Agrium Inc

Latest Agrium Inc News and Updates

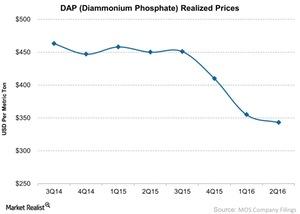

How Mosaic’s Phosphate Prices Fared in 2Q16

Phosphate fertilizer prices are key to Mosaic’s (MOS) Phosphate segment’s sales, earnings, and stock price.

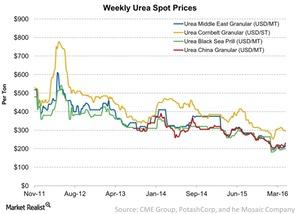

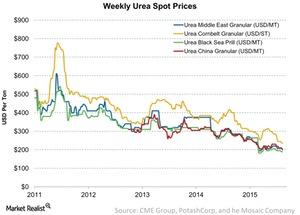

Tracking Urea Price Movement during the Week Ending April 22

In 2013, about 54% of global ammonia was upgraded to urea, according to FERTECON. But urea prices have rebounded from their lows at the beginning of 2016.

Urea Prices: The Continuing Decline Last Week

Granular urea prices in the Middle East declined 5% to $200 per metric ton in the week ended July 1. It was $210 per metric ton in the previous week.

Analysts’ Ratings and the Next-12-Month Price Target for Mosaic

Of the 22 analysts surveyed, about 32% of them gave Mosaic (MOS) a “buy” rating. About 41% of analysts issued a “hold” rating, and only 27% issued a “sell” rating.

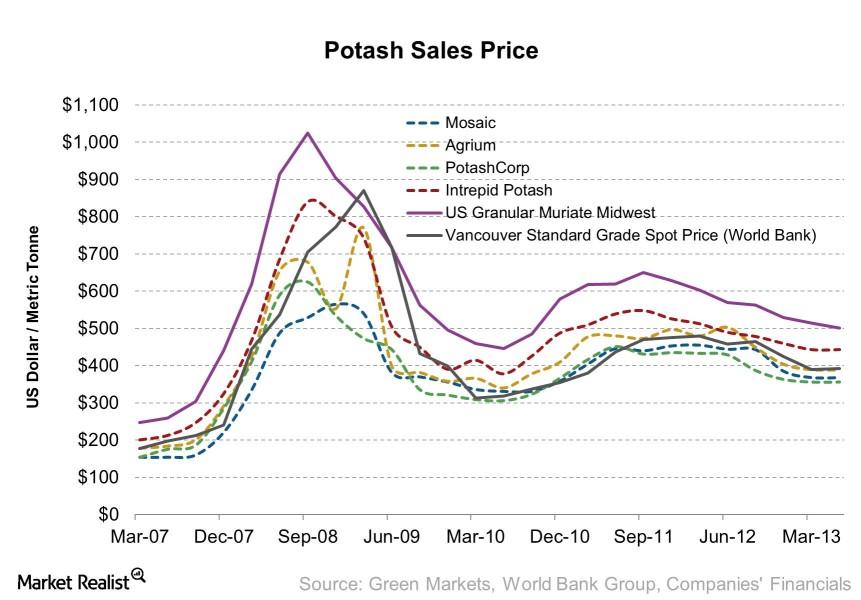

Why India’s potash price discount won’t affect share prices

The significance of potash price Wholesale potash price is one of two factors (the other being sales volume) that influence potash producers’ revenues. When prices rise, so does revenue, which will translate to higher profitability (margins), earnings, and share prices. However, when prices fall, they will have a negative impact on fundamentals and share prices. […]Materials Key trends Intrepid Potash investors should watch for in 2014

After a year of declining sales and increasing costs, management seems much more optimistic regarding potash as well as Langbeinite.

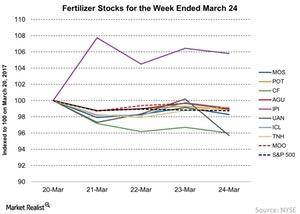

Fertilizer Stocks and Commodity Prices: Week Ending March 24

The week ending March 24, 2017, was broadly negative for agricultural fertilizer stocks. The VanEck Vectors Agribusiness ETF (MOO) fell 0.98%.

