Enable Midstream Partners LP

Latest Enable Midstream Partners LP News and Updates

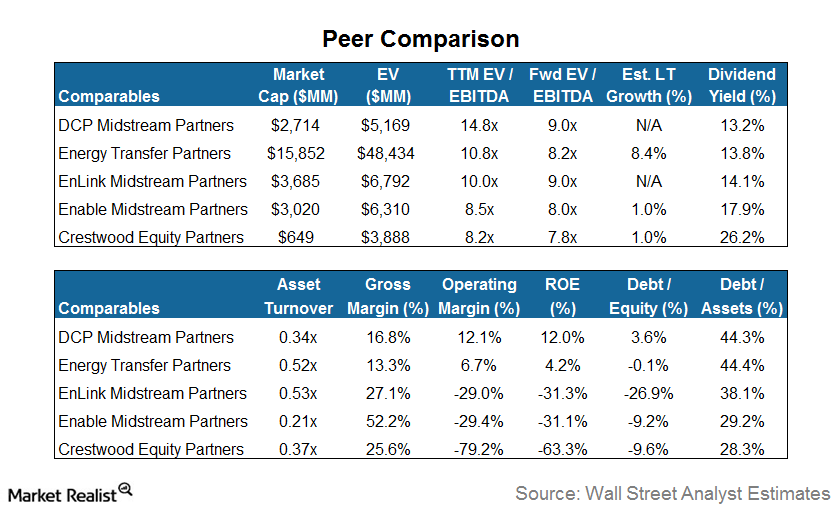

Where Does DCP Midstream Stand Compared to Its Peers?

DCP Midstream Partners (DPM) has an enterprise value of $2.7 billion.

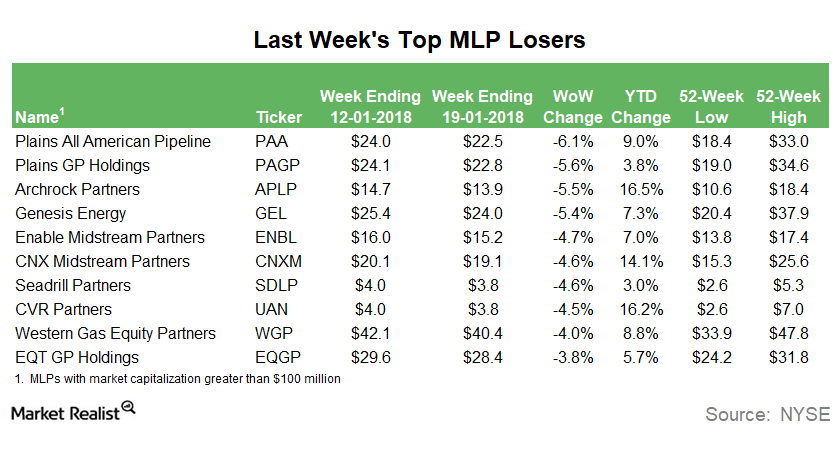

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

These Energy Stocks Rose the Most Last Week

Oil field services stock CARBO Ceramics (CRR) was the biggest gainer among the energy sector stocks last week.

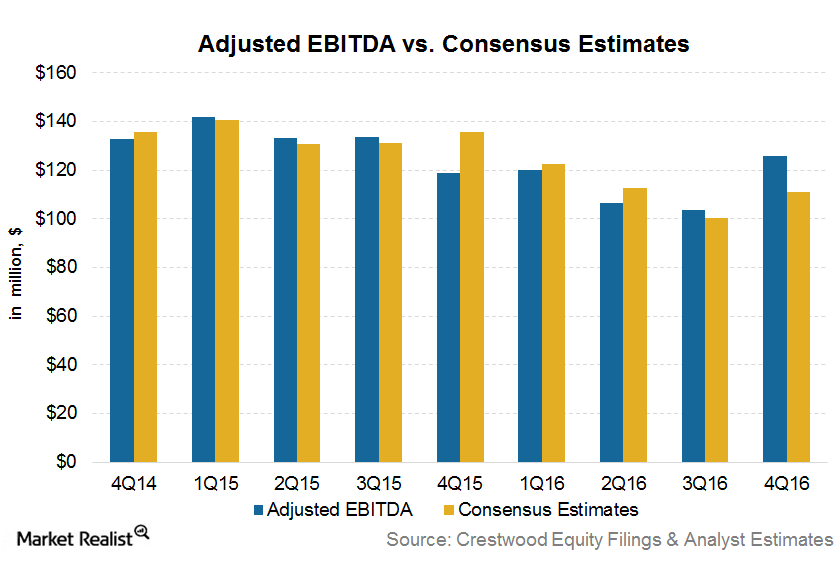

What Drove Crestwood Equity Partners’s 4Q16 EBITDA Growth?

Crestwood Equity Partners (CEQP) reported its 4Q16 earnings on February 21, 2017. Its 4Q16 adjusted EBITDA increased to $125.6 million from $118.9 million in 4Q15, a year-over-year increase of 5.6%.

ONEOK: Trading 57% below Its 50-Day Moving Average

ONEOK (OKE) is currently trading 57% below its 50-day moving average. It’s generally been trading below its 50-day moving average since mid-2014 when energy prices began falling.

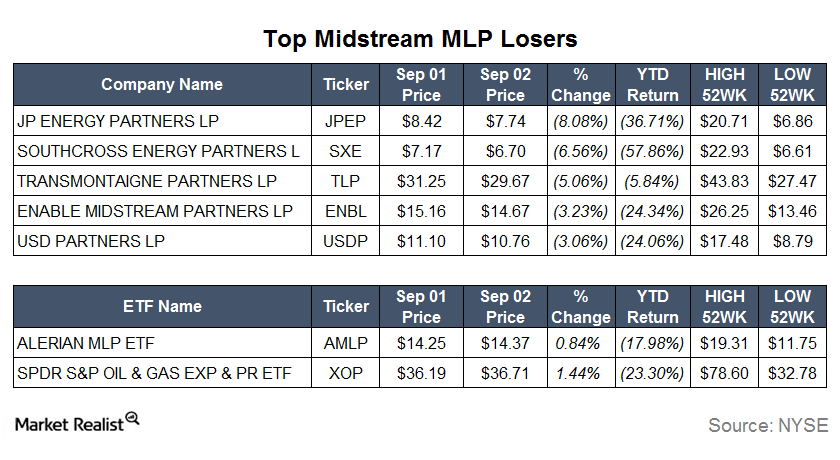

JP Energy Partners: Top Midstream MLP Loser on September 2

JP Energy Partners (JPEP) was the top loser among midstream MLPs at the end of trading on September 2, falling 8.08%. JPEP stock has been on a roller coaster ride for the past few days.