Vineet Kulkarni

Vineet Kulkarni joined Market Realist in July 2015 and has written more than 4,000 articles. He covers macroeconomics, renewables, and utilities. Vineet earned his master’s degree in business administration with a finance specialization. He's also a CFA Level 3 candidate. Apart from his passion for the stock markets, Vineet is an avid trekker and loves listening to classic rock.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Vineet Kulkarni

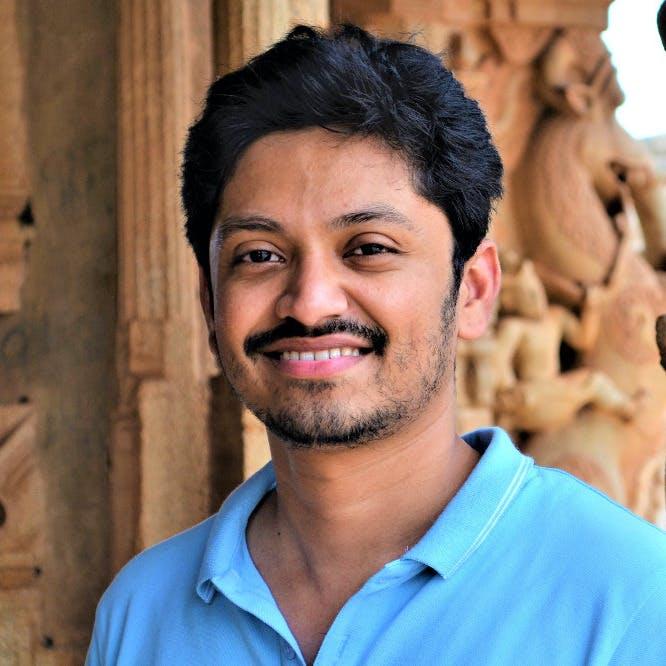

What Are Analyst Recommendations for Apache?

Wall Street analysts gave mixed recommendations after Apache’s quarterly results. Apache shares fell 5% on November 6, 2015, after the earnings release.

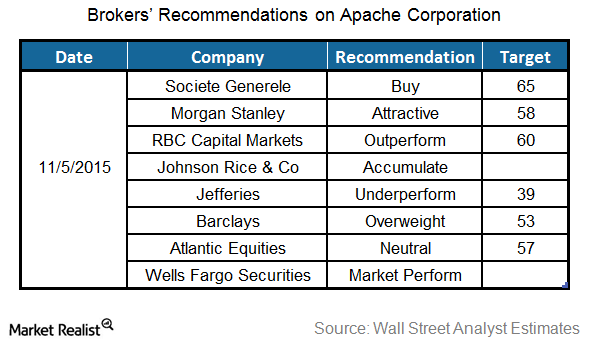

What Investors Should Know about Dominion Energy’s Dividends

Dominion Energy’s (D) payout ratio (the percentage of profit that it gave away in the form of dividends) was 81% in 2016, which is higher than the industry average and slightly on the lower side of its five-year payout average of 85%.

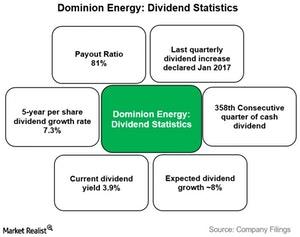

Will Southern Company Beat Its Q3 EPS Estimates?

Southern Company’s management has given an EPS guidance of $1.05 for the third quarter.

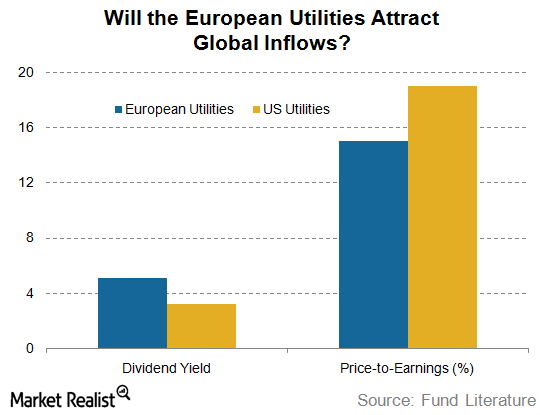

Are US Utilities Both Safe Havens and Overvalued?

