also look at some of the company-specific developments that impacted mining stocks.

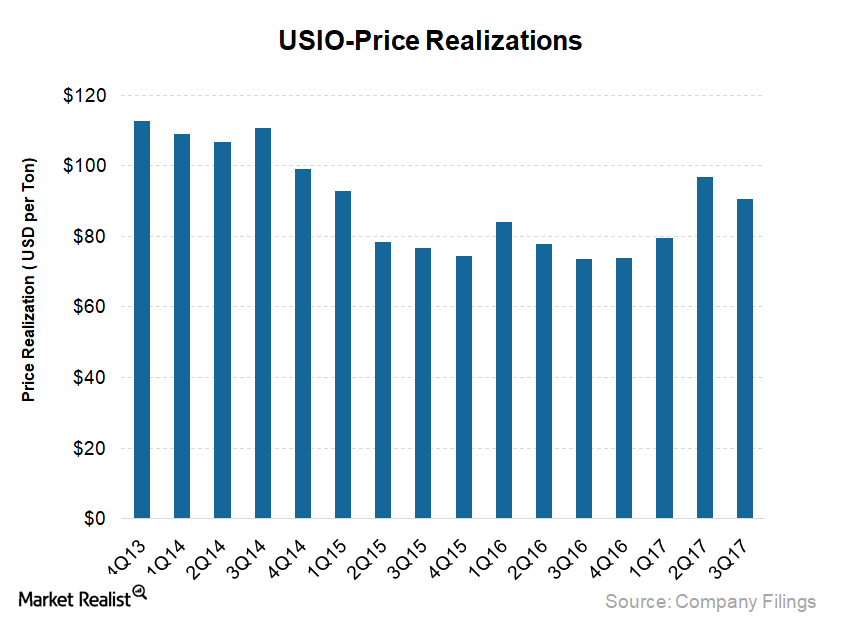

Can Cleveland-Cliffs’ Realized Prices in the US Recover in 2018?

For 3Q17, Cleveland-Cliffs reported average realized prices came in at $90.50 per ton.

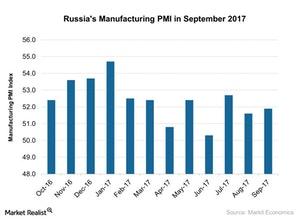

Russia’s Manufacturing PMI Improved Marginally in September

The final Russia Manufacturing PMI (Purchasing Managers’ Index) rose marginally in September 2017. It was 51.9 in September compared to 51.6 in August.

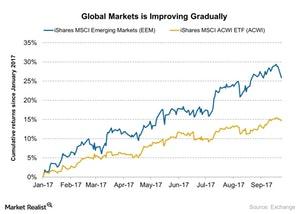

How Emerging Economies Are Supporting Global Growth

According to the report provided by the World Bank in June 2017, global (ACWI) growth is expected to strengthen to 2.7% in 2017.

