Vineet Kulkarni

Vineet Kulkarni joined Market Realist in July 2015 and has written more than 4,000 articles. He covers macroeconomics, renewables, and utilities. Vineet earned his master’s degree in business administration with a finance specialization. He's also a CFA Level 3 candidate. Apart from his passion for the stock markets, Vineet is an avid trekker and loves listening to classic rock.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Vineet Kulkarni

Can Tesla’s Solar Roof V3 Take Its Stock Even Higher?

Tesla launched the third version of its Solar Roof tile last week. Its previous versions failed to gain ground, but this one is expected to be different.

Elon Musk Says Tesla’s Solar Business Could Outdo EVs

Elon Musk sees huge growth potential in Tesla’s solar business. On the Q3 earnings call, he said it could even outgrow Tesla’s electric vehicles.

How PG&E Stock Could Trade after a Terrible Week

Bankrupt utility PG&E lost more than 25% last week. The fall came after the bankruptcy court allowed a bondholder group to pitch their restructuring plan.

T-Mobile-Sprint Merger: Mississippi Leaves Lawsuit

Mississippi, once a critic of the T-Mobile-Sprint merger, now backs it. Could other states withdraw from the multistate lawsuit opposing the merger?

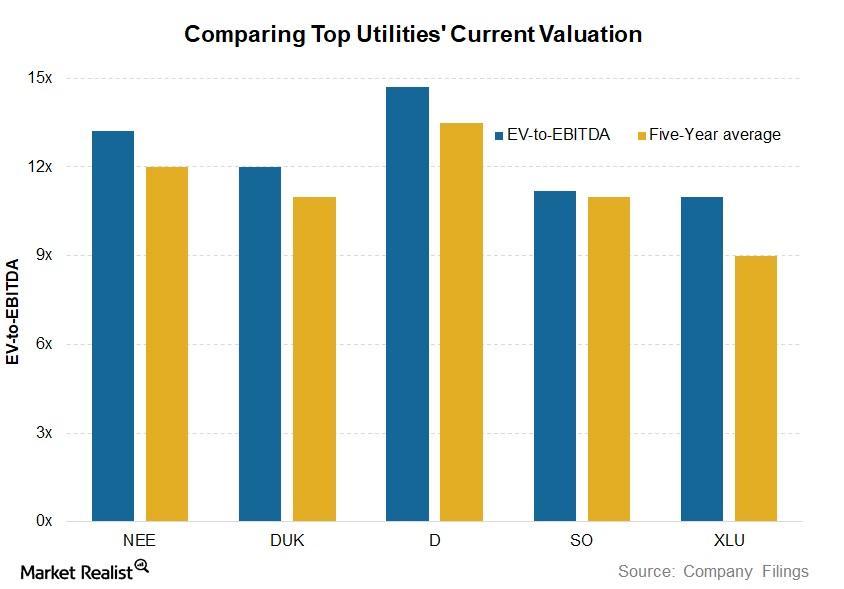

Duke Energy and Southern Company’s Current Valuations

Top utility stocks Duke Energy (DUK) and Southern Company (SO) are trading at an EV-to-EBITDA valuation multiple of 11.4x and 10.5, respectively.

Solar Stocks with Bright Upside Potential: FSLR, ENPH

Solar stocks have had a great run this year. Strong demand, falling costs, and higher corporate investments have supported these renewables in 2019.

Why Utilities Could Keep Smashing in the Fourth Quarter

Despite valuation concerns, utility stocks seem relatively well placed at the moment, especially going into October, compared to broader markets.

Why First Solar Stock Could Continue to Climb

Top solar stock First Solar (FSLR) has surged about 10% in September. FSLR is trading close to its 52-week high and might continue to march upward.

SolarEdge Stock Reaches All-Time High: Where to Now?

SolarEdge Technologies stock rose 17% to hit an all-time high of $91.40 on Friday. The solar inverter maker’s stock fell earlier this month.

