Agrium Inc

Latest Agrium Inc News and Updates

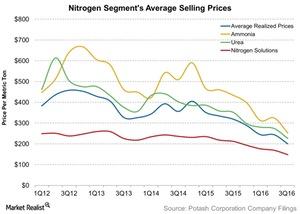

Why Did PotashCorp’s Nitrogen Prices Fall in 3Q16?

Nitrogen selling prices PotashCorp (POT) sells nitrogen fertilizers such as ammonia, urea, and nitrogen solutions. It competes with other natural gas–based nitrogen producers such as CF Industries (CF) and Terra Nitrogen (TNH), which primarily produce and sell nitrogen fertilizers. Agrium (AGU), which is a part of the PowerShares International Dividend Achievers ETF (PID), produces nitrogen fertilizers […]

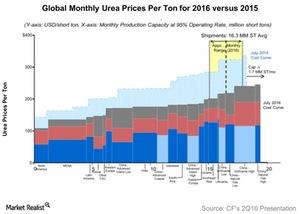

Cost Curves 101: What Nitrogen Investors Must Consider

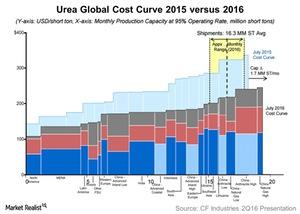

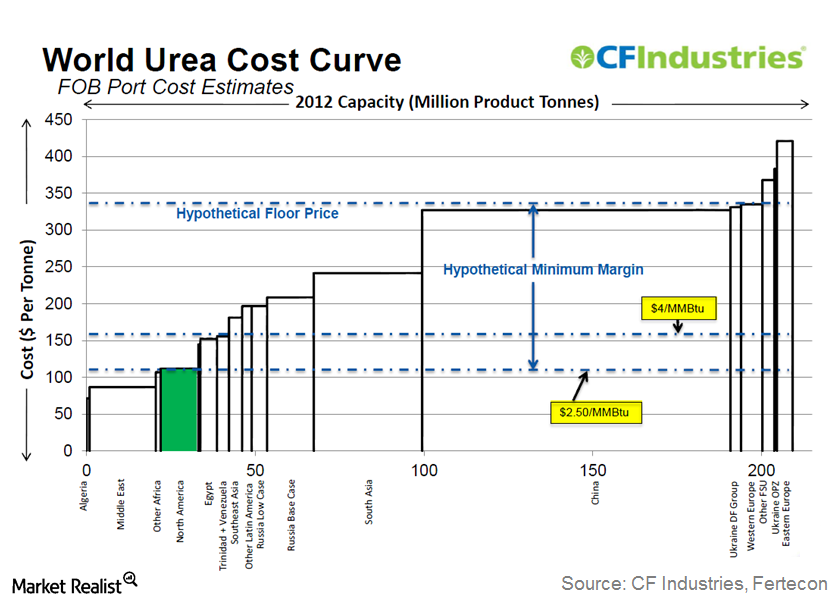

Demystifying the cost curve Earlier in this series, we saw that prices of nitrogen have fallen over the years, despite its significance in crop growth and feeding the vast population. The lower prices are due to a flatter cost curve, which we’ll explain in this part. Flat cost curve In the chart above, we compare a […]

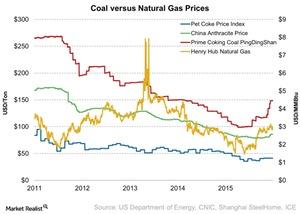

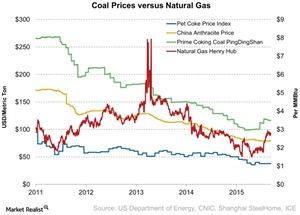

Coal Prices Remained Flat for the Week Ending October 7

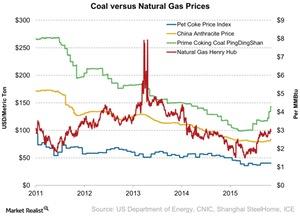

Chinese producers primarily use coal to produce nitrogen, especially urea-based fertilizers, while producers in North America mostly rely on natural gas.

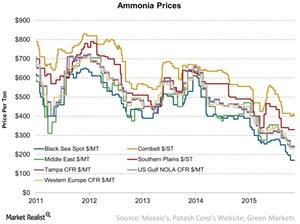

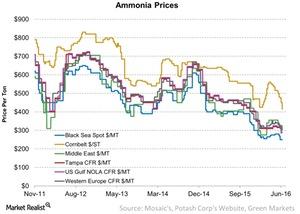

A Look at Ammonia Prices Last Week

The current levels of ammonia prices at several locations are below their comparative levels last year.

Urea Input: Anthracite Coal Prices Rose Last Week in China

Producers in China mainly use coal as an input material to produce nitrogen fertilizers, especially urea. China is impacted by price movements in coal.

