Understanding How Higher Interest Rates Impede Utilities

The near-zero interest rate environment has resulted in a low cost of debt, which has motivated more new debt issuances by utilities.

Jan. 4 2017, Updated 5:35 p.m. ET

The interest rate and utilities

The near-zero interest rate environment has resulted in a low cost of debt, which has motivated more new debt issuances than new equity issuances by utilities.

However, the normalization of interest rates by the US Federal Reserve could reverse this scenario again, as debt servicing would become more expensive.

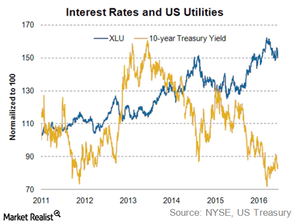

At the same time, Treasury yields (TLT) become more attractive when interest rates rise, making utilities (XLU) less competitive in terms of yields. For this reason, conservative investors tend to dump utility stocks (IDU) and load up on bonds when interest rates rise.

In the next part, we’ll analyze the earnings of US utilities and discuss their earnings outlooks for 2017.