CVR Partners LP

Latest CVR Partners LP News and Updates

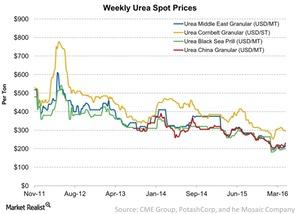

Tracking Urea Price Movement during the Week Ending April 22

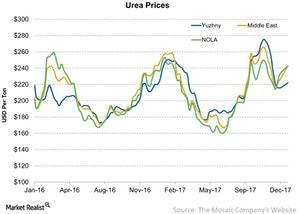

In 2013, about 54% of global ammonia was upgraded to urea, according to FERTECON. But urea prices have rebounded from their lows at the beginning of 2016.

Urea Prices: The Continuing Decline Last Week

Granular urea prices in the Middle East declined 5% to $200 per metric ton in the week ended July 1. It was $210 per metric ton in the previous week.

Did Capacity Shutdowns in China Impact Urea Prices?

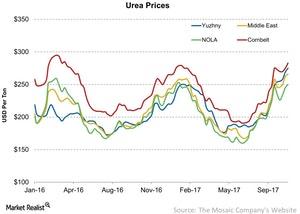

For the week ending October 28, the overall movement in urea prices was flat to positive. Granular urea prices rose 6.6% to $211 per metric ton in China.

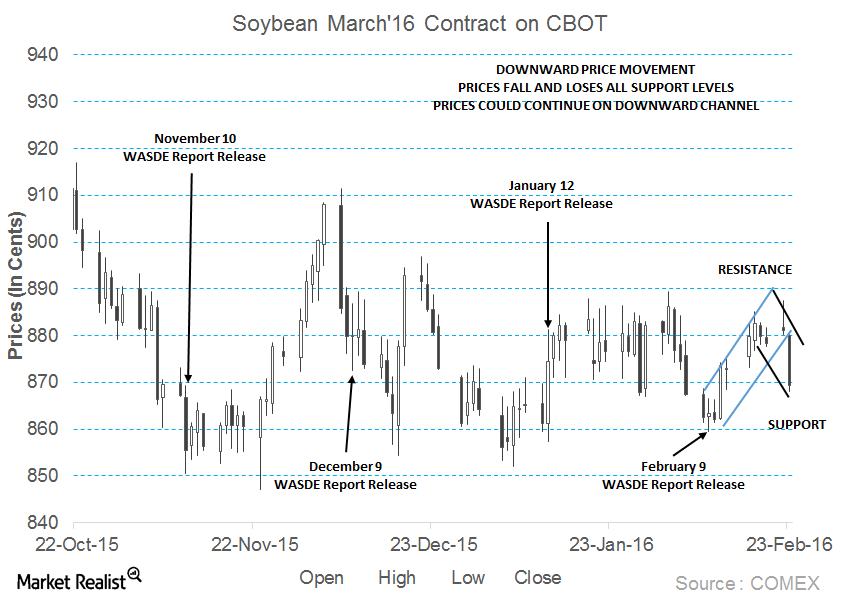

Soybean Prices Might Continue on the Downward Channel

March soybean futures contracts were trading near the support level of $8.70 per bushel on February 23. Prices fell for the second consecutive trading day.

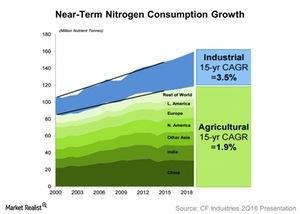

How Much Demand Will There Be for Nitrogen in the Near Term?

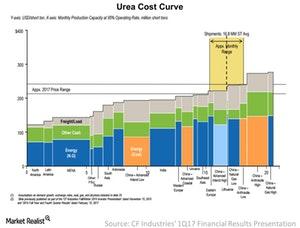

According to CF Industries, nitrogen prices could remain under pressure as new capacities come online in 2017. However, the company believes that things should improve in 2018.

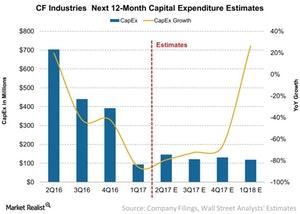

Capital Expenditure Expectations for CF Industries in 2Q17

CF Industries (CF) is expected to see a significant reduction in its capital expenditure (or capex) year-over-year (or YoY) in 2Q17 and for the next four quarters.