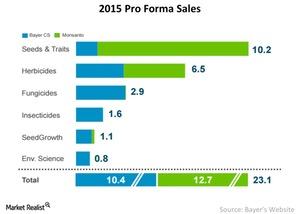

Synergies Monsanto and Bayer Could Exploit through a Merger

Monsanto’s business is the best fit for Bayer’s Crop Science segment—it contributes ~22% of Bayer’s revenue. The segment is similar to Monsanto’s business.

Why Nitrogen Prices Have Fallen So Hard this Year

The global nitrogen fertilizer capacity is abundant, allowing it to fulfill the current market requirements. This has put pressure on nitrogen prices, which fell significantly over the past year.

Why Have Mosaic’s Potash Shipments Declined?

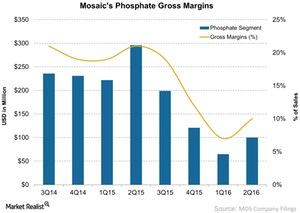

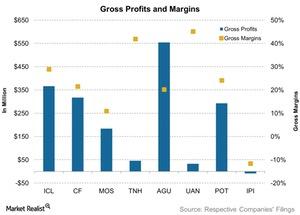

The gross margin rate for Mosaic’s Phosphate segment fell significantly in 2Q16, to 10% from 21% in 2Q15.

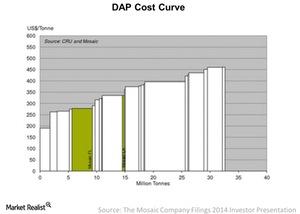

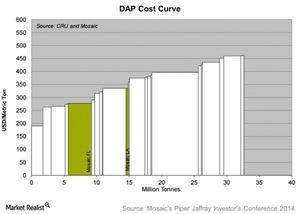

How DAP- and MAP-Producing Countries Stack Up on the Cost Curve

In 2014, the cost of production for DAP per ton ranged from $190 to $450 per metric ton, as we can see in the chart.

