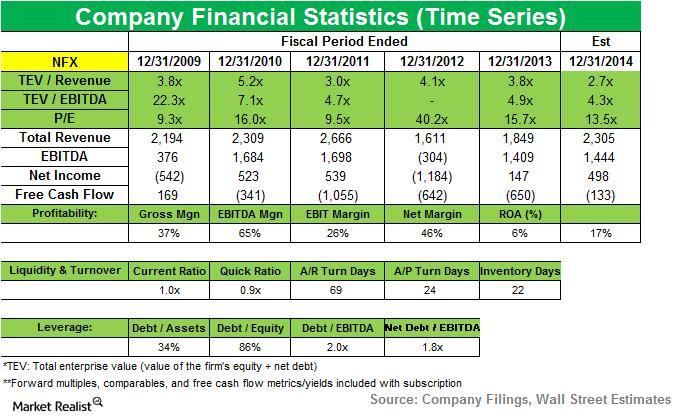

Newfield Exploration Co

Latest Newfield Exploration Co News and Updates

Balyasny exits position in Newfield Exploration Co.

BAM exited its position in Newfield Exploration Co. in 3Q14. It accounted for 1.31% of BAM’s second quarter portfolio. NFX is an energy company.

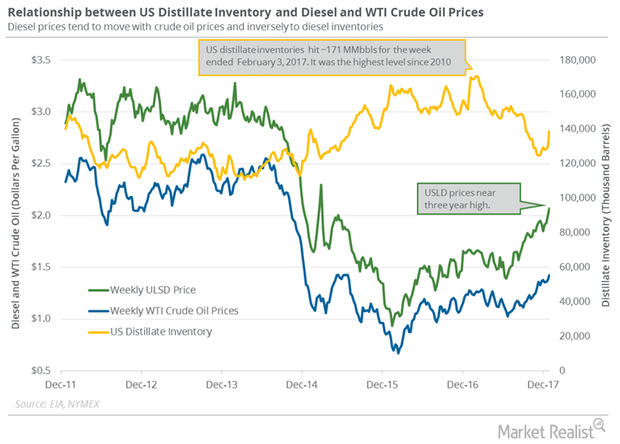

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

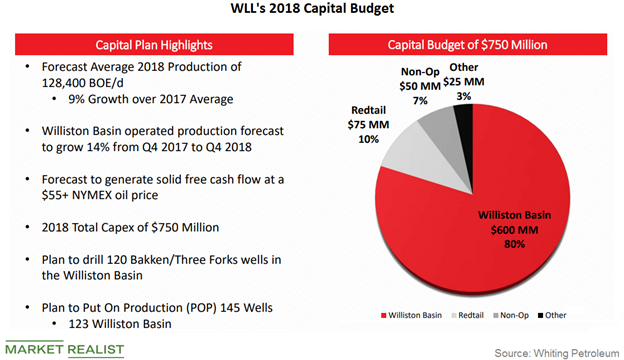

Whiting Petroleum’s Capex Plans for 2018

Whiting Petroleum’s (WLL) 2018 capital expenditure forecast is $750 million, compared to its capex of $912 million in 2017.

