PPL Corp

Latest PPL Corp News and Updates

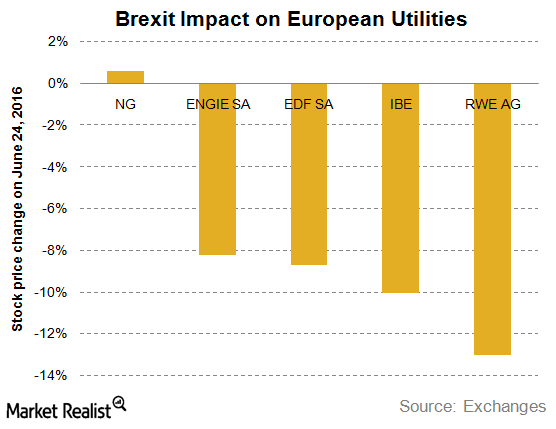

Brexit’s Impact: European Utilities Nosedive, National Grid Gains

The struggling European utilities sector encountered another obstacle in the form of Brexit. Upcoming policy changes will pave the way for them in the future.

Not All Utility Stocks Are Overpriced

Utility stocks seem overvalued. Utilities have reached record levels. They have been trading at inflated valuations for months.

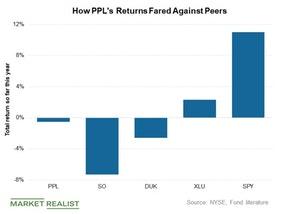

How PPL’s Returns Fared Compared to Its Peers in 2018

PPL (PPL), the top-yielding stock among the S&P 500 Utilities, has underperformed its peers in terms of total returns in 2018.

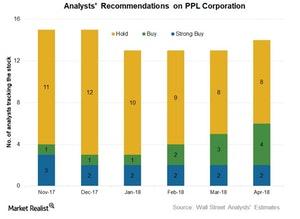

PPL: Analysts’ Views and Target Prices

PPL (PPL) stock offers an attractive potential upside of more than 13% in a year with a mean target price of $32.3. PPL stock is trading at $28.5.

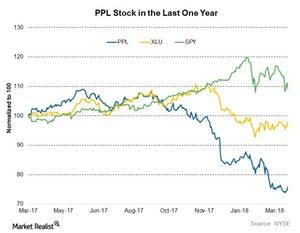

What PPL’s Current Valuation Means for the Stock

PPL Corporation (PPL) stock was particularly hit by the recent utilities turmoil. Its valuation fell significantly over the last few months.

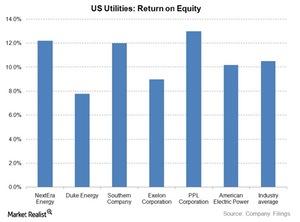

A Look at US Utilities’ Return on Equity

Duke Energy’s (DUK) adjusted return on equity stayed below 8% due to volatile earnings from international operations. This ROE was on the lower side of the industry average.

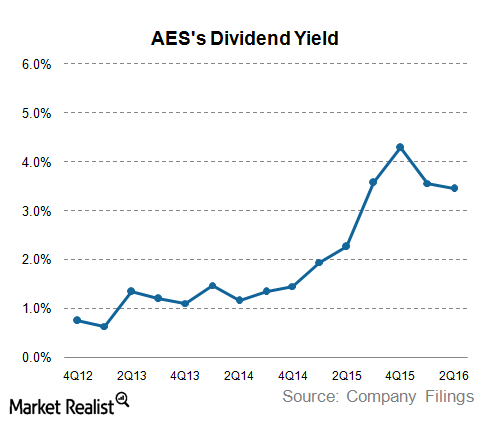

A Look at AES’s Dividend Yield

AES’s (AES) dividend yield has improved significantly in the last couple of years. The 10% fall in dividends in 2016 is among one of the highest in the industry.

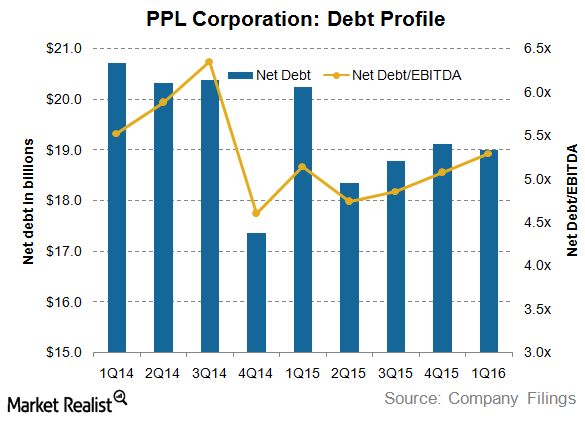

Inside PPL Corporation’s Debt Profile in 1H16

At the end of the first quarter of 2016, PPL’s total debt stood at $19.8 billion. Of this amount, $18 billion was long-term debt.