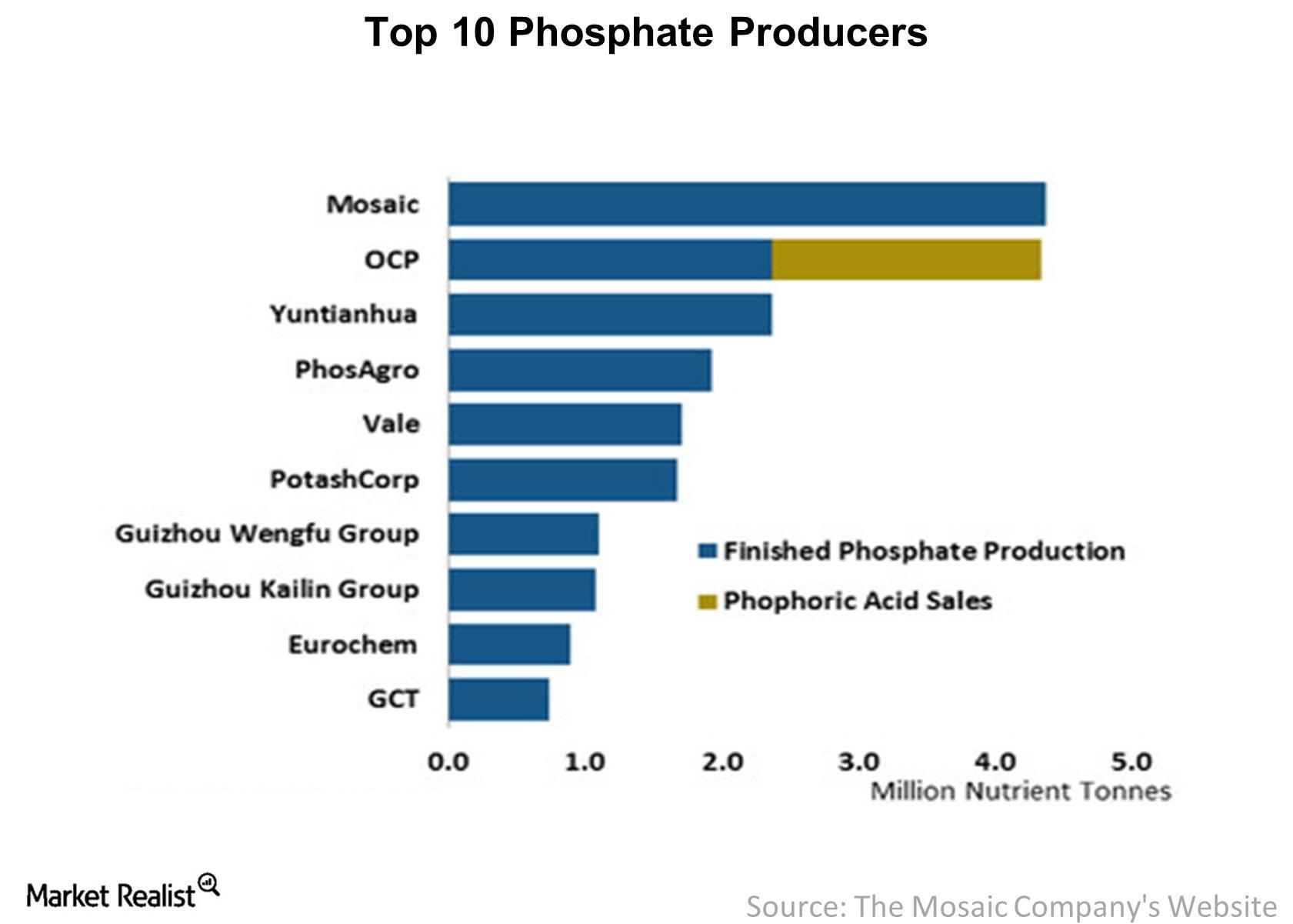

Phosphate Consumption Outlook and Top Producers to Serve the Market

The Mosaic Company (MOS), which acquired CF Industries’s (CF) phosphate business in 2014, is the largest producer of phosphate globally.

How Are Pet Coke, Coal, and Natural Gas Prices Trending?

The petroleum (or pet) coke index remained unchanged from the previous week during the week ending July 22, 2016.

Why Do Ammonia Prices Keep Falling?

Ammonia prices in the Southern Plains had the steepest fall of 10.5% last week, continuing the previous week’s trend.

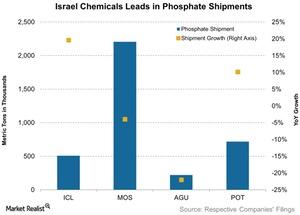

How Phosphate Shipments Performed in 1Q16

Israel Chemicals, which shipped 0.5 million metric tons during the recent quarter, saw the largest jump in shipment growth—20% year-over-year.

How Fertilizer Companies’ Gross Margins Were Pressured in 1Q16

The fertilizer industry moves in cycles and with most companies experiencing a decline in margins, the industry seems to be in the bottom cycle.

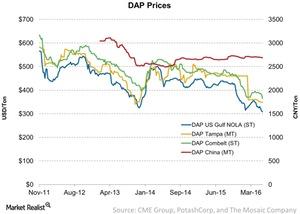

Last Week’s DAP Fertilizer Price Trends: Must-Knows

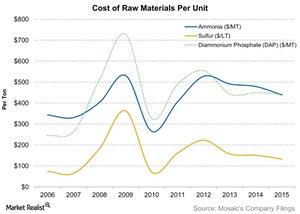

Ammonia is used to make phosphate fertilizers like DAP (diammonium phosphate) and MAP (monoammonium phosphate).

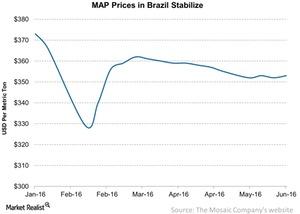

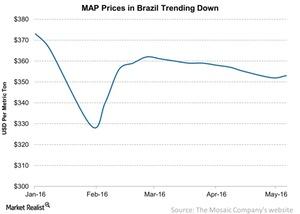

Why MAP Fertilizer Prices Continue to Stabilize

Last, average MAP prices in Brazil inched up to $353 per metric ton from $352 per metric ton the previous week.

Urea Prices: Still a Concern for Nitrogen Fertilizer Stocks

As most global ammonia production is upgrading to urea, ammonia prices may affect urea prices.

Ammonium Phosphate Prices: A Comparison

MAP (monoammonium phosphate) is the second-most used phosphate fertilizer after DAP (diammonium phosphate).

What’s Monsanto’s Outlook for the Next 12 Months?

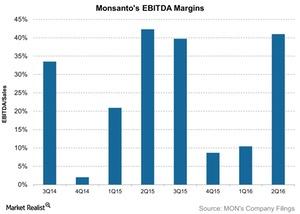

For fiscal 2Q16, Monsanto reported EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.8 billion.

Where Does Mosaic Stand on the Cost Curve for Its Fertilizers?

Fertilizer prices and input costs affect all players in the industry. Survival and profitability come down to where a company stands on the cost curve.

How Has Mosaic Done in Terms of Raw Material Costs?

Mosaic purchases certain raw materials at fixed costs to be consumed over time, but the selling prices of its finished goods can fluctuate rapidly.

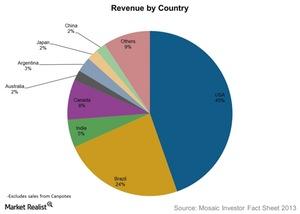

Who Are Mosaic’s Customers and How Does It Reach Them?

Mosaic doesn’t sell directly to farmers. Its customers include cooperatives, wholesale distributors, retail chains, and independent retailers.

How Phosphate Fertilizer Prices Are Changing Trends

In the 2010–2011 planting season, phosphate fertilizers accounted for about 23% of total NPK fertilizers consumed globally.

