Seadrill Ltd

Latest Seadrill Ltd News and Updates

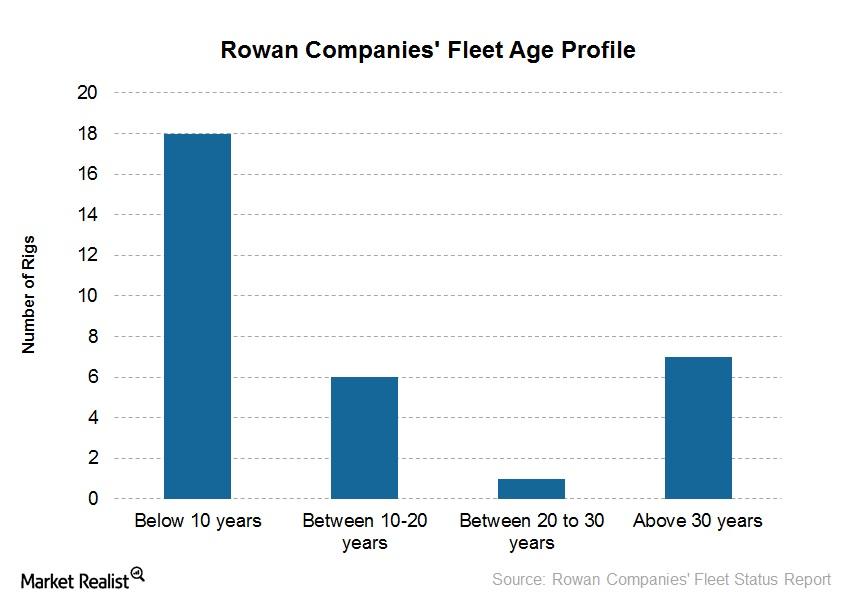

Analyzing Rowan’s Rig Scrapping and Stacking Activity in 3Q15

Offshore drilling (XLE) (IYE) is a capital-intensive industry requiring a large amount of money to keep rigs active and well-maintained.

Seadrill Stock Rose 98% in Week 20

The offshore drilling industry made headlines last week, especially Seadrill (SDRL), which reached a 52-week high of $0.73.

How Offshore Drilling Stocks Performed Last Week

Most offshore drilling stocks traded in the green in the week ended July 13. The best performer during the week was Noble.

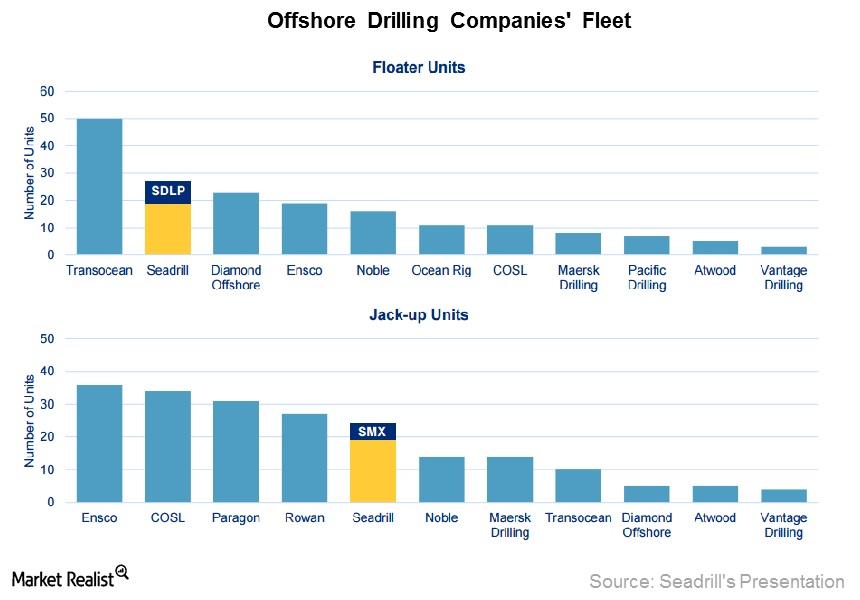

A Review of Floaters and Jack-Up Fleets for Offshore Drillers

Seadrill and Diamond Offshore have more than 20 floaters in their fleets. Ensco and Rowan Companies have more jack-ups in their fleets than peers have.

