What PPL’s Current Valuation Means for the Stock

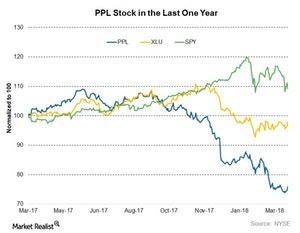

PPL Corporation (PPL) stock was particularly hit by the recent utilities turmoil. Its valuation fell significantly over the last few months.

March 30 2018, Updated 7:35 a.m. ET

Valuation

PPL Corporation (PPL) stock was particularly hit by the recent utilities turmoil. Its valuation fell significantly over the last few months. Currently, PPL is trading at a PE (price-to-earnings) multiple of 13x—compared to its five-year historical average valuation near 14x. So, based on PE, PPL looks to be trading at a discount against its historical valuation.

Xcel Energy (XEL) is trading at a PE multiple of 19x while Duke Energy (DUK) stock is trading at 21x.

The rate-sensitive utilities are trading weakly, mainly because of the Fed’s aggressive stance on interest rate hikes this year. The Fed delivered yet another interest rate hike last week, which increased the US benchmark interest rate to 1.50%–1.75%. Interestingly, the Fed continues to look aggressive and expects at least two more rate hikes this year. This faster-than-expected rate hike pace from the Fed could dent utility stocks (XLU)(VPU).