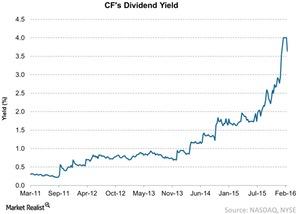

Checking in with CF Industries’ Dividend Yield

As of February 19, CF Industries pays a quarterly dividend of $0.3 per share. In 2015, it paid an annual dividend per share of $3.6—down from $5 in 2014.

The Prevalent Price of Potash in 2016

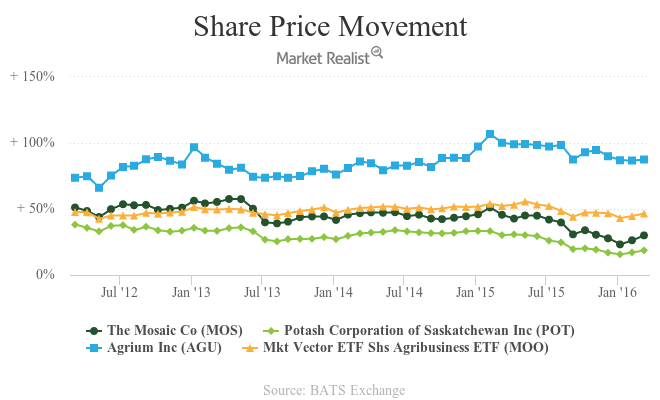

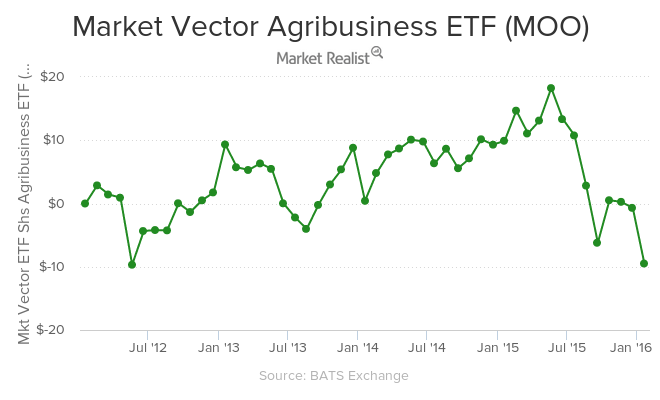

As of January 19, 2016, the VanEck Vectors Agribusiness ETF (MOO) returned -12.7% in 2015. YTD as of January 19, the ETF is down by 8%.

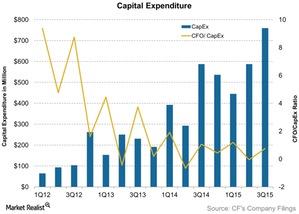

What is CF Industries’ Capital Expenditures Ratio Telling Us?

CF Industries’ cash flow to capital expenditure ratio has been falling. CF Industries’ cash flow to capital expenditure ratio stands at 0.75 as of 3Q15.

