What Does American Water Works’ Leverage Indicate?

American Water Works’ debt-to-equity ratio has stayed in the range of 1.2x–1.4x. Stable debt-to-equity is usually considered a sign of financial discipline.

Nov. 20 2020, Updated 11:23 a.m. ET

AWK’s debt-to-equity ratio

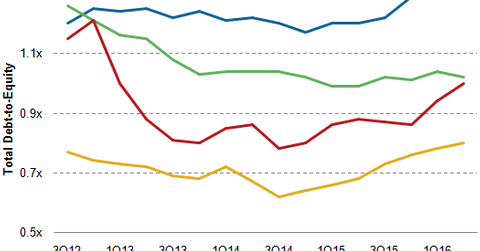

American Water Works (AWK) had one of the highest debt-to-equity ratios (1.3x) at the end of 2Q16. The company had a total debt of $6.8 billion on June 30, 2016. But during the past fifteen quarters, AWK’s debt-to-equity ratio has stayed in the range of 1.2x–1.4x, and stable debt-to-equity is generally considered a sign of financial discipline.

The chart above shows the debt-to-equity ratios of US water utilities (PHO) during the past couple of years. Notably, none of our selected companies’ ratios is currently high enough to be a matter of great concern. Instead, this stability indicates their financial discipline.

Where do other water utilities stand?

By comparison, American States Water (AWR) had a total debt of $3.6 billion at the end of 2Q16. Its debt-to-equity ratio was 0.8x while its debt-to-market-capitalization ratio was 0.24x. Among the four utilities under our consideration, AWR has the lowest debt-to-equity ratio.

Aqua America’s (WTR) debt-to-equity ratio stands at 1x, and it had a total debt of $1.8 billion at the end of 2Q16. Notably, WTR’s debt-to-equity ratio has marginally fallen during the past couple of years—a positive sign for the company—while the leverage of California Water Service (CWT) has increased during the past few quarters to 1x.

Credit rating

According to Standards & Poor’s, American Water Works has a credit rating of “A” and has a stable outlook. American States Water and California Water Service also have stable outlooks with “A+” ratings.

Continue to the next part for further leverage comparisons.