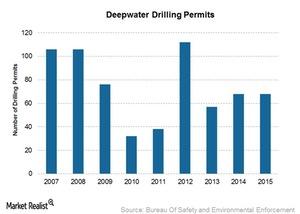

The 2010 Gulf Oil Spill Tragedy and Its Aftermath across the Industry

The marine oil spill in April 2010 was the worst environmental disaster in US history, causing millions of barrels of oil gushed into the Gulf.

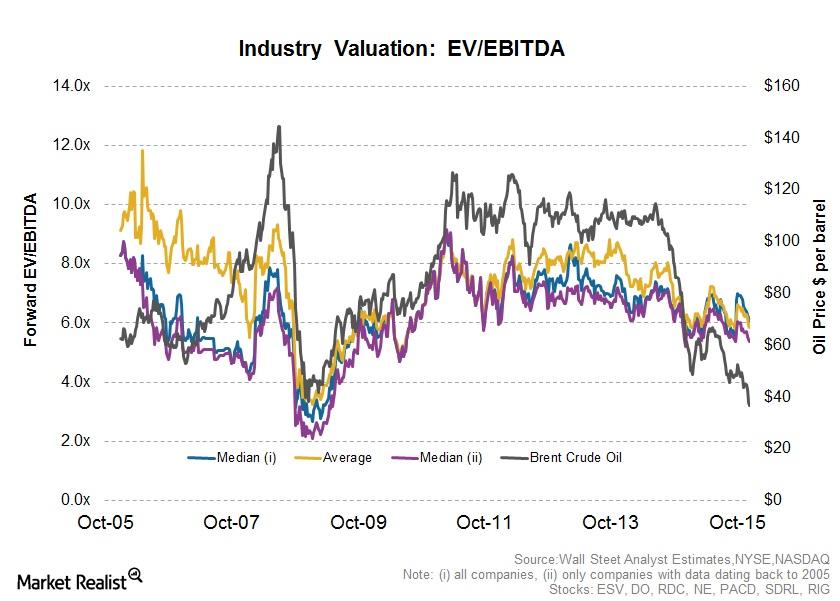

How to Interpret Valuation Multiples in the Offshore Drilling Industry

Offshore drilling companies are capital-intensive and have varying degrees of financial leverage. Thus, we use the EV-to-EBITDA multiple as a valuation.

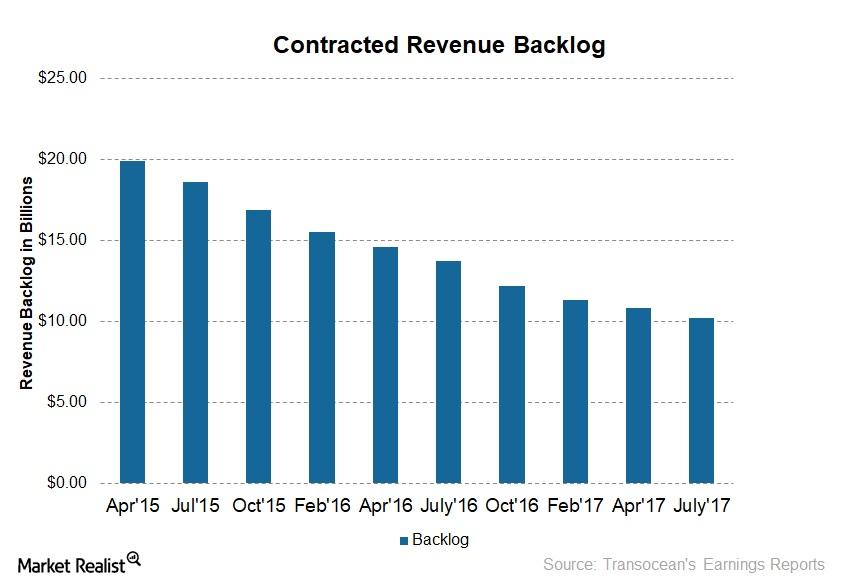

Transocean Secured New Contracts

As of July 25, 2017, Transocean (RIG) had a backlog of $10.2 billion—compared to $10.8 billion in April 2017.

