Syngenta AG

Latest Syngenta AG News and Updates

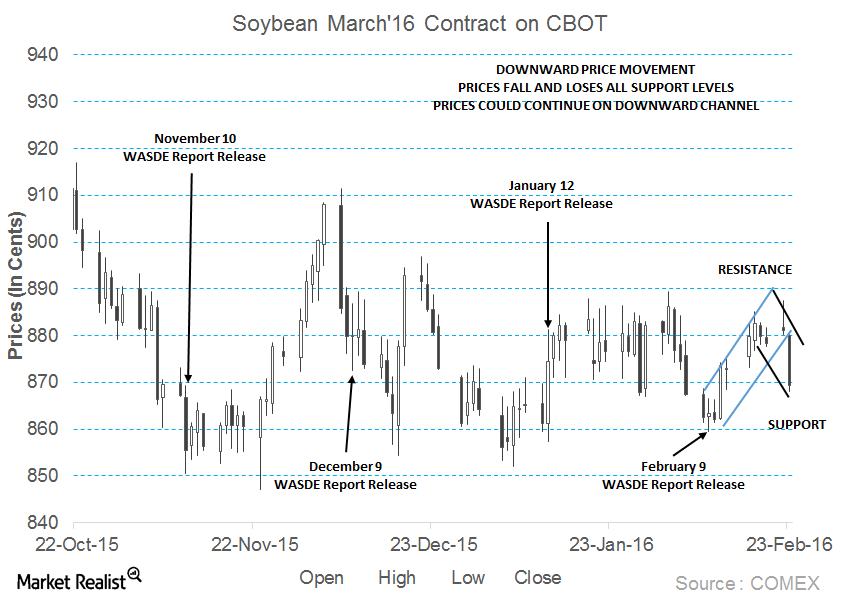

Soybean Prices Might Continue on the Downward Channel

March soybean futures contracts were trading near the support level of $8.70 per bushel on February 23. Prices fell for the second consecutive trading day.

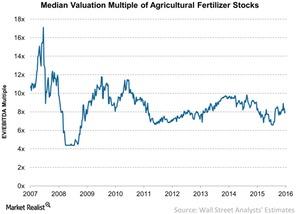

Valuation Multiples for Agricultural Chemicals after Brexit

In this part of the series, we’ll look at agricultural fertilizer producers’ valuations from their historical standpoints. Over the long run, valuation multiples impact a company’s share price.

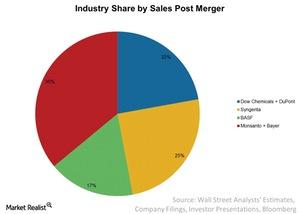

What Hurdles Could Monsanto-Bayer Deal Face?

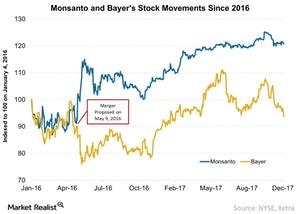

A few days ago, Monsanto (MON) agreed to Bayer’s takeover offer of $128 per share for a total deal value of $66 billion.

Corn, Soybean, and Wheat Prices Fall in August, but Why?

On August 13, the crop index stood at 89.9. It rose by 1% following the USDA’s latest stock-to-use ratio, which was published on August 12.

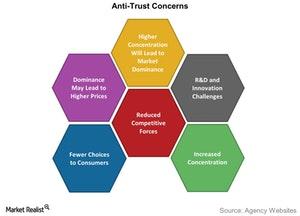

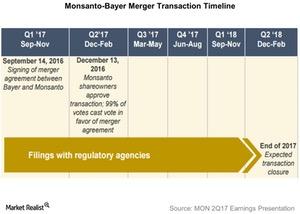

The Bayer-Monsanto Merger Concerns

Some anti-trust agencies have pushed back their merger approval deadlines over anti-competitive concerns the deal will likely create.

The Bayer-Monsanto Merger Deal: An Update

On September 14, 2016, Bayer signed an agreement with Monsanto (MON) to acquire it for $66 billion, or $128 per share. The offer represented a 44% premium over Monsanto’s stock price.

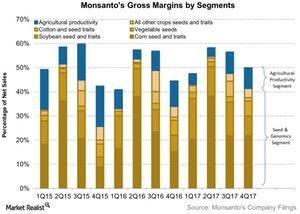

Monsanto’s 4Q17 Gross Margins by Segment

The Seed and Genomics segment’s gross margins expanded from 34.0% in 4Q16 to 41.4% in 4Q17.

The Monsanto-Bayer Merger: Can This Seed Take Root?

Monsanto’s (MON) proposed merger with Bayer is expected to be completed by the 2Q18—but only if it gets the green light from antitrust authorities.

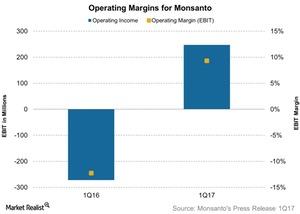

Why Monsanto’s Operating Margins Improved in 1Q17

Monsanto reported operating income or EBIT of $247 million, which rose from -$272 million in fiscal 1Q16.

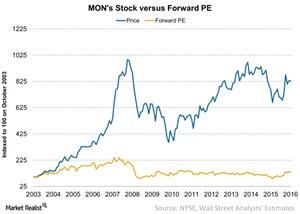

How Monsanto’s Stock Has Tracked Its Historical Price-to-Earnings

The price-to-earnings ratio is a popular multiple investors use to determine the value of their investments in companies such as Monsanto (MON).

Company Overview: A Look at Monsanto’s Key Executives

In 2016, Monsanto (MOO) had 21,000 employees. Let’s take a look at some of the company’s key executives.

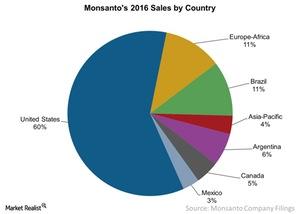

What Geographic Segments Contribute to Monsanto’s Sales?

Including the United States, Mexico, and Canada, Monsanto’s total North American sales contribution stood close to 68% of its 2016 sales.

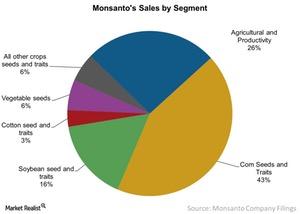

This Segment Has Become Important for Monsanto in the Last Decade

Monsanto (MON) conducts its global sales through two broad segments known as the Seeds & Genomics and Agricultural Productivity segments.

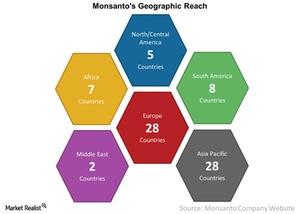

Monsanto Has a Huge Presence in Over 150 Countries

For over 100 years, Monsanto (MON) has been spread across several countries, with some of its brands being sold and used in over 150 countries.

Monsanto’s History Dates Back to 1901

In 1964, Monsanto introduced its first herbicide by the name of Ramrod. Four years later, in 1968, the company commercialized an herbicide called Lasso.

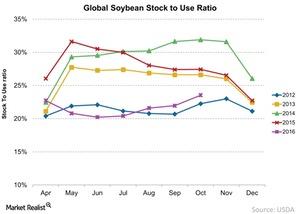

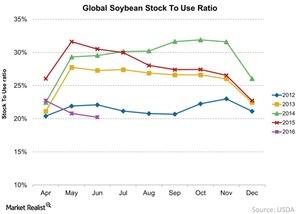

