Vineet Kulkarni

Vineet Kulkarni joined Market Realist in July 2015 and has written more than 4,000 articles. He covers macroeconomics, renewables, and utilities. Vineet earned his master’s degree in business administration with a finance specialization. He's also a CFA Level 3 candidate. Apart from his passion for the stock markets, Vineet is an avid trekker and loves listening to classic rock.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Vineet Kulkarni

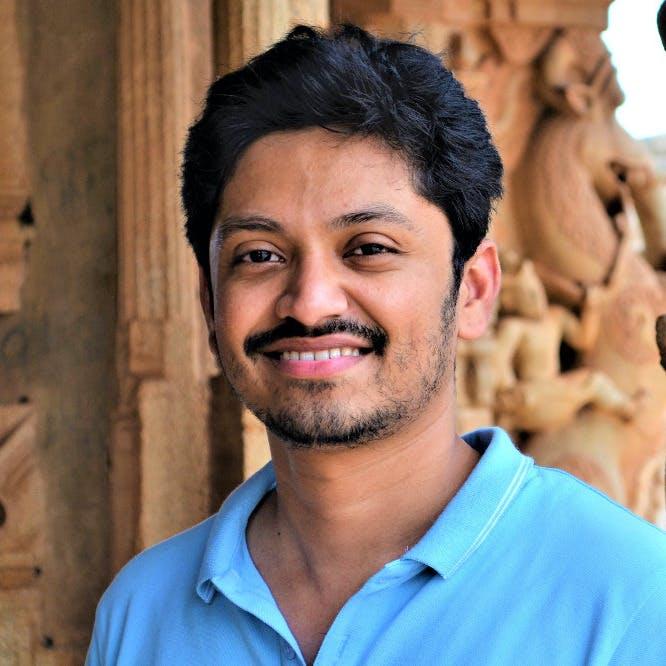

Utilities Overview: How Does the Electricity Supply Chain Work?

The US electric utility industry is a mature business that is growing slowly and steadily. The country’s electric grid consists of 7,300 power plants and 160,000 miles of high-voltage power lines that deliver electricity to more than 145 million customers.

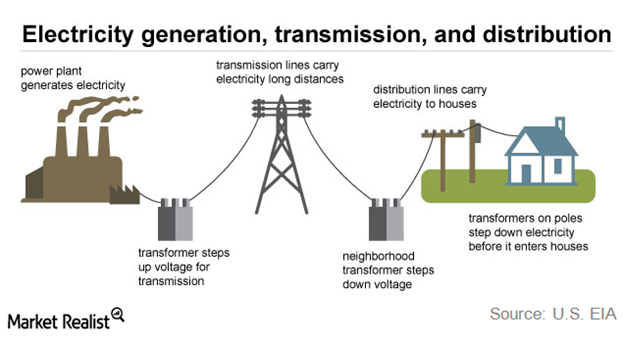

What Are Institutional Investors Doing with American Water Works Holdings?

Institutional investors have decreased their positions in American Water Works (AWK) in the past couple of months.

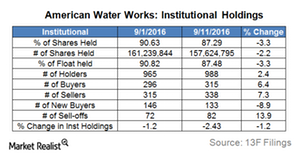

Inside Water Utilities’ Historical Dividends and Growth

US water utilities have distributed fair dividends for the past few years American Water Works’ dividend growth during the past five years stands at 10%.

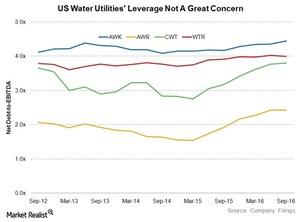

How Is American Water Works’ Leverage Compared to Peers?

Water utilities depend heavily on debt financing due to their capital projects for the longer term, and so company leverages can be useful for investors.

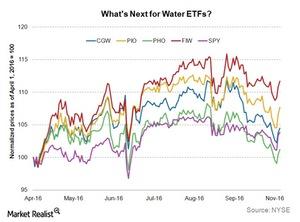

Why Are Water ETFs Yielding More than Water Utilities?

Water utility ETFs (exchange-traded funds) yield approximately 100–150 basis points more than what water utility companies yield.

