South32 Limited

Latest South32 Limited News and Updates

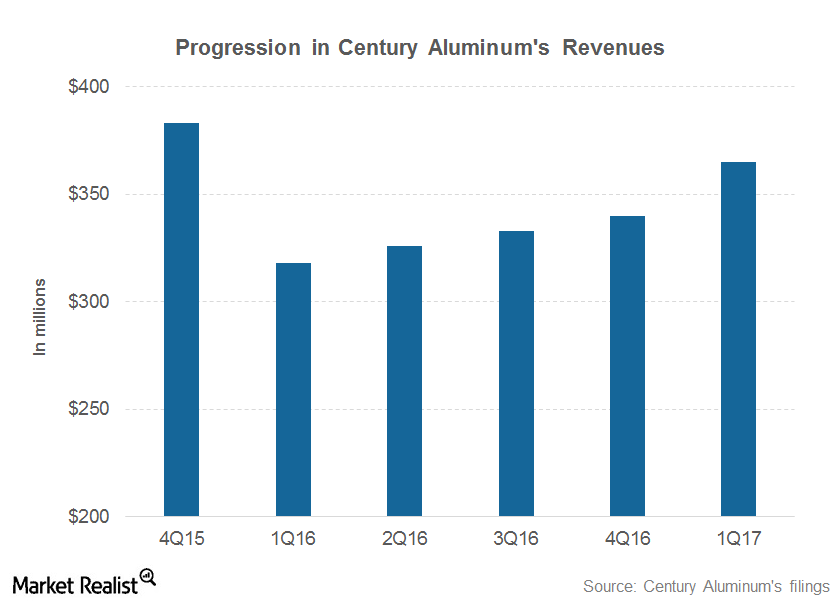

What Investors Should Know about Century Aluminum’s 1Q17 Results

Century Aluminum (CENX) was among the best-performing aluminum stocks (NHYDY) (ACH) (SOUHY) last year with gains of 94%.

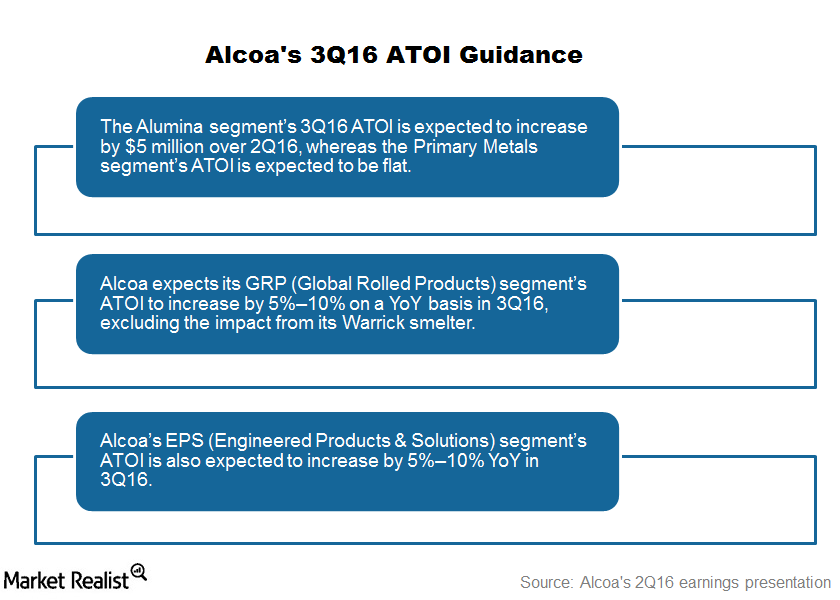

Alcoa’s 3Q16 Guidance: Everything You Need to Know

Alcoa’s 3Q16 guidance Previously, we looked at factors that could impact Alcoa’s (AA) 3Q16 revenues. In this part, we’ll look at the company’s profitability metrics. Note that there are several metrics you can use to measure an enterprise’s profitability. Alcoa releases a non-GAAP (generally accepted accounting principles) measure, the ATOI (after tax operating income). In […]

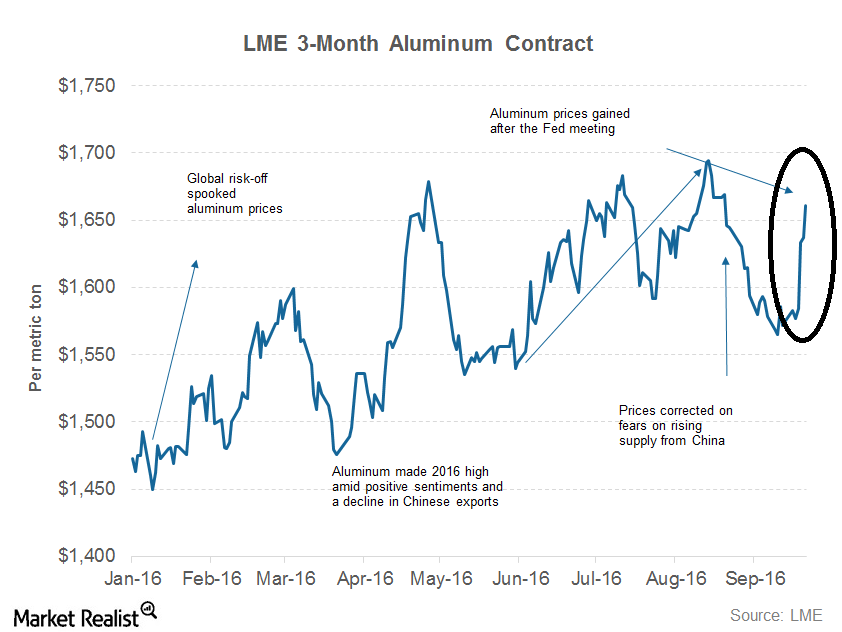

What’s Driving Aluminum Prices in 2016?

Aluminum prices have shown resilience this year. However, aluminum has been facing stiff resistance at $1,700 per metric ton.