SPDR S&P® North American Natural Res ETF

Latest SPDR S&P® North American Natural Res ETF News and Updates

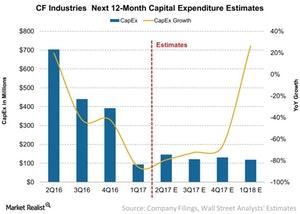

Capital Expenditure Expectations for CF Industries in 2Q17

CF Industries (CF) is expected to see a significant reduction in its capital expenditure (or capex) year-over-year (or YoY) in 2Q17 and for the next four quarters.

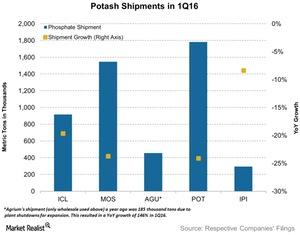

How Potash Shipments Performed in 1Q16

Mosaic (MOS) and PotashCorp (POT) were hit the hardest, with their respective shipments declining by 24% each to 1.5 million tons and 1.7 million tons year-over-year.

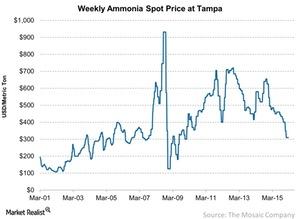

Why Ammonia Prices Will Benefit Phosphate Producers

The average price of ammonia for the week ending March 11 stood at $310 per metric ton, remaining unchanged from the previous week.

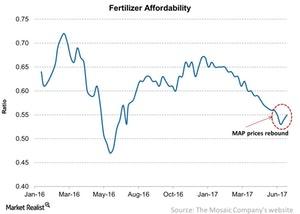

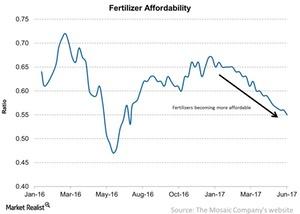

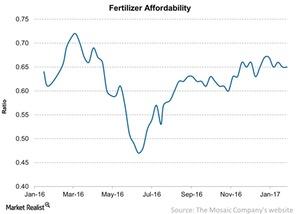

Fertilizers Were Affordable for the Week Ending June 23

According to the Fertilizer Affordability Index, 2017 has been one of the most affordable years for fertilizers. Mosaic issues the index.

CF Industries: A Good Fit for Top 10 Agricultural Chemicals List?

Over the past ten-year period, CF Industries has risen 186.0% and significantly outperformed the S&P 500 Index’s rise of 69.2% over the same period.

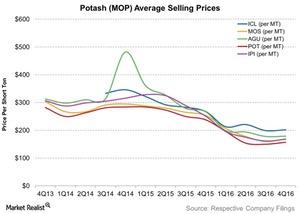

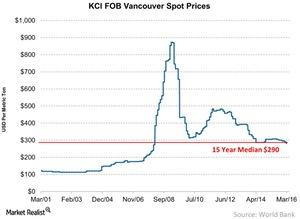

How Do Recent Potash Prices Compare with Their 15-Year Average?

The average weekly price of MOP (muriate of potash) in Vancouver remained unchanged for the week ended May 20, 2016.

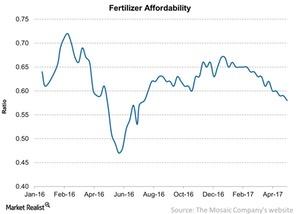

Fertilizers Were More Affordable in Week Ended November 25

For the week ending November 25, fertilizer affordability fell to 0.65x from 0.66x week-over-week.

Potash on the Barrel: Prices for Five Major Producers

On average, potash prices for these five producers fell ~33% YoY in 4Q16. Excess supply and weak demand added downward pressure.