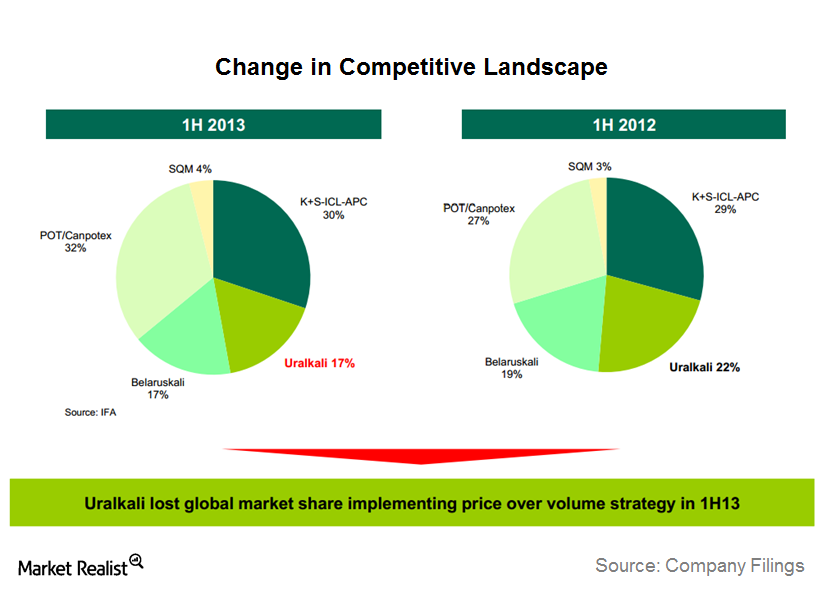

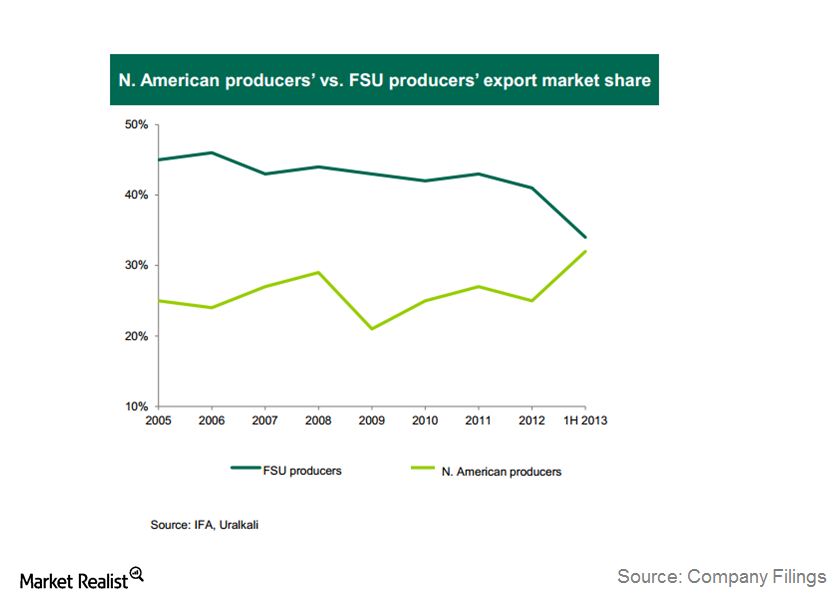

Why is Uralkali taking back—not gaining—fertilizer market share?

Uralkali’s move towards a volume-over-price strategy in order to gain market share (more like taking back market share) was the more important story.

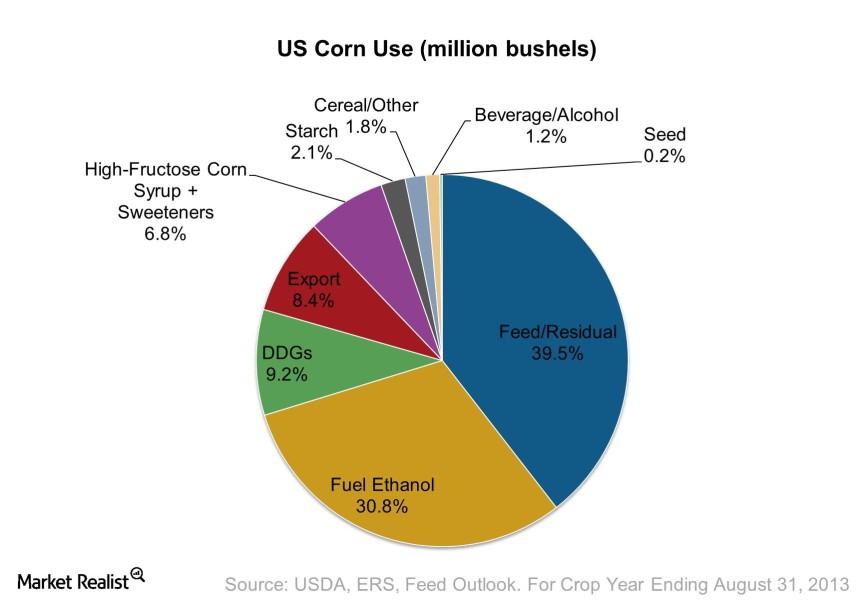

Why the average American uses more than 4 ears of corn per day

The United States is the biggest user of corn, consuming 265 million mt (metric tonnes) of corn in 2012—equivalent to 26% of global consumption.

Overview: The key factors that drive ammonia and urea prices

In this series, we’ll cover how costs in the United States, China, and Europe influence nitrogenous fertilizer prices along with other factors.

Why the wayward Canpotex upset the Russian giant Uralkali

In its recent earnings call, Uralklali highlighted its new strategy, called the Revenue Maximization Strategy.

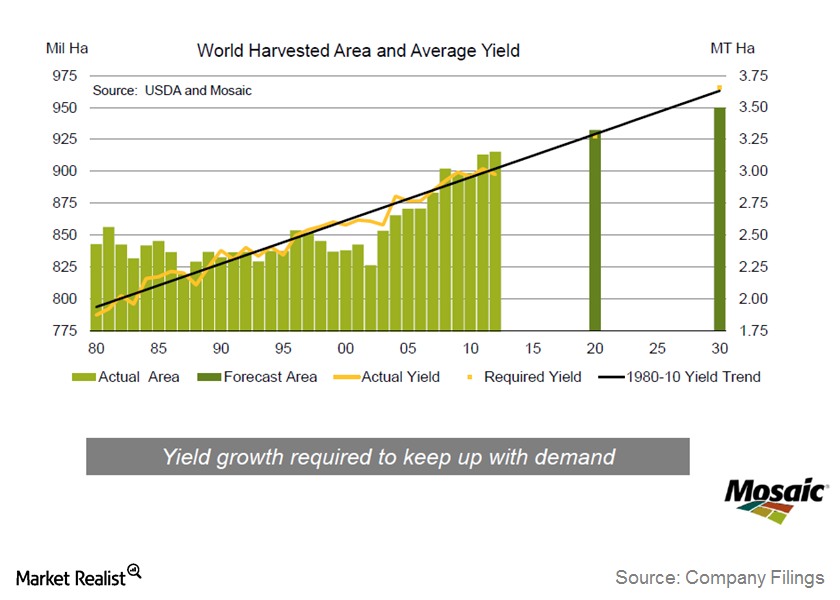

Why Mosaic shows that agriculture is always a cyclical business

In this series, we’ll explore Mosaic Co.’s latest discussions on its third quarter 2013 earnings results and the industry outlook.