The rush to US utilities despite their already stretched valuations indicates their safe-haven appeal amid global turmoil.

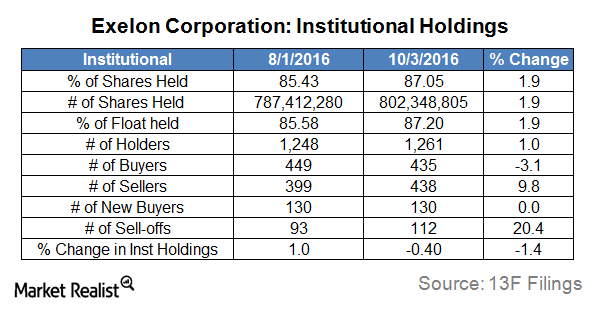

A Look at Institutional Investors’ Holdings in Exelon

In the past couple of months, institutions have increased their positions in Exelon by nearly 2%, from 85.6% to 87.2%, as of October 3, 2016.

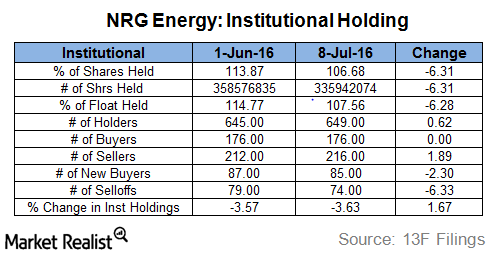

What Are Institutional Investors Doing with NRG Energy?

Institutional investors decreased their positions in NRG Energy (NRG) in June 2016.

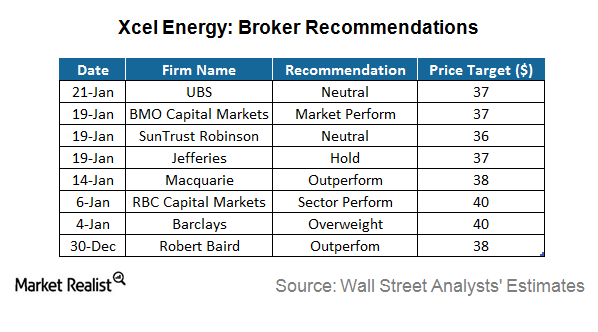

No Analysts Recommend a “Sell” on Xcel Energy

Of the 18 analysts tracking Xcel Energy, 13 recommend it as a “hold,” five recommend it as a “buy,” and none recommend it as a “sell.”

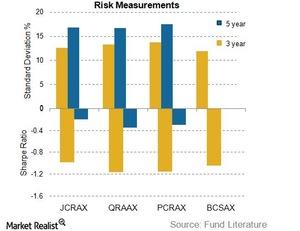

Volatility: Risks and Rewards Go Hand in Hand

The Sharpe ratio is calculated using standard deviation as its volatility measure.

What’s in Store for Dominion Energy Stock?

Dominion Energy (D), one of the laggards among top utilities this year, seemed strong lately and is currently trading close to an eight-month high.

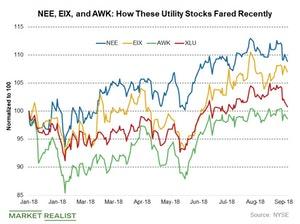

Highest Dividend Growth: Comparing NEE, EIX, and AWK

Utilities have been weak compared to the broader markets this year largely due to the strength in the Treasury yields.

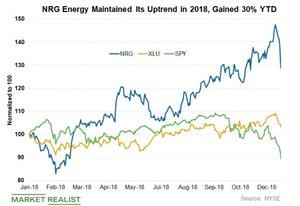

NRG Energy’s Valuation Compared to Its Peers

Currently, NRG Energy (NRG) stock is trading at a forward PE ratio of 8.5x based on its estimated EPS in 2019.

