Permian Basin: Is It a Sweet Spot for Apache and US Producers?

The Midland and Delaware basins, which are sub-basins of the Permian, had IRRs of 15% even at sub-$40 oil prices. Apache (APA) has significant operations in both of these basins.

June 24 2016, Updated 9:07 a.m. ET

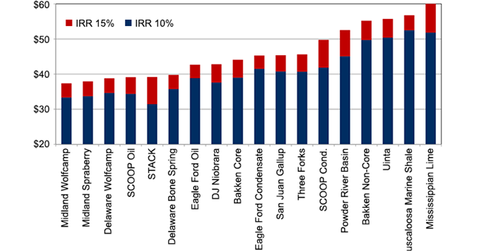

US onshore plays: Internal rates of return

Analysts at Raymond James recently surveyed internal rates of return (or IRRs) across major North American plays.

The Midland and Delaware basins, which are sub-basins of the Permian, had IRRs of 15%, even at sub-$40 oil prices. Apache (APA) has significant operations in both of these basins. Concho Resources (CXO) also has operations in the Permian Basin. APA and CXO make up ~3% of the Energy Select Sector SPDR ETF (XLE).

In comparison, the Bakken non-core and the Mississippi Lime need oil prices to be at least $50–$60 per barrel in order to achieve IRR of at least 10%.