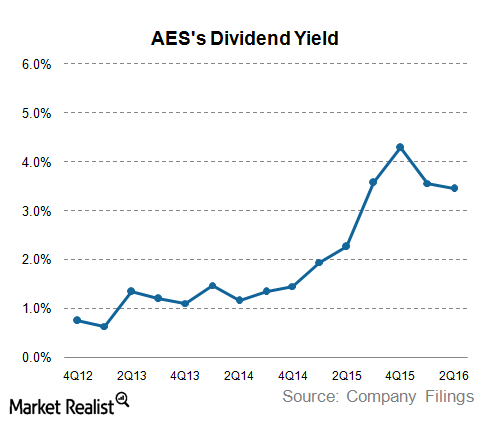

A Look at AES’s Dividend Yield

AES’s (AES) dividend yield has improved significantly in the last couple of years. The 10% fall in dividends in 2016 is among one of the highest in the industry.

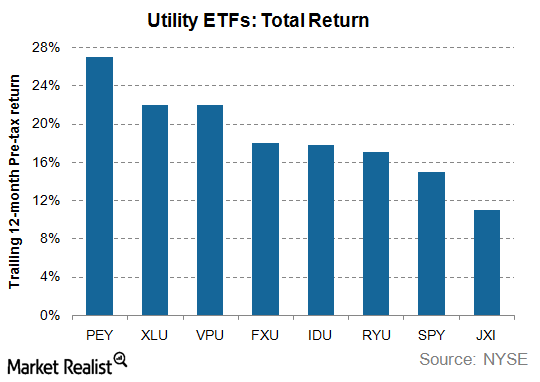

RYU, FXU, and JXI: Will These Utility ETFs Outrun Utility Stocks?

The Guggenheim S&P 500 Equal Weight Utilities ETF (RYU) invests nearly 80% of its portfolio in US utilities and 20% in telecoms.

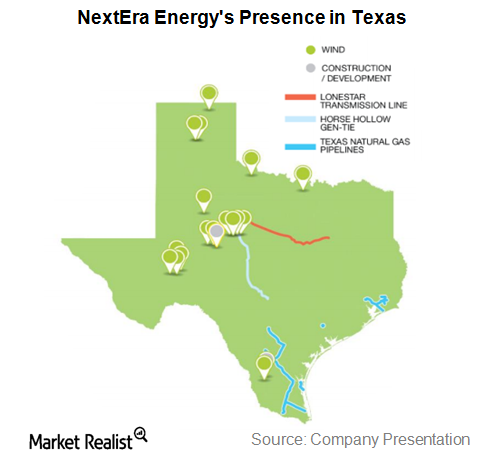

NextEra Energy to Extend Its Presence in Texas by Buying Oncor

Just a couple of weeks after withdrawing from the Hawaiian Electric deal, renewables giant NextEra Energy (NEE) announced its decision to buy Oncor on July 29.

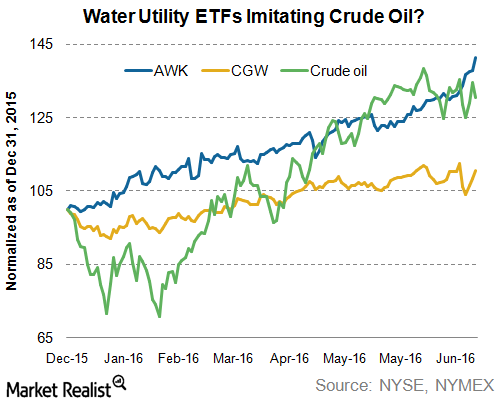

What Does the Correlation between Water Utilities and Crude Oil Mean?

Investors may find water utilities attractive due to their yields and stable earnings growth. However, they may not be as safe as they seem.

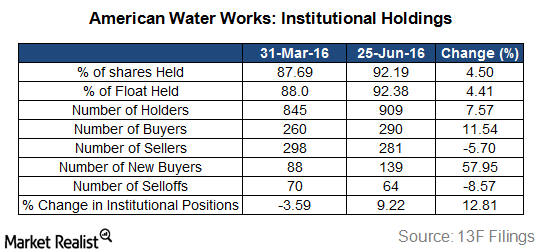

What Do Institutional Investors Think about American Water Works?

Institutional investors increased their positions in American Water Works (AWK) in 2Q16 as compared to where they stood on March 31, 2016.