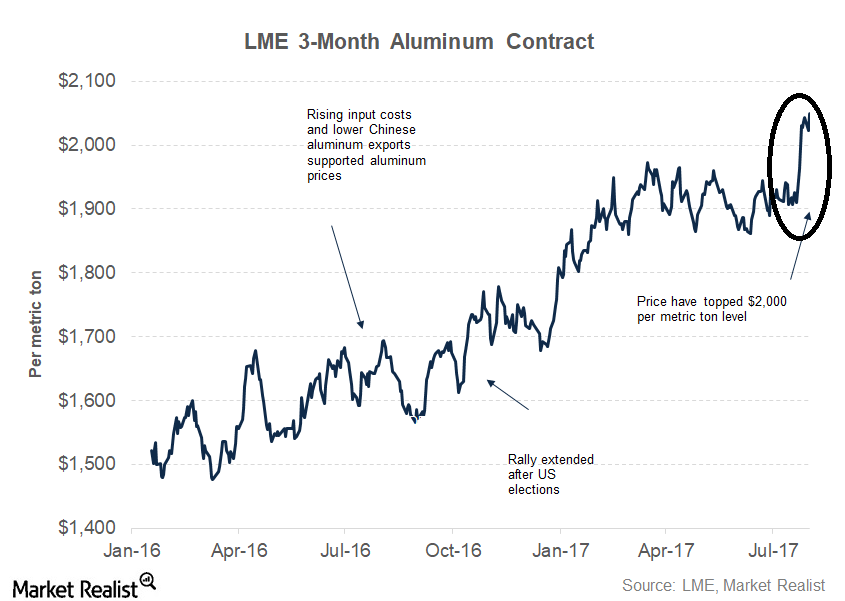

Aluminum’s Outlook: What Investors Can Expect

Aluminum prices have been strong in 2017 and have built on last year’s gains. The entire industrial metals space has come a long way since 1Q16.

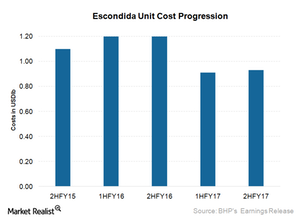

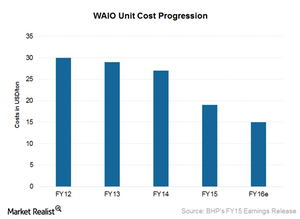

What Could Drive BHP Billiton’s Copper Costs in Fiscal 2018?

BHP Billiton’s (BHP) copper production fell 16.0% in fiscal 2017 to 1.3 million tons.

Aluminum Prices Defy Gravity and Maintain the $2,000 Level

Aluminum prices have gained more than 22% so far in 2017. This trend was preceded by a 13.6% rise in 2016.

Freeport and Copper: Is a Correction in the Cards?

Copper prices have shown strength over the last few trading sessions, which has helped the upwards price action of miners including Freeport-McMoRan (FCX), Glencore (GLNCY), and Southern Copper (SCCO).

Is China Cutting Aluminum Capacity? Analyzing Producers’ Views

As we noted previously, aluminum prices have been strong this year. Strength has been driven by positive supply and demand dynamics.

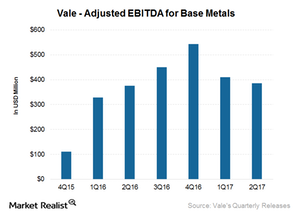

What’s Vale’s Base Metals Outlook?

As we saw in the previous two parts of this series, Vale’s (VALE) iron ore and coal production increased sequentially in 2Q17.