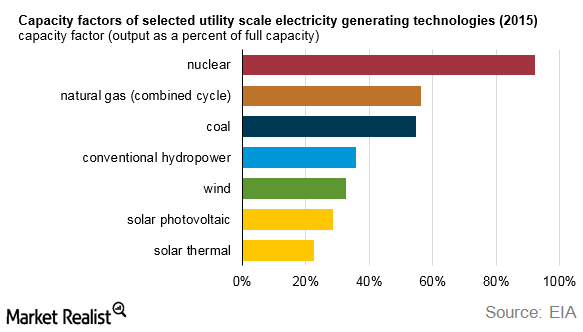

Energy Sources: Capacity Factor and Capacity Additions

Capacity additions in wind power have been quite volatile over the past few years due to uncertainty over tax incentive policies.

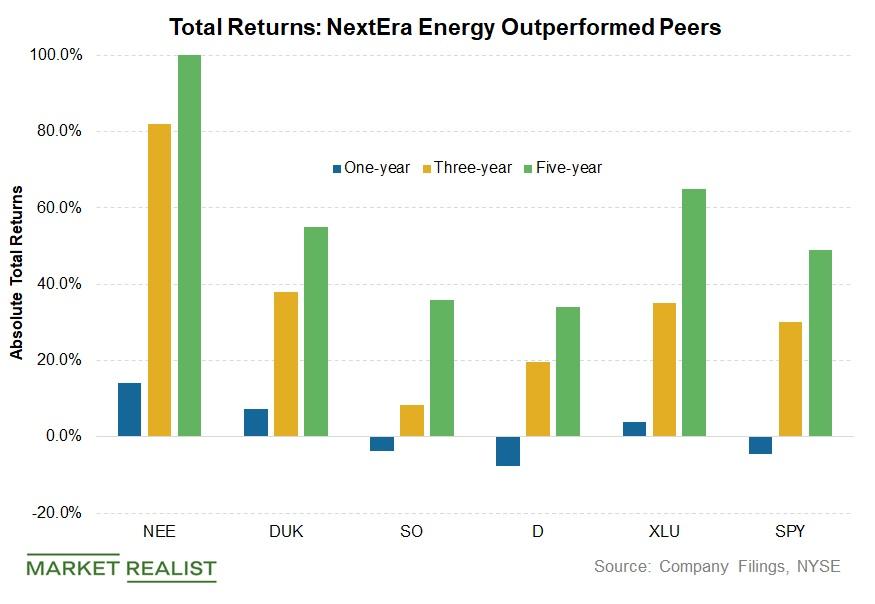

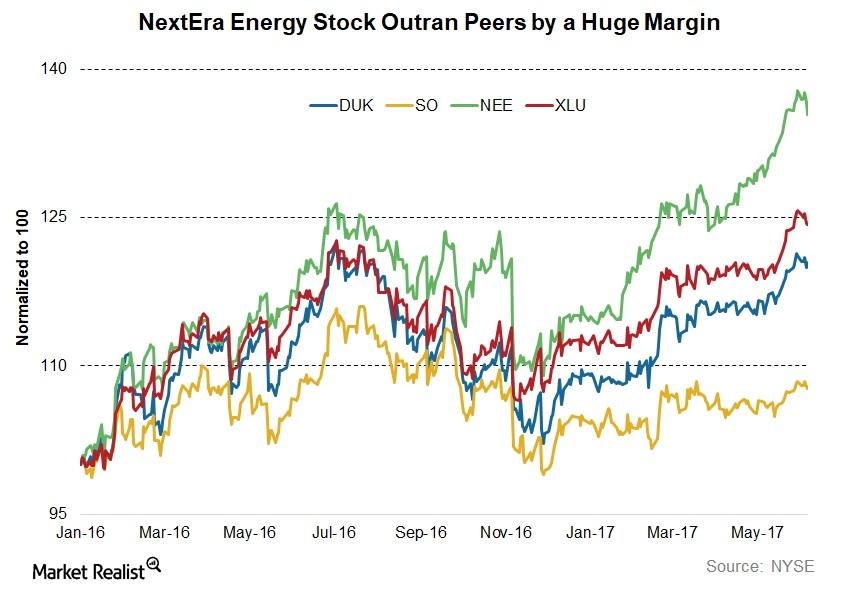

NEE, DUK, SO, and D: Comparing Top Utilities’ Total Returns

NextEra Energy (NEE) beat its peers in terms of returns in the last few years. NextEra Energy returned 14% in 2018.

