Vanguard Utilities ETF

Latest Vanguard Utilities ETF News and Updates

VPU Versus XLU: Which Utility ETF Is Better?

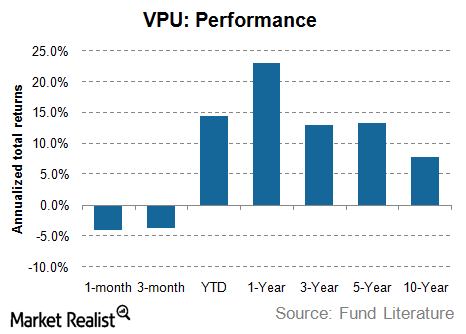

Utility ETFs have performed well in the last one year. The Vanguard Utilities Fund ETF (VPU) has been no exception to this.

XLU: How US Utilities Are Currently Valued

So far, US utilities have had a decent run this year. The Utilities Select Sector SPDR ETF (XLU) has risen more than 14%.

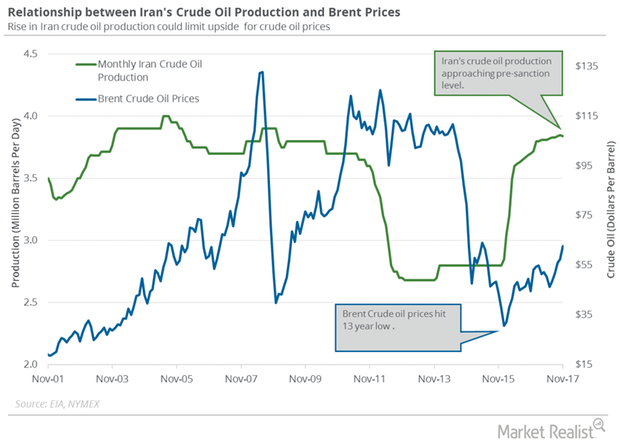

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

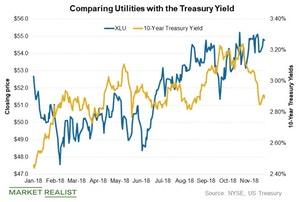

Comparing Utilities and Treasury Yields

The benchmark ten-year Treasury yield trended lower and changed from 2.68% to 2.66% last week.

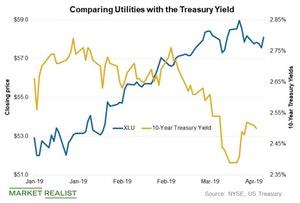

Comparing Utility Stocks and Treasury Yields

The benchmark ten-year Treasury yields closed at 2.5% last week. Treasury yields and utility stocks usually trade inversely to each other.

What FirstEnergy’s Chart Indicators Suggest

Utilities have been following a downtrend recently, plummeting more than 10% since early last week.

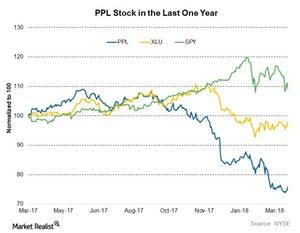

What PPL’s Current Valuation Means for the Stock

PPL Corporation (PPL) stock was particularly hit by the recent utilities turmoil. Its valuation fell significantly over the last few months.

How FirstEnergy Stock Ranks against Peers

FirstEnergy (FE) has been one of the top-performing stocks among the S&P 500 Utilities Index (XLU) this year.