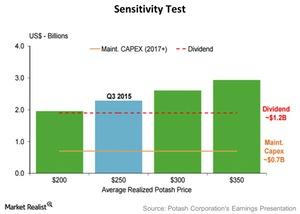

How Sensitive Is PotashCorp’s Dividend to Potash Prices?

In the last 12 months, PotashCorp (POT) has earned about 36% of its total sales from its Potash segment.

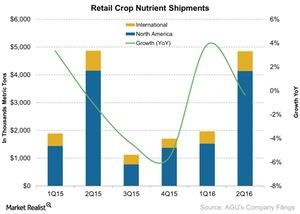

How Did Agrium’s Retail Shipments Perform in 2Q16?

Agrium’s (AGU) Retail segment’s shipments declined by 0.03% to 4.84 million tons in 2Q16, down from 4.86 million tons in 2Q15.

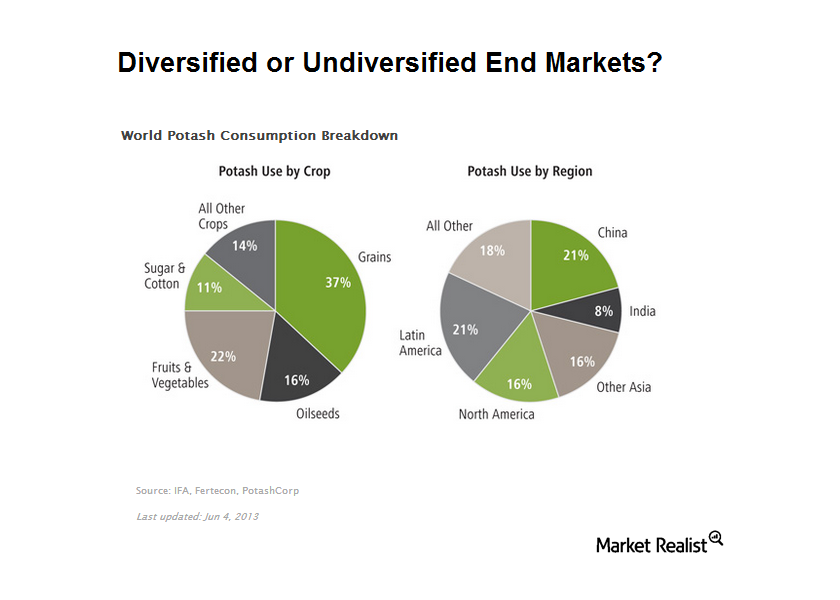

Why is the end use of potash internationally diversified?

As crops widely trade in the international market, they often converge with each other if transportation costs aren’t so high.

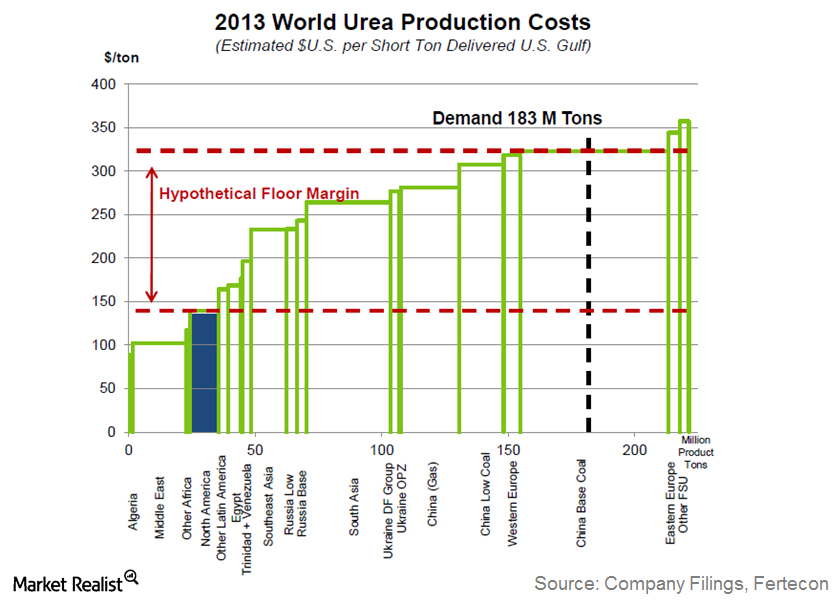

Why industry capacity changes also affect urea prices and profits

Generally, a capacity increase tends to lag demand growth, as producers like to see a stronger market before making significant investments.