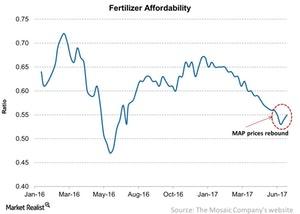

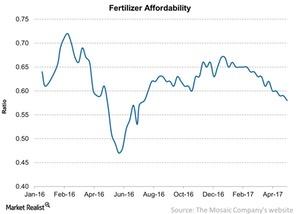

Fertilizers Were Affordable for the Week Ending June 23

According to the Fertilizer Affordability Index, 2017 has been one of the most affordable years for fertilizers. Mosaic issues the index.

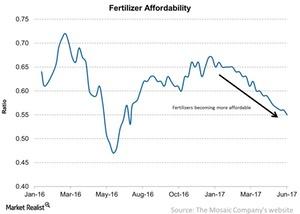

Why the Fertilizer Affordability Index Was Lower Last Week

The Fertilizer Affordability Index has shown a downward trend since the beginning of the year. Fertilizers have become more affordable in 2017.

Fertilizer Affordability Fell for the Week Ending April 28

For the week ending April 28, the Fertilizer Affordability Index fell slightly to 0.58x—compared to 0.59x the previous week.

Why CVR Partners Missed Analyst Estimates in Second Quarter

CVR Partners missed both top-line and bottom-line estimates for the second quarter, and the stock fell 4.5% after the earnings release.

Who Are the Biggest Players in the Fertilizer Industry?

There’s a handful of big players in the agricultural fertilizer industry. Setting up business requires huge capital, which makes for a high barrier to entry.

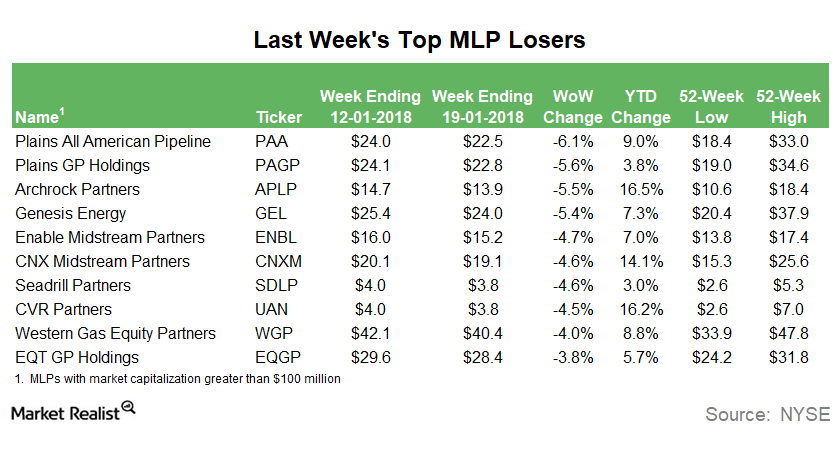

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

A Review of Fertilizer Prices Last Week

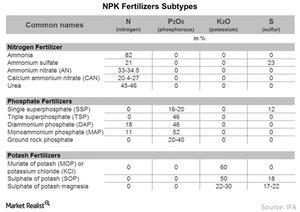

In this series, we’ll look at key NPK (nitrogen, phosphorous, and potassium) fertilizer prices last week.

