Top Utilities’ Stock Price Targets Get Bumped Up

Many top utility stocks’ price targets were changed last week.

April 22 2019, Published 3:23 p.m. ET

Price targets

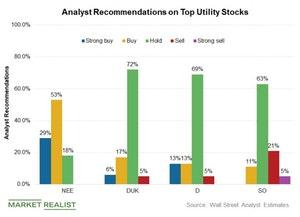

Many top utility stocks’ price targets were changed last week. Analysts’ median target price of $195.50 for NextEra Energy (NEE) implies a 3.2% based its current price of $189.40. Today, Credit Suisse raised NEE’s price target from $190 to $199, and Morgan Stanley raised it from $191 to $193 on April 18.

Top utilities

Analysts’ median target price of $91.60 for Duke Energy (DUK) implies a 2.8% upside from its current price of $89.10. Credit Suisse raised Duke Energy’s target price from $88 to $91 today, and Morgan Stanley raised it from $91 to $94 on April 18.

Analysts’ median target price of $77.60 for Dominion Energy (D) implies a 3.5% upside from its current price of $74.90. Credit Suisse cut Dominion’s target price from $78 to $77 today.

Analysts’ median target price of $51.10 for Southern Company (SO) implies a fall from its current price of ~$52. Credit Suisse increased SO’s price target from $48 to $51 today.