Southern Co

Latest Southern Co News and Updates

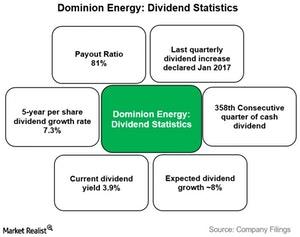

What Investors Should Know about Dominion Energy’s Dividends

Dominion Energy’s (D) payout ratio (the percentage of profit that it gave away in the form of dividends) was 81% in 2016, which is higher than the industry average and slightly on the lower side of its five-year payout average of 85%.

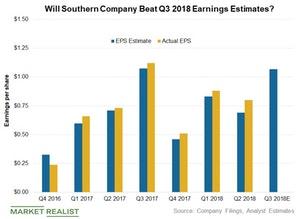

Will Southern Company Beat Its Q3 EPS Estimates?

Southern Company’s management has given an EPS guidance of $1.05 for the third quarter.

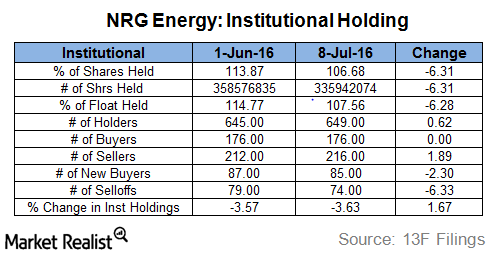

What Are Institutional Investors Doing with NRG Energy?

Institutional investors decreased their positions in NRG Energy (NRG) in June 2016.

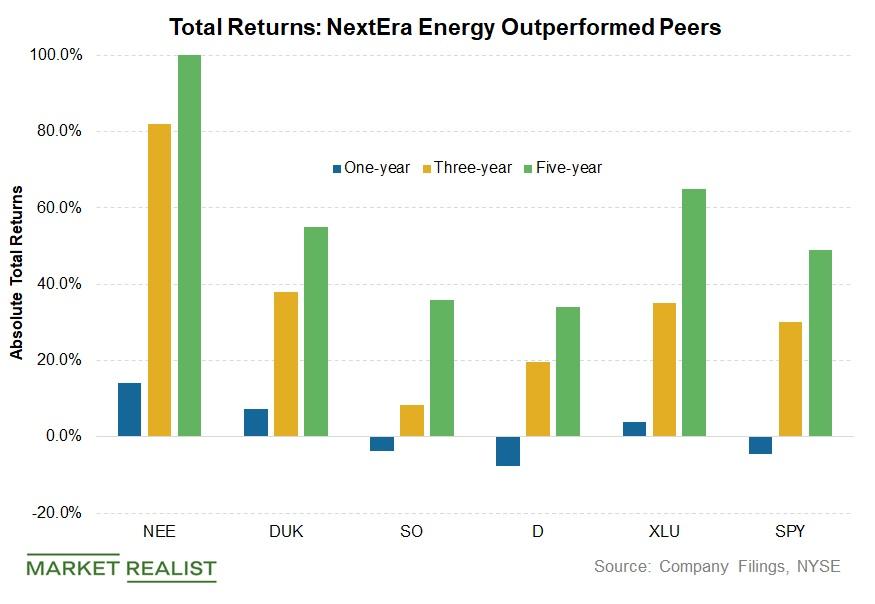

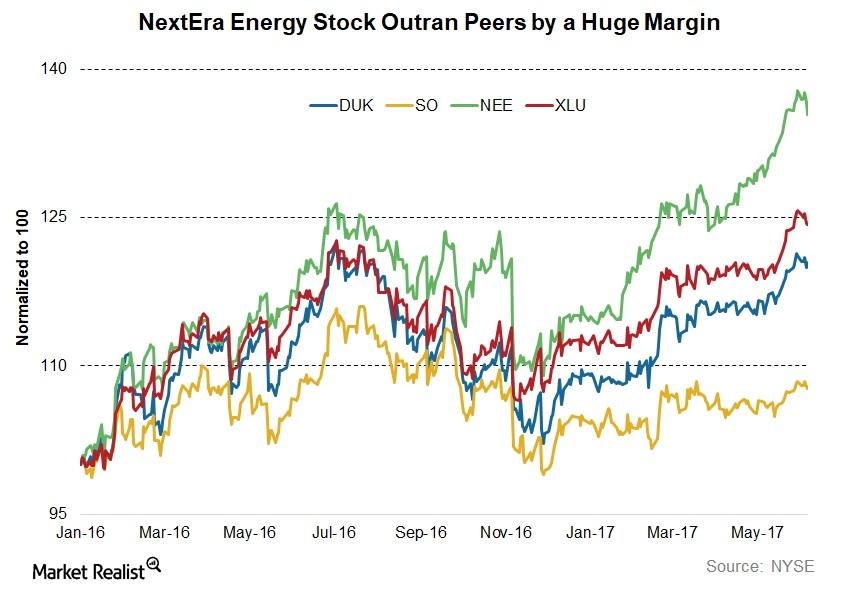

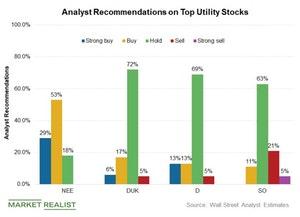

NEE, DUK, SO, and D: Comparing Top Utilities’ Total Returns

NextEra Energy (NEE) beat its peers in terms of returns in the last few years. NextEra Energy returned 14% in 2018.

