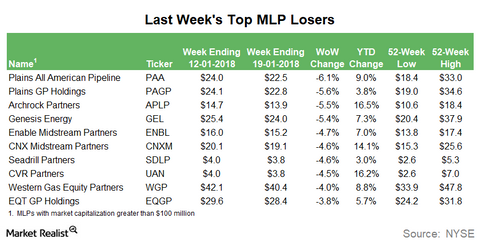

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

Nov. 20 2020, Updated 12:45 p.m. ET

Plains All American Pipeline

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower. PAA’s plunge last week’s could be mainly due to the slight decline in crude oil prices and rating downgrade. PAA’s GP (general partner), Plains GP Holdings (PAGP), was also among the biggest MLP losers last week. It fell 5.6%. PAA and PAGP have lost 27.9% and 31.0%, respectively, over the past year.

Archrock Partners

Archrock Partners (APLP), an MLP involved in contract compression services, was the third-biggest MLP loser last week. It fell 5.5%. Similar to PAA, APLP’s weakness last week could be due to its rating downgrade. APLP has seen three rating downgrades following the announcement of its acquisition by Archrock (AROC). AROC is APLP’s sponsor. Despite the recent decline, APLP has risen 16.5% YTD (year-to-date).

Genesis Energy

Genesis Energy (GEL), a midstream MLP mainly involved in crude oil and refined products transportation, terminaling, and logistics, was the fourth-biggest MLP loser last week. GEL ended the week 5.4% lower. GEL has lost 32.4% over the past year, which could be due to the partnership’s weak earnings, relatively high commodity price exposure, and high leverage.