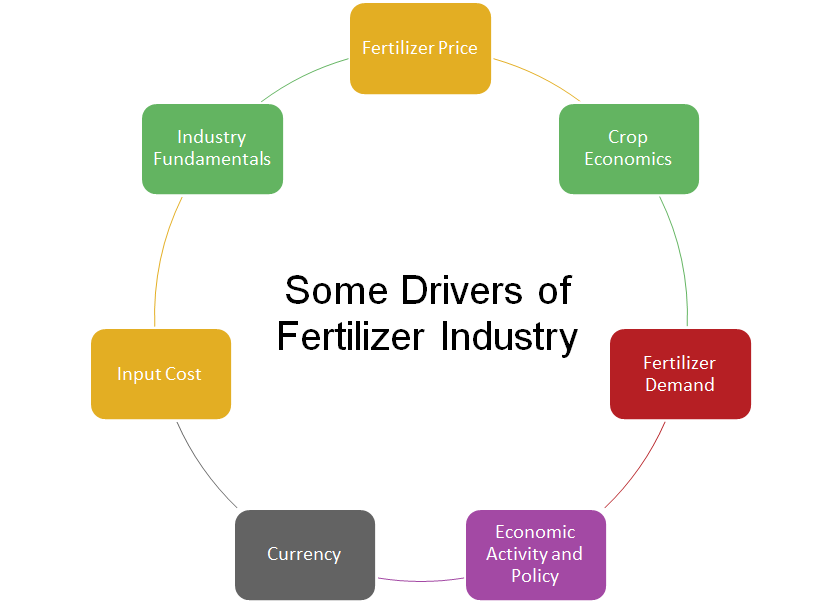

Analyzing the key factors that affect the fertilizer industry

The Essential Fertilizers Weekly series comprises key factors that have a potential impact on the bottom line—depending on revenue and expenses.

Must-know: The key drivers of fertilizer company performance

The importance of the bottom line The performance of any investment over the medium to long term depends on current or future changes in the bottom line, like earnings per share, free cash flow per share, EBITDA (earnings before interest, tax, depreciation, and amortization) per share, and dividend per share. When the bottom line is […]

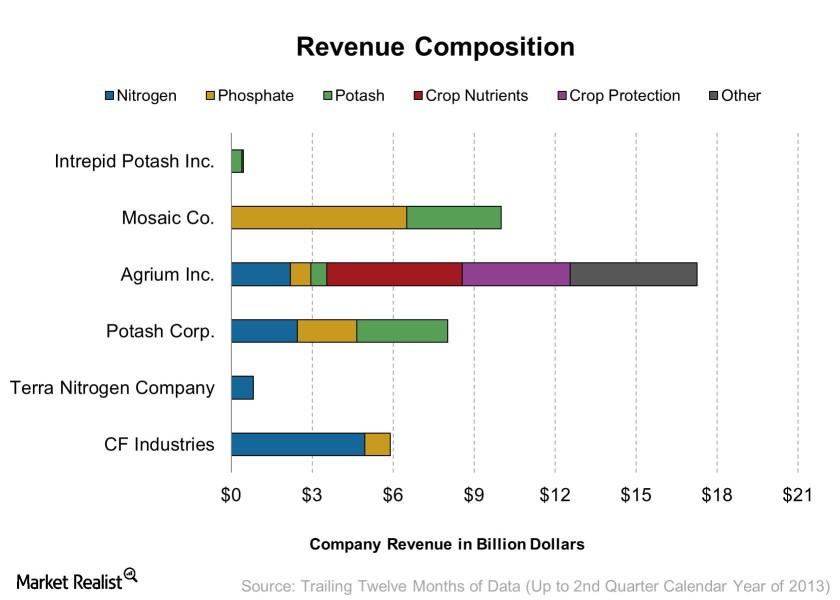

Revenue composition of major publicly traded fertilizer stocks

Main companies traded on the US market There are six main fertilizer producers that are widely traded on the US stock exchange: CF Industries Holdings Inc. (CF), Agrium Inc. (AGU), Mosaic Co. (MOS), Potash Corp. (POT), Terra Nitrogen Company LP (TNH) and Intrepid Potash Inc. (IPI). While they all operate producer fertilizers, each are exposed […]