Extracting the Basics: An Introduction to Offshore Drilling

Oil is one of the most important and most frequently traded commodities, and offshore drilling is an integral part of the oil industry.

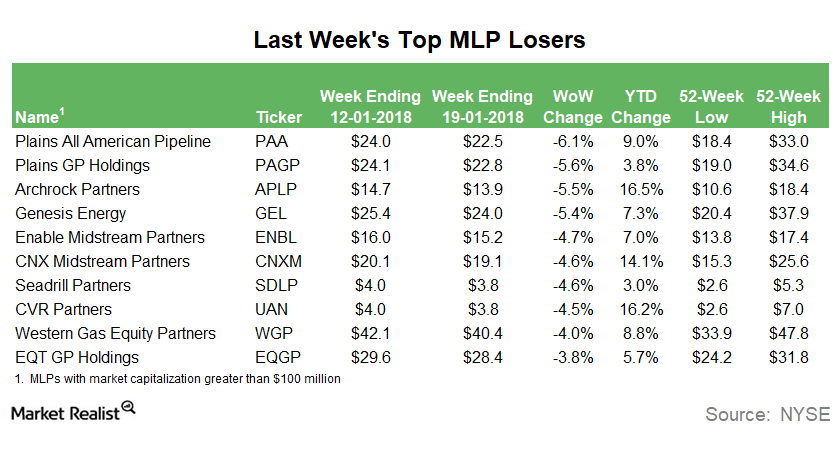

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

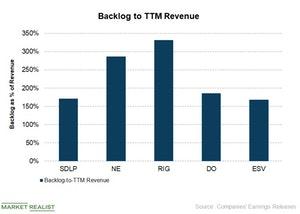

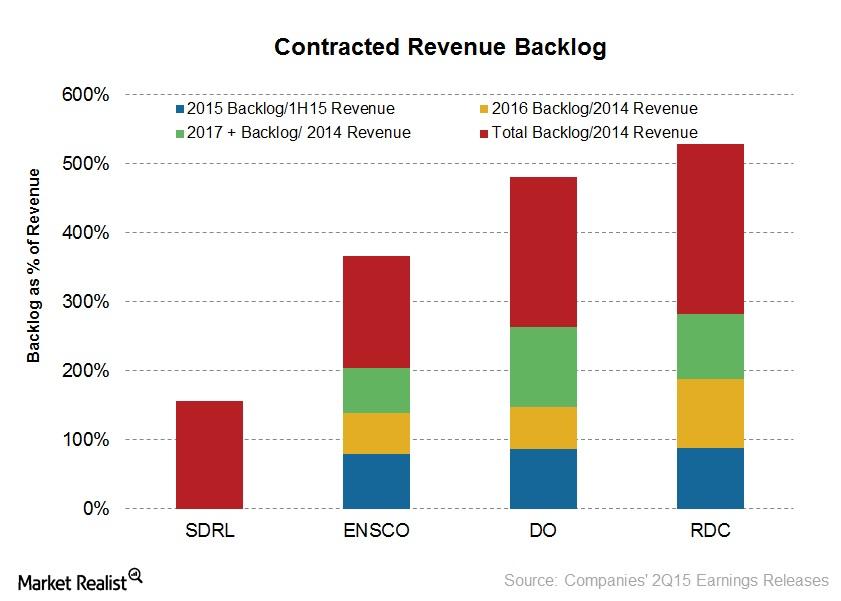

Transocean Has the Highest Backlog among Its Peers

In the last part of this series, we saw which offshore drillers had the highest and lowest falls in their backlogs. In this article, we’ll compare offshore drillers’ backlogs versus their revenues.