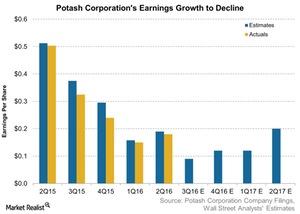

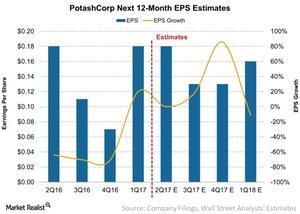

History’s Not on POT’s Side when It Comes to Earnings Growth

When we look at the past five quarters, we see that PotashCorp has missed all its earnings estimates.

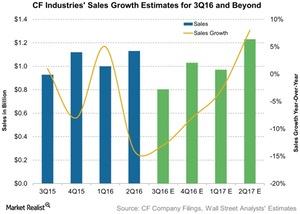

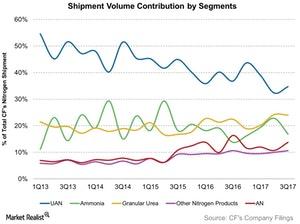

CF’s 3Q16 Sales Estimate Shows a Common Trend in the Industry

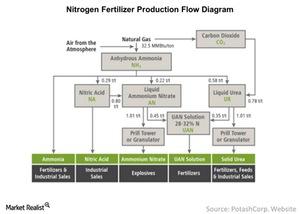

CF Industries’ (CF) sales segment includes UAN (urea ammonia nitrate), AN (ammonia nitrate), ammonia, and granular urea.

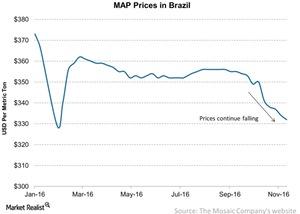

Analyzing the MAP Prices in Brazil Last Week

The MAP (monoammonium phosphate) prices in Brazil saw positive momentum last week. Brazil is still a favorable market for fertilizer producers.

Fertilizers Were Less Affordable Last Week

Last week, fertilizer affordability rose to 0.66x from 0.65x week-over-week. A ratio below one means that fertilizers are more affordable than during the base year.

Why the Fertilizer Affordability Index Was Lower Last Week

The Fertilizer Affordability Index has shown a downward trend since the beginning of the year. Fertilizers have become more affordable in 2017.

No Hope for MAP Prices in Brazil: Week Ending August 18

Last week, MAP (monoammonium phosphate) prices continued to fall and brought more pain for phosphate producers (NANR).

How Did Potash Prices Change throughout the World Last Week?

The average weekly price of MOP (muriate of potash) at Vancouver has been flat since the beginning of March.

Fertilizer Affordability Fell for the Week Ending April 28

For the week ending April 28, the Fertilizer Affordability Index fell slightly to 0.58x—compared to 0.59x the previous week.

How Subdued Potash Prices Have Extended to Potash Players

The weekly average price for potash in Vancouver remained flat in the week ended June 24, 2016. Prices are below their 15-year average of $290 per metric ton.

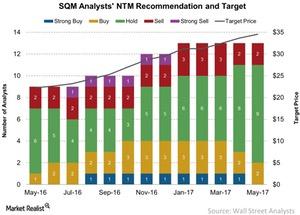

Analysts’ Recommendations and Price Target for SQM

Sociedad Química y Minera de Chile (SQM) has yet to announce its earnings, unlike most of the companies we’ve discussed so far in this series.

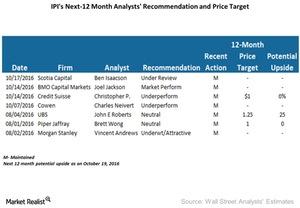

What Analysts Recommend for Intrepid Potash ahead of 3Q16 Earnings

Intrepid Potash (IPI) is nearing $1 per share, which means that only a few analysts are covering the stock.

The Love-Hate Relationship between Freeport and Indonesia

According to Freeport-McMoRan’s agreement with Indonesia’s government, it must divest an additional 20.6% stake in its Indonesian operations to the government or its citizens.