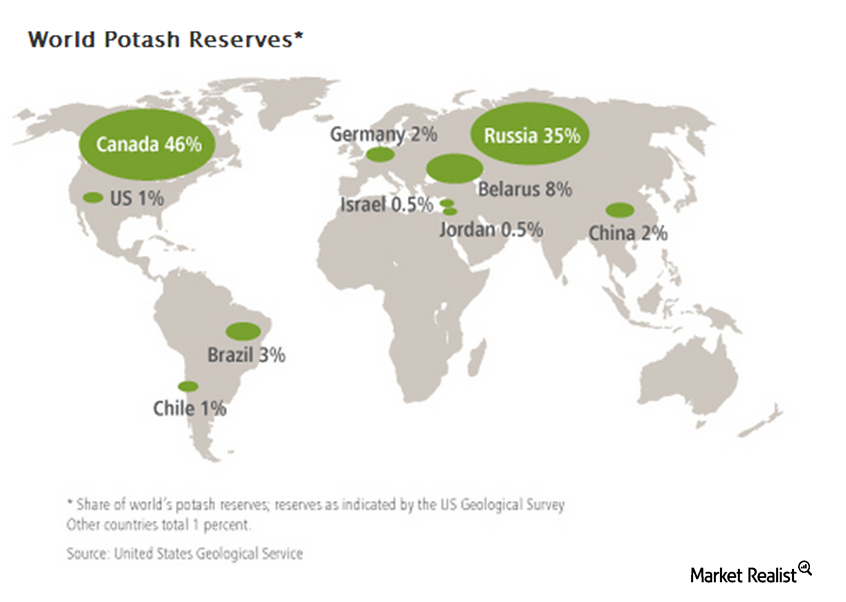

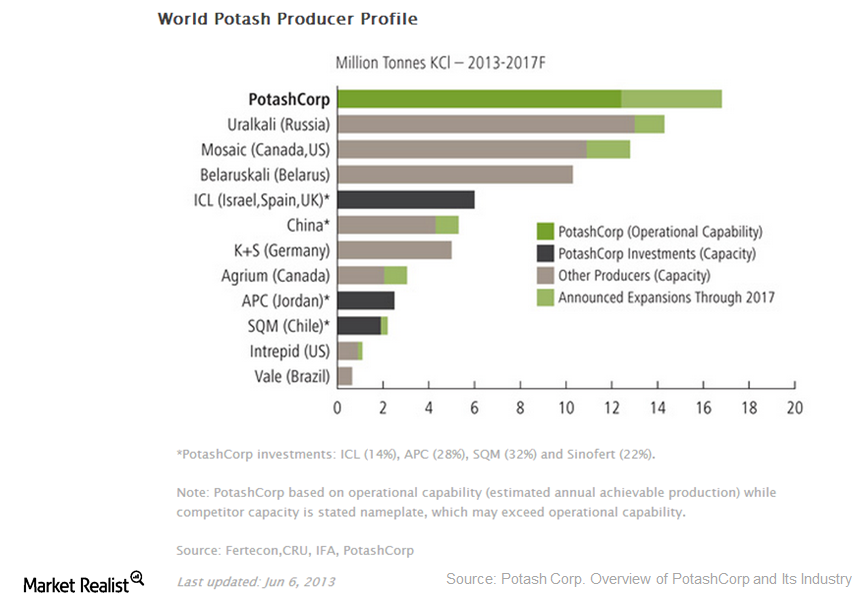

Must-know: Why cost and location affect potash production

Where potash is found Of all the fertilizer sub-industries, potash is the most concentrated. Mineral deposits of potash are more geographically concentrated than phosphate rock. Most of these resources are found in Canada, Russia, and Eastern Europe. Because of this, a large chunk of the world potash supply is controlled by companies like Potash Corp. […]

