BTC iShares U.S. Utilities ETF

Latest BTC iShares U.S. Utilities ETF News and Updates

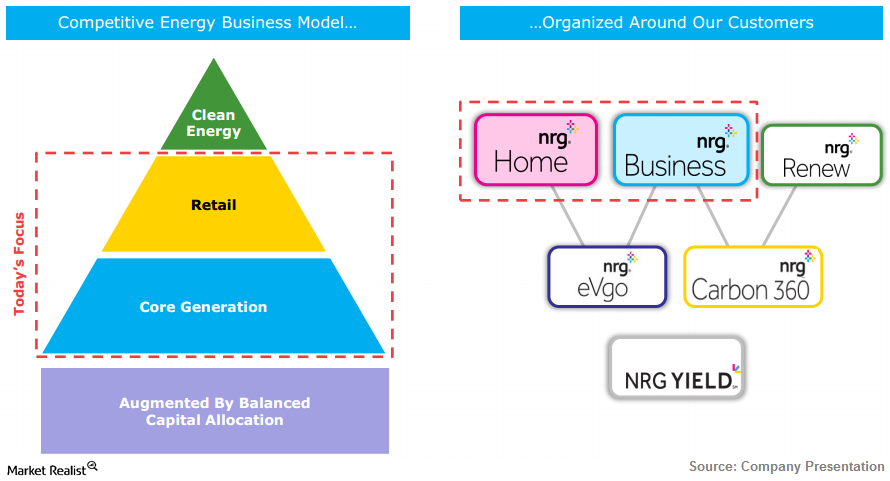

Oaktree Capital Sheds Nearly Half Its Holdings in NRG Energy

NRG Energy is a US-based integrated retail electricity and wholesale power-generation firm. The company has 2.5 million residential customers across the US.

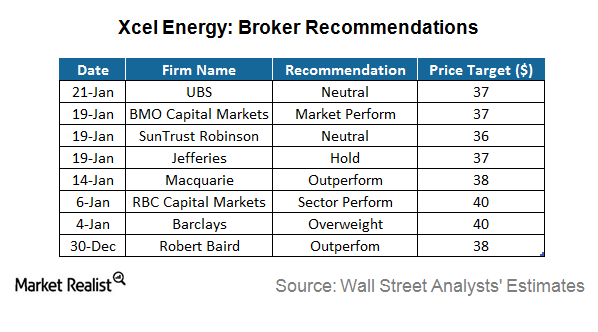

No Analysts Recommend a “Sell” on Xcel Energy

Of the 18 analysts tracking Xcel Energy, 13 recommend it as a “hold,” five recommend it as a “buy,” and none recommend it as a “sell.”

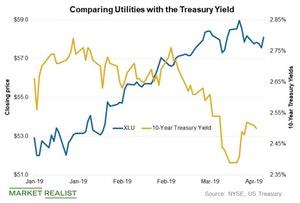

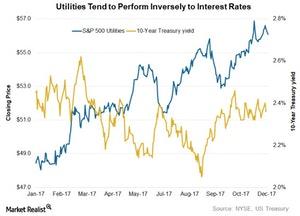

Comparing Utilities and Treasury Yields

The benchmark ten-year Treasury yield trended lower and changed from 2.68% to 2.66% last week.

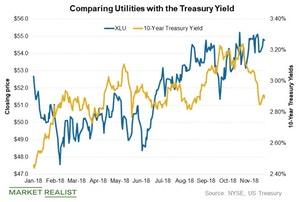

Why Utilities Could Keep Smashing in the Fourth Quarter

Despite valuation concerns, utility stocks seem relatively well placed at the moment, especially going into October, compared to broader markets.

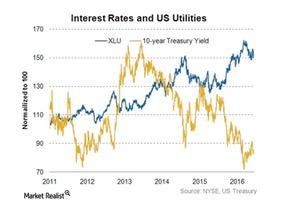

Comparing Utility Stocks and Treasury Yields

The benchmark ten-year Treasury yields closed at 2.5% last week. Treasury yields and utility stocks usually trade inversely to each other.

XLU’s Chart Indicators and Short Interest

Currently, the Utilities Select Sector SPDR ETF (XLU) is trading at $58.2 after hitting an all-time high of $58.7 last week.