DAP Prices See a Mixed Week for the Week Ending August 19

Average DAP prices in China were flat at 2,669 Chinese yuan per metric ton last week. DAP prices in Morocco remained unchanged at $340 per metric ton.

Why did JANA Partners boost its position in General Motors?

JANA Partners enhanced its position in from 0.17% to 4.23% last quarter General Motors.

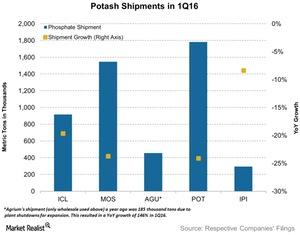

How Potash Shipments Performed in 1Q16

Mosaic (MOS) and PotashCorp (POT) were hit the hardest, with their respective shipments declining by 24% each to 1.5 million tons and 1.7 million tons year-over-year.

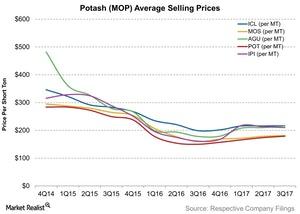

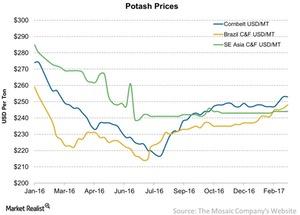

What 2017 Meant for Potash Producers

Potash fertilizers Most of the fertilizer companies we’ve discussed in this series sell all or some of the three NPK (nitrogen, phosphorous, and potassium) macronutrients. To learn more about these macronutrients’ key role in agriculture, read Agricultural Fertilizer Industry: Your Comprehensive Overview. In this part, we’ll look at what 2017 meant for potash producers. Price trends […]

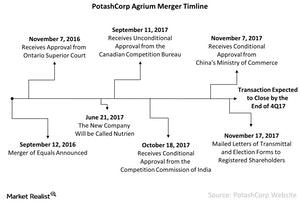

An Update on the PotashCorp-Agrium Merger

On September 12, 2016, PotashCorp and Agrium announced their intention to combine in a merger of equals. But China and India have set conditions.

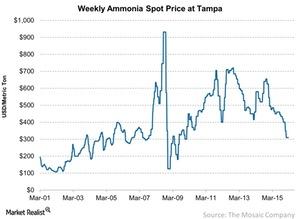

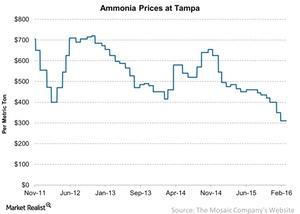

Why Ammonia Prices Will Benefit Phosphate Producers

The average price of ammonia for the week ending March 11 stood at $310 per metric ton, remaining unchanged from the previous week.

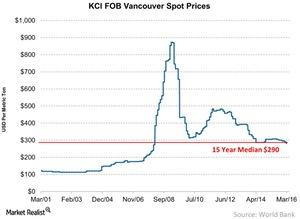

How Do Recent Potash Prices Compare with Their 15-Year Average?

The average weekly price of MOP (muriate of potash) in Vancouver remained unchanged for the week ended May 20, 2016.

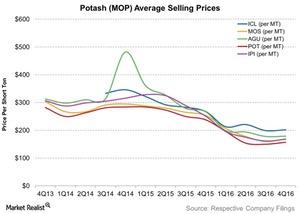

Potash on the Barrel: Prices for Five Major Producers

On average, potash prices for these five producers fell ~33% YoY in 4Q16. Excess supply and weak demand added downward pressure.

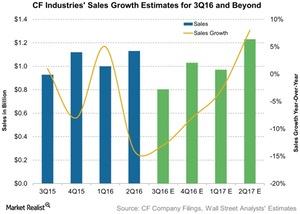

CF’s 3Q16 Sales Estimate Shows a Common Trend in the Industry

CF Industries’ (CF) sales segment includes UAN (urea ammonia nitrate), AN (ammonia nitrate), ammonia, and granular urea.