Generac Challenges Enphase Energy, SolarEdge Duopoly

Short-seller Citron Research noted that Generac Holdings could challenge solar microinverter makers Enphase Energy and SolarEdge’s duopoly.

Enphase Energy Stock Looks Strong, 600% 2019 Gain

Solar microinverter company Enphase Energy (ENPH) has rallied more than any other stock in the space this year with a more-than-600% gain.

PG&E Stock Fell 25% on Higher Risks from Tubbs Fire

PG&E (PCG) shares are trading more than 25% lower on Monday. A federal judge ruled that the utility must face victims of the Tubbs Fire.

First Solar Disappoints in Q2 but Raises Guidance

First Solar (FSLR) reported its second-quarter earnings results yesterday. It reported EPS of -$0.18 for the quarter.

Utilities Are Back in Focus as the Trade War Escalates

Investors turned to defensive utilities intensified yesterday after President Trump announced 10% tariffs on another $300.0 billion worth of Chinese goods.

Solar Stocks: Sunnova’s Debut, Q2 Earnings, and More

Solar stocks traded a little sluggish in the last few weeks. First Solar has risen more than 53%, while SunPower has risen more than 106% this year.

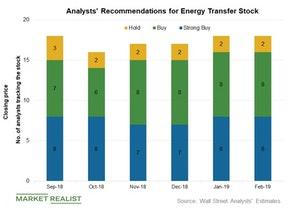

ET, EPD, and KMI: Analysts’ Views and Target Prices

According to analysts’ estimates, Energy Transfer (ET) stock has a median target price of $21.24—compared to its current market price of $14.82.

Is Joe Biden’s Green New Deal Really Feasible?

Joe Biden has proposed a climate change framework that aims to zero down on carbon emissions and create millions of new jobs by 2050.

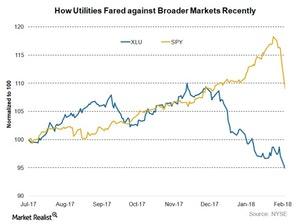

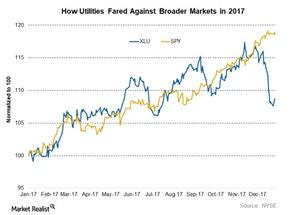

Why Utilities Underperformed the Broader Market Last Week

The defensives and utilities sector fell more than 2% last week while broader markets fell just 0.3%. Here’s why.

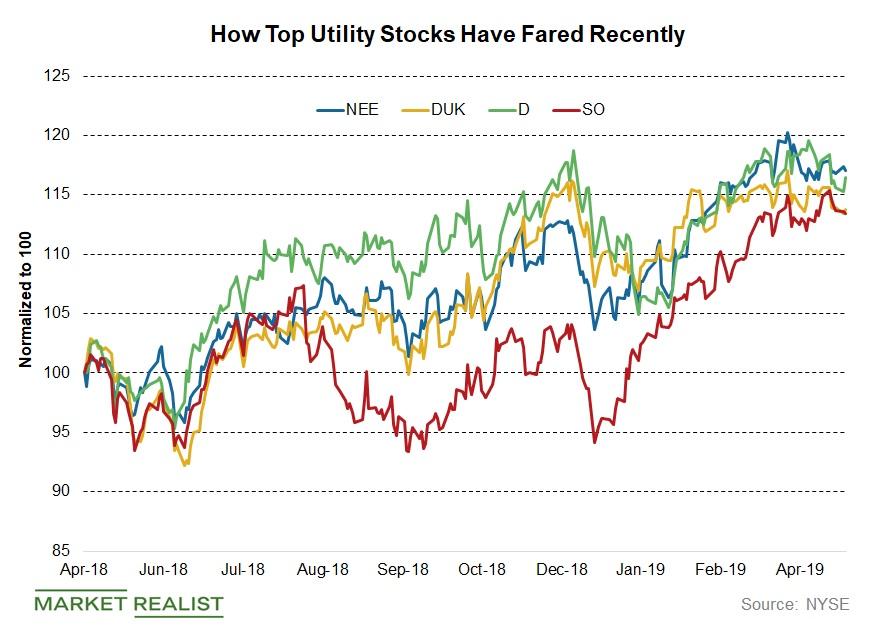

How Utility Stocks Fared Last Week

Utilities were close to their all-time high and gained 0.4% last week, while broader markets also gained marginally.