Fertilizer Affordability Didn’t Change Last Week

Last week, the Fertilizer Affordability Index remained unchanged at 0.65x week-over-week. Fertilizers are more affordable than during the base year.

Potash Prices Trend Upwards in the 1st Week of 2018

The potash fertilizer prices for both granular and standard grade were comfortably higher compared to the levels observed last year around the same week.

Assessing the Shift in CF Industries’ Product Mix

In the earlier part of this series, we discussed how shipments impacted CF Industries’ (CF) sales. From our analysis, it’s clear that a rise in selling prices remains the most important growth catalyst for the company.

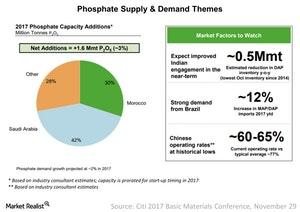

Phosphate Prices in 2018

Phosphate prices Earlier in this series, we discussed phosphate prices in 2017 and what has driven prices down recently. We saw that excess capacity pushed down phosphate fertilizer (NANR) prices during the year. In this part, we’ll look at supply and demand trends for phosphate fertilizers in 2018. Supply and demand In 2017, overall global […]

MAP Prices Remained Strong in Week Ended December 15

MAP (monoammonium phosphate) prices have shown strength in recent weeks, moving higher to peak at $ $403 per metric ton in Brazil.

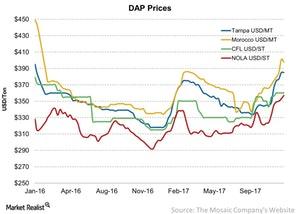

How DAP Prices Performed in Week Ended December 8

Last week, which ended December 8, 2017, was broadly mixed for movements in DAP (diammonium phosphate) prices. Some regions saw weekly gains, and others moved sideways to negative.

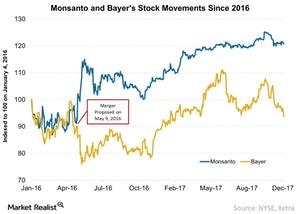

The Bayer-Monsanto Merger Deal: An Update

On September 14, 2016, Bayer signed an agreement with Monsanto (MON) to acquire it for $66 billion, or $128 per share. The offer represented a 44% premium over Monsanto’s stock price.

Your Potash Price Update for the Week Ending November 24

Last week, the granular MOP (muriate of potash) prices in NOLA (New Orleans) in the US (NANR) rose by as much as 45 basis points week-over-week to $203 per metric ton.

MAP Prices Were Firm for the Week Ending September 15

In recent months, MAP prices in Brazil have been on a downward trajectory. However, MAP prices appear to have found firmness in recent weeks.

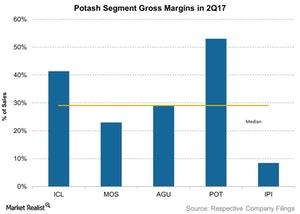

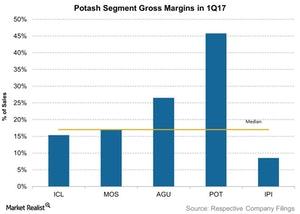

Inside the Potash Margins of 5 Major Fertilizer Companies

Given the growth in potash shipments and the increase in price realization, it’s natural that the margins of potash producers improved YoY in 2Q17.

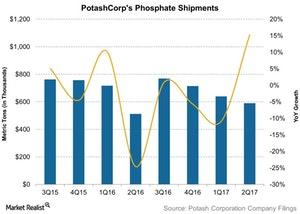

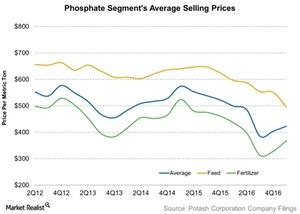

Shipments for PotashCorp’s Phosphate Segment See Strong Growth

PotashCorp’s (POT) phosphate segment contributed almost a fourth of overall sales for 2Q17. Sales were driven by shipments and price realizations.