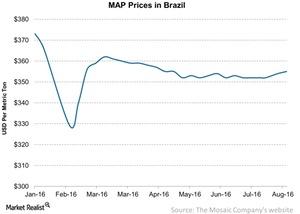

Analyzing the MAP Prices in Brazil Last Week

The MAP (monoammonium phosphate) prices in Brazil saw positive momentum last week. Brazil is still a favorable market for fertilizer producers.

No Hope for MAP Prices in Brazil: Week Ending August 18

Last week, MAP (monoammonium phosphate) prices continued to fall and brought more pain for phosphate producers (NANR).

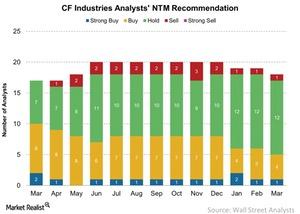

Analysts’ Recommendations and Price Target for CF Industries

On March 13, 2017, five of the 18 analysts covering CF Industries (CF) recommended a “strong buy” to a “buy” for the next 12 months, down from six analysts in February.

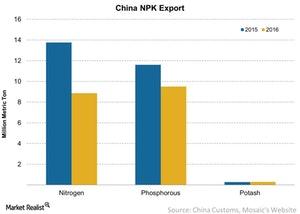

How China’s Fertilizer Export Sector Is Changing

China is the largest consumer of nitrogen fertilizers, but it produces most of it within its borders. Urea is Chinese farmers’ top choice.

How Did Potash Prices Change throughout the World Last Week?

The average weekly price of MOP (muriate of potash) at Vancouver has been flat since the beginning of March.

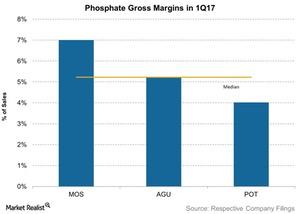

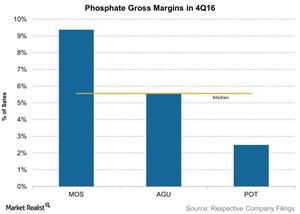

Key Players’ Phosphate Segment Margins in 1Q17

Mosaic (MOS) continued to enjoy higher margins at 7%—compared to Agrium’s (AGU) margins at 5%. Mosaic’s margins were flat year-over-year.

Why Phosphate Matters: Margins Among the Biggest Producers

The median gross margin for these companies’ phosphate segments was 14%, as a percentage of segment sales in 4Q15.

How Subdued Potash Prices Have Extended to Potash Players

The weekly average price for potash in Vancouver remained flat in the week ended June 24, 2016. Prices are below their 15-year average of $290 per metric ton.

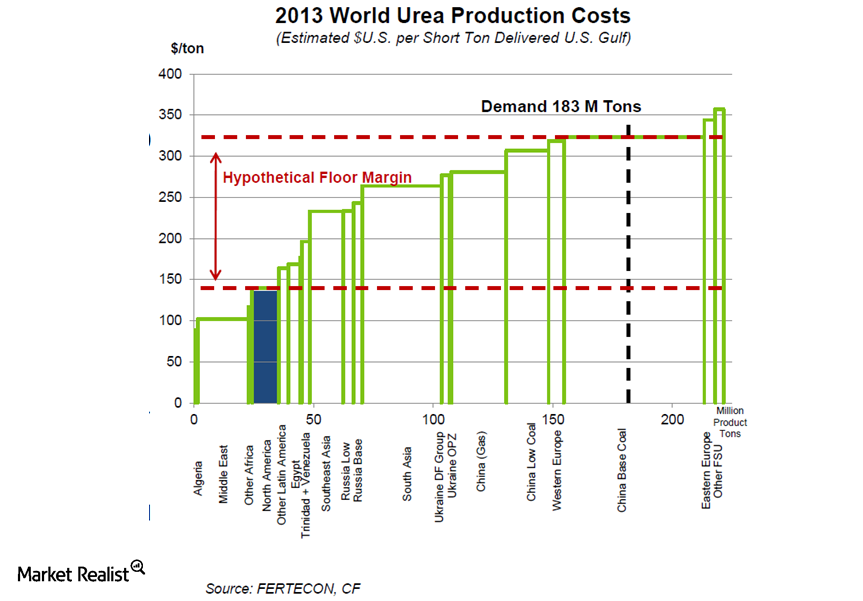

2 key things that set the floor and ceiling for urea prices

Without an understanding of factors that affect crop prices, it would be difficult to formulate a view on future crop prices and demand for nitrogenous fertilizers.

