Can Monsanto Report Earnings Growth in Fiscal 1Q17?

For 2017, Wall Street analysts are estimating that Monsanto (MON) could report EPS of $4.70, which would translate into earnings growth of 5.3% year-over-year.

Dec. 29 2016, Updated 7:35 a.m. ET

Earnings per share

Over the past five-year period, Monsanto (MON) had an annual earnings growth rate of 3.9%. Syngenta (SYT) had an annual growth in earnings of -1.6%, Dow Chemical (DOW) had earnings growth of 11% annually, and DuPont (DD) reported a 5% decline in earnings.

EPS estimates

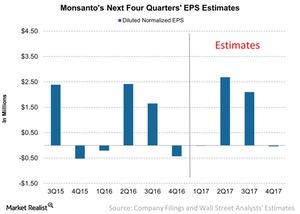

According to the Wall Street analysts’ estimates, Monsanto is expected to report flat earnings per share (or EPS) in fiscal 1Q17 compared to -$0.11 per share in fiscal 1Q16. However, most of Monsanto’s sales occur in the second and the third quarters, so we must take the full-year perspective.

For 2017, Wall Street analysts are estimating that Monsanto (MON) could report EPS of $4.70, which would translate into earnings growth of 5.3% year-over-year.

The agribusiness (NANR) industry is going through its fair share of challenges, with farmers facing price risks from commodities such as corn, soybeans, and wheat. More recently, the inventory of these three crops indicated that there is oversupply, which has put downward pressure on prices. In turn, this impacts farm income and the decision to grow crops.

Regulation related to renewable fuels such as ethanol, which is made from corn, can also impact Monsanto. In the final part of this series, we’ll discuss the valuation multiple for Monsanto and its peers.