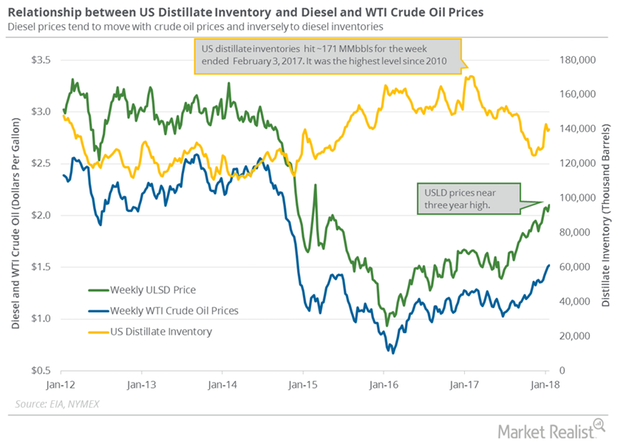

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

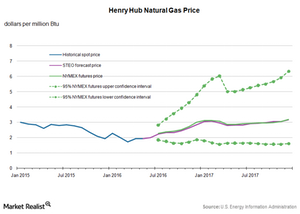

Natural Gas Prices Are Trading above Key Moving Averages

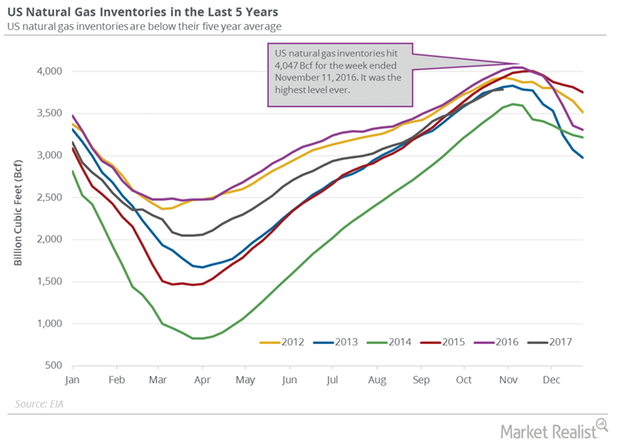

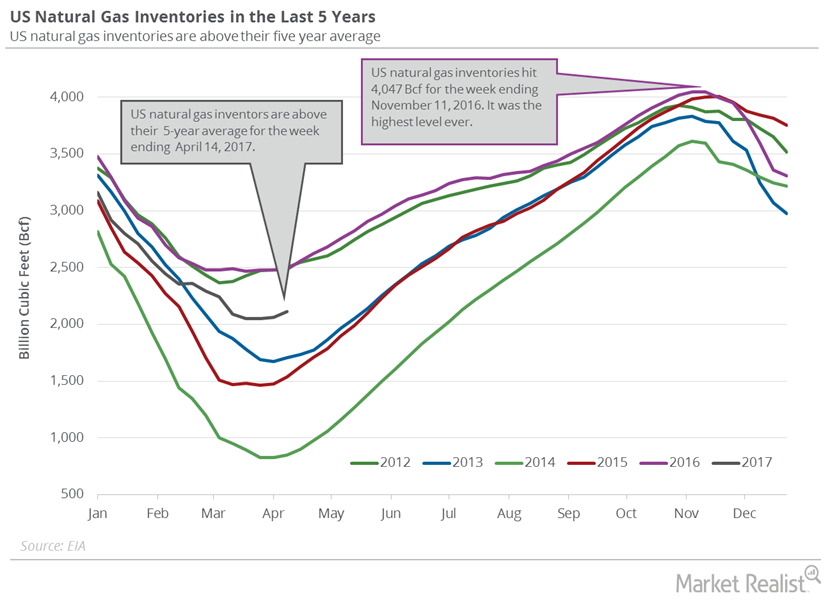

US natural gas inventories are 25% higher than their five-year average. High natural gas inventories could also limit the upside for US natural gas prices.

Hedge Funds: Bullish or Bearish on Natural Gas?

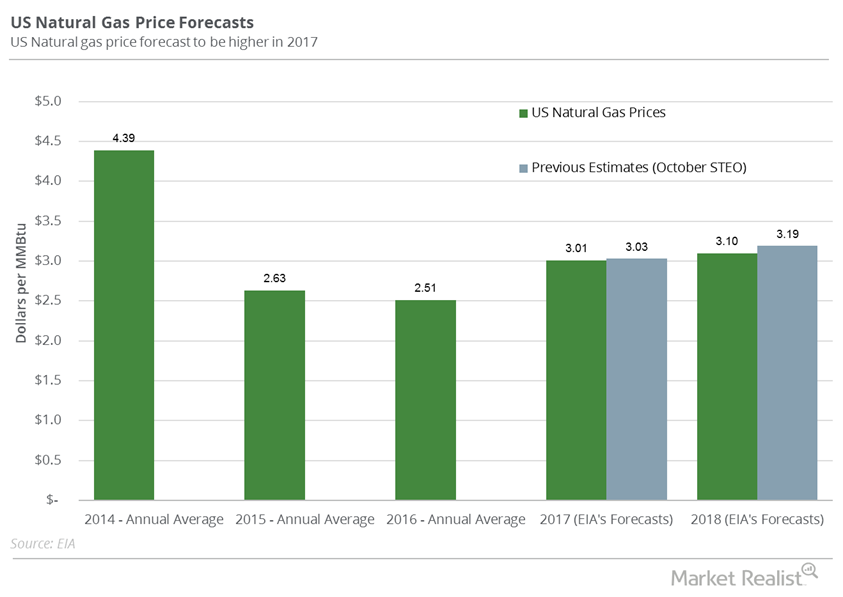

Aegent Energy Advisors predicts that US natural gas prices might not exceed $3.18 per MMBtu by December 2017.