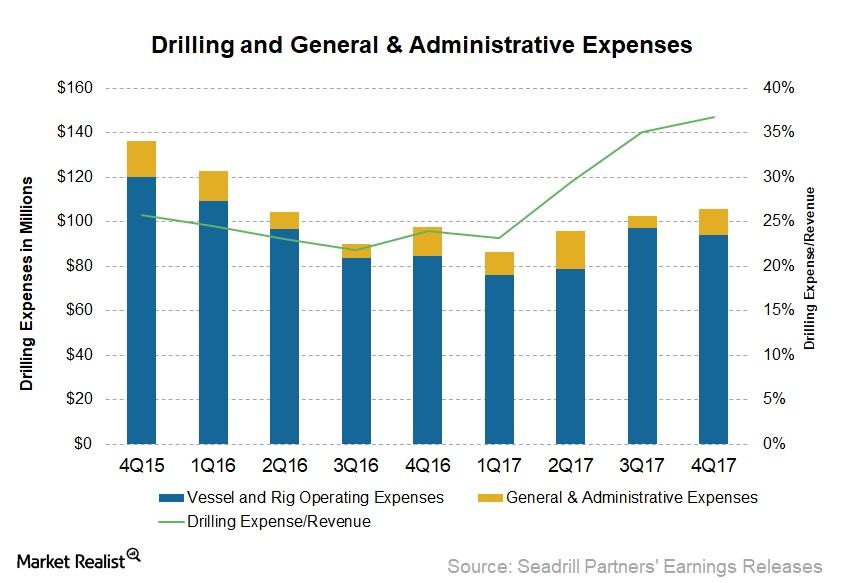

A Look at Seadrill Partners’ Cost Performance in 4Q17

Seadrill Partners’ (SDLP) vessel and rig operating expenses fell 3% to $94 million in 4Q17 compared to $96.9 million in 3Q17.

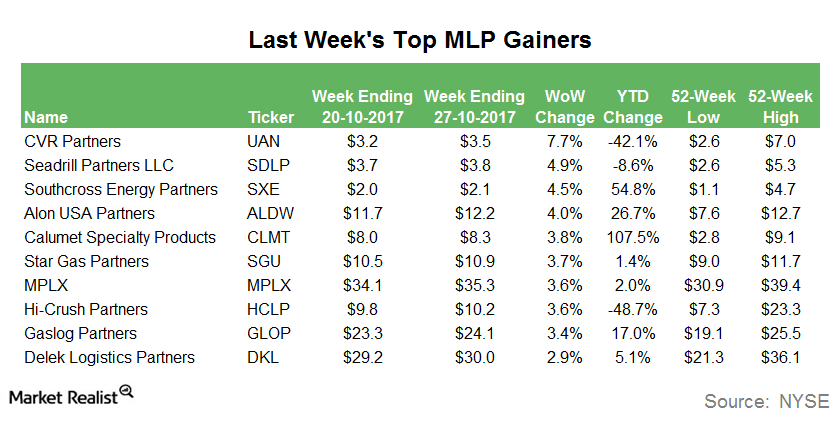

Last Week’s Top MLP Gainers

CVR Partners (UAN), the MLP mainly involved in the production of nitrogen fertilizers, was the top MLP gainer last week. CVR Partners rose 7.7%.