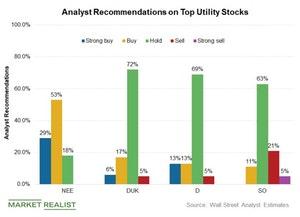

NEE, DUK, D, and SO: How Top Utility Stocks Are Currently Valued

NextEra Energy, the biggest utility by market cap, is trading at a forward PE multiple of 22x based on analysts’ estimated EPS for the next 12 months.

Top Utilities’ Stock Price Targets Get Bumped Up

Many top utility stocks’ price targets were changed last week.

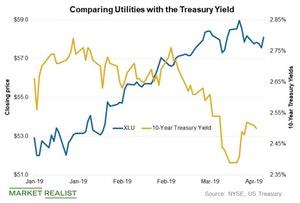

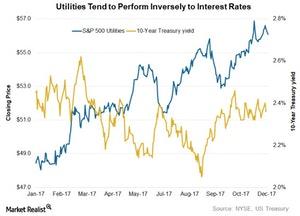

Comparing Utility Stocks and Treasury Yields

The benchmark ten-year Treasury yields closed at 2.5% last week. Treasury yields and utility stocks usually trade inversely to each other.

XLU’s Chart Indicators and Short Interest

Currently, the Utilities Select Sector SPDR ETF (XLU) is trading at $58.2 after hitting an all-time high of $58.7 last week.

A Look at Leaders and Laggards in the Utilities Sector Last Week

Utilities continued their upward march last week and outperformed broader markets.

First Solar’s Results: Q4 Profit Fell but 2019 Guidance Is Intact

First Solar (FSLR) released its fourth-quarter and full-year 2018 earnings on February 21.

NextEra Energy: Institutional Activity in Q4

The Vanguard Group was the largest institutional investor in NextEra Energy (NEE) at the end of the fourth quarter.

How’s First Solar Stock Placed Compared to Its Peers?

First Solar stock is trading at a forward PE ratio of 18x. On average, solar stocks (TAN) are trading at a forward valuation multiple of 14x.

What FirstEnergy’s Chart Indicators Suggest

Utilities have been following a downtrend recently, plummeting more than 10% since early last week.

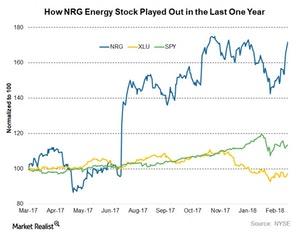

Elliott Management Exits NRG Energy in Q1: What’s Next?

Elliott Management, the activist shareholder whose involvement doubled NRG Energy (NRG) stock in the last year, has exited NRG.

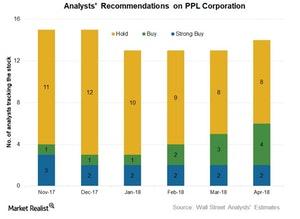

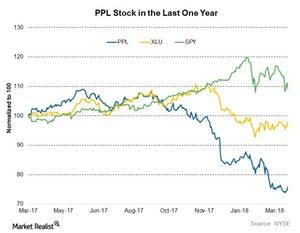

PPL: Analysts’ Views and Target Prices

PPL (PPL) stock offers an attractive potential upside of more than 13% in a year with a mean target price of $32.3. PPL stock is trading at $28.5.

What PPL’s Current Valuation Means for the Stock

PPL Corporation (PPL) stock was particularly hit by the recent utilities turmoil. Its valuation fell significantly over the last few months.

How FirstEnergy Stock Ranks against Peers

FirstEnergy (FE) has been one of the top-performing stocks among the S&P 500 Utilities Index (XLU) this year.

