Plains GP Holdings LP

Latest Plains GP Holdings LP News and Updates

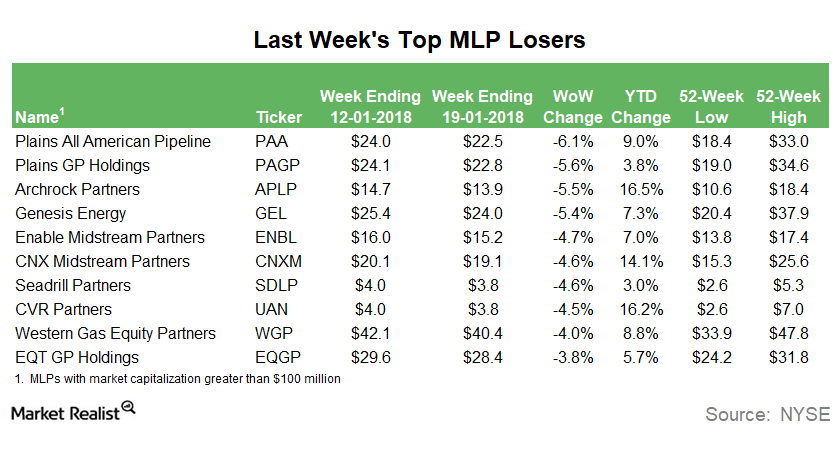

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

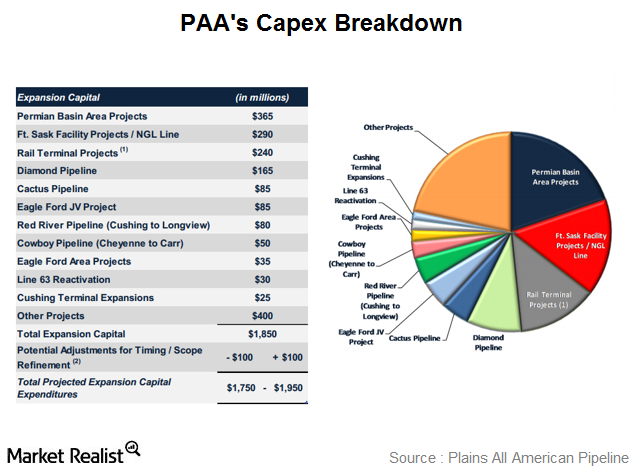

Plains All American Pipeline’s capex plan for 2015

Plains All American Pipeline expects to spend $1.85 in capex in 2015, highlighted by several projects in multiple geographic regions or resource plays.

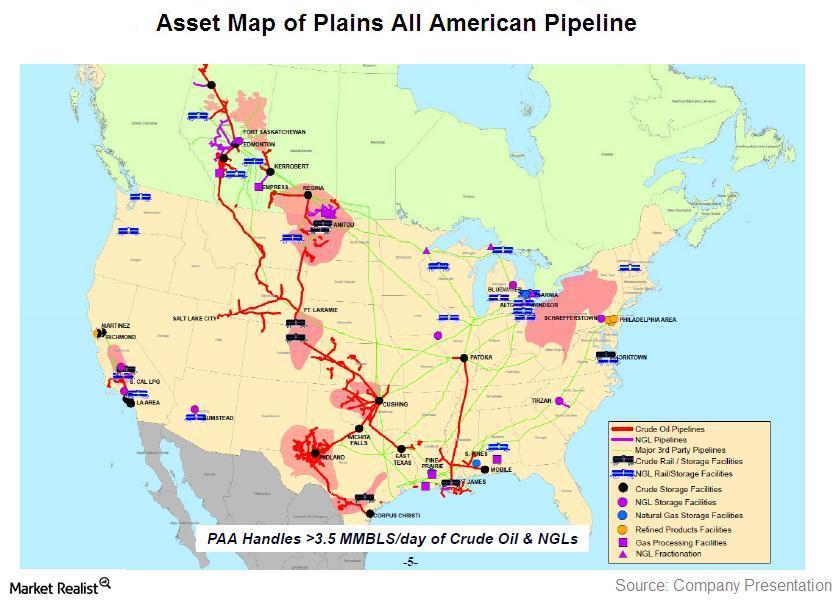

Must-know: An introduction to Plains All American Pipeline

Plains All American Pipeline L.P. (PAA) is a master limited partnership that operates in the midstream energy business.