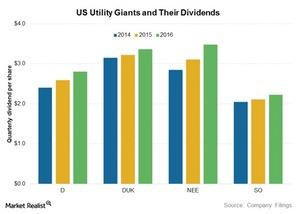

D, DUK, NEE, and SO: Top Utilities’ Dividends

Dominion Resources (D) paid annual dividends of $2.80 in 2016. Duke Energy (DUK) paid dividends of $3.36 per share last year.

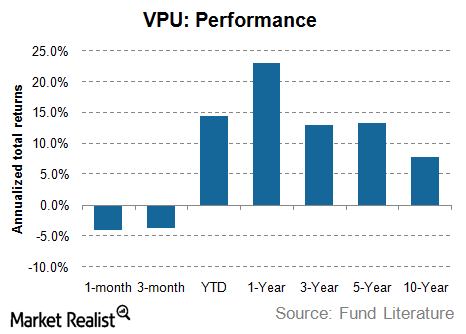

VPU Versus XLU: Which Utility ETF Is Better?

Utility ETFs have performed well in the last one year. The Vanguard Utilities Fund ETF (VPU) has been no exception to this.

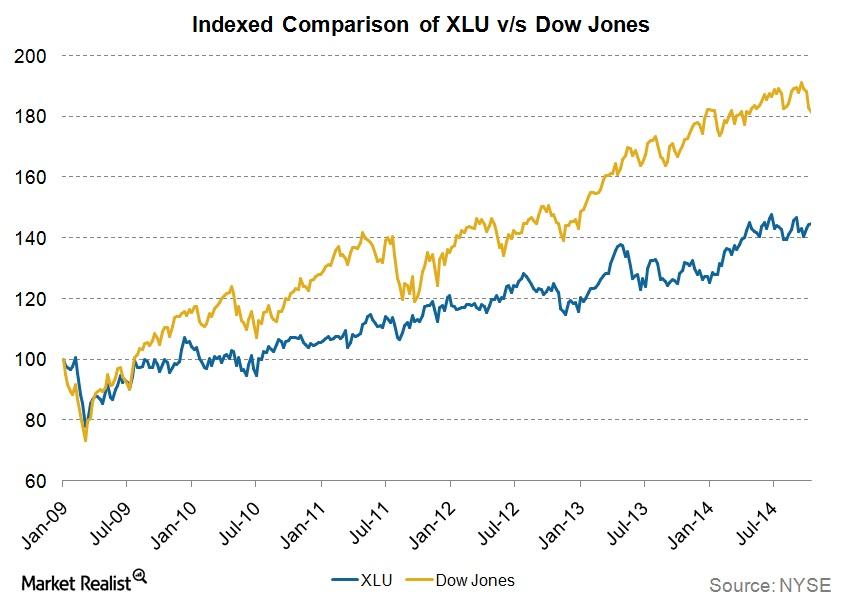

Must-know: US power sector and its indicators

The power sector is the backbone of any economy. All of the other industries depend on it. In the U.S., the power utilities business is characterized by steady dividends and stable earnings.

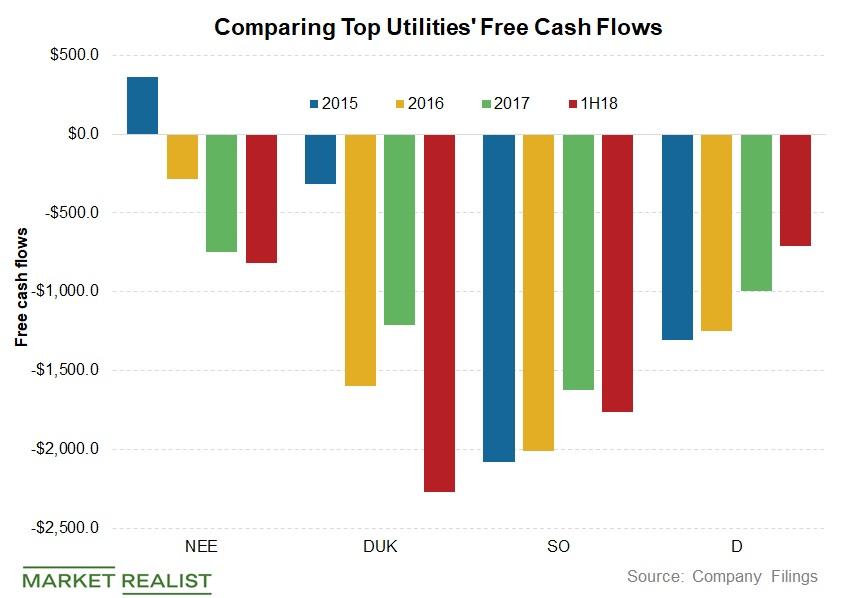

Analyzing Top Utilities’ Free Cash Flow Trends

The top four utilities have failed to generate positive free cash flows in the last few years.