How’s PPL Stock Valued Compared to Its Peers?

Currently, PPL is trading at a PE (price-to-earnings) multiple of 13x—compared to peers’ (XLU) average valuation around similar levels.

NRG Energy’s Current Valuation

Currently, NRG Energy (NRG) stock is trading at an EV-to-EBITDA valuation of 12x—compared to its five-year historical valuation of around 11x.

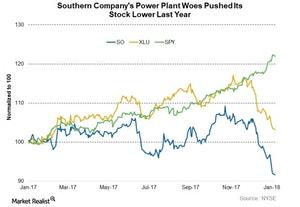

How Does Southern Company’s Dividend Profile Look?

Georgia-based Southern Company (SO) currently offers a dividend yield of 5.2%, the highest among top SPX utilities.

How Are Utilities’ Dividend Yields and Valuations Trending?

Utilities’ dividend yields have started looking even more attractive after their recent fall.

Does Southern Company Stock Have an Attractive Valuation?

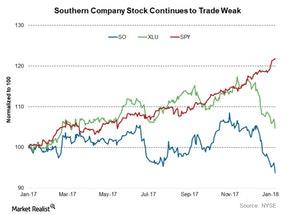

Southern Company (SO), the second largest rate-regulated utility, is currently trading at an EV-to-EBITDA multiple of 10.5x.

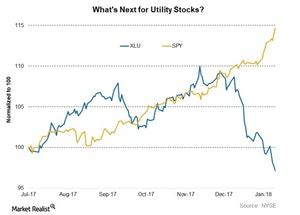

How US Utility Stocks Are Valued for the New Year

US utilities have corrected notably over the past few weeks, and their recent valuations could start attracting new entrants.

Analyzing Top Utilities’ Current Valuations

The steep fall in utilities in the last couple of weeks seems to have aggravated utilities due to their record high valuations.

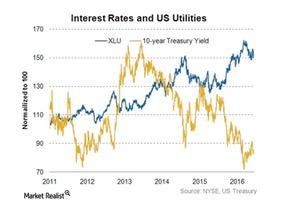

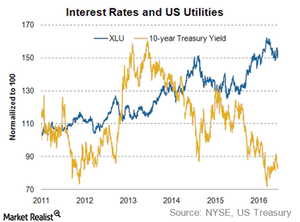

Utilities Tend to Have Inverse Relationship with Interest Rates

On December 13, 2017, ten-year Treasury yields fell to 2.4%. The ten-year Treasury yields (TLT) reported a yearly high of 2.6% prior to the first rate hike in March 2017.

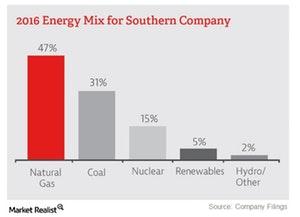

A Look at Southern Company’s Generation Mix

At 46 GW (gigawatts) Southern Company (SO) has the second-largest generation capacity in the country.

