EQT GP Holdings LP

Latest EQT GP Holdings LP News and Updates

Key Updates on the EQT-RICE Merger

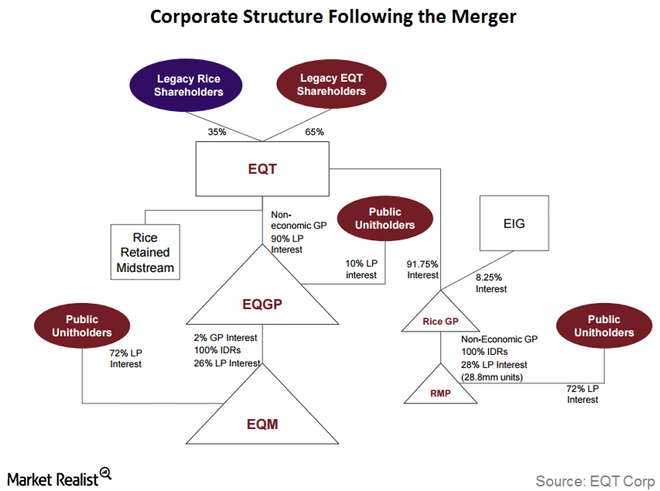

Under EQT Corporation’s (EQT) existing ownership, the company owns a 90% limited partner interest and non-economic general partner interest in EQT GP Holdings (EQGP).

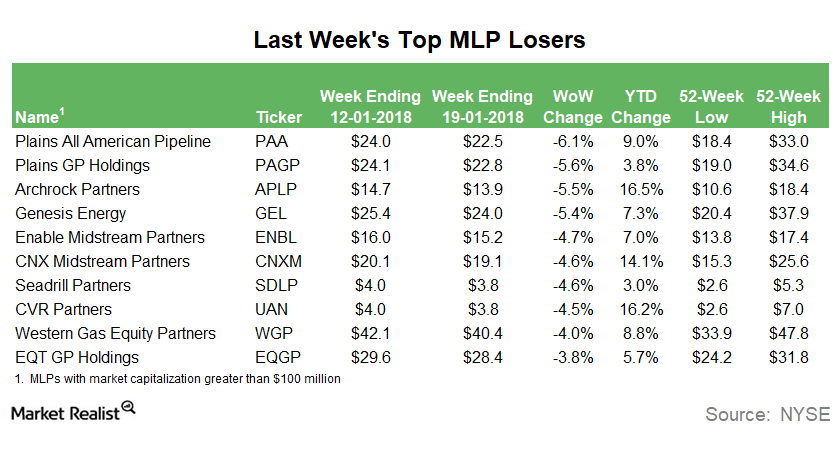

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

How Do These MLPs Look in 2018?

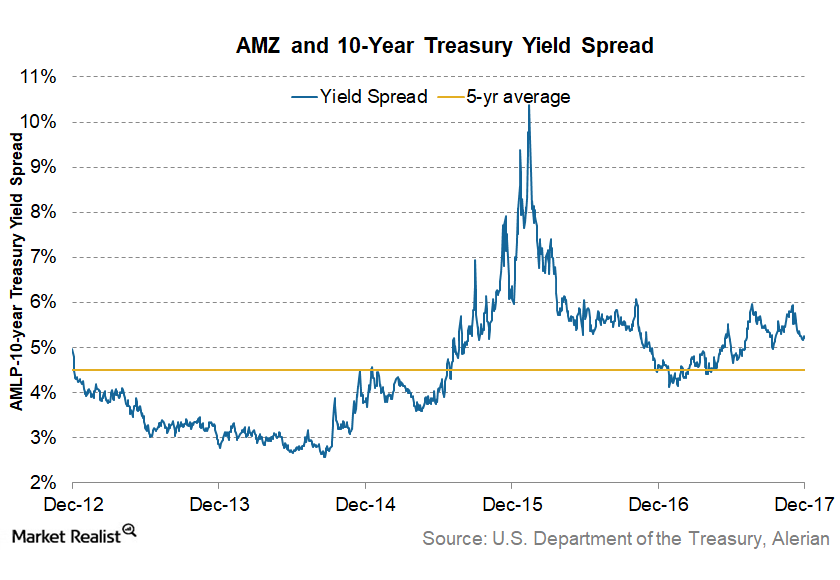

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

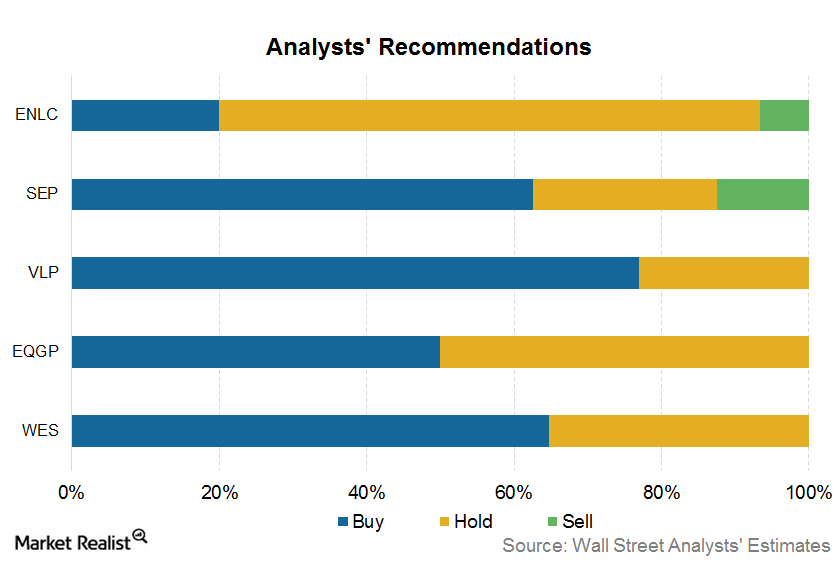

MLP Rating Updates Last Week

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”