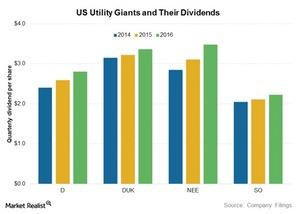

D, DUK, NEE, and SO: Top Utilities’ Dividends

Dominion Resources (D) paid annual dividends of $2.80 in 2016. Duke Energy (DUK) paid dividends of $3.36 per share last year.

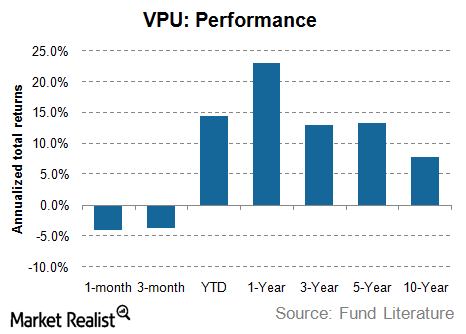

VPU Versus XLU: Which Utility ETF Is Better?

Utility ETFs have performed well in the last one year. The Vanguard Utilities Fund ETF (VPU) has been no exception to this.

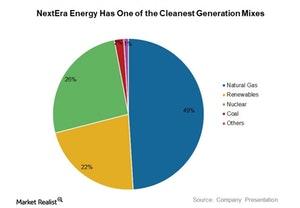

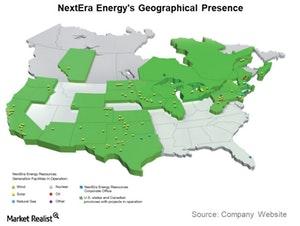

NEE Has One of the Cleanest Generation Mixes in the US

NextEra Energy (NEE) has one of the cleanest generation mixes among peers.

XLU: How US Utilities Are Currently Valued

So far, US utilities have had a decent run this year. The Utilities Select Sector SPDR ETF (XLU) has risen more than 14%.

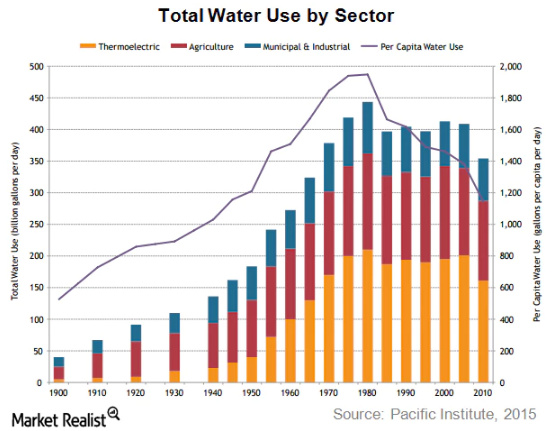

What Does Declining Water Usage Mean for Water Utilities?

Increasing efficiency with water has been a major reason behind falling water usage. Between 2005 and 2010, total water usage in the US fell by ~13%.

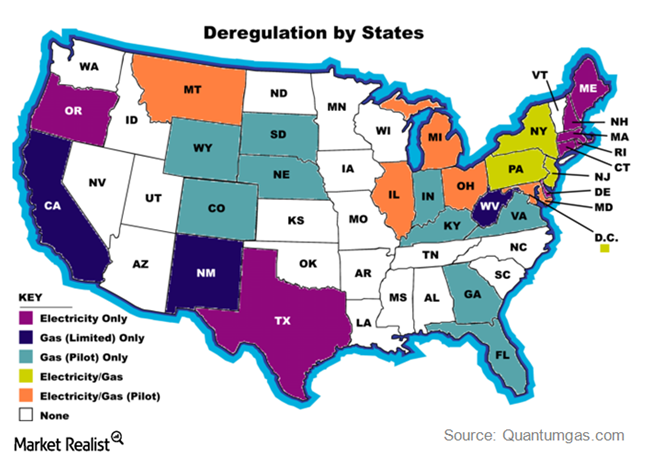

Breaking Down the Regulated and Deregulated US Electric Markets

The US electric utility industry is mostly regulated. The Public Utilities Regulatory Policies Act (or PURPA) was passed in 1978, beginning the deregulation of the utility industry.