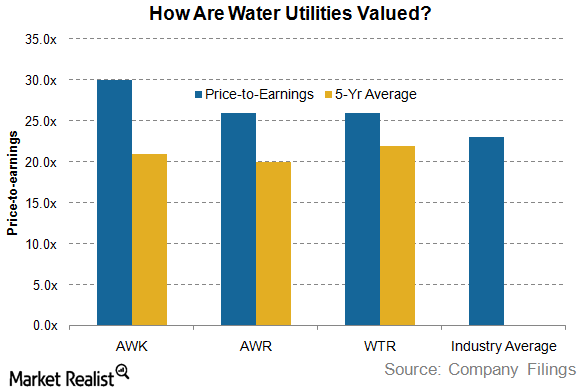

Are US Water Utilities Fairly Valued?

It seems that US water utilities are trading at a premium compared electric utilities.

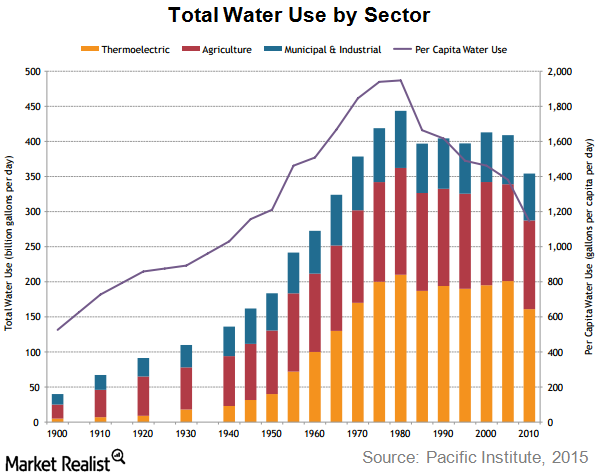

What Does Falling Water Usage Mean for Water Utilities?

According to data released by the United States Geological Survey (or USGS), national water usage experienced a sharp drop between 2005 and 2010.

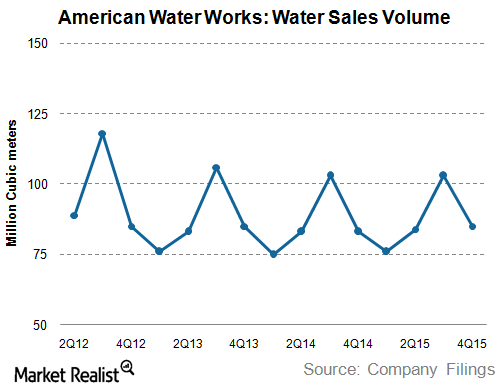

How Are American Water Works’ Sales Volumes Trending?

American Water Works (AWK) witnessed a sharp decline in its water sales volumes after 2010 despite a population increase and economic growth.

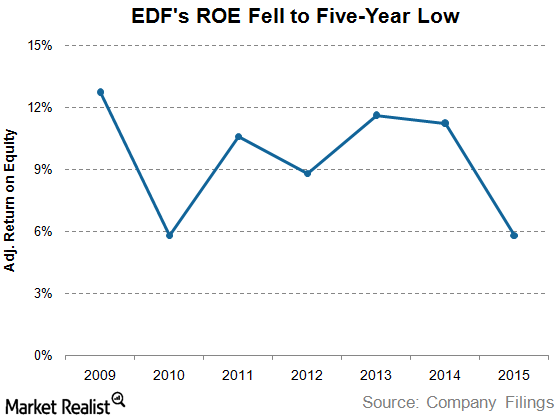

Électricité de France’s Operational Insights

Électricité de France’s adjusted return on equity has fallen drastically due to weak power prices and slowing demand.

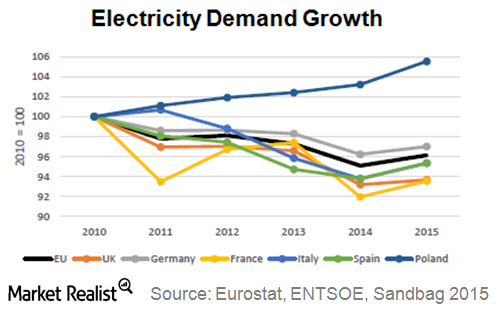

Focusing on Electricity Demand Growth in Europe

In the European Union, electricity demand rose by ~1.1% in 2015, recovering from a fall of ~2.3% in 2014.

