Aqua America Inc

Latest Aqua America Inc News and Updates

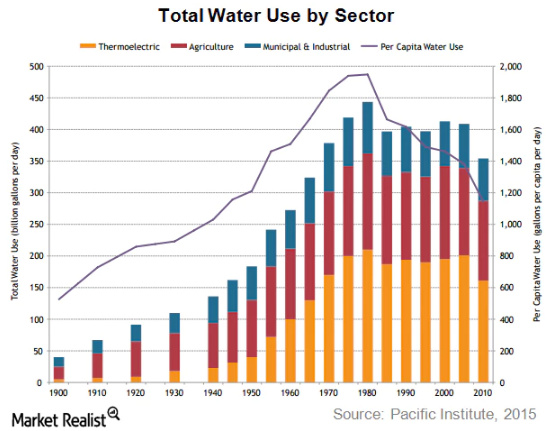

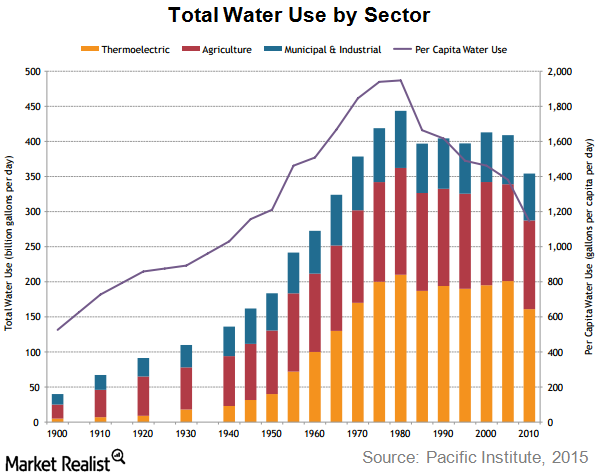

What Does Declining Water Usage Mean for Water Utilities?

Increasing efficiency with water has been a major reason behind falling water usage. Between 2005 and 2010, total water usage in the US fell by ~13%.

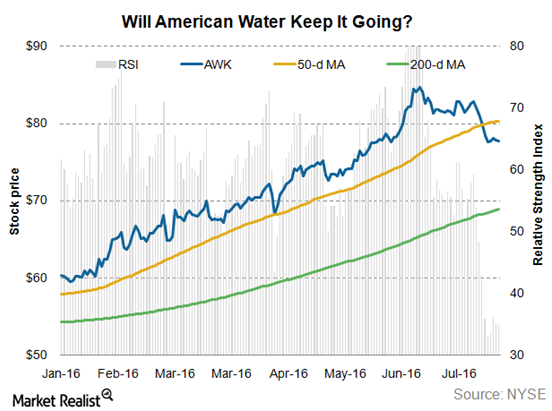

What’s ahead for American Water Works Stock?

American Water Works’ investors are likely concerned by the fact that the stock has corrected by ~12% since July 2016. But it has rallied by ~40% YTD.

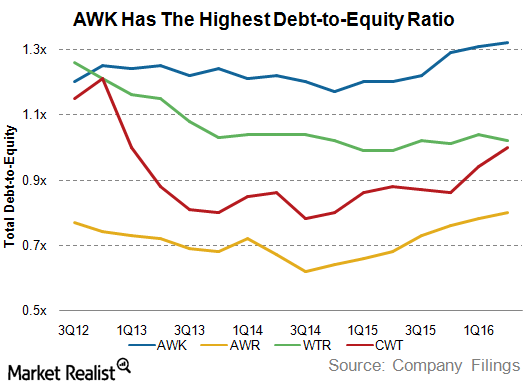

What Does American Water Works’ Leverage Indicate?

American Water Works’ debt-to-equity ratio has stayed in the range of 1.2x–1.4x. Stable debt-to-equity is usually considered a sign of financial discipline.

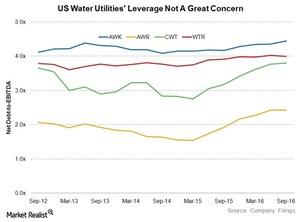

How Is American Water Works’ Leverage Compared to Peers?

Water utilities depend heavily on debt financing due to their capital projects for the longer term, and so company leverages can be useful for investors.

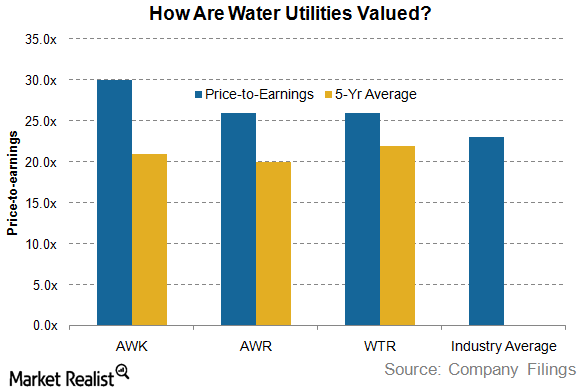

Are US Water Utilities Fairly Valued?

It seems that US water utilities are trading at a premium compared electric utilities.

What Does Falling Water Usage Mean for Water Utilities?

According to data released by the United States Geological Survey (or USGS), national water usage experienced a sharp drop between 2005 and 2010.