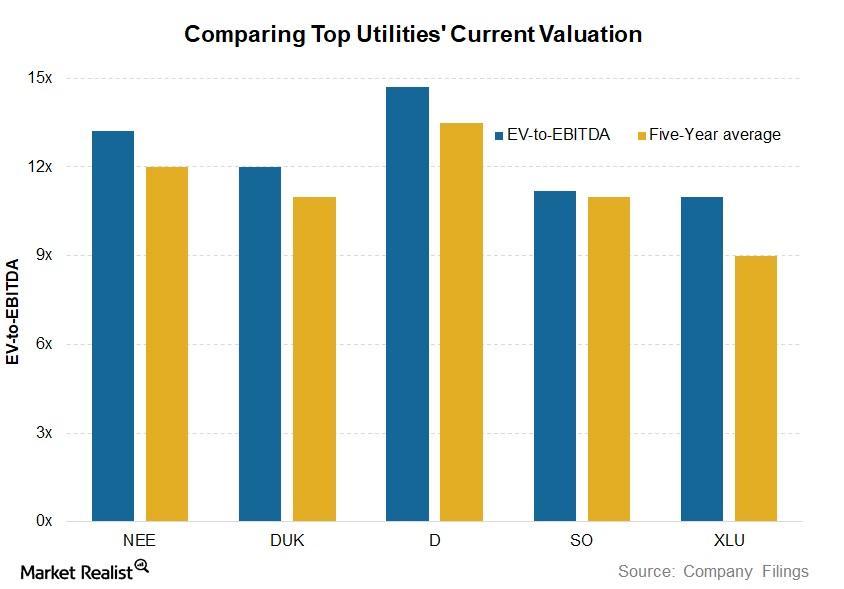

Not All Utility Stocks Are Overpriced

Utility stocks seem overvalued. Utilities have reached record levels. They have been trading at inflated valuations for months.

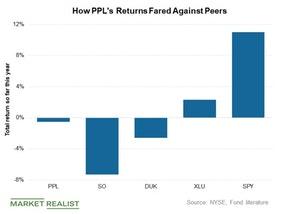

How PPL’s Returns Fared Compared to Its Peers in 2018

PPL (PPL), the top-yielding stock among the S&P 500 Utilities, has underperformed its peers in terms of total returns in 2018.

The Best Utility Stock out There: NEE, DUK, or SO?

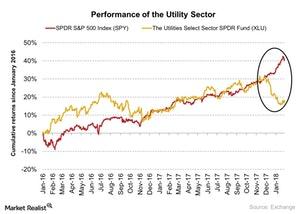

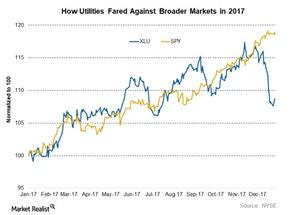

Over the past few years, utility stocks have given enormous returns and have largely followed broader markets.

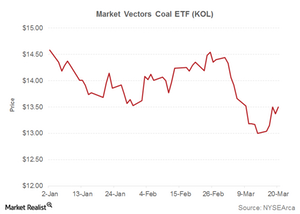

Why Coal and Power Indicators Matter for Long-Term Investing

Why are we combining thermal coal and power indicators? Thermal coal is mostly used for electricity generation.

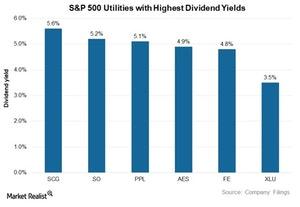

These 5 S&P 500 Utilities Offer Highest Dividend Yields

The Utilities Select Sector SPDR ETF (XLU), which tracks the S&P 500 Utilities Index, is currently trading at a dividend yield of 3.5%.

NextEra Energy’s Earnings: Solid Growth in Q2

NextEra Energy’s adjusted earnings have risen 13% year-over-year. The company reported an EPS of $2.35, which beat analysts’ consensus estimates.

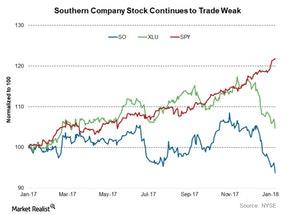

Dividend Faceoff: Southern Company vs Duke Energy

Dividend yields of Southern Company (SO) and Duke Energy (DUK) currently stand at multi-year lows because utility stocks had a solid run this year.

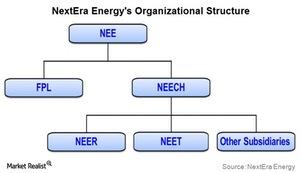

Utilities company overview: NextEra Energy

NextEra Energy (NEE) is the second-largest power company in the US after Duke Energy (DUK) in terms of market capitalization.

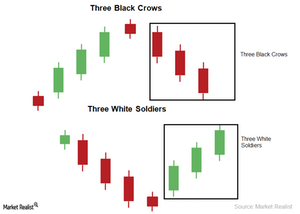

Three Black Crows And Three White Soldiers Candlestick Pattern

The Three White Soldiers candlestick pattern is also a reversal pattern. It forms at the bottom of a downtrend. The pattern has three candles. All three of the candles are long and bullish.

Regulated business is Southern Company’s strength

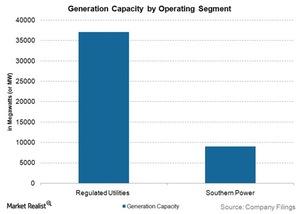

Southern Company manages its regulated utility business through the following four subsidiary companies: Alabama Power, Georgia Power, Gulf Power, and Mississippi Power. These subsidiaries have a combined power generation capacity of 37,000 megawatts (or MW).