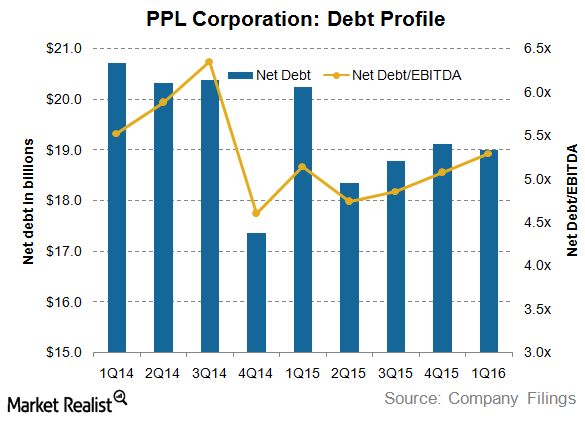

Inside PPL Corporation’s Debt Profile in 1H16

At the end of the first quarter of 2016, PPL’s total debt stood at $19.8 billion. Of this amount, $18 billion was long-term debt.

Why Is Xcel Energy’s Rising Debt So Concerning?

At the end of the fourth quarter of 2015, Xcel Energy’s total debt stood at $13 billion. Its debt-to-equity ratio was 1.3x, and its debt-to-capitalization ratio was 0.6x.

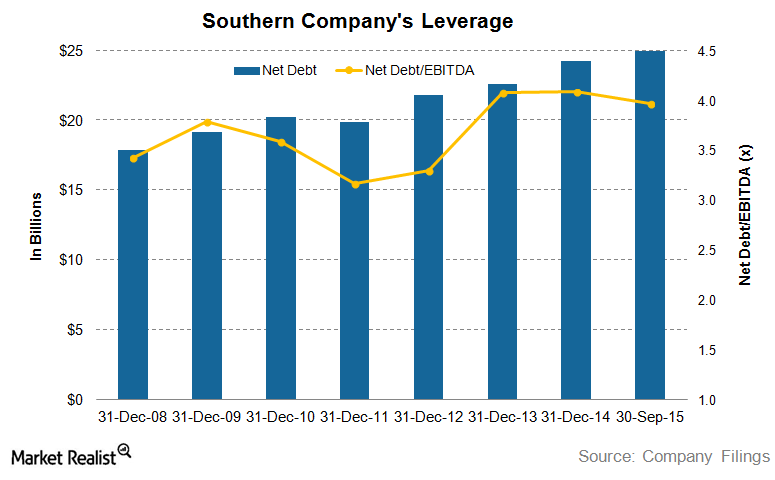

Analyzing Southern Company’s Debt Profile

As of September 30, 2015, Southern Company had total debt of $27 billion against equity of $20.6 billion. Of this, $22.3 billion is long-term debt.

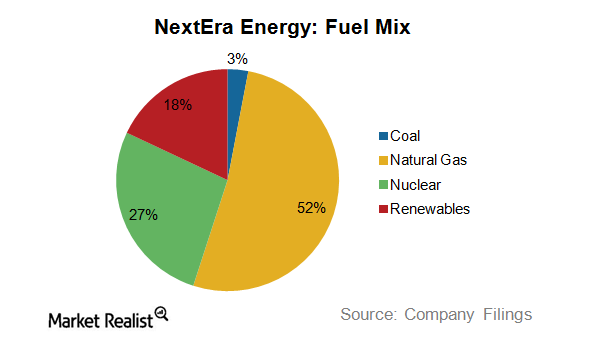

NextEra Energy Seeks Capacity Addition Using Renewables

NEE is further expanding its renewables footprint. In 9M15, it added 225 megawatts of wind capacity and 115 megawatts of solar generation capacity.