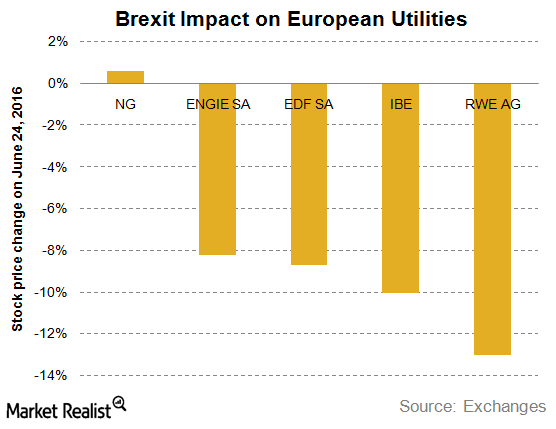

Brexit’s Impact: European Utilities Nosedive, National Grid Gains

The struggling European utilities sector encountered another obstacle in the form of Brexit. Upcoming policy changes will pave the way for them in the future.

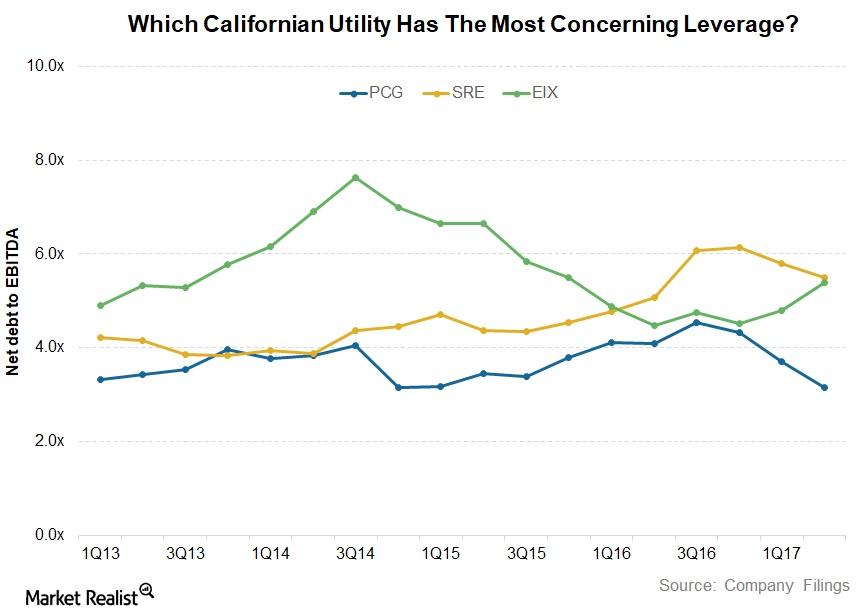

Is Sempra Energy the Smart Pick of 2018?

California-based Sempra Energy (SRE) has emerged as the largest utility by market cap in the state after PG&E Corporation’s (PCG) wildfire fiasco.

Which SPX Utility Has the Most Alarming Leverage?

At the end of 2Q17, PG&E had a total debt of $18.5 billion, while Sempra Energy had total debt of $18.1 billion. Its debt might increase going forward.

Where Does NextEra Energy Really Stand in 2H17?

NextEra Energy is one of the fastest-growing utilities in the country. In this series, we’ll discuss its operational and financial metrics and see whether it’s attractive from a long-term investment perspective.

