Why have energy companies increased their debt?

In 2010, US upstream energy companies aggregated $128 billion of total debt. As of 4Q14, this increased to $199 billion of combined debt, a jump of 55%.

March 19 2015, Published 8:24 a.m. ET

Energy sector debt landscape

In 2010, US upstream energy companies aggregated $128 billion of total debt, according to S&P Capital IQ. As of 4Q14, this increased to $199 billion of combined total debt, a jump of 55%. This group doesn’t include Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX).

Debt issued by energy companies is typically bought up by pension funds, insurance companies, and savings plans. Some of the energy upstream and integrated companies that have increased leverage in the past one year include Apache Corporation (APA), Exxon Mobil Corporation (XOM), ConocoPhillips (COP), and Laredo Petroleum (LPI). These are components of the Energy Select Sector SPDR Fund (XLE). Apache Corporation, Exxon Mobil, and ConocoPhillips together account for 21% of XLE’s total market capitalization.

Why energy upstream companies need debt

Shale wells deplete more quickly than conventional wells. In addition, drillers employ technologies such as horizontal drilling and hydraulic fracking for extraction. Producers need to keep drilling new wells to maintain output.

All these drive upstream companies to incur debt. According to the Bloomberg Intelligence North America Independent Exploration & Production Index, 57 companies in the index owe a combined $248.5 billion. This is 86% higher than three years ago. According to Bloomberg, over the past five years, investments totaling $1.4 trillion were poured into the oil and gas industry, including debt and capital.

Why debts increased

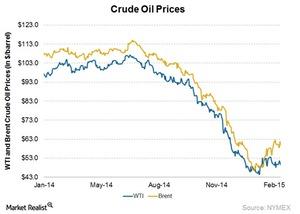

A couple of factors have allowed production and exploration companies to increase leverage. They include low interest rates and increasing oil prices until halfway through last year. Low interest rates enabled funding growth with cheap debt. Higher oil prices mean higher revenue, leading to higher cash flows and the ability to service debt.

An important third factor is production and exploration costs. In a difficult condition such as falling oil prices, this can determine an energy company’s survival. Read Market Realist’s Why production cost may determine survival of the fittest oil companies to know more on this.

But the party is now over since the price of crude oil has slumped to a multiyear low, as shown in the above graph. Since June last year, WTI (West Texas Intermediate) price has fallen ~50%. Brent crude oil price, which is a benchmark of international crude oil price, has also fallen ~48%.

Read the following section to understand why the energy landscape has changed.