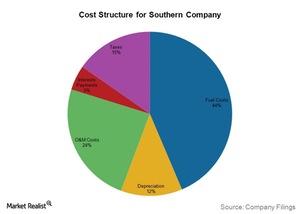

Cost structure sets Southern Company above its competitors

Fuel costs per kWh can be used to evaluate the efficiency of a power producer to produce electricity. Southern Company’s fuel cost per kWh is lower than its competitors’ in the regulated utility business.

NextEra Energy plays in regulated and unregulated utility markets

NextEra Energy is a Florida-based power company. Its subsidiaries are Florida Light & Power and NextEra Energy Resources.

Southern Company’s Dividends Compared to Its Peers

Southern Company (SO), the top regulated utility, declared a quarterly dividend of $0.62 per share last month. The ex-date for the dividends is Friday.

Why Utilities Could Keep Smashing in the Fourth Quarter

Despite valuation concerns, utility stocks seem relatively well placed at the moment, especially going into October, compared to broader markets.

Utilities Are Back in Focus as the Trade War Escalates

Investors turned to defensive utilities intensified yesterday after President Trump announced 10% tariffs on another $300.0 billion worth of Chinese goods.

Why Utilities Underperformed the Broader Market Last Week

The defensives and utilities sector fell more than 2% last week while broader markets fell just 0.3%. Here’s why.

How Utility Stocks Fared Last Week

Utilities were close to their all-time high and gained 0.4% last week, while broader markets also gained marginally.

Top Utilities’ Stock Price Targets Get Bumped Up

Many top utility stocks’ price targets were changed last week.

XLU’s Chart Indicators and Short Interest

Currently, the Utilities Select Sector SPDR ETF (XLU) is trading at $58.2 after hitting an all-time high of $58.7 last week.

A Look at Leaders and Laggards in the Utilities Sector Last Week

Utilities continued their upward march last week and outperformed broader markets.

