Genesis Energy LP

Latest Genesis Energy LP News and Updates

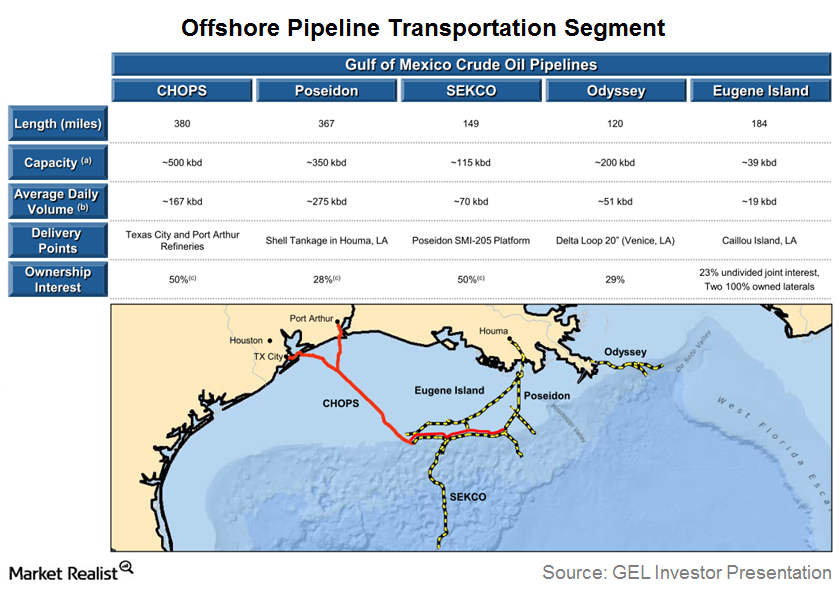

An Overview of Genesis Energy’s Offshore Pipeline Segment

Until recently, Genesis Energy’s Offshore Pipeline segment owned interest in ~1200 miles of offshore pipelines spread across five pipeline systems.

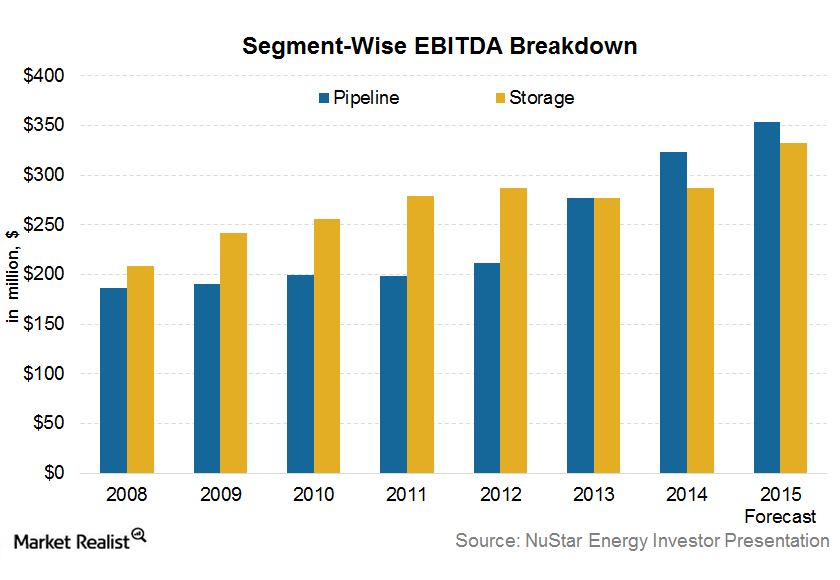

Pipeline Segment Will Drive NuStar Energy’s 4Q15 Performance

The pipeline segment is NuStar’s largest business segment in terms of the EBITDA. It accounted for 50% of the total segment EBITDA in the first nine months of 2015.

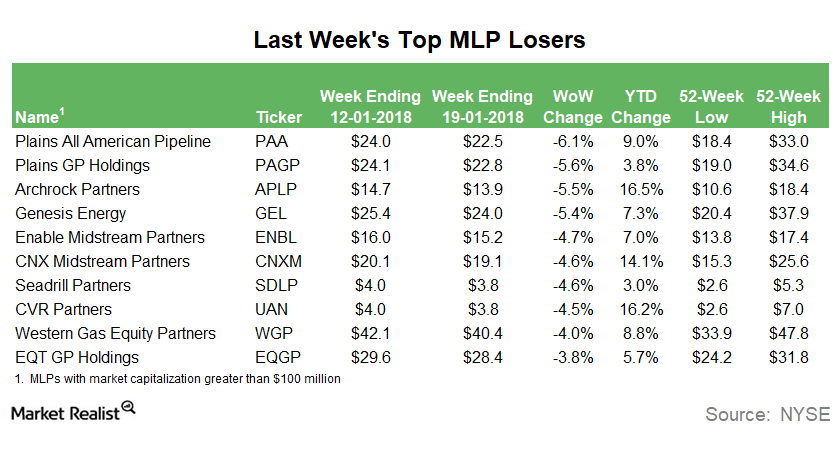

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

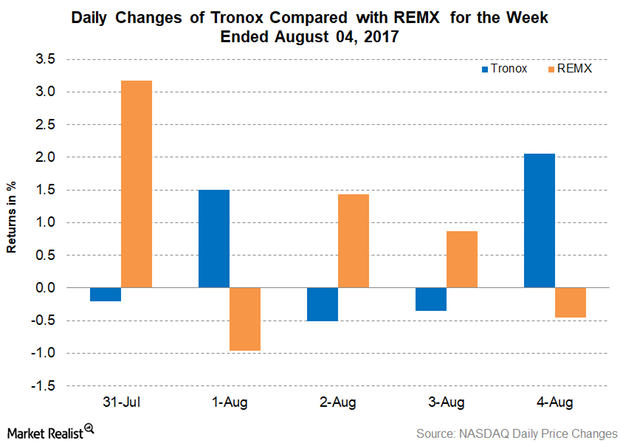

Tronox Will Sell Its Alkali Chemicals Business

On August 2, 2017, Tronox (TROX) announced that it entered into a definitive agreement with Genesis Energy LP (GEL) to sell its alkali chemicals business.

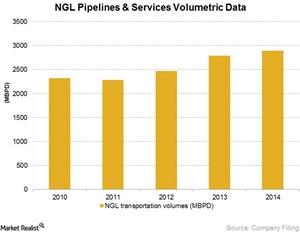

EPD’s Most Profitable Segment: NGL Pipelines & Services

EPD’s Natural Gas Liquid Pipelines & Services segment involves natural gas processing plants and NGL marketing activities.