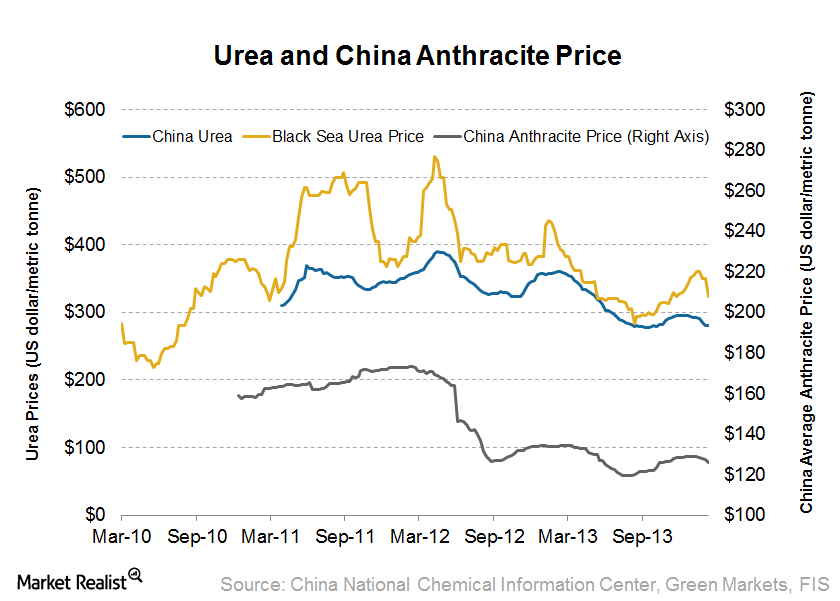

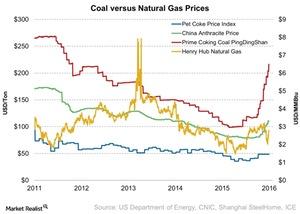

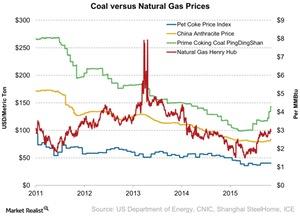

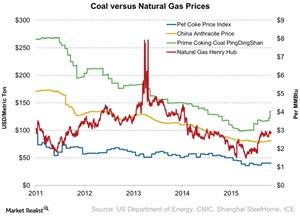

Why coal prices affect global urea fertilizer producers like CF

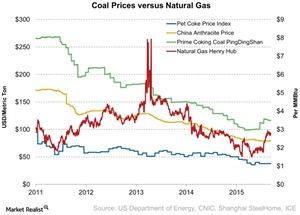

This series covers key trends that are currently affecting coal and natural gas prices and, consequently, nitrogen fertilizer producers as well.

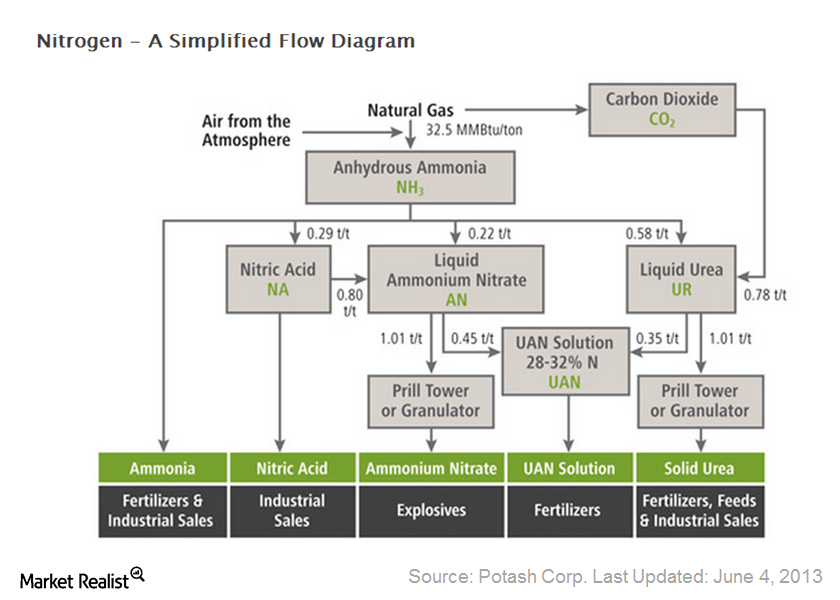

An investor’s guide to nitrogen fertilizers: Key 2014 drivers

Nitrogen is an important nutrient for crop development and growth. It’s also the most important input that allows farmers to feed billions of people in the world.

What to Expect from Mosaic’s 1Q18 Earnings

Mosaic is expected to report EPS of $0.28 in 1Q18, which would be a significant rise from its EPS of $0.04 in 1Q17.

Urea Prices Rose Last Week

Urea prices for the standard grade in the NOLA (New Orleans) region of the US and in Egypt saw the steepest weekly change last week.

Urea Prices Fell Last Week

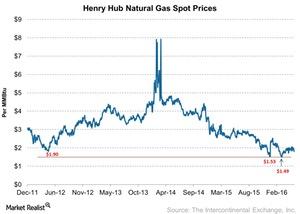

Nitrogen fertilizer prices remained volatile on the back of the volatility in the input prices of natural gas.

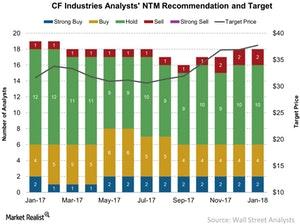

How Analysts View CF Industries in January 2018

Nineteen Wall Street analysts are covering CF Industries. They have a consensus mean rating of 2.7 on the stock with an overall “hold” recommendation as of January 10, 2018.