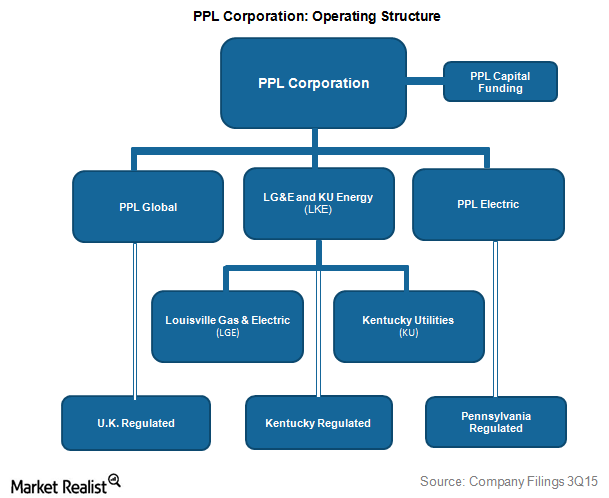

An Analysis of the Operating Structure of PPL

PPL is concentrated in the UK. It manages utility operations through PPL Global, PPL Electric, Louisville Gas and Electric, and Kentucky Utilities.

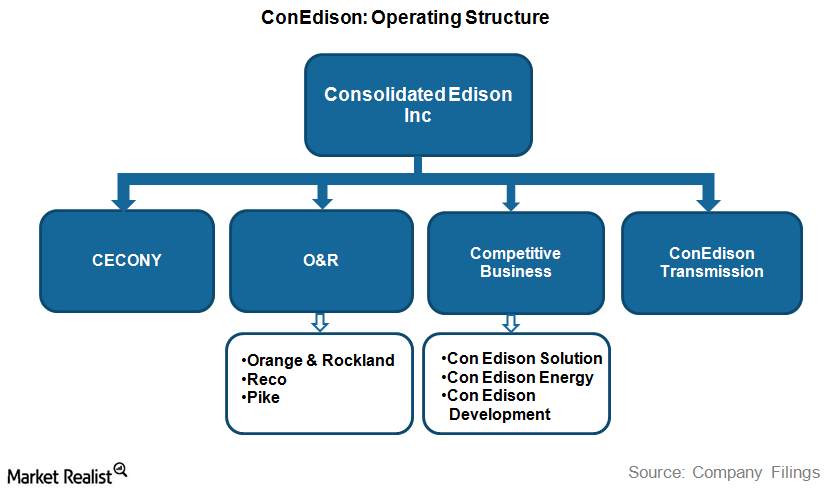

What You Should Know about Con Edison’s Operating Structure

Con Edison handles its competitive energy business through its three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy, and Con Edison Development.

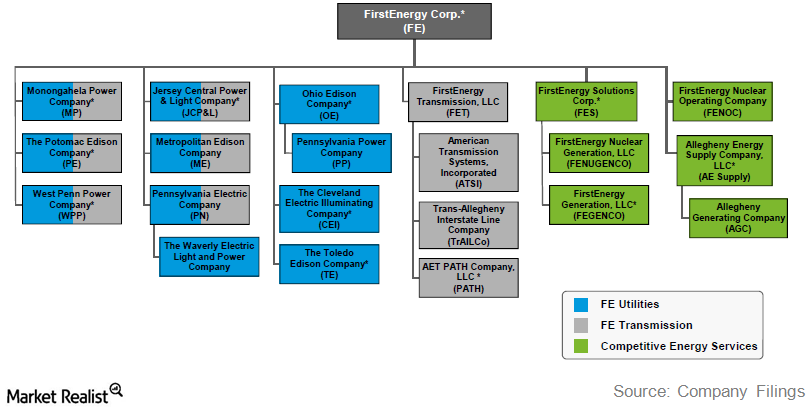

A Key Overview of FirstEnergy’s Operating Structure

FirstEnergy’s revenues are primarily derived from electric services provided by ten subsidiaries. The company serves a combined population of ~13.5 million.

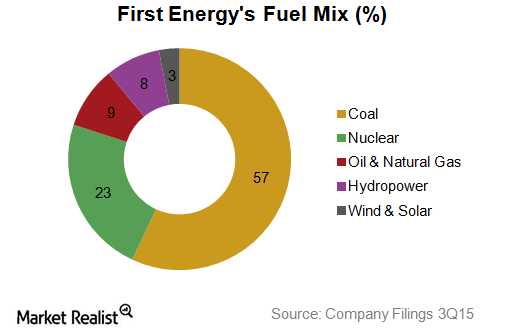

FirstEnergy Relies Heavily on Coal for Power Generation

FirstEnergy generates power from a diverse mix of primary energy sources but is primarily dependent on coal, which accounts for 57% of its power generation.