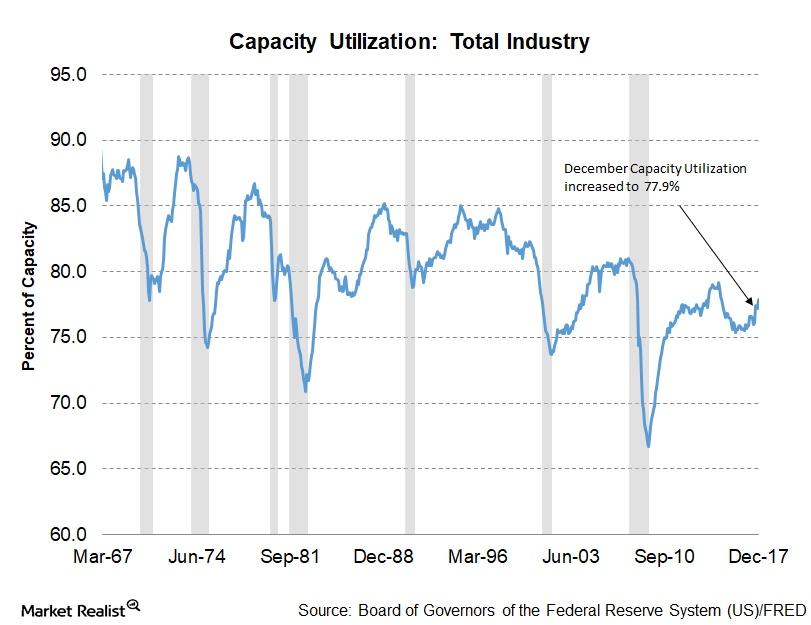

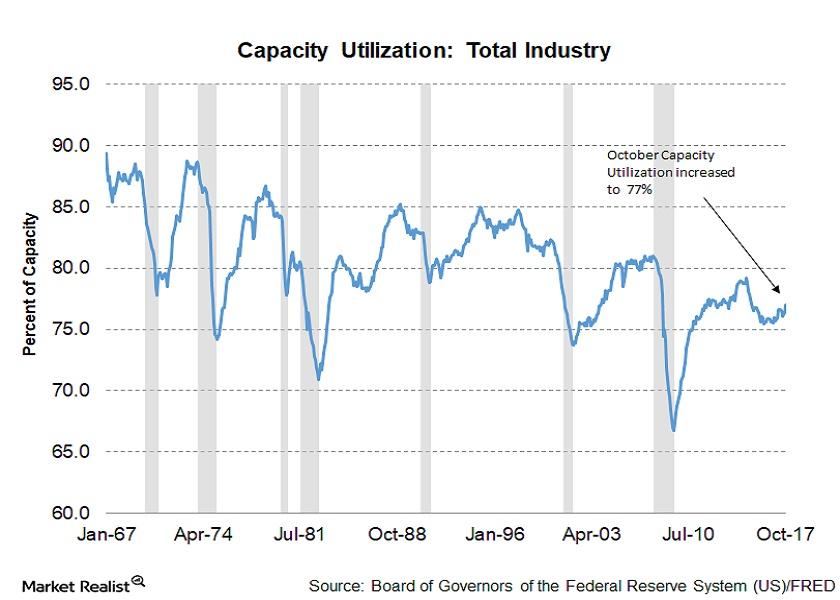

Capacity Utilization Trends across US Industries in December

Capacity utilization and the US economy Among the key macroeconomic indicators published by the Federal Reserve, US industries’ capacity utilization is particularly important for understanding the health of each industry. Changes to this indicator can help forecast any changes to the business cycle, product demand, and workforce demand. Increasing levels of capacity utilization could translate to a higher number […]

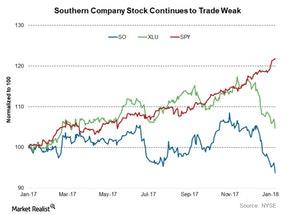

Does Southern Company Stock Have an Attractive Valuation?

Southern Company (SO), the second largest rate-regulated utility, is currently trading at an EV-to-EBITDA multiple of 10.5x.

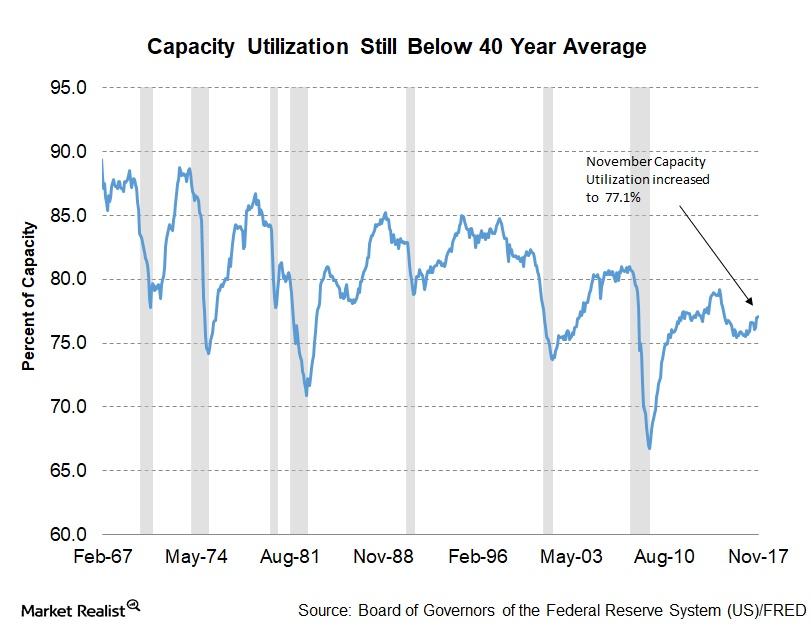

A Look at Capacity Utilization across US Industries in November

In the November capacity utilization report, the manufacturing sector remained strong with 76.4% capacity utilization, the highest level since May 2008.

Reading the Trends in Capacity Utilization across US Industries in October

Among the key macroeconomic indicators published by the Fed, capacity utilization in US industries helps investors forecast business cycle changes.

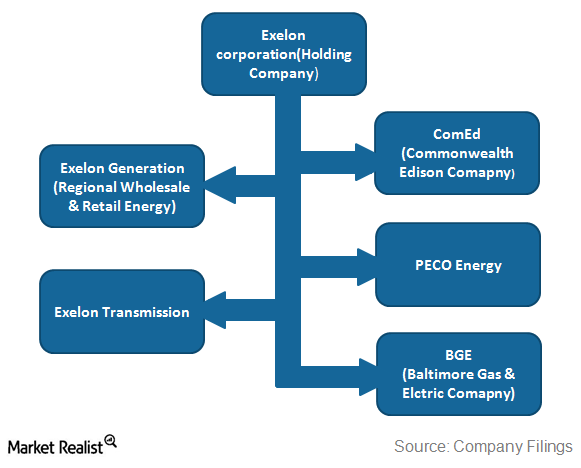

How Exelon’s Hybrid Business Model Provides Balanced Revenues

Exelon (EXC) manages end-to-end operations in the power utilities segment through its subsidiaries.