Xcel Energy Inc

Latest Xcel Energy Inc News and Updates

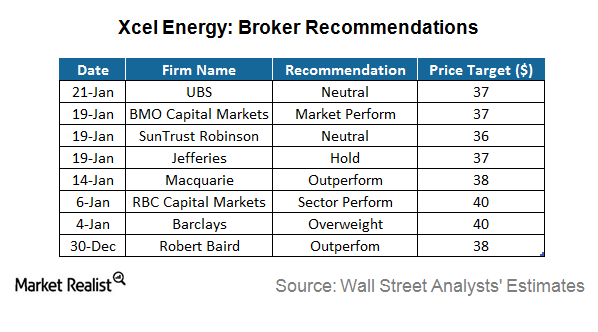

No Analysts Recommend a “Sell” on Xcel Energy

Of the 18 analysts tracking Xcel Energy, 13 recommend it as a “hold,” five recommend it as a “buy,” and none recommend it as a “sell.”

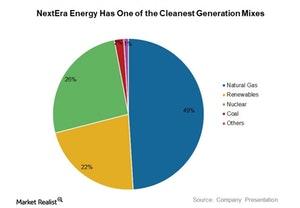

NEE Has One of the Cleanest Generation Mixes in the US

NextEra Energy (NEE) has one of the cleanest generation mixes among peers.

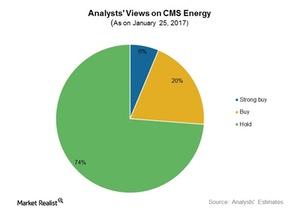

Inside CMS Energy’s Price Targets ahead of 4Q16 Results

CMS Energy (CMS) has a mean price target of $44.33 for the coming year. This implies an estimated upside of 5.6%.

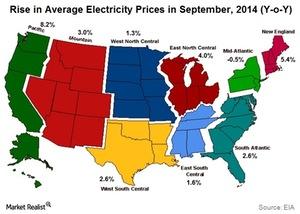

New England and the Pacific are great regions to produce power

The US is divided into nine divisions. The Pacific and New England divisions had the highest year-over-year, or YoY, growth in electricity prices in September 2014.

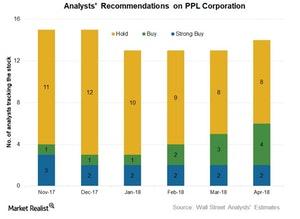

PPL: Analysts’ Views and Target Prices

PPL (PPL) stock offers an attractive potential upside of more than 13% in a year with a mean target price of $32.3. PPL stock is trading at $28.5.

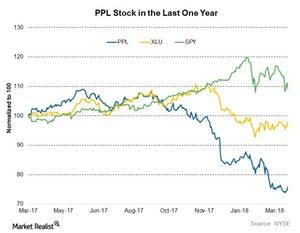

What PPL’s Current Valuation Means for the Stock

PPL Corporation (PPL) stock was particularly hit by the recent utilities turmoil. Its valuation fell significantly over the last few months.

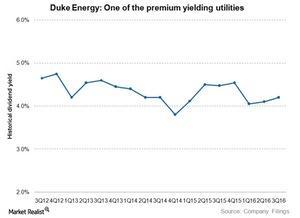

Why Does Duke Energy Yield Better Than the Industry Average?

Duke Energy is one of the highest-yielding S&P 500 Utilities stocks. Its large regulated operations fetch stable earnings and offer stable dividends.

Why Is Xcel Energy’s Rising Debt So Concerning?

At the end of the fourth quarter of 2015, Xcel Energy’s total debt stood at $13 billion. Its debt-to-equity ratio was 1.3x, and its debt-to-capitalization ratio was 0.6x.