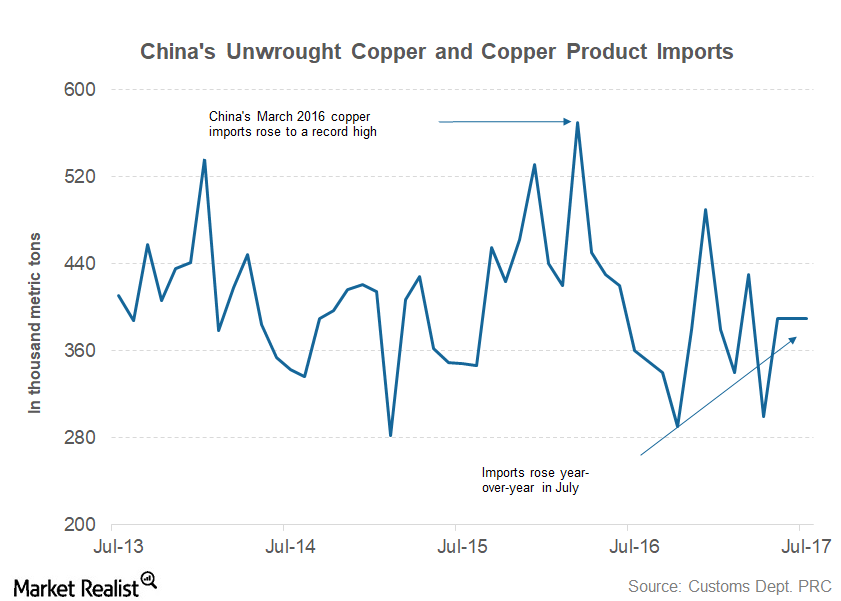

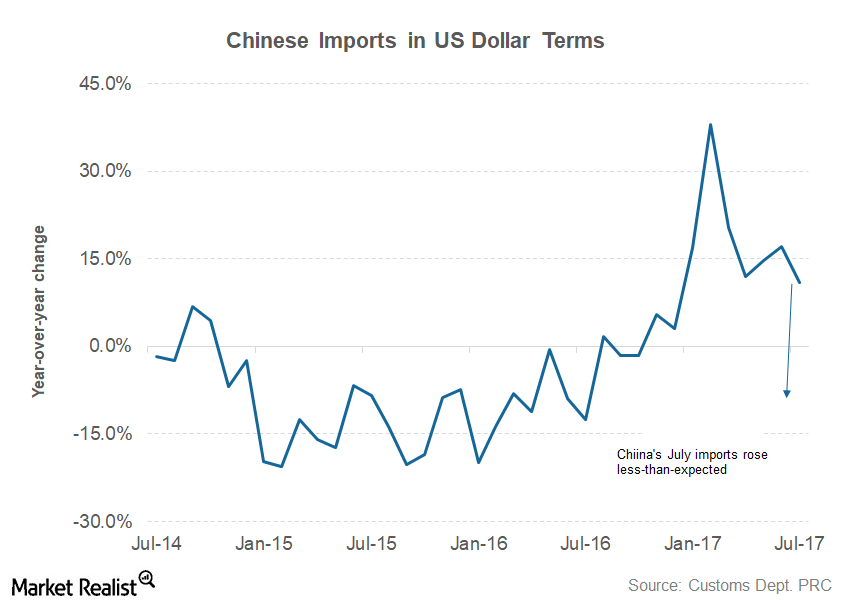

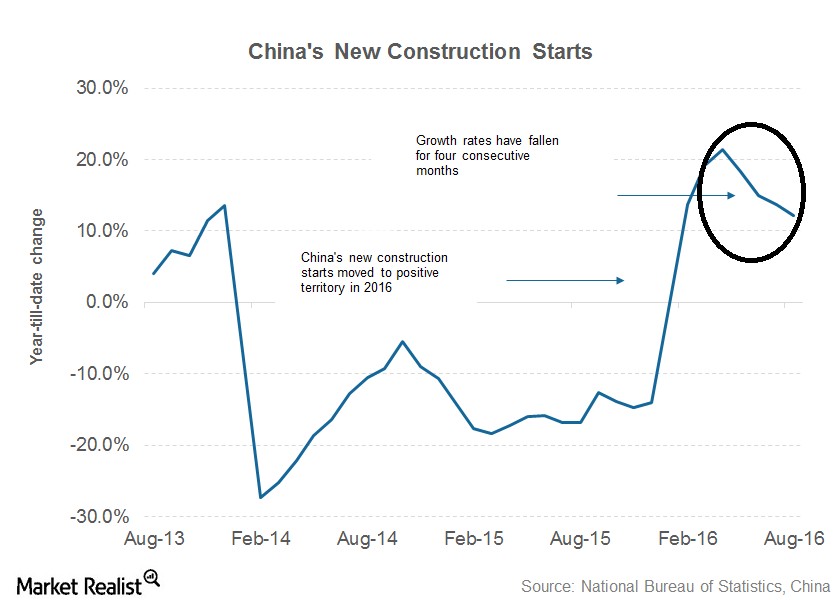

Will China’s Disappointing July Trade Deflate Metal Bulls?

On August 8, China released its trade data for July. The country’s exports in dollar terms rose 7.2% compared to July 2016 while imports rose 11%.

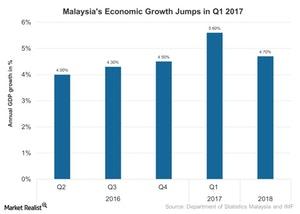

Can Improved Demand Help Malaysia’s Economy Expand in 2Q17?

The Malaysian economy gave us an impressive growth story in 1Q17, with its increased investments in infrastructure and private sector expansion.