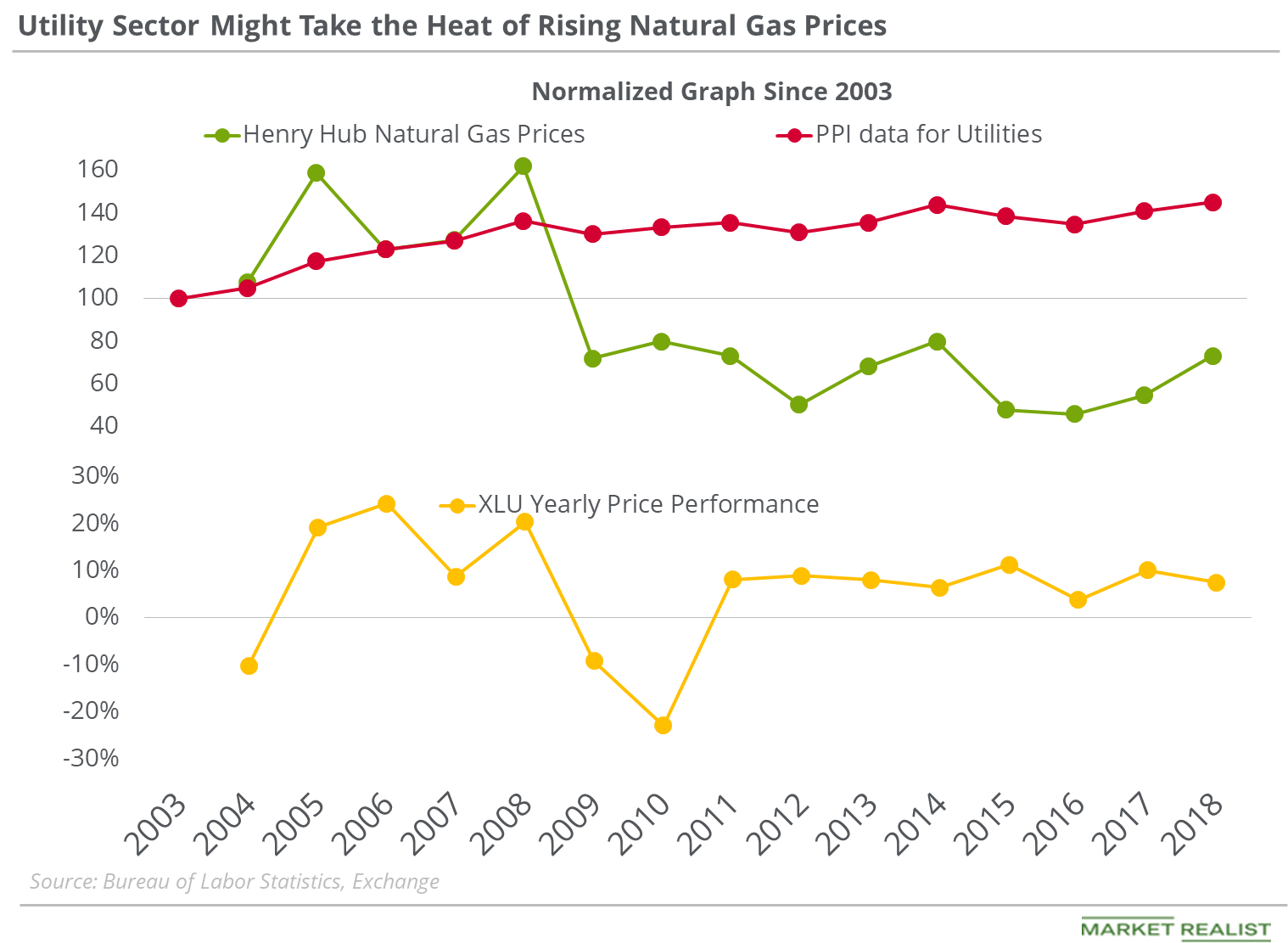

Utilities’ PPI Could Increase with Higher Natural Gas Prices

On March 3, 2016, natural gas active futures were at the lowest closing level in the last 17 years.

Why Utility Sector Had Inverse Correlation with S&P 500 in January

The Utilities Select Sector SPDR ETF (XLU), which tracks the performance of the utility sector, fell 3.2% in January 2018.

Does Southern Company Stock Have an Attractive Valuation?

Southern Company (SO), the second largest rate-regulated utility, is currently trading at an EV-to-EBITDA multiple of 10.5x.

How US Utility Stocks Are Valued for the New Year

US utilities have corrected notably over the past few weeks, and their recent valuations could start attracting new entrants.

Analyzing Top Utilities’ Current Valuations

The steep fall in utilities in the last couple of weeks seems to have aggravated utilities due to their record high valuations.

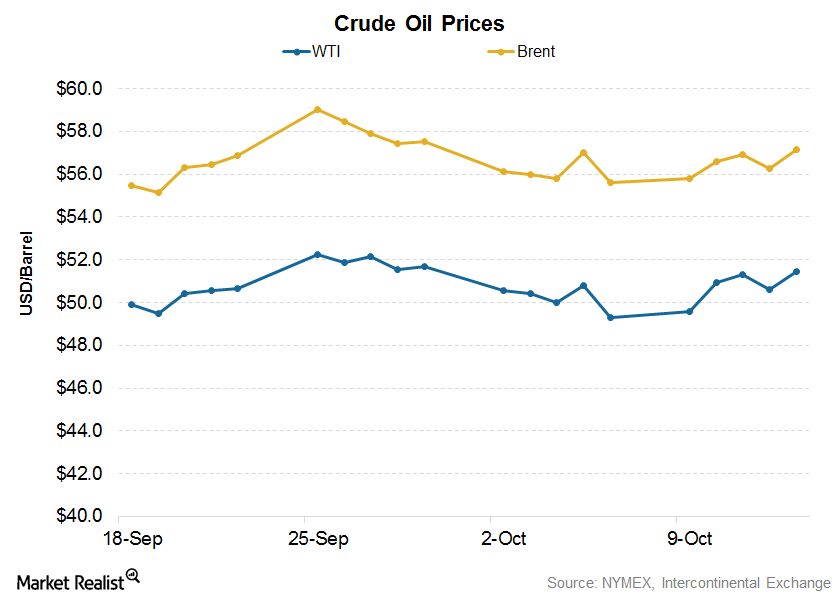

How Higher Crude Oil Prices Impact Coal Producers

On October 13, 2017, Brent crude oil prices settled at $57.17 per barrel, 3% higher than $55.60 reported during the previous week.

How Crude Oil Indirectly Impacts Coal Prices

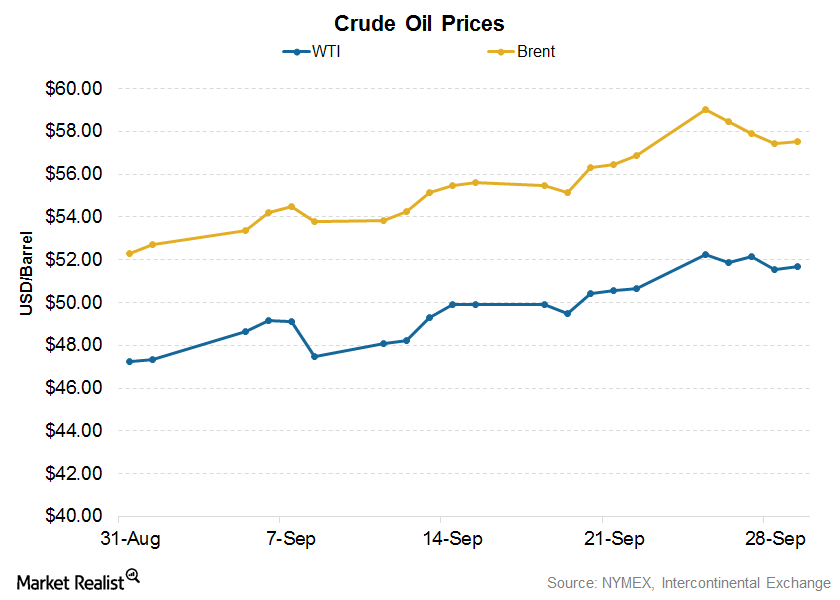

On September 29, 2017, Brent crude oil prices closed at $57.54 per barrel compared to $56.86 the previous week.