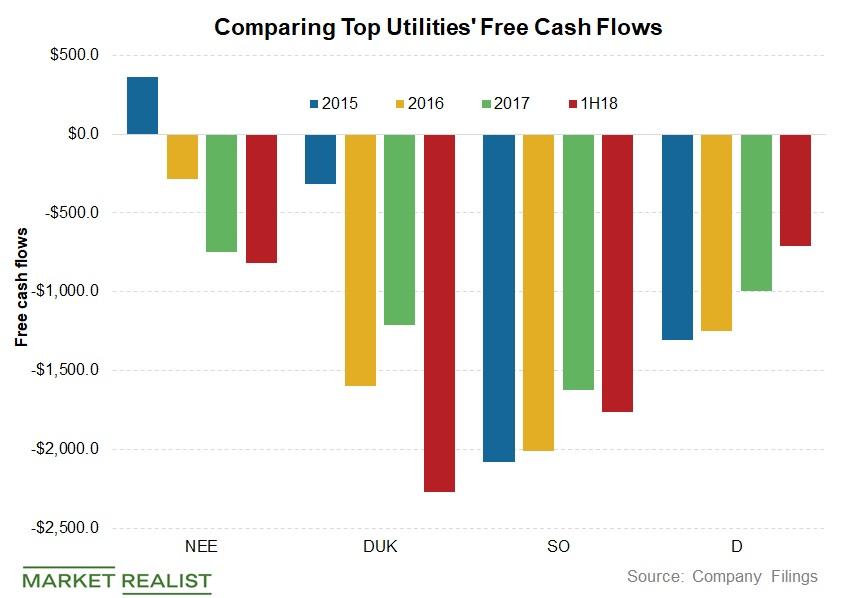

Analyzing Top Utilities’ Free Cash Flow Trends

The top four utilities have failed to generate positive free cash flows in the last few years.

Not All Utility Stocks Are Overpriced

Utility stocks seem overvalued. Utilities have reached record levels. They have been trading at inflated valuations for months.

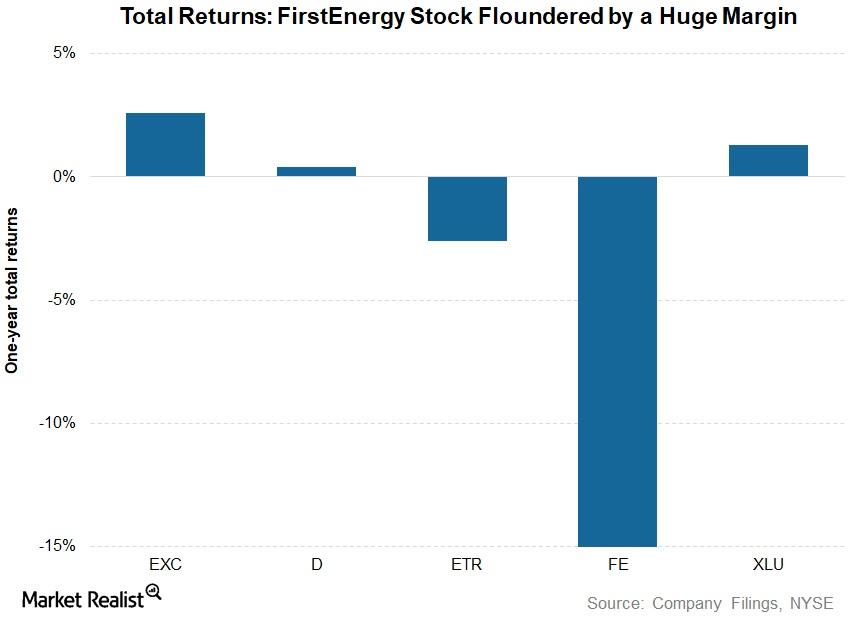

FE, D, EXC, or ETR: Which Utility Stock Stung Investors?

Exelon (EXC) stock has corrected nearly 2% in the last year. Including dividends, its returns have come in at ~3%.

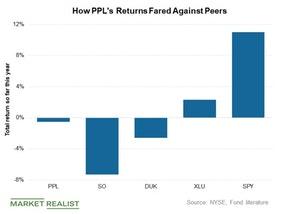

How PPL’s Returns Fared Compared to Its Peers in 2018

PPL (PPL), the top-yielding stock among the S&P 500 Utilities, has underperformed its peers in terms of total returns in 2018.

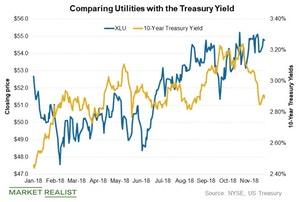

Comparing Utilities and Treasury Yields

The benchmark ten-year Treasury yield trended lower and changed from 2.68% to 2.66% last week.

The Best Utility Stock out There: NEE, DUK, or SO?

Over the past few years, utility stocks have given enormous returns and have largely followed broader markets.