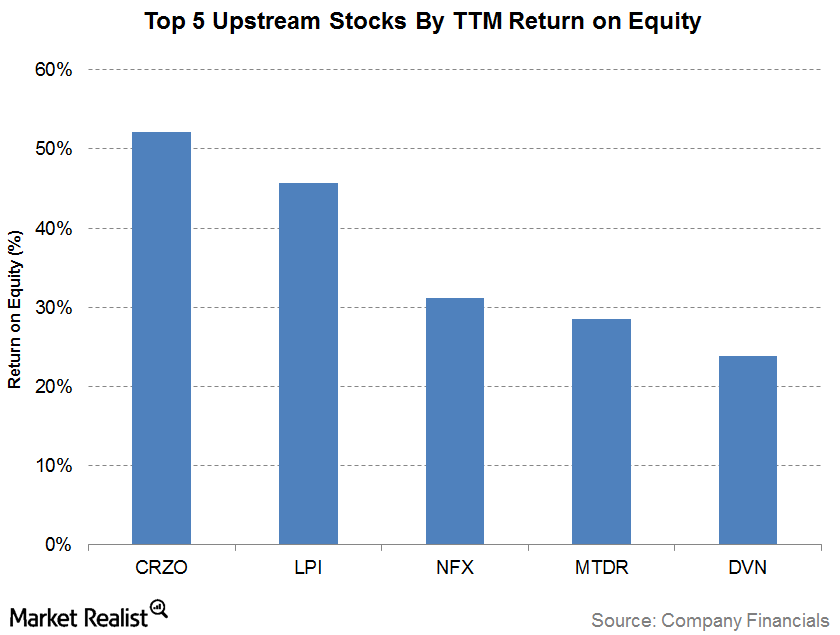

The Top 5 Upstream Companies Based on Return on Equity

The company with the highest trailing 12-month ROE (return on equity) as of 3Q17 is Carrizo Oil & Gas (CRZO) with an ROE of 52.1%.

Are US Natural Gas Inventories Bullish for Natural Gas Futures?

The EIA estimates that US gas inventories rose by 15 Bcf (billion cubic feet) or 0.4% to 3,790 Bcf on October 27–November 3, 2017.

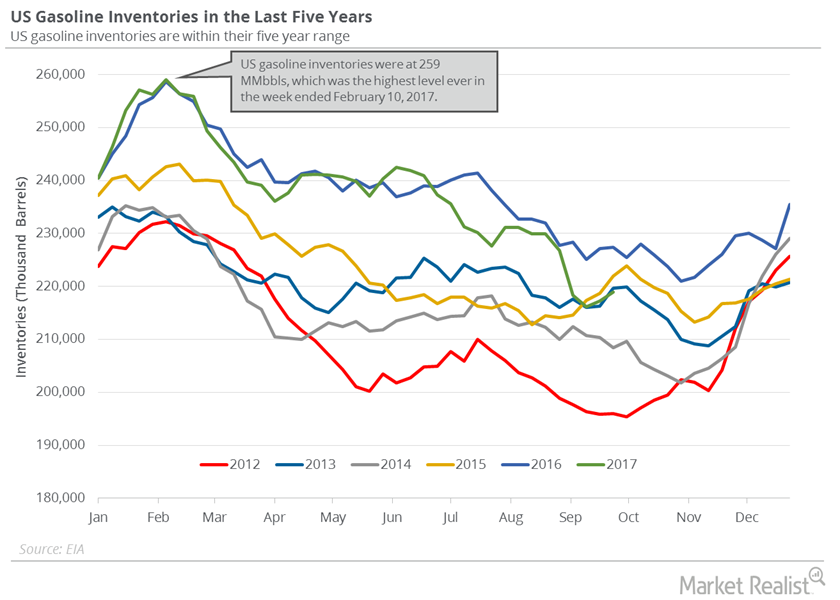

Are US Gasoline Inventories a Pain for Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories rose by 1.6 MMbbls to 218.9 MMbbls on September 22–29, 2017.

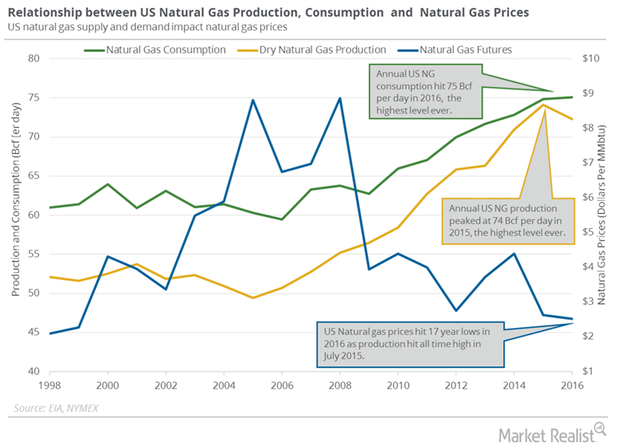

How US Natural Gas Production and Consumption Are Driving Prices

Market data provider PointLogic estimates that weekly US dry natural gas production fell by 0.2 Bcf (billion cubic feet) per day to 74.3 Bcf per day from September 21 to 27, 2017.

US Natural Gas Inventories Pressure Prices

The EIA reported that US natural gas inventories rose by 54 Bcf to 2,115 Bcf on April 7–14, 2017. Inventories rose 2.6% week-over-week but fell 14.8% YoY.