A MAP Price Update for the Week Ended October 27

MAP (monoammonium phosphate) prices hit a low of $343 per metric ton in August but have been on an upward momentum since then.

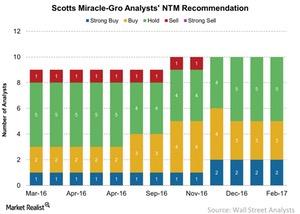

Scotts Miracle-Gro: Analyst Recommendations and Target Prices

Analyst recommendations for Scotts Miracle-Gro (SMG) have trended with earnings estimates, with more analysts recommending a “buy” for the stock.

A Price Update on MAP Fertilizers in Brazil

Last week, the MAP prices in Brazil rose as much as 5.6% week-over-week to $394 per metric ton from $373 per metric ton a week ago.

Who Are the Biggest Players in the Fertilizer Industry?

There’s a handful of big players in the agricultural fertilizer industry. Setting up business requires huge capital, which makes for a high barrier to entry.

Will Potash Prices Continue to Fall in 2016?

Potash prices over the past few years have been considerably lower than what we saw during their peaks of ~$482 in 2011 and ~$870 in 2009.

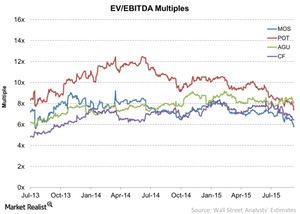

How Valuation Multiples Have Changed for Fertilizer Companies

Mosaic (MOS), which has historically traded at a high valuation multiple of 9.2x, is currently trading at an enterprise value to next 12-month EBITDA ratio of 5.7x.

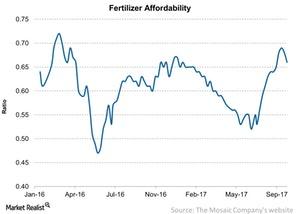

Fertilizer Affordability Index Update for October 6

The Fertilizer Affordability Index kept trending lower last week, continuing its two-week streak.

What 2017 Could Hold for Potash Producers

Potash stocks struggled for most of 2016. In 1H16, potash demand was negatively affected due to delays in potash contract settlements in China and India.

Why Ammonia Prices Are Falling

The average price of ammonia for the week ending March 4, 2016, stood at $310 per metric ton compared to $311 per metric ton a week ago.

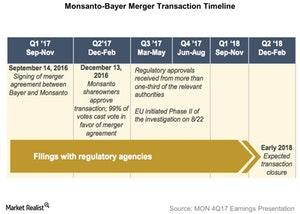

An Update on the Monsanto-Bayer Proposed Merger

Bayer recently filed for an extension with European Union regulators, which pushed back the merger with Monsanto to early 2018.

Are MAP Prices Beginning to Lift?

MAP (monoammonium phosphate) is the second most used phosphate fertilizer after DAP (diammonium phosphate).

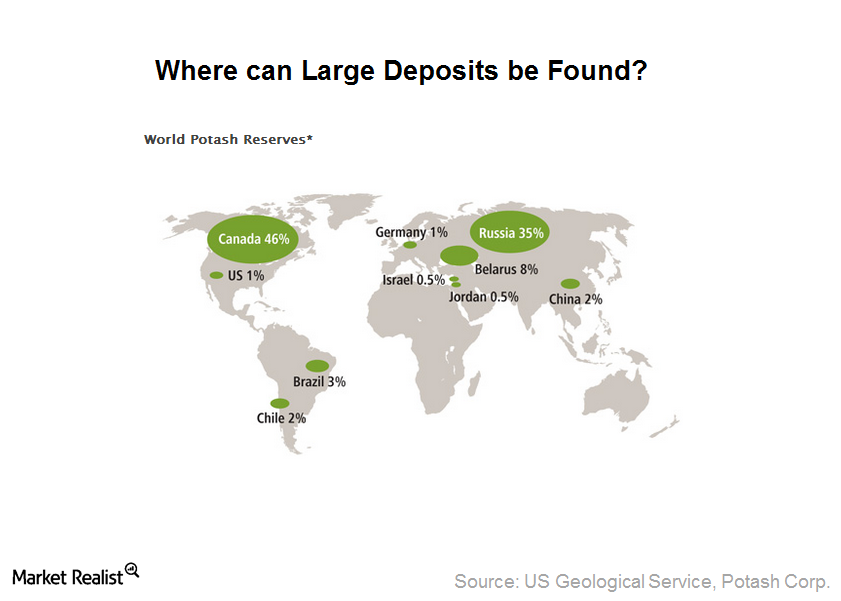

Why are economical potash deposits concentrated in 3 locations?