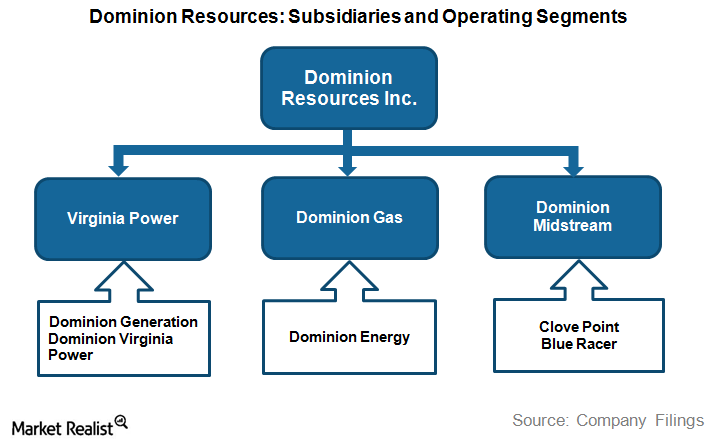

Understanding Dominion Resources’ Corporate Structure

Dominion Resources engages in all stages of the energy value chain, including power generation, transmission, and distribution.

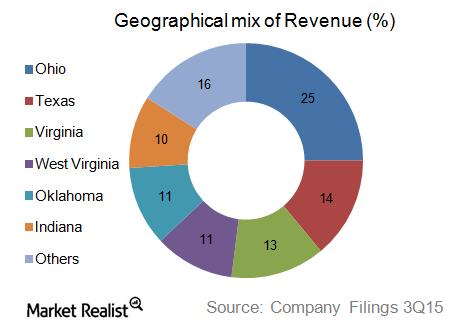

American Electric Power’s Balanced Geographical Revenue Mix

American Electric Power has a geographically diversified market combination, with a major chunk of its revenue coming from its homeland Ohio.

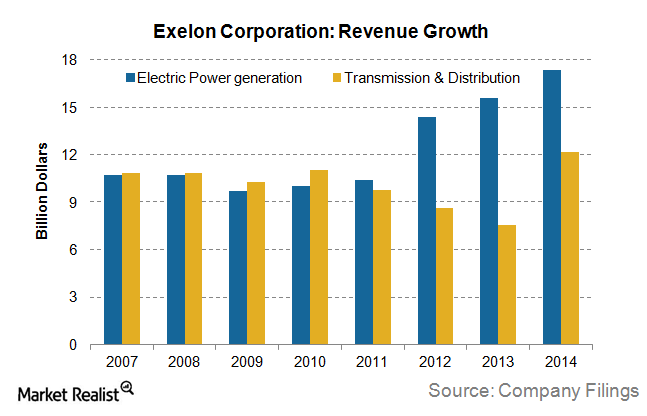

Analyzing Exelon’s Key Revenue Drivers

Demand growth for electricity in the last decade has been sluggish due to increasingly energy-efficient devices and equipment.

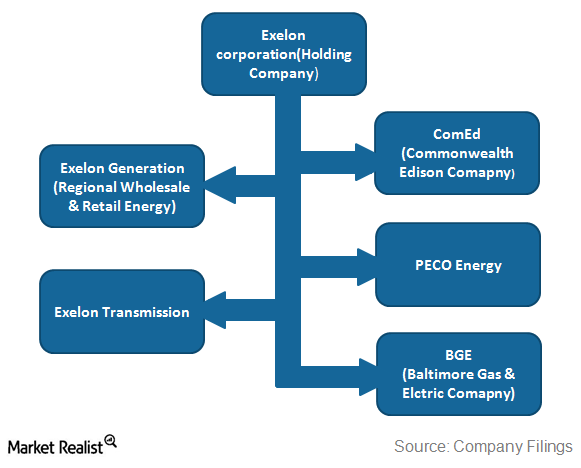

How Exelon’s Hybrid Business Model Provides Balanced Revenues

Exelon (EXC) manages end-to-end operations in the power utilities segment through its subsidiaries.