Utilities Tend to Have Inverse Relationship with Interest Rates

On December 13, 2017, ten-year Treasury yields fell to 2.4%. The ten-year Treasury yields (TLT) reported a yearly high of 2.6% prior to the first rate hike in March 2017.

How Higher Interest Rates Can Impact Utilities

Treasury yields (TLT) become more attractive when interest rates rise, making utilities (XLU) less competitive in terms of yields.

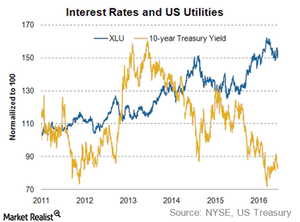

Understanding How Higher Interest Rates Impede Utilities

The near-zero interest rate environment has resulted in a low cost of debt, which has motivated more new debt issuances by utilities.

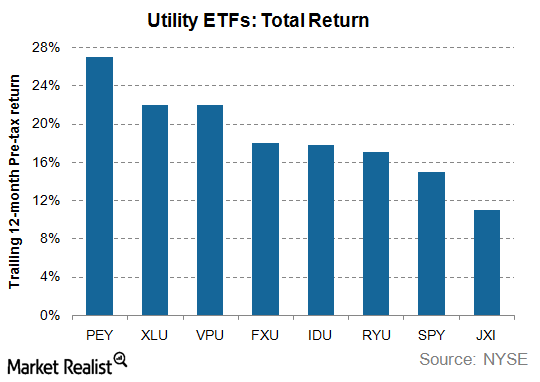

RYU, FXU, and JXI: Will These Utility ETFs Outrun Utility Stocks?

The Guggenheim S&P 500 Equal Weight Utilities ETF (RYU) invests nearly 80% of its portfolio in US utilities and 20% in telecoms.

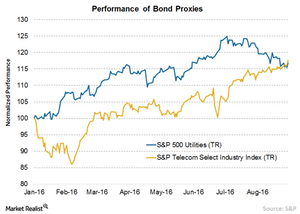

Why Some Popular Positions Become Risky

According to Factset data, around 93% of companies in the utilities (JXI) sector and 80% in the telecom (IXP) sector reported revenues below estimates in the second quarter of 2016.

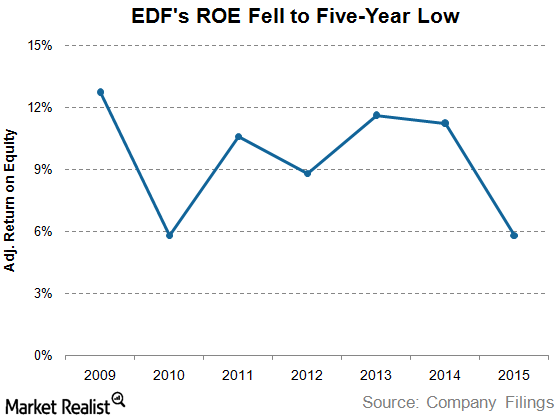

Électricité de France’s Operational Insights

Électricité de France’s adjusted return on equity has fallen drastically due to weak power prices and slowing demand.

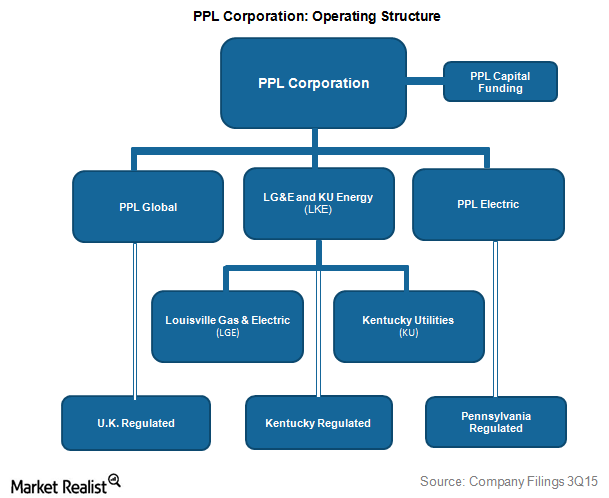

An Analysis of the Operating Structure of PPL

PPL is concentrated in the UK. It manages utility operations through PPL Global, PPL Electric, Louisville Gas and Electric, and Kentucky Utilities.

