Urea Prices Moved Higher in Week Ended October 27

Last week continued to be a positive week for urea prices. Prices have risen lately as a result of excess capacities cooling off.

Oct. 30 2017, Updated 10:00 a.m. ET

Urea prices

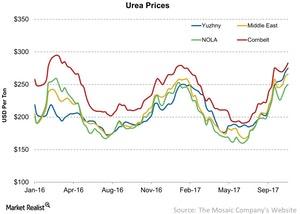

Last week continued to be a positive week for urea prices. At each of the four locations depicted in the chart below, urea prices rose higher week-over-week. Prices have risen lately as a result of excess capacities cooling off. During PotashCorp’s (POT) recent 3Q17 earnings call, it estimated that urea capacity could be absorbed over the next 18 to 24 months.

Weekly movements

Last week, which ended October 27, 2017, granular urea prices at the three locations in the above chart rose week-over-week. Prices in the Cornbelt rose 2.9% to $257 per metric ton, from $249 per metric ton a week ago. Prices in the NOLA (New Orleans) region rose 2.0% week-over-week to $227 per metric ton, from $222 per metric ton. In the Middle East region, granular urea prices rose 1.5% to $266 per metric ton, from $262 per metric ton a week ago.

Weekly prices for prilled urea also rose last week at the Yuzhny location by 2.2% week-over-week to $275 per metric ton, from $269 per metric ton.

Year-over-year movements

Year-over-year, urea prices at each of the above four locations were significantly higher last week. In the Cornbelt, prices rose 24.0% year-over-year. At NOLA, urea prices were 25.0% higher, and in the Middle East, prices rose 29.0% year-over-year. Similarly, prilled urea prices at the Yuzhny location were 42.0% higher from the corresponding week a year ago.

China slowing down

China, which has been one of the largest exporters of urea, has been slowing down. In PotashCorp’s 3Q17 earnings release, management stated that China has exported about 3.6 million tons of urea so far this year, which was less than 7.4 million tons a year ago. China is heading toward a stricter policy on the use of synthetic fertilizers and taking steps toward more environmentally friendly production measures. All these factors are supportive of higher urea prices, which will benefit players (MOO) such as CF Industries (CF), CVR Partners (UAN), and Agrium (AGU).

In the next part, we’ll take a look at the weekly movements in natural gas prices.