Will PotashCorp Report Flat Earnings Growth in 2Q17?

PotashCorp (POT) had lackluster earnings growth last year. However, the company reported EPS (earnings per share) growth in 1Q17.

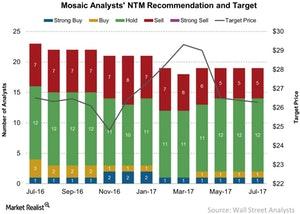

Wall Street Recommendations and Price Target for Mosaic

Mosaic (MOS) remains a painful investment for investors. The company has delivered losses of 18.7% year-to-date as of July 13.

Where Intrepid’s Potash Segment Margin Stands next to Peers

Intrepid Potash’s (IPI) gross margin for its Potash segment swung to positive territory in 1Q17, while its Trio margins were in the negative territory.

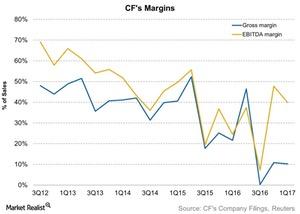

A Review of CF Industries’ Margin Trends

Over the past five years, CF Industries’ (CF) gross and EBITDA (earnings before interest, tax, depreciation, and amortization) margins have contracted.

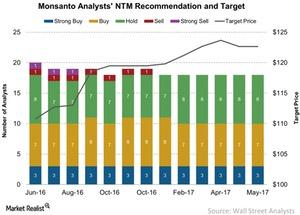

Monsanto’s Price Targets and Recommendations in June 2017

On June 9, Monsanto (MON) stock closed at $117.5 per share.

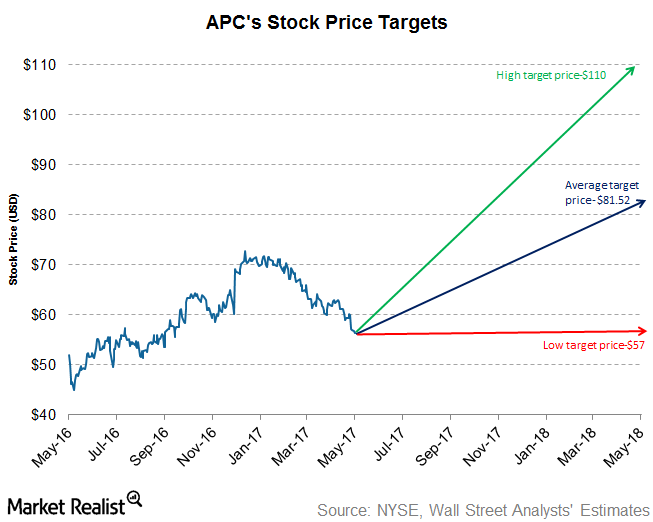

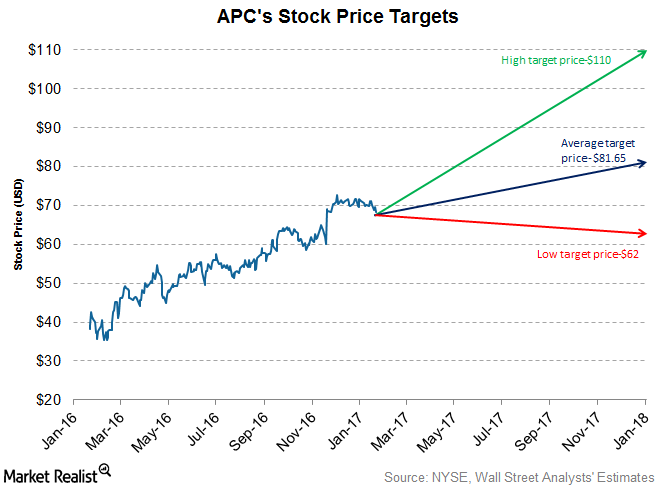

Analyst Recommendations for Anadarko Petroleum after 1Q17

Approximately 83.0% of analysts have rated Anadarko Petroleum (APC) a “buy.” The average broker target price is $81.52.

