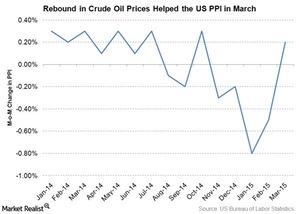

A Rebound in Crude Oil Prices Helped the PPI in March

On Tuesday, April 14, the U.S. Bureau of Labor Statistics released its PPI (Producer Price Index) figures for February. The PPI gained 0.2% in March.

April 16 2015, Updated 9:09 a.m. ET

US PPI up by 0.2% in March

On Tuesday, April 14, the U.S. Bureau of Labor Statistics released its PPI (Producer Price Index) figures for February. The PPI gained 0.2% in March—in line with median market expectations. It was a good rebound from the 0.5% fall in February. The rebound in oil prices after mid-March helped the PPI revive in March.

US energy sector gains as oil price revives

The rebound in oil prices was also good news for the US energy sector (XLE). The Energy Select Sector SPDR ETF (XLE) gained about 7% over the past month. Oil and gas drilling companies like Ensco (ESV), Diamond Offshore Drilling (DO), and Helmerich & Payne (HP) also gained about 22%, 13%, and 18% over the past month. On April 14, Ensco was up 6.65%, Diamond Offshore gained 5.58%, and Helmerich & Payne’s stock ended 5.11% higher.

Slowing output forecasts led to the recent surge in crude oil. For our fundamental analysis on the recent rally in crude oil price, read Crude Oil Rallies for the Third Consecutive Day.

The consumer sector also saw some positive news on the indicator front on April 14.

US retail sales revive in March

The U.S. Bureau of the Census reported retail sales figures for March. According to the report, retail sales in the US (SPY) (IVV) increased by 0.9% in March on a monthly basis. Median expectations from the retail sales report were pegged at a 1.1% increase. Although the figures came in below market expectations, they certainly demonstrate a revival in retail sales after three successive months of decline. Retail sales declined by 0.5% in February, 0.8% in January, and 0.9% in December 2014.

April 14 brought some positive indicator releases in the US amid a month of slowing indicator readings. The IMF (International Monetary Fund) also downgraded its growth forecast for the US economy for 2015 and 2016. Let’s take a look.