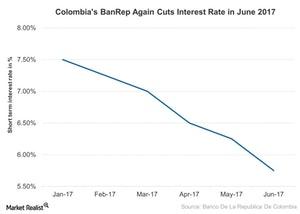

Will Monetary Easing Support Colombia’s Economic Growth in 2017?

Colombia, an important Latin American (ILF) economy, is currently facing sluggish growth due to a decline in commodity prices (DBC) and political instability.

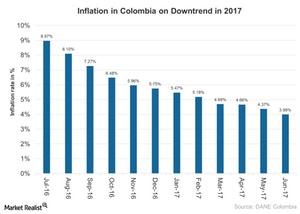

How Colombia’s Inflation Is Trending

Annual consumer inflation in Colombia (GXG) has dropped for 12 consecutive months as of June 2017.

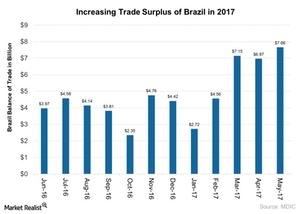

Improved Global Demand Boosted Brazil’s Trade Surplus in May 2017

Brazil’s exports stood at $19.7 billion in May 2017, a 12.6% increase year-over-year, boosted by sales of semi-manufactured products and basic products.

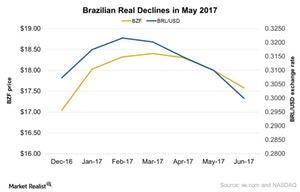

Slumping Commodity Prices Pressure the Brazilian Real in 2Q17

The Brazilian real dropped ~2% in May 2017 amid the country’s ongoing political instability.

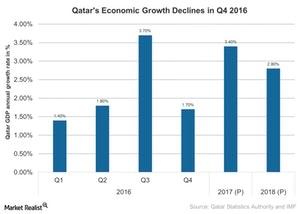

Will Qatar’s Economic Growth Continue to Fall amid the Crisis?

Qatar was expected to grow at a faster pace in 2017. However, economic sanctions by its neighbors are expected to impact its economic activity in 2017.

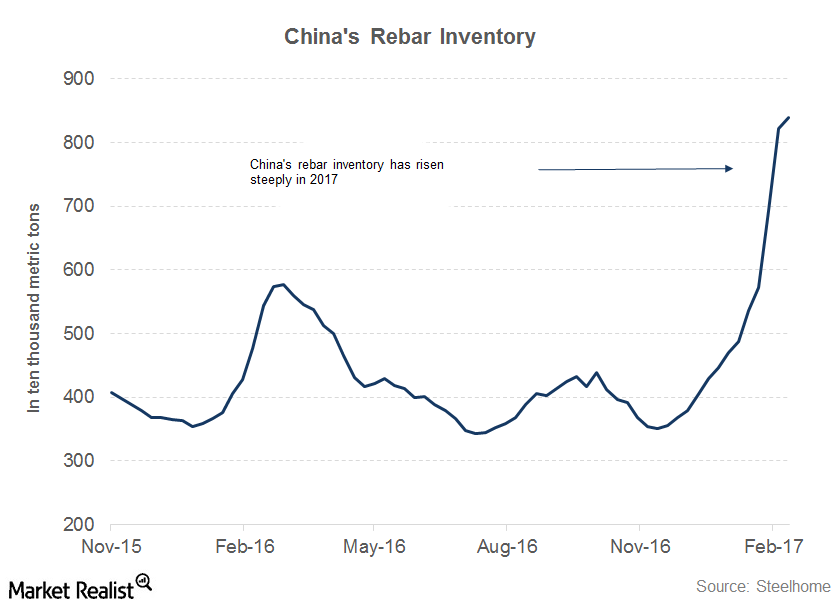

Are Rising Chinese Steel Inventories a Risk for Steel Investors?

With higher steel production and subdued demand, one would expect a tsunami of Chinese steel exports, but this wasn’t the case last month. So what did China want with so much steel?