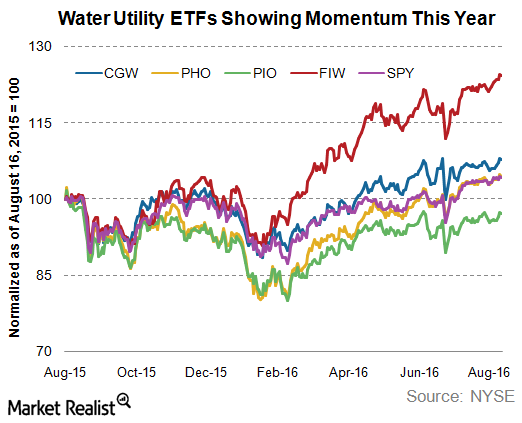

Why Do Water ETFs Yield More Than Water Utilities?

Water utility ETFs (exchange-traded funds) yield roughly 100–150 basis points more than what water utility holding companies yield.

These Utilities Have Increased Dividends for 45+ Years

Investors take shelter under relatively safe utility stocks amid market turmoil due to their stable dividend payment abilities.

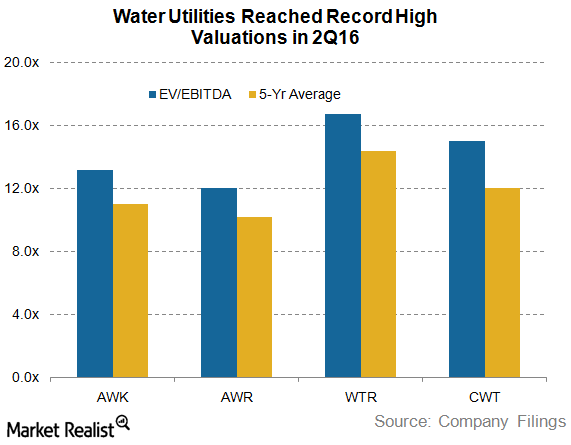

What Do Overvalued Water Utilities Indicate?

Given the sharp rally during the past six months, major water utilities are trading at huge premiums compared to their historical valuation multiples.

Behind the Earnings of US Water Utilities in 2016

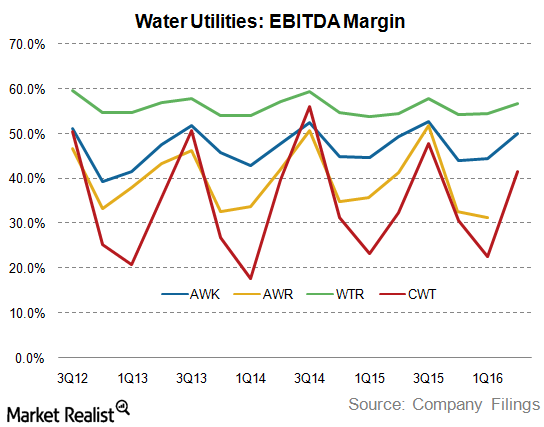

US water utilities have experienced a cyclical but flat earnings growth pattern in the past couple of years.

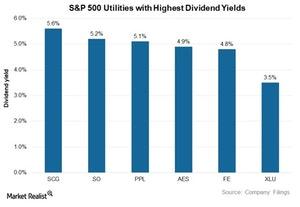

These 5 S&P 500 Utilities Offer Highest Dividend Yields

The Utilities Select Sector SPDR ETF (XLU), which tracks the S&P 500 Utilities Index, is currently trading at a dividend yield of 3.5%.

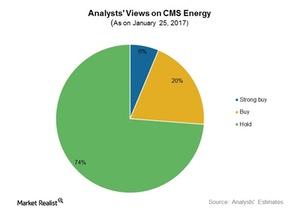

Inside CMS Energy’s Price Targets ahead of 4Q16 Results

CMS Energy (CMS) has a mean price target of $44.33 for the coming year. This implies an estimated upside of 5.6%.