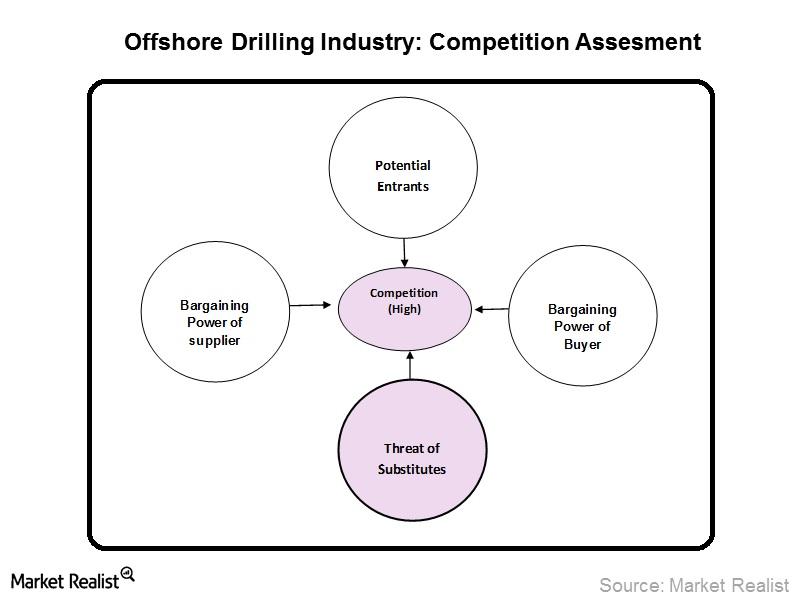

The Intense Competition in the Offshore Drilling Industry

The offshore drilling industry has a high degree of financial and operating leverage, which forces participants to engage in price competition.

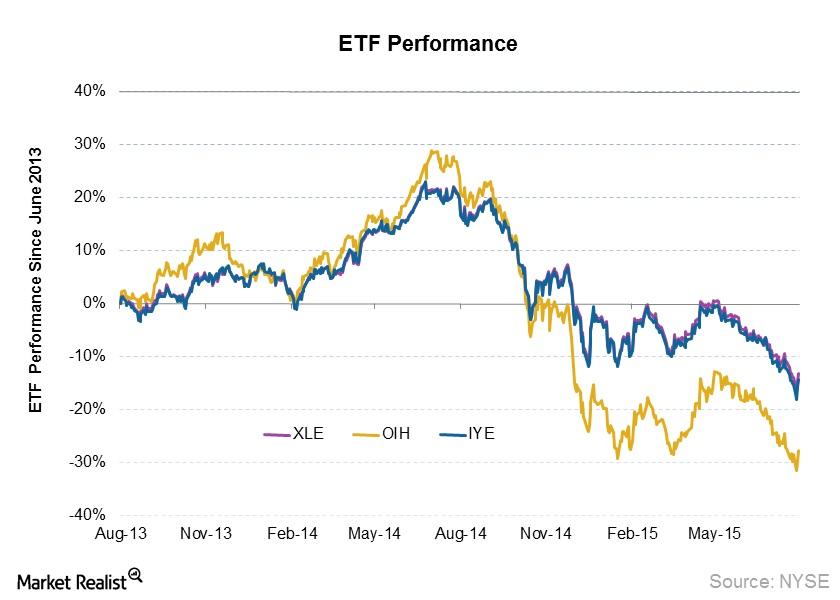

ETF Exposure in the Offshore Drilling Space

Among the biggest ETFs in the offshore drilling space, investors can choose between ETFs like OIH, XLE, and IYE for exposure to offshore drilling.