Understanding PotashCorp’s Phosphate Price Dive in 1Q17

PotashCorp’s average realized prices for phosphate fell ~15% to $423 per ton in 1Q17, as compared to $499 per ton in 1Q16.

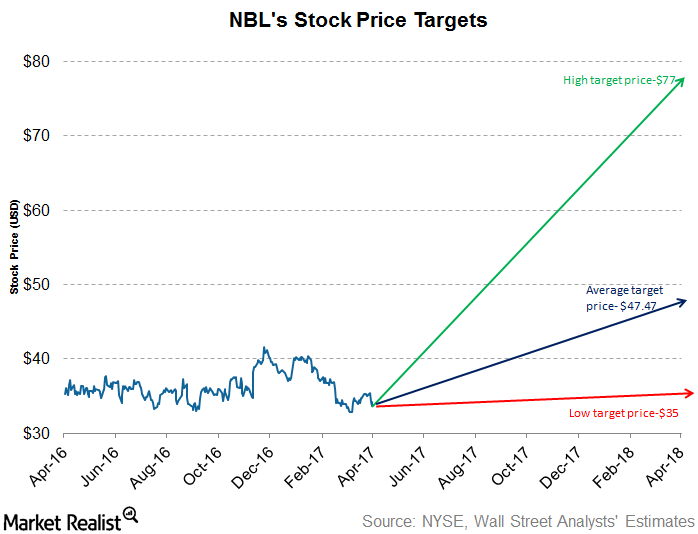

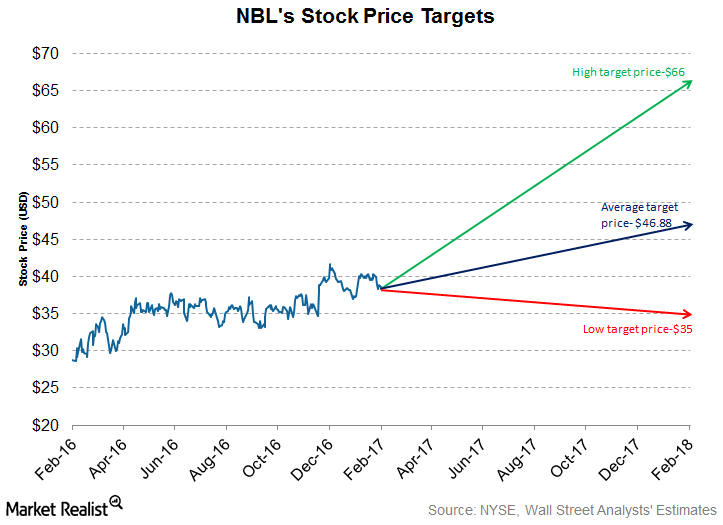

What Are Analysts’ Recommendations for Noble Energy?

Approximately 53% of the analysts rate Noble Energy (NBL) as a “buy” and 32.3% rate it as a “hold.” The average broker target price is $47.47.

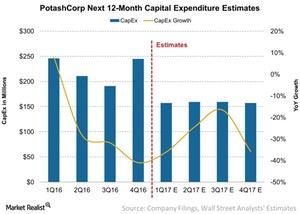

What Analysts Forecast for PotashCorp’s Capital Expenditure

In recent years, agricultural fertilizer companies like PotashCorp (POT), Agrium (AGU), Israel Chemicals (ICL), and CF Industries (CF) have incurred higher capital expenditures.