Canada, Russia, and Belarus together account for more than 89% of the world’s estimated reserves and a little over 66% of global capacity.

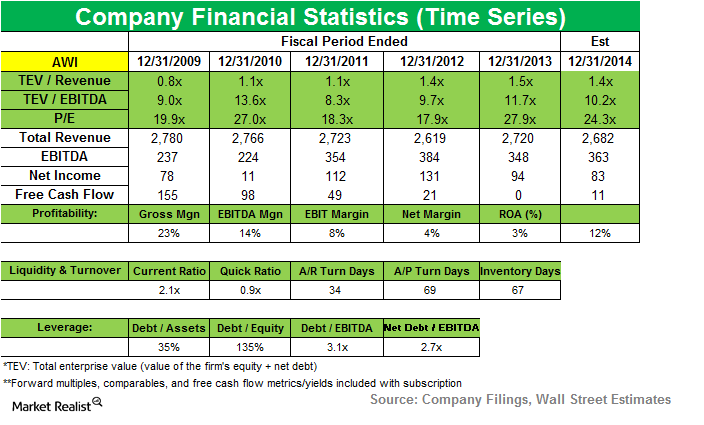

ValueAct gets seat on Armstrong World Industries’ board

While Armstrong’s 3Q14 results beat estimates, its consolidated net sales fell slightly compared to 3Q13, due to lower volumes in Europe and lower sales of resilient and wood flooring in the Americas.

