Will Qatar’s Economic Growth Continue to Fall amid the Crisis?

Qatar was expected to grow at a faster pace in 2017. However, economic sanctions by its neighbors are expected to impact its economic activity in 2017.

June 22 2017, Published 12:28 p.m. ET

Qatar economy

Qatar, an oil-rich nation, was expected to grow at a faster pace in 2017 due to improved oil (USO) (UCO) prices and increased investments. However, economic sanctions by its neighbors in the region are expected to impact its economic activity in 2017. The sanctions include an impasse on the flow of capital, people, and trade, which will likely impact Qatar’s economic growth in 2017.

Let’s look at the latest available GDP growth data for Qatar in the past year.

Economic activity in Qatar

Qatar (QAT) aims to diversify its economic activity from exhaustible oil and gas wealth to other sectors including banking and finance. Economic growth has been under pressure due to lower commodity (DBC) prices in the last few years. Lower hydrocarbon prices had a negative impact on its economic performance in the past year.

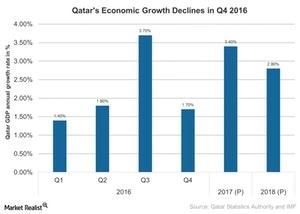

Qatar’s economy grew 1.7% on a year-over-year basis in 4Q16—compared to a 3.9% increase in 3Q16. The output fell 6.4% for mining and quarrying in 4Q16—compared to a fall of 2.6% in 3Q16. The transportation and construction sectors grew 4.3% and 4%, respectively, in 4Q16—compared to 7% and 15.9%, respectively, in 3Q16. However, financial and insurance activities showed resilience and grew 6.8% in 4Q16—compared to 6.6% in 3Q16.

Expectations

According to the International Monetary Fund report, in April 2017, Qatar’s GDP growth is projected at 3.4% for 2017. The growth would be driven by expansion in the non-hydrocarbon sector due to increased public investment. The expansion is supported by additional output from the new Barzan Gas Project. The Barzan Gas Project is a joint venture between Qatar Petroleum and ExxonMobil (XOM). The project is expected to meet Qatar’s increasing domestic gas demand.

If Qatar’s crisis lasts for a long time, it could have a severe impact on the country’s investments. As a result, growth expectations are lower for 2017 and 2018.

In the next part, we’ll look at Qatar’s exports amid the crisis.