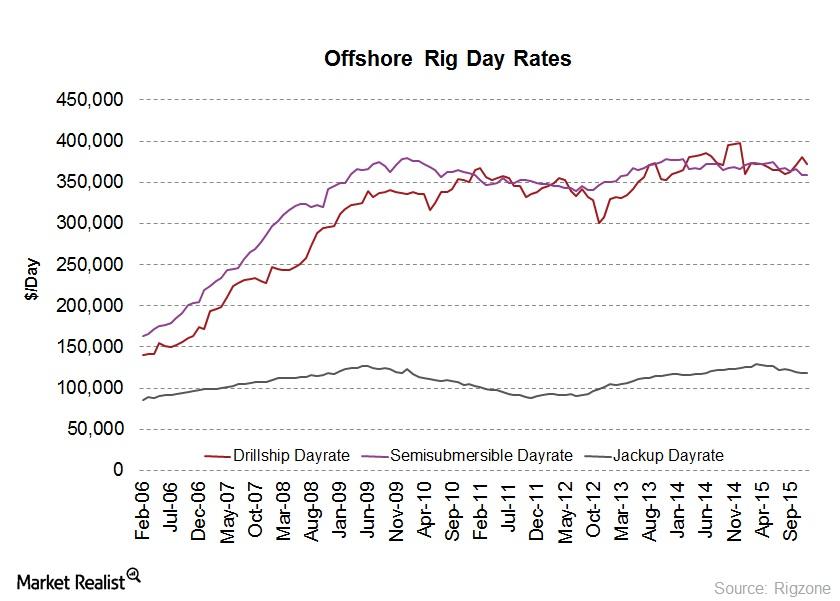

Day Rates and Lifelines of Offshore Drilling Companies

Even in the same category of rigs, different water depth capabilities cause offshore drilling day rates differ. Day rates are also impacted by region.

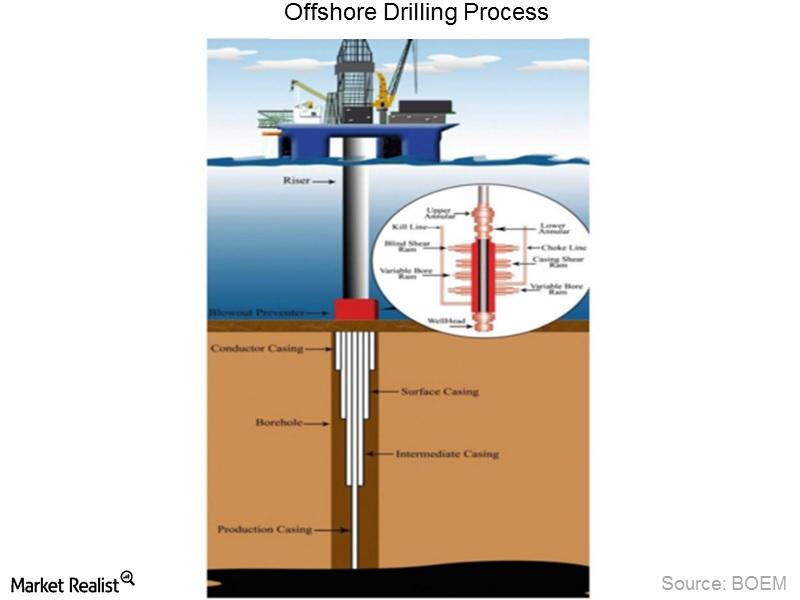

Why the Offshore Drilling Process Is so Complex and Costly

The offshore drilling process requires complex machinery and large crews. At every stage, things that can go wrong, so each stage requires special care.

Rowan Companies Has Highest Backlog among its Peers

Overall, Rowan Companies (RDC) has a comparatively stronger backlog. Higher backlogs are associated with stable revenues in the short to midterm, which reduces risk for investors.

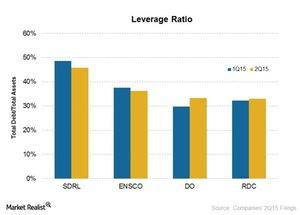

Which Offshore Driller Is the Most Leveraged?

As the above chart shows, Seadrill (SDRL) has the highest leverage, with a debt-to-asset ratio of 46%. Ensco (ESV) has the second highest ratio at 36%.

Why Did the YMLP ETF Fall Last Week?

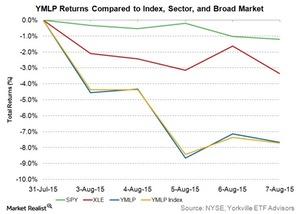

The Yorkville High Income MLP ETF (YMLP) dropped 7.69% in the week ended August 7. The broad-market SPDR S&P 500 ETF (SPY) dropped 1.2%.