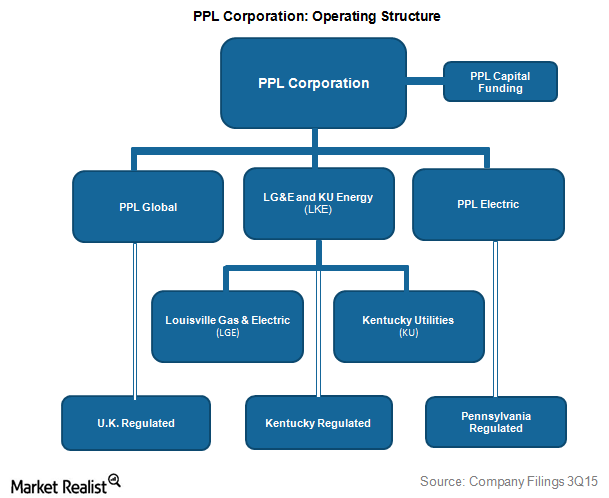

An Analysis of the Operating Structure of PPL

PPL is concentrated in the UK. It manages utility operations through PPL Global, PPL Electric, Louisville Gas and Electric, and Kentucky Utilities.

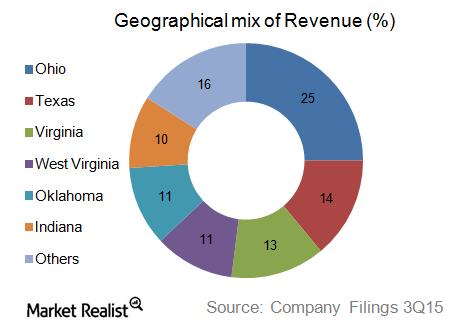

American Electric Power’s Balanced Geographical Revenue Mix

American Electric Power has a geographically diversified market combination, with a major chunk of its revenue coming from its homeland Ohio.

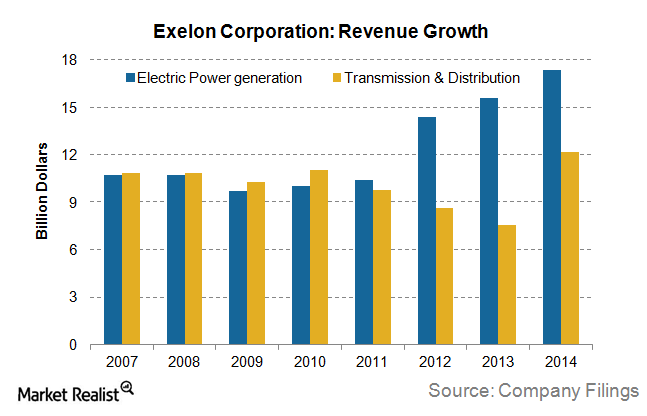

Analyzing Exelon’s Key Revenue Drivers

Demand growth for electricity in the last decade has been sluggish due to increasingly energy-efficient devices and equipment.

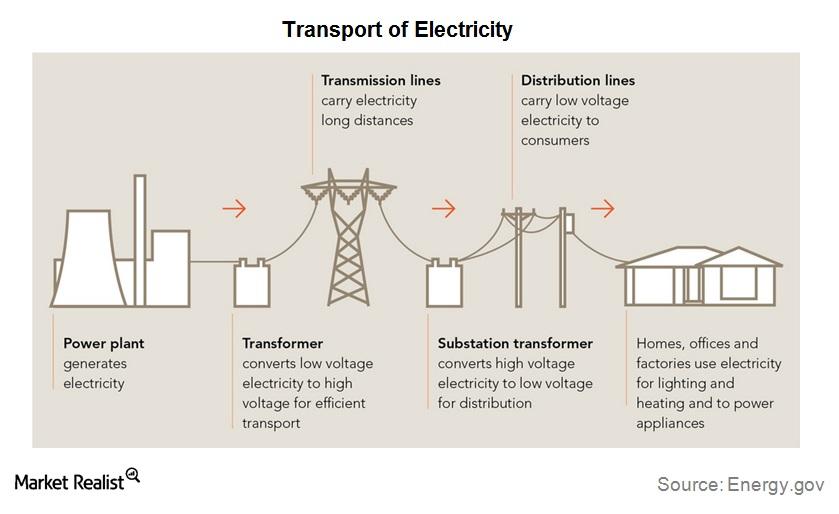

Must-know: The supply chain delivers electricity

The industry’s supply chain consists of three broad categories—generation, transmission, and distribution. Power generation requires a fuel source—for example, coal, nuclear, natural gas, or wind—and a power plant to convert the fuel source into electricity.