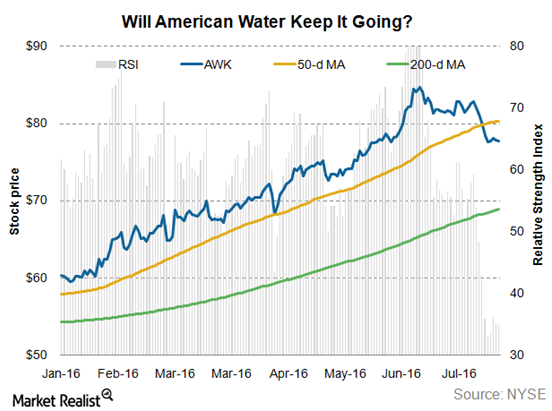

What’s ahead for American Water Works Stock?

American Water Works’ investors are likely concerned by the fact that the stock has corrected by ~12% since July 2016. But it has rallied by ~40% YTD.

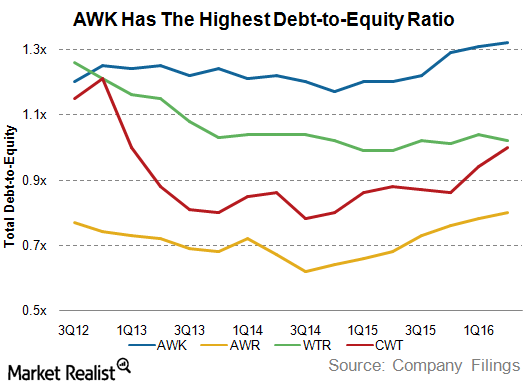

What Does American Water Works’ Leverage Indicate?

American Water Works’ debt-to-equity ratio has stayed in the range of 1.2x–1.4x. Stable debt-to-equity is usually considered a sign of financial discipline.

NextEra Energy’s Earnings: Solid Growth in Q2

NextEra Energy’s adjusted earnings have risen 13% year-over-year. The company reported an EPS of $2.35, which beat analysts’ consensus estimates.

How Will Energy Transfer Stock Perform in 2020?

Energy Transfer (ET) stock had a weak run despite strong earnings growth in 2019. Here’s a look into how analysts think ET will perform in 2020.

Tesla Solar: Could 2020 Be the Year of the Solar Roof?

During Tesla’s Q3 call, Musk said that he thinks Tesla’s solar segment could be as big or even bigger than the company’s electric vehicle business.

Dividend Faceoff: Southern Company vs Duke Energy

Dividend yields of Southern Company (SO) and Duke Energy (DUK) currently stand at multi-year lows because utility stocks had a solid run this year.

Tesla Solar: Is the Version 3 Roof Really Superior?

Whether Elon Musk made 2019 the Year of Solar is debatable. But with Tesla’s Solar Roof Version 3, the company made some notable developments.

Warren Buffett Has Loads of Cash and No Takers

Berkshire Hathaway’s huge cash pile might stay in place for a while. Warren Buffett was outbid by Apollo Global Management in his efforts to buy Tech Data.

Will Tesla Solar’s Israel Expansion Bring Success?

Tesla registered a wholly-owned subsidiary in Israel last month. Along with expanding its EV business, its foray will be important for its Solar segment.

Enphase Energy or SolarEdge: How They Stack Up

Enphase Energy (ENPH) stock fell more than 5% Friday after gaining around 25% collectively over the five previous trading sessions.

Where First Solar Stock Might Go from Here

First Solar stock has an EV-to-EBITDA valuation of 6.4x its estimated earnings for the next 12 months. The industry’s mean valuation is greater than 11x.

Williams Companies: What Could Lift Its Ailing Stock?

Williams Companies stock fell for the seventh consecutive day on Wednesday and closed almost at an 11-month low. Midstream stocks are trading weak.

Southern Company’s Dividends Compared to Its Peers

Southern Company (SO), the top regulated utility, declared a quarterly dividend of $0.62 per share last month. The ex-date for the dividends is Friday.

Tesla Solar: Is Google SEO the Only Issue?

Tesla (TSLA) launched a new version of its Solar Roof tile last month, called Solarglass. It could be a key driver of its energy segment.

Where PG&E Stock Might Go amid Interest from Mayors

PG&E gained for the sixth straight day amid increased uncertainty. The stock has gained more than 80% during this period and closed at $8 on Tuesday.