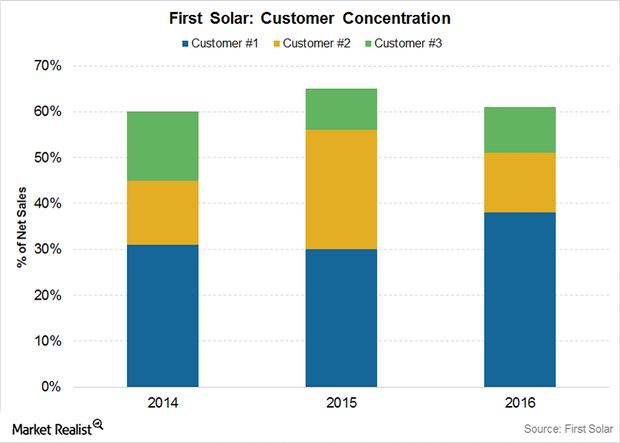

Southern and Nextera Energy: First Solar’s Key Customers

High customer concentration In 2016, First Solar (FSLR) sold solar modules to customers in the United States, India, and the United Arab Emirates. Approximately 23% of its total revenue was from third-party module sales. The majority of First Solar’s customer base is in the United States, which makes up to more than 80% of total […]

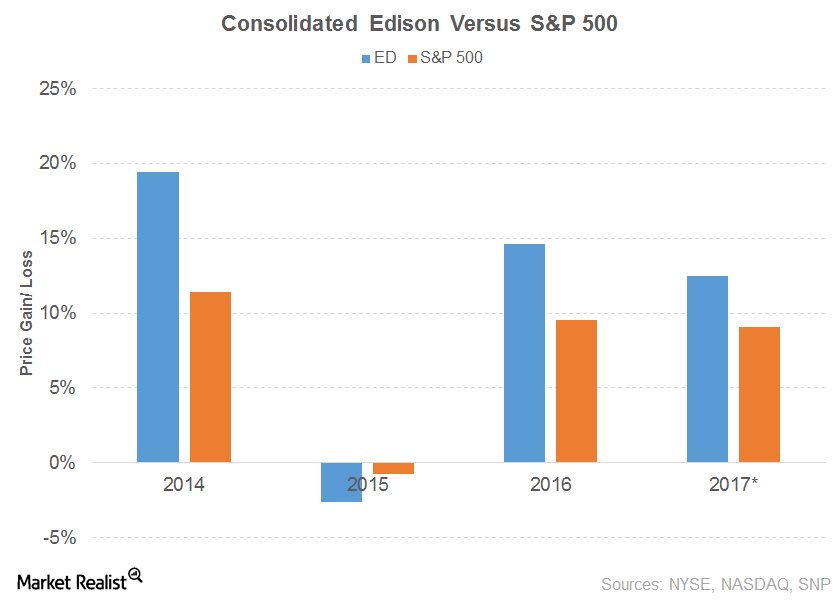

Consolidated Edison’s Dividend Trajectory

Consolidated Edison’s (ED) 2016 operating revenues fell 4.0% due to a decline in every segment; namely, electric, gas, steam, and non-utility.

Utilities Overview: How Does the Electricity Supply Chain Work?

The US electric utility industry is a mature business that is growing slowly and steadily. The country’s electric grid consists of 7,300 power plants and 160,000 miles of high-voltage power lines that deliver electricity to more than 145 million customers.

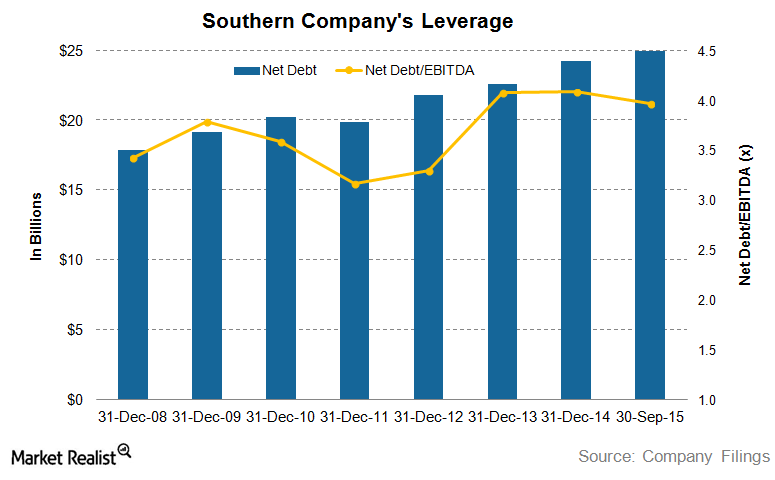

Analyzing Southern Company’s Debt Profile

As of September 30, 2015, Southern Company had total debt of $27 billion against equity of $20.6 billion. Of this, $22.3 billion is long-term debt.

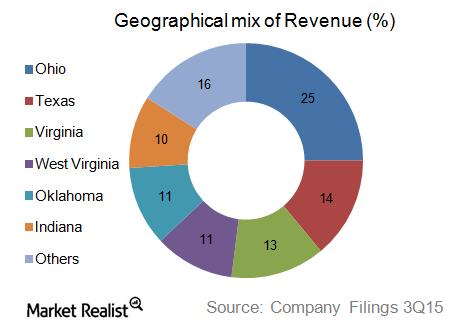

American Electric Power’s Balanced Geographical Revenue Mix

American Electric Power has a geographically diversified market combination, with a major chunk of its revenue coming from its homeland Ohio.

