How Exelon’s Hybrid Business Model Provides Balanced Revenues

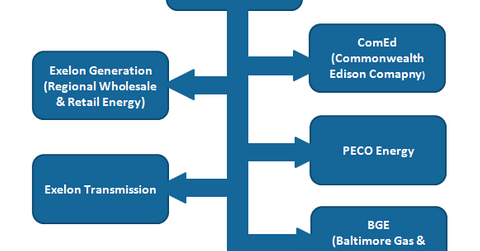

Exelon (EXC) manages end-to-end operations in the power utilities segment through its subsidiaries.

Dec. 7 2015, Published 1:02 p.m. ET

Pillars of Exelon’s growth

Exelon (EXC) manages end-to-end operations in the power utilities segment through its subsidiaries. Exelon operates generation subsidiaries like Exelon Generation and Constellation Energy along with distribution subsidiaries like Baltimore Gas & Electric, Commonwealth Edison Company, and PECO Energy.

Generation

Exelon Generation is an integral business that consists of generation, physical delivery, and marketing of electricity across various geographical regions in Exelon’s territory. The subsidiary sells renewable energy as well as energy-related products, and it is also engaged in upstream natural gas operations. Exelon separated its generation business from its regulated energy segments, PECO and ComEd (Commonwealth Edison Company), in 2001.

ComEd

ComEd’s energy delivery business includes the purchase and retail sale of power. The business also provides transmission and distribution services to retail customers in Northern Illinois including the city of Chicago.

PECO Energy

PECO’s physical energy delivery consists of the purchase and regulated retail sale of electricity, electricity transmission and distribution services, and natural gas to retail customers in Southern Pennsylvania.

Baltimore Gas & Electric

BGE’s business activities consist of the purchase and regulated sale of electricity and natural gas and electricity transmission and distribution services to retail customers located in central Maryland, including the city of Baltimore.

Exelon’s hybrid business model offers balanced revenues from regulated and unregulated operations. Hybrid Utilities (VPU) operate at all stages of the energy value chain. These utilities (IDU) sell electricity from their generating plants to the highest bidder and benefit by charging more when the demand is high. Utilities like Duke Energy (DUK) and Dominion Resources (D) get a small contribution from their unregulated segments as compared to the regulated ones.