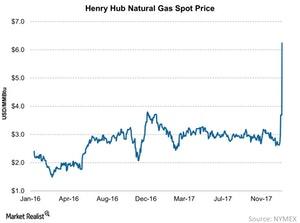

Why Natural Gas Rose Sharply Last Week

Natural gas is one of the key input components for gas-based nitrogen fertilizer producers (MOO)(MXI) such as CF Industries (CF), Terra Nitrogen (TNH), CVR Partners (UAN), and Nutrien (NTR).

Urea Prices Saw Good Start to 2018

In the week ending January 5, the prices for granular as well as prilled urea were broadly higher week-over-week.

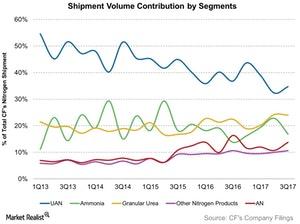

Assessing the Shift in CF Industries’ Product Mix

In the earlier part of this series, we discussed how shipments impacted CF Industries’ (CF) sales. From our analysis, it’s clear that a rise in selling prices remains the most important growth catalyst for the company.

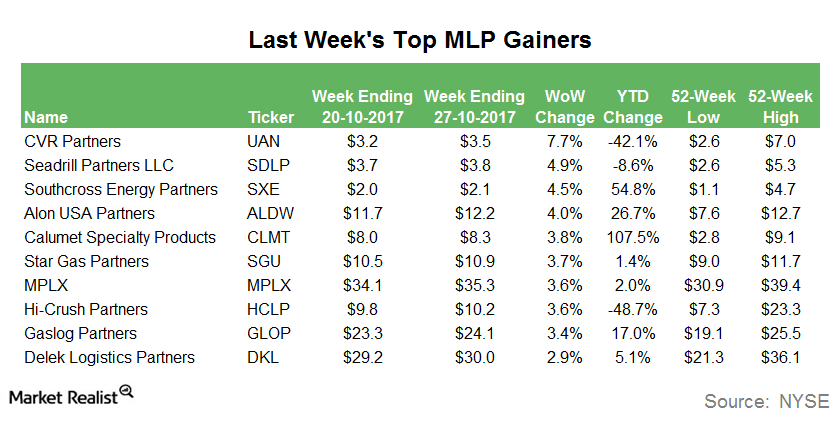

Last Week’s Top MLP Gainers

CVR Partners (UAN), the MLP mainly involved in the production of nitrogen fertilizers, was the top MLP gainer last week. CVR Partners rose 7.7%.

Urea Prices Moved Higher in Week Ended October 27

Last week continued to be a positive week for urea prices. Prices have risen lately as a result of excess capacities cooling off.

Granular Urea versus Prilled Urea Last Week

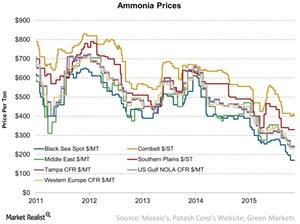

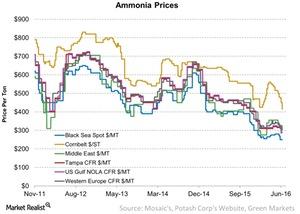

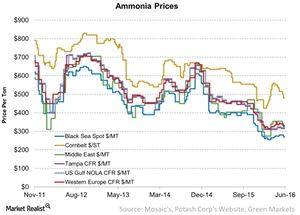

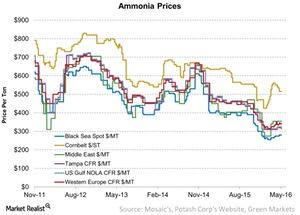

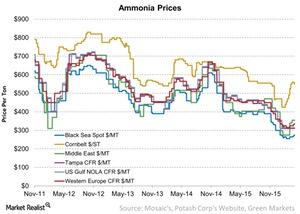

Last week, granular urea prices moved higher, which helped bring some relief to urea producers. But the falling global ammonia prices remained a challenge.

Understanding the Urea Cost Curve for CF Industries

Not only did CF Industries’ earnings fall year-over-year (or YoY) in 1Q17, its margins were also significantly lower YoY. To understand why, let’s dig deeper into the cost curve.

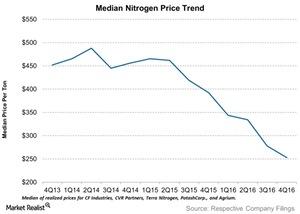

Nitrogen Producers’ Realized Prices: A Key Comparison

In 4Q16, the average price of ammonia for the five producers in our chart fell by an average of 38%.

The Most Common NPK Fertilizers: Why Combinations Are Important

Fertilizers are commonly labeled using a convention that includes the amount of NPK available in the mix.