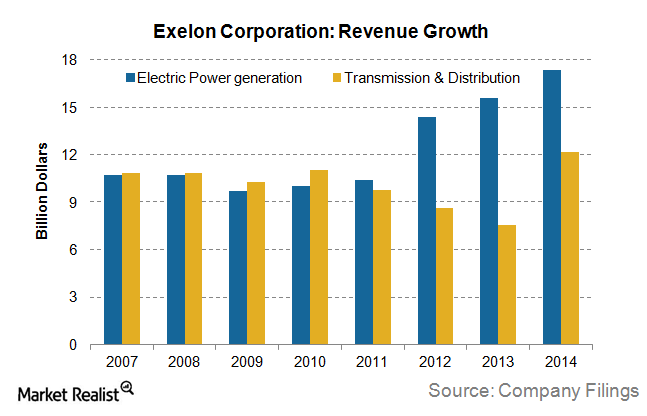

Analyzing Exelon’s Key Revenue Drivers

Demand growth for electricity in the last decade has been sluggish due to increasingly energy-efficient devices and equipment.

Electricity Generation Falls in All Census Divisions

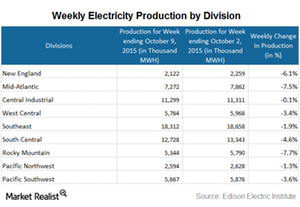

the electricity generation in the US fell by 3.5% to 71.1 million mWh. Electricity generation fell in all of the nine census divisions during the week ended October 9.

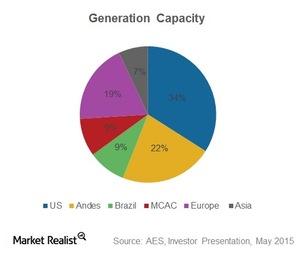

How Does AES Corporation Categorize Its Businesses?

AES Corporation (AES) is a diversified power generation and utility company. It operates its business under six SBUs (strategic business units).

Southern Company Is a Diversified Utility Company

Southern Telecom is a telecommunications subsidiary of Southern Company. It provides dark fiber optic solutions to various businesses.

SPY’s Struggle with Wall Street Continues

Of the 502 constituent stocks of SPY, only 23 recorded positive returns on Wall Street on August 20. Only seven stocks traded at a closing price above their moving averages.

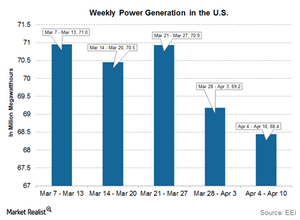

US Electricity Production Falls for the Second Straight Week

Electricity storage is expensive. Most of the produced electricity is consumed instantaneously. As a result, electricity generation mirrors consumption.

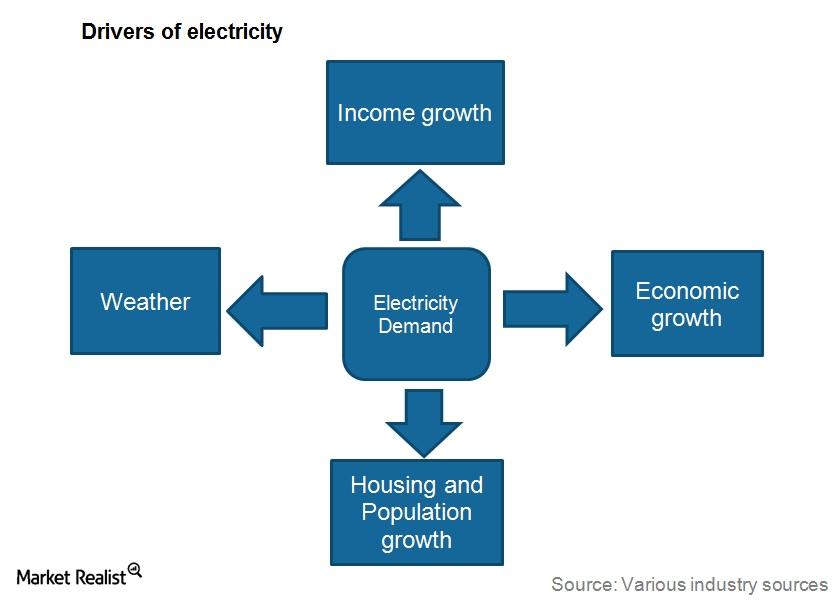

Must-know: Factors that impact electricity demand

The most important factor that affects electricity demand is household income. According to the U.S. Energy Information Administration (or EIA), between 1981 and 2001, household real disposable income increased by 49%—from $17,217 to $25,698.

