Why Have Mosaic’s Potash Shipments Declined?

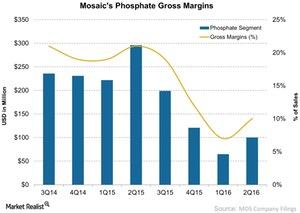

The gross margin rate for Mosaic’s Phosphate segment fell significantly in 2Q16, to 10% from 21% in 2Q15.

Aug. 9 2016, Updated 11:05 a.m. ET

Phosphate segment’s margins

The gross margins for agricultural fertilizer companies such as Mosaic (MOS), PotashCorp (POT), Agrium (AGU), and CF Industries (CF) indicate how cost-efficient they were over a period. Amid falling commodity prices, as we saw earlier, it’s critical that companies maintain cost efficiency to remain competitive in the market (NANR).

Gross margin rate

The gross margin rate for Mosaic’s Phosphate segment fell significantly in 2Q16, to 10% from 21% in 2Q15. In absolute numbers, the company reported a gross profit of $100 million in 2Q16, compared with $296 million in 1Q15. The weakness in margins was mostly due to the weakness in average realized prices, which failed to rebound as expected by the company’s management.

Outlook

The 2Q16 weakness is expected to continue in 3Q16, as management guided a gross margin rate of about 10% in its earnings call. This would be significantly lower than the 19% margin in 3Q15. During the earnings call, the management stated that “we expect the gross margin rate in Phosphates to stay around 10% in the third quarter, with additional benefit from lower sulfur and ammonia costs offsetting expected lower realized prices and higher phosphate rock costs.”

You can get exposure to Mosaic through the VanEck Vectors Agribusiness ETF (MOO), which invests 2.5% in the company. Let’s look at Mosaic’s Potash segment next.