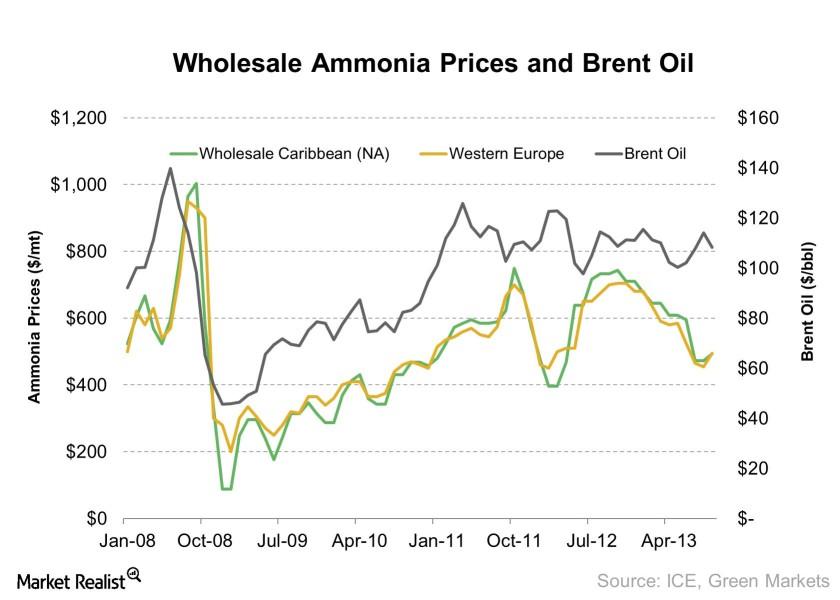

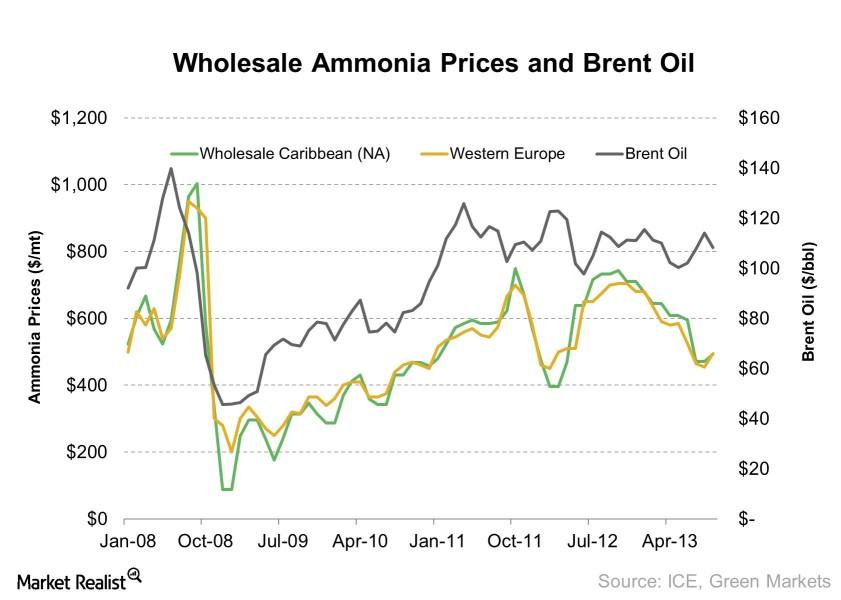

Essential fertilizer trends: The importance of Brent oil prices

Why oil affects fertilizer price In a competitive industry like nitrogenous fertilizer, the marginal producer’s cost sets the floor for the industry. These producers are the most expensive manufacturers to supply the product at that point in time. When the marginal producer’s cost rises, so does the industry’s. On the the other hand, falling costs […]

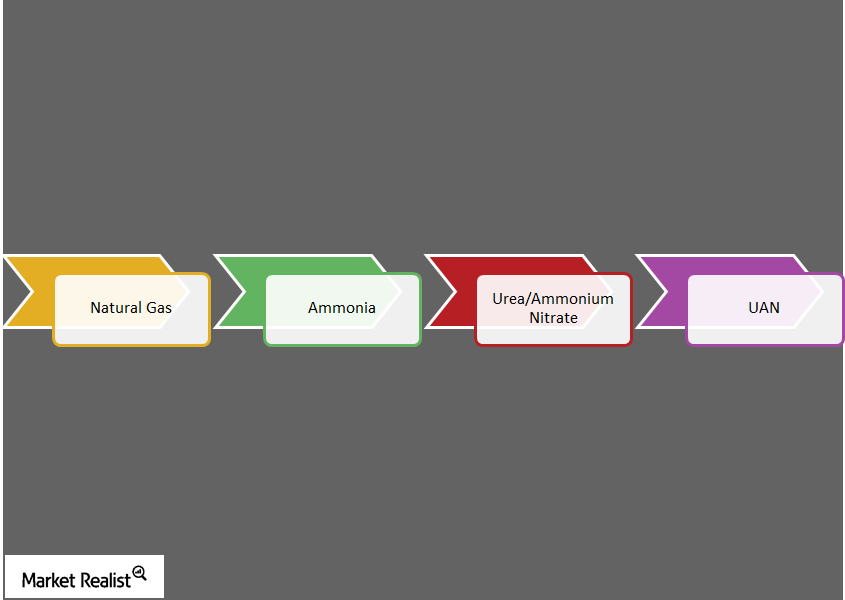

Key inputs and processes of nitrogenous fertilizer production

The importance of costs Understanding how fertilizers are produced is an important part of investing. What companies buy and what they pay for will be their costs. When costs are rising, they can have a negative impact on earnings and cash flow if the industry can’t pass them on to buyers. Conversely, when costs are falling, […]

The relationship between ammonia and Brent oil hasn’t returned

In a competitive industry like the nitrogenous fertilizer industry, the marginal producer’s cost sets the industry floor.

