Alcoa’s 3Q16 Guidance: Everything You Need to Know

Alcoa’s 3Q16 guidance Previously, we looked at factors that could impact Alcoa’s (AA) 3Q16 revenues. In this part, we’ll look at the company’s profitability metrics. Note that there are several metrics you can use to measure an enterprise’s profitability. Alcoa releases a non-GAAP (generally accepted accounting principles) measure, the ATOI (after tax operating income). In […]

Oct. 4 2016, Updated 10:06 a.m. ET

Alcoa’s 3Q16 guidance

Previously, we looked at factors that could impact Alcoa’s (AA) 3Q16 revenues. In this part, we’ll look at the company’s profitability metrics. Note that there are several metrics you can use to measure an enterprise’s profitability. Alcoa releases a non-GAAP (generally accepted accounting principles) measure, the ATOI (after tax operating income). In this article, we’ll look at the 3Q16 ATOI guidance provided by Alcoa.

Upstream guidance

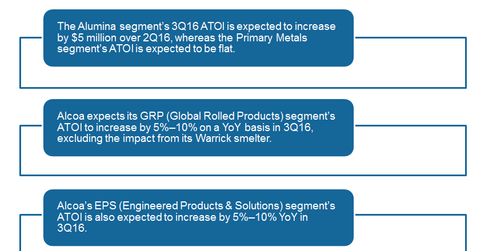

According to Alcoa, in the upstream business, the alumina segment’s 3Q16 ATOI is expected to increase by $5 million over 2Q16, whereas the Primary Metals segment’s ATOI is expected to be flat. This assumption excludes any impact from metal prices (DBC) and currency movements. That said, aluminum prices have been strong in 3Q16, though we saw a correction in alumina prices.

Alcoa expects its fiscal 2016 net income to rise $160 million for every $100 per metric ton rise in aluminum prices. Similarly, its net income is expected to fall $160 million for every $100 per ton fall in aluminum prices. Peers Century Aluminum (CENX), Rio Tinto (RIO), and South32 (SOUHY) have varying sensitivity to commodity prices.

Downstream guidance

In its downstream business, Alcoa expects its GRP (Global Rolled Products) segment’s ATOI to rise 5%–10% on a YoY (year-over-year) basis in 3Q16, excluding the impact from its Warrick smelter. Alcoa’s EPS (Engineered Products & Solutions) segment’s ATOI is also expected to rise 5%–10% YoY in 3Q16, whereas its TCS (Transportation & Construction Solutions) segment’s 3Q16 ATOI is expected to rise only 1%–3%. The guidance is based on constant currency rates. In the next article, we’ll see what are analysts projecting for Alcoa’s 3Q16 profitability.