Western Gas Equity Partners LP

Latest Western Gas Equity Partners LP News and Updates

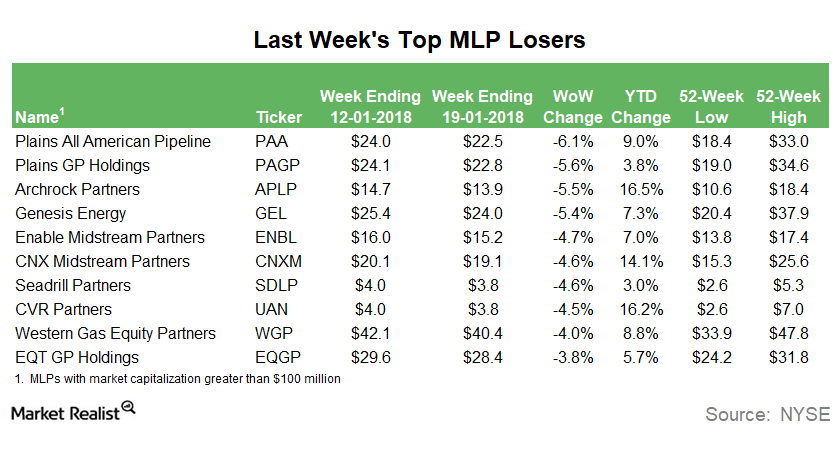

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

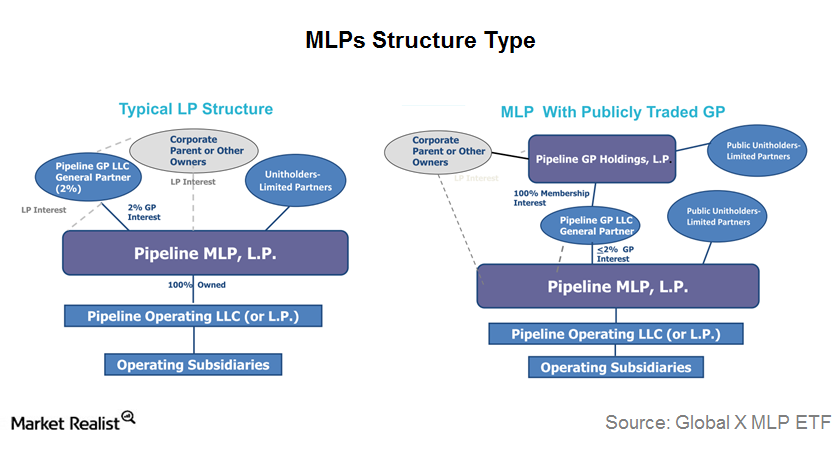

Do MLPs Benefit from the LP-GP Model?

MLPs generally have an LP-GP (limited partner and general partner) model structure in which the LP is a publicly traded entity and owns the majority of the operating assets.