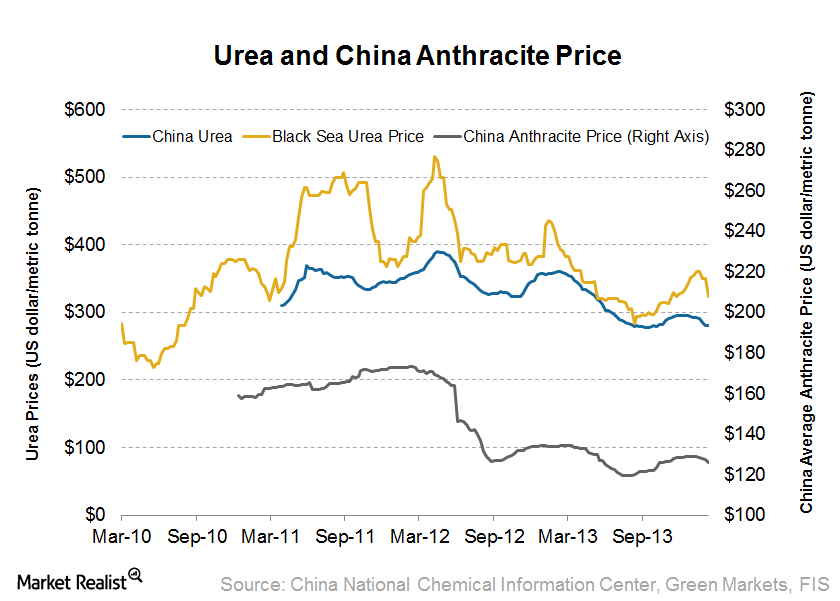

Why Chinese producers are driving nitrogenous fertilizer prices down (Part 1)

How China affects the global fertilizer market China, the world’s largest producer of nitrogen (a chemical used to make nitrogenous fertilizers for growing plants) occupies roughly 40% of global production capacity. Although much of its output is sold to domestic farmers—as an export tax of as much as 75% during the on-season restricts domestic firms […]

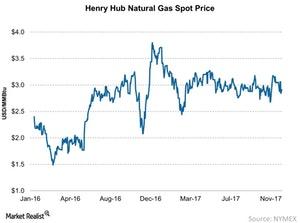

Natural Gas Prices for Fertilizer: Week Ended December 8

According to the EIA (U.S Energy Information Administration), natural gas prices were broadly mixed from November 29 to December 6, 2017.

Why coal prices affect global urea fertilizer producers like CF

This series covers key trends that are currently affecting coal and natural gas prices and, consequently, nitrogen fertilizer producers as well.

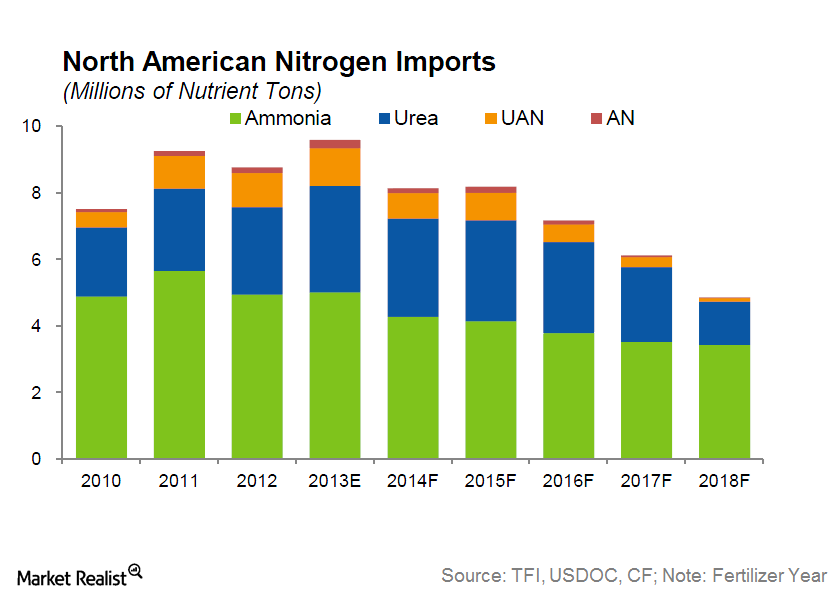

Must-know: Why US fertilizer companies offer a key advantage

The United States is one of the largest producers of agricultural products in the world, but it’s not a key producer of nitrogen fertilizers.

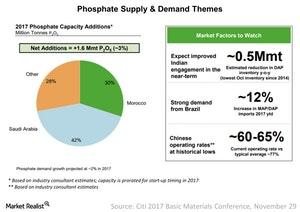

Phosphate Prices in 2018

Phosphate prices Earlier in this series, we discussed phosphate prices in 2017 and what has driven prices down recently. We saw that excess capacity pushed down phosphate fertilizer (NANR) prices during the year. In this part, we’ll look at supply and demand trends for phosphate fertilizers in 2018. Supply and demand In 2017, overall global […]