What Put Pressure on the Energy Sector in February 2018?

The US energy sector was badly affected by the recent market sell-off in February 2018.

Dec. 4 2020, Updated 10:52 a.m. ET

Energy sector in February 2018

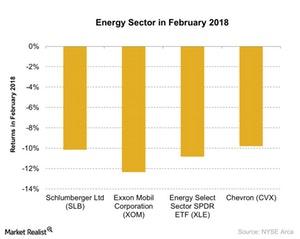

The US energy sector was badly affected by the recent market sell-off in February 2018. The Energy Select Sector SPDR ETF (XLE), which tracks the performance of the energy sector, fell 10.8% in February 2018. Similarly, the ETF posted a huge fall in 2017.

Major holdings of the energy sector

Major holdings of the XLE include Chevron (CVX), ExxonMobil (XOM), and Schlumberger (SLB). These stocks fell 9.8%, 12.4%, and 10.2%, respectively, in February 2018. The fall in crude oil prices mainly affected the movement of the energy sector in February 2018. The WTI (West Texas Intermediate) crude oil active futures contracts fell 4.8% in February 2018.

The United States Oil (USO) ETF, which tracks the performance of crude oil, also fell 4.6% in that month. Although the 4Q17 earnings figures of major energy stocks showed some improvements, the fall in crude oil price mainly affected the energy stocks in February 2018.

Crude oil is a growth-driven commodity. When the prospect for global growth increases, crude oil tends to rise. However, when the prospect for global growth weakens, crude oil prices tend to fall, as the demand for crude oil decreases during a slow-growth environment. In the previous part of this series, we saw that the rising concern about the future global growth outlook and expectations for an aggressive Fed mainly caused the fall in the markets.

In the next part of this series, we’ll analyze the performance of the technology sector in February 2018.