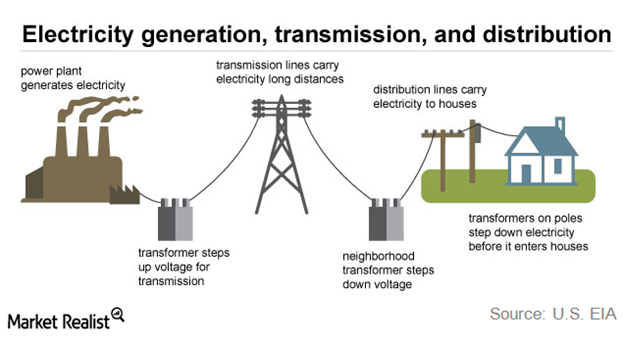

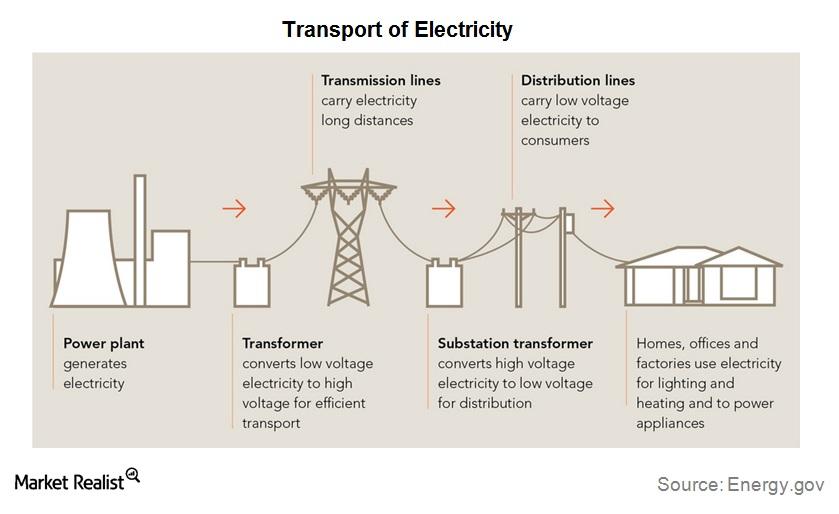

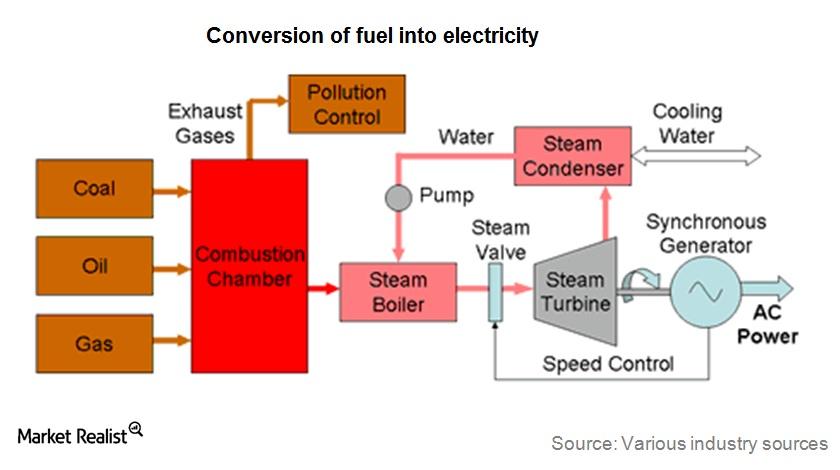

Must-know: The supply chain delivers electricity

The industry’s supply chain consists of three broad categories—generation, transmission, and distribution. Power generation requires a fuel source—for example, coal, nuclear, natural gas, or wind—and a power plant to convert the fuel source into electricity.Energy & Utilities Must-know: The top US electric utility companies

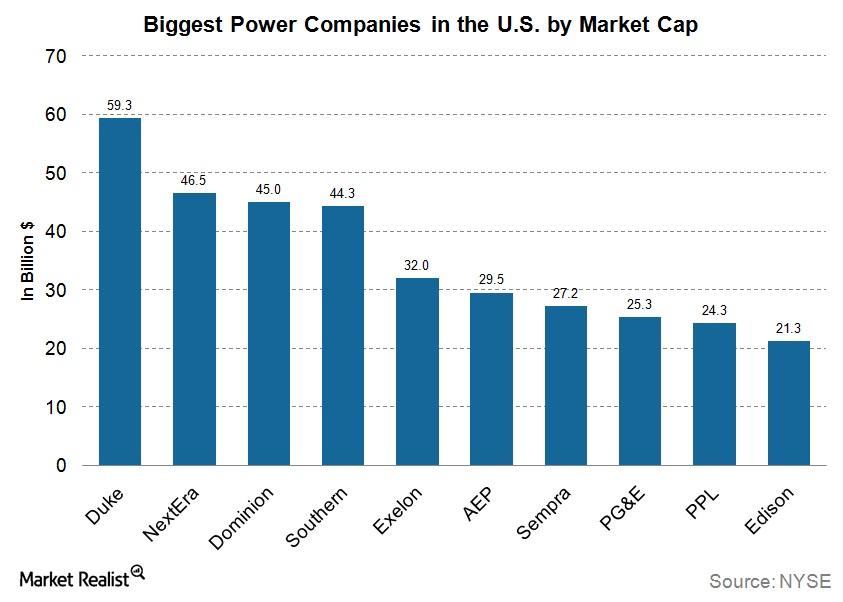

The top electric utility companies in the U.S. include Duke Energy, Exelon Corporation, Southern Company, NextEra Energy, and Dominion Resources. These companies are largest in terms of market cap.

Must-know: Terminology used in the electric utilities industry

Electricity comes from energy sources that are found in nature. These sources are called primary energy sources. They’re the first form of energy. Primary energy sources include coal, gas, oil, wind, and water.