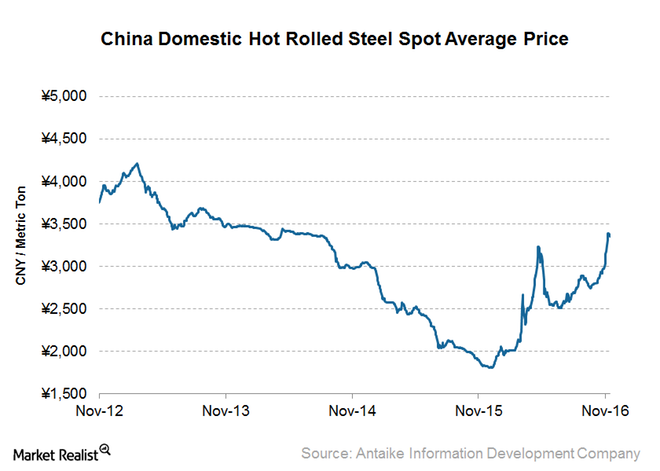

What Could Impact Chinese Steel Prices in 2017?

Since China is the world’s largest steel producer and exporter, it’s important for investors to keep track of Chinese steel prices.

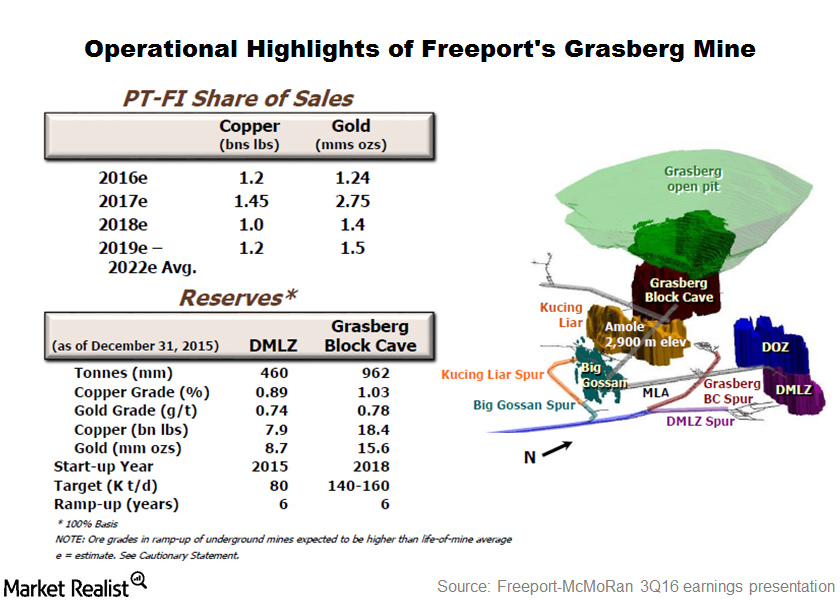

What Are Freeport’s Near-Term Growth Drivers?

Freeport expects its copper shipments to fall next year due to asset sales. The falling trend in its copper shipments could continue beyond 2017.

IMF Warns about 3 Risks to the Global Financial System

The International Monetary Fund (or IMF) warned that there are three major risks to the global financial system in its latest report on global financial stability.