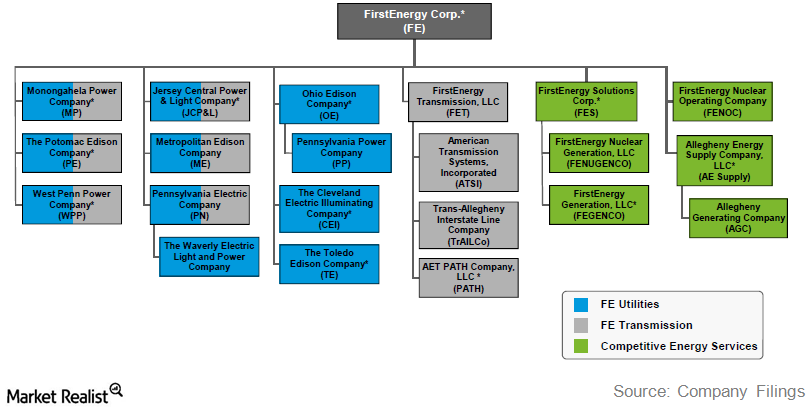

A Key Overview of FirstEnergy’s Operating Structure

FirstEnergy’s revenues are primarily derived from electric services provided by ten subsidiaries. The company serves a combined population of ~13.5 million.

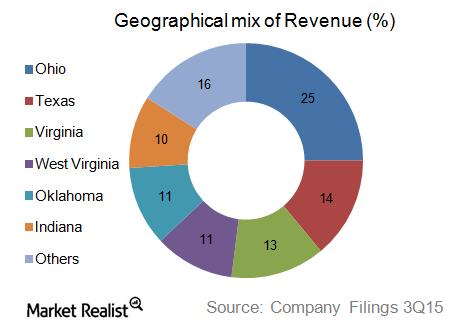

American Electric Power’s Balanced Geographical Revenue Mix

American Electric Power has a geographically diversified market combination, with a major chunk of its revenue coming from its homeland Ohio.

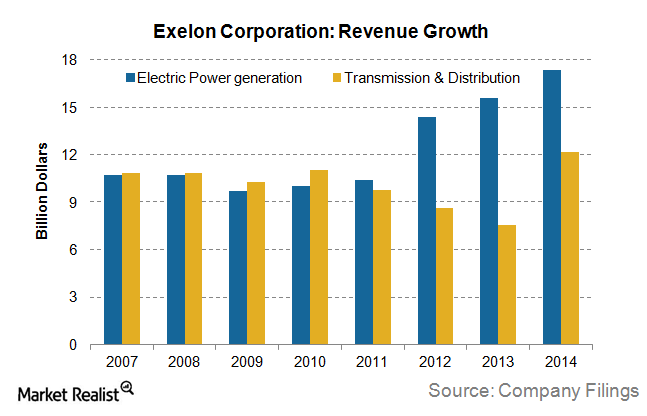

Analyzing Exelon’s Key Revenue Drivers

Demand growth for electricity in the last decade has been sluggish due to increasingly energy-efficient devices and equipment.

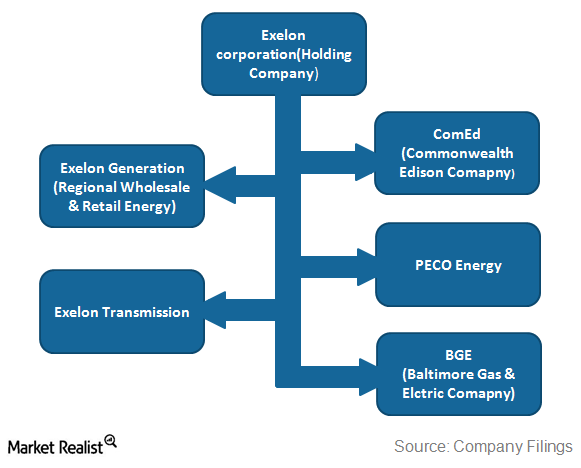

How Exelon’s Hybrid Business Model Provides Balanced Revenues

Exelon (EXC) manages end-to-end operations in the power utilities segment through its subsidiaries.