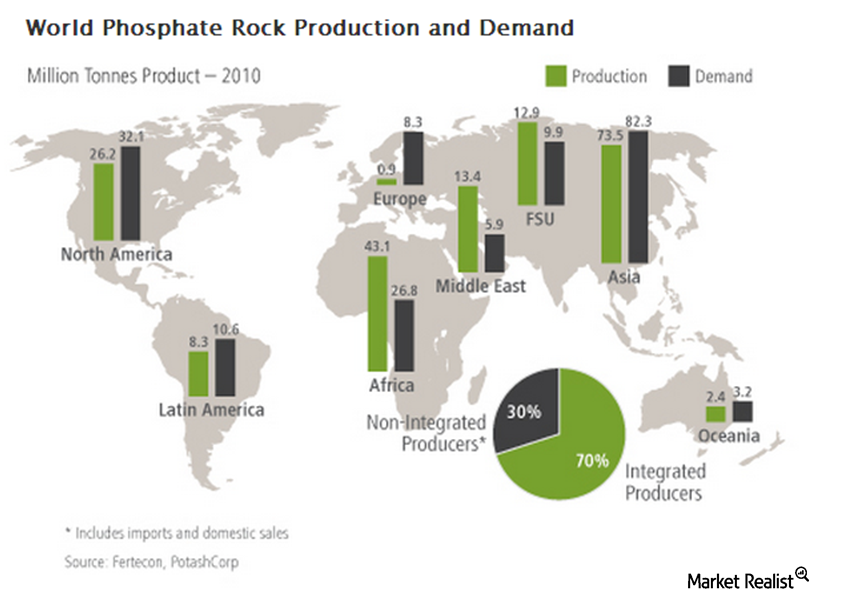

Why phosphate is a less competitive fertilizer sub-industry

The phosphate industry is less competitive than the nitrogen industry Unlike nitrogen-based fertilizers, the production of phosphate and potash fertilizers begins in mines. Mineral deposits for the latter two fertilizers are much scarcer and are usually concentrated in specific regions around the world. Because of this, there are fewer firms that make up the two […]

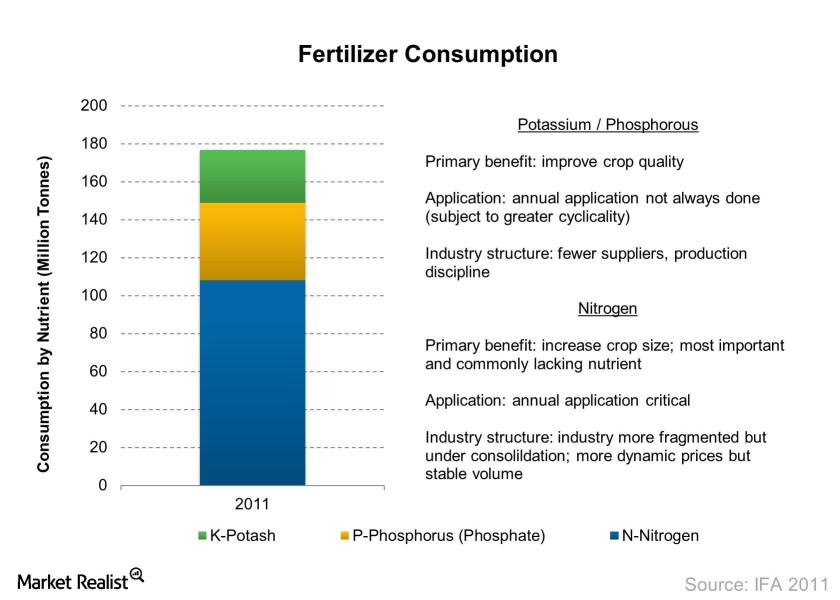

Fertilizer industry overview: Must-know fertilizer types

Fertilizers are used in the agriculture industry to improve the yield farmers receive. The three main types of nutrients or fertilizers are nitrogen, phosphate, and potash.

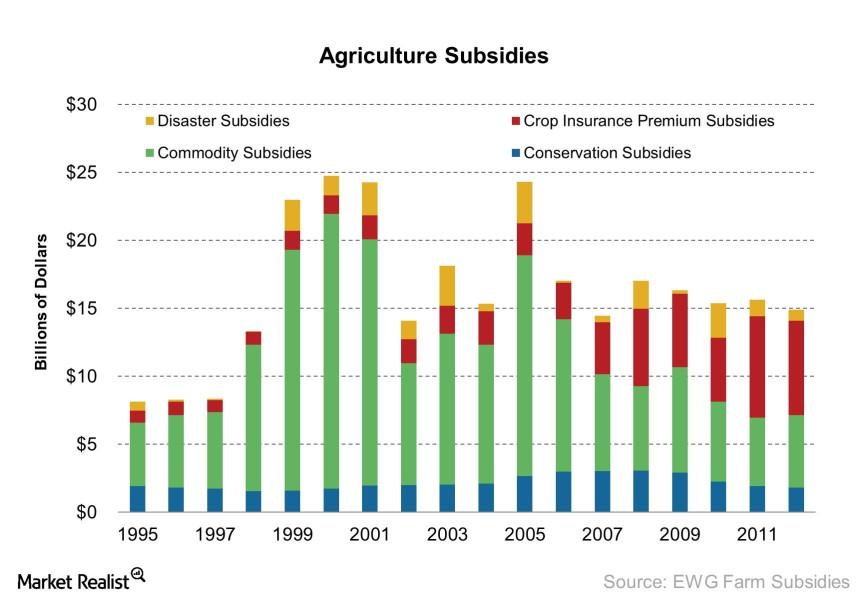

Must-know: Important types of farm subsidies in the United States

As a critical part of economic and social welfare, agriculture is a key industry governments around the world support.

Why are potash producers increasing capacity?

Introduction Most often, investors expect new capacity addition plans as a positive indicator of booming business. This is because companies often increase their capacity following a period of demand boom. But capacity increases can be negative, as we saw with several fiber optics companies back during the tech bubble, when earnings plummet on falling demand […]