Rising Anthracite Prices Pressure Chinese Fertilizer Producers

Anthracite coal is used to produce nitrogen fertilizers. For the week ending November 18, average weekly anthracite coal prices in China rose 3.8%.

Fertilizer Update: Are Market Dynamics Changing?

Producers in China primarily use coal as an input material to produce nitrogen, especially urea-based fertilizers. China is the world’s biggest urea exporter.

Coal Prices Remained Flat for the Week Ending October 7

Chinese producers primarily use coal to produce nitrogen, especially urea-based fertilizers, while producers in North America mostly rely on natural gas.

A Look at Ammonia Prices Last Week

The current levels of ammonia prices at several locations are below their comparative levels last year.

Urea Input: Anthracite Coal Prices Rose Last Week in China

Producers in China mainly use coal as an input material to produce nitrogen fertilizers, especially urea. China is impacted by price movements in coal.

Weekly Nitrogen Update: Anthracite Prices Fell in China

For the week ending September 9, average weekly anthracite coal prices in China fell 4.2% to $81.1 per metric ton—compared to the previous week.

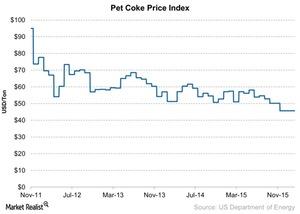

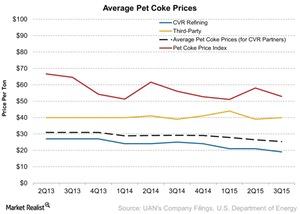

Pet Coke and Coal Prices Moved Sideways Last Week

While most North American producers use natural gas to produce nitrogen fertilizers, CVR Partners (UAN) mainly uses pet coke as a hydrogen source.

How Are Pet Coke, Coal, and Natural Gas Prices Trending?

The petroleum (or pet) coke index remained unchanged from the previous week during the week ending July 22, 2016.

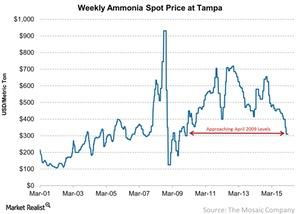

Why Do Ammonia Prices Keep Falling?

Ammonia prices in the Southern Plains had the steepest fall of 10.5% last week, continuing the previous week’s trend.

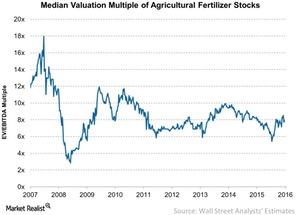

How Do Valuation Multiples Compare among Fertilizer Companies?

To date, the median valuation of fertilizer stocks is around 7.9x. That’s at the midpoint of the nine-year average of 8.2x.

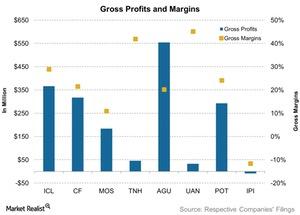

How Fertilizer Companies’ Gross Margins Were Pressured in 1Q16

The fertilizer industry moves in cycles and with most companies experiencing a decline in margins, the industry seems to be in the bottom cycle.

How Did Ammonia Prices Move Last Week?

Last week, nitrogen producers CF Industries (CF), CVR Partners (UAN), Terra Nitrogen (TNH), and PotashCorp (POT) ended in the red.

Urea Prices: Still a Concern for Nitrogen Fertilizer Stocks

As most global ammonia production is upgrading to urea, ammonia prices may affect urea prices.

How Do Natural Gas Price Forecasts Impact Fertilizer Companies?

Natural gas is the key raw material for the production of nitrogen fertilizers such as ammonia and urea.

How Did Ammonia Prices Trend Last Week?

Ammonia prices for Tampa CFR (cost and freight) moved down 1.6% to $315 per metric ton compared to $320 per metric ton in the previous week.

Ammonia Prices in the International Market Inch Up

In the international market, ammonia at the Black Sea, Ukraine, inched up to $275 per metric ton FOB, a rise of 1.9% from the previous week.

Ammonia Prices Fell Slightly from the Previous Week

Ammonia was trading at $310 per metric ton as of the week ending March 4, 2016. It fell $1 from the previous week ending February 26, 2016.

What’s Happening to Pet Coke Prices?

Coal, or petroleum coke, is widely used by nitrogen fertilizers producers in China. Declining coal prices negatively impact natural gas-based producers.

How CVR Partners Benefits from Pet Coke Prices

Unlike other companies, CVR Partners (UAN) uses petroleum coke, or pet coke, to produce nitrogen fertilizers.