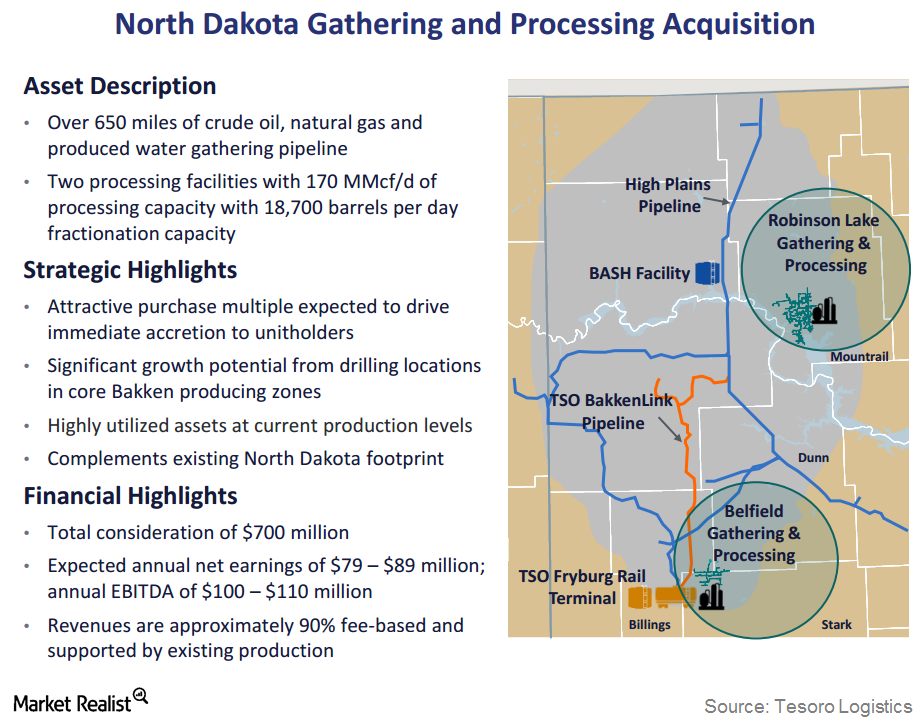

Whiting Petroleum Announces Bakken Midstream Divestiture

On November 21, 2016, Whiting Petroleum announced its intention to sell its Bakken midstream assets to an affiliate of Tesoro Logistics Rockies for $375 million.

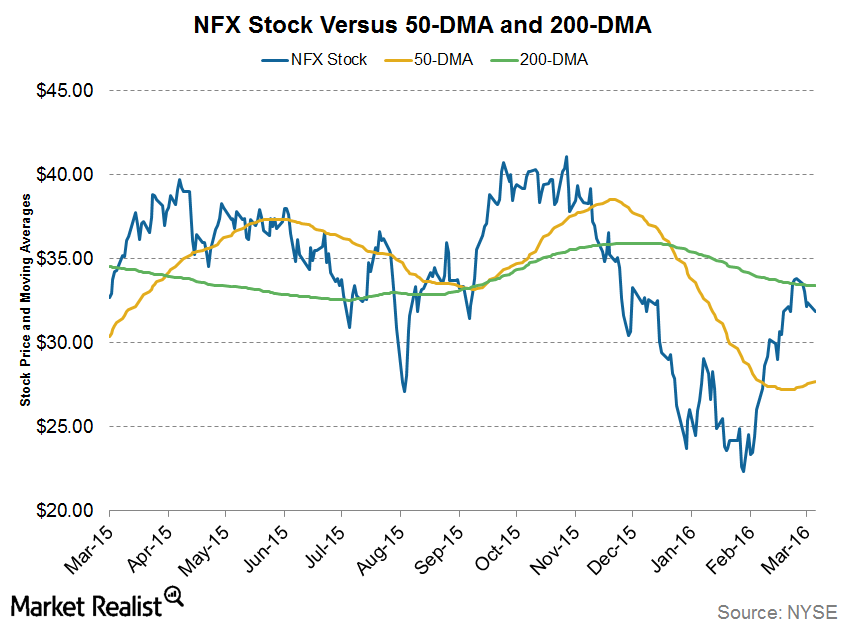

Newfield Exploration Stock Is Up, but for How Long?

With the recent rally in crude oil prices, Newfield Exploration (NFX) stock has been on an uptrend. On March 1, 2016, it crossed its 50-day moving average for the first time in 2016.

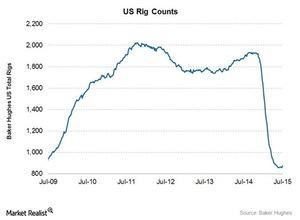

Biggest US Rig Count Rise in a Year: What Does It Change?

Despite recent rises, at 876, the US rig count is still at its lowest level since January 2003. In September 2014, the average rig count came close to the record, reaching 1,931.