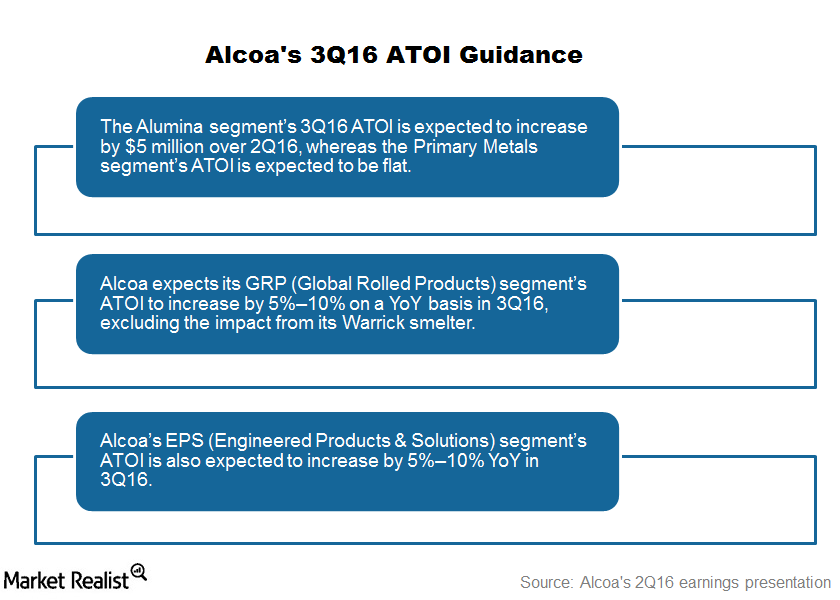

Alcoa’s 3Q16 Guidance: Everything You Need to Know

Alcoa’s 3Q16 guidance Previously, we looked at factors that could impact Alcoa’s (AA) 3Q16 revenues. In this part, we’ll look at the company’s profitability metrics. Note that there are several metrics you can use to measure an enterprise’s profitability. Alcoa releases a non-GAAP (generally accepted accounting principles) measure, the ATOI (after tax operating income). In […]

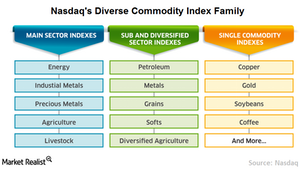

Nasdaq Commodity Index: Reflecting the Global Commodity Market

On the commodities side, we have broad-based commodity benchmark, the Nasdaq Commodity Index, aptly named.

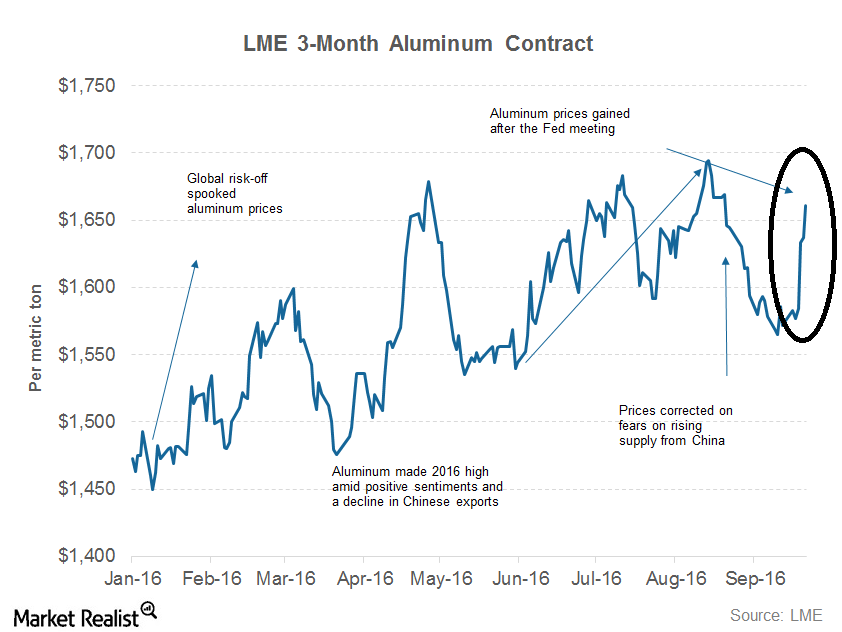

What’s Driving Aluminum Prices in 2016?

Aluminum prices have shown resilience this year. However, aluminum has been facing stiff resistance at $1,700 per metric ton.

How Do Chinese Copper Demand Indicators Look This Month?

It’s important for investors in companies such as Freeport-McMoRan, BHP Billiton, and Rio Tinto to track Chinese copper demand indicators.

Why Did Inflation Rates Ease for Brazil and Chile?

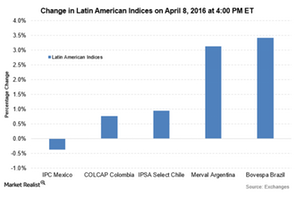

Brazil’s inflation rate slowed for the second straight month in March. The annual inflation rose by 9.4%—compared to 10.4% in the previous month.

Depressed Iron Ore Prices Will Strain BHP Billiton’s Cash Flows

Iron ore forms the biggest chunk of BHP Billiton’s revenues and earnings. For its latest quarter, the company delivered 7% year-over-year growth.