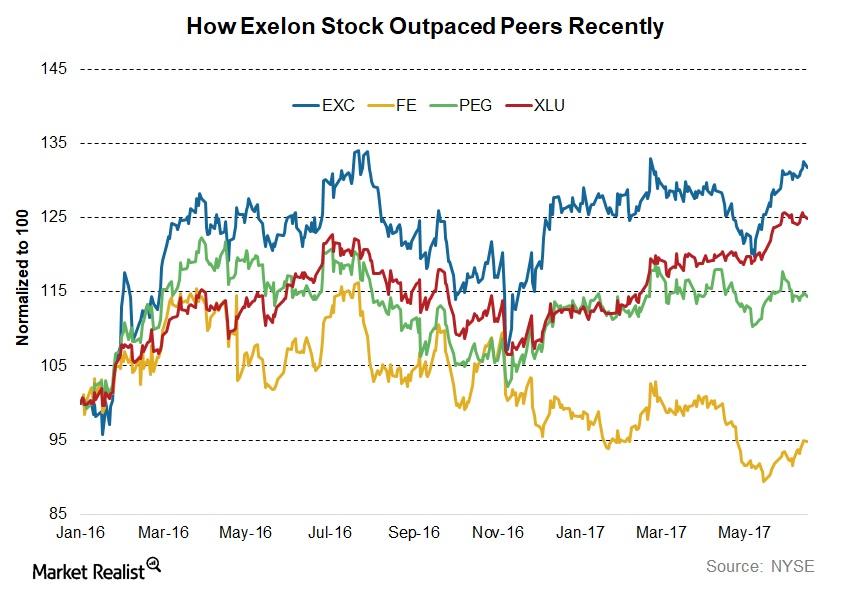

EXC, FE, and PEG: Are Hybrid Utilities Really Worth the Risk?

US utilities including giants like Duke Energy (DUK) and Southern Company (SO) have done fairly well in the last few months compared to broader markets.

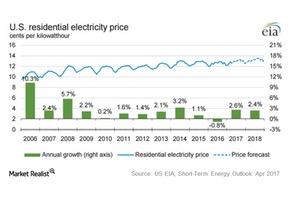

Looking at US Electricity Prices in 2017

The EIA expects electricity prices to rise 2.6% in 2017 compared to 2016.

Dominion Resources Stock Approaches Peak: What’s Next?

Dominion Resources (D) continues to look interesting from an investor’s perspective as the stock approaches multiyear highs.

How Higher Interest Rates Can Impact Utilities

Treasury yields (TLT) become more attractive when interest rates rise, making utilities (XLU) less competitive in terms of yields.

Analyzing Chart Indicators for WEC Energy Stock

As of January 23, 2017, WEC Energy Group (WEC) stock was trading at a 2.0% premium to its 50-day moving average.

Understanding How Higher Interest Rates Impede Utilities

The near-zero interest rate environment has resulted in a low cost of debt, which has motivated more new debt issuances by utilities.

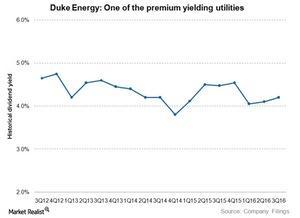

Why Does Duke Energy Yield Better Than the Industry Average?

Duke Energy is one of the highest-yielding S&P 500 Utilities stocks. Its large regulated operations fetch stable earnings and offer stable dividends.

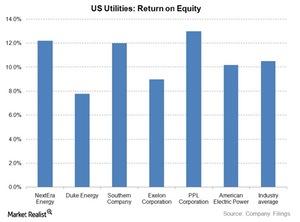

A Look at US Utilities’ Return on Equity

Duke Energy’s (DUK) adjusted return on equity stayed below 8% due to volatile earnings from international operations. This ROE was on the lower side of the industry average.

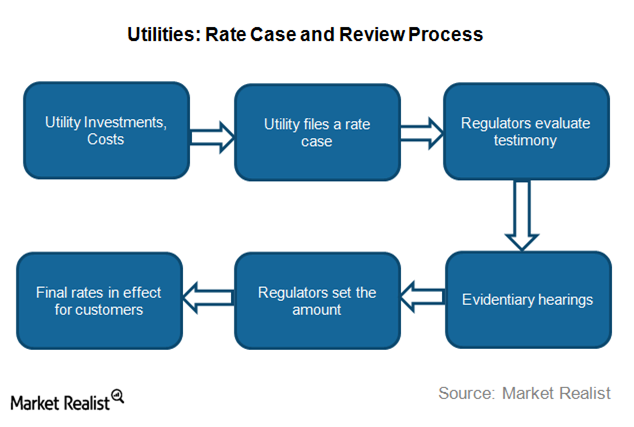

A Look at Utilities’ Rate Cases and the Review Process

The utilities industry is a relatively stable industry, as the demand for electricity, water, and gas—basic business and consumer needs—is less influenced by economic cycles than other industries.