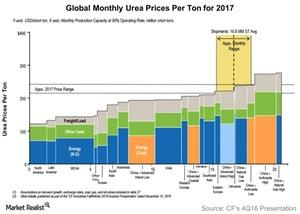

Urea Cost Curve Steepens: What It Means for CF Industries

Urea prices have fallen by an average of 14% annually over the past five years. The consistent fall has been due to falling energy costs, leading to lower production costs across the board.

What Analysts Recommend for Noble Energy after Its Earnings

Approximately 67.0% of the analysts rate Noble Energy (NBL) as a “buy” and 33.0% rate it as a “hold.” The average broker target price is $46.88.

What Analysts Recommend for Anadarko after Its 4Q16 Earnings

The average broker target price of $81.65 for Anadarko Petroleum implies a potential return of ~19.4% for the stock in the next 12 months.

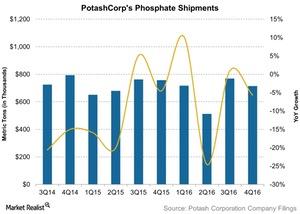

How PotashCorp’s Phosphate Shipments Performed in 4Q16

Overall shipments for PotashCorp’s Phosphate segment fell 6.0% in 4Q16 to 0.72 million tons, from $0.76 million tons in 4Q15.

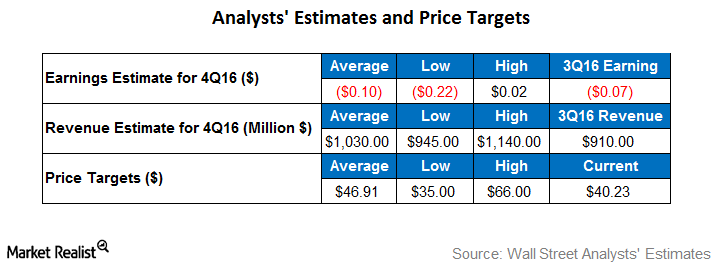

What Are Analysts’ Recommendations and Forecasts for NBL?

For 4Q16, analysts have an average earnings estimate of -$0.10 per share for Noble Energy (NBL). The low estimate stands at ~-$0.22 per share.

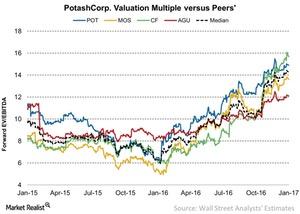

Comparing PotashCorp’s Enterprise Multiple with Its Peers

PotashCorp (POT), which is currently trading at an EV-t0-EBITDA multiple of 15.0x, is trading far above its low point of 6.0x a year ago.

A Look at Nitrogen Fertilizer Cost Drivers and Production Flow

Energy as well as freight and handling can be the two biggest costs for nitrogen fertilizer production.

Why Monsanto’s Operating Margins Improved in 1Q17

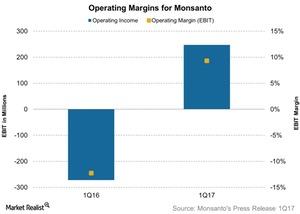

Monsanto reported operating income or EBIT of $247 million, which rose from -$272 million in fiscal 1Q16.

Inside the Soybean Inventory Rise in December

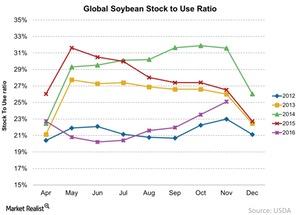

The global soybean stock-to-use ratio for soybeans rose to ~25.1% in December 2016, as compared to 24.8% in November 2016.

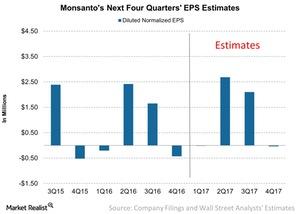

Can Monsanto Report Earnings Growth in Fiscal 1Q17?

For 2017, Wall Street analysts are estimating that Monsanto (MON) could report EPS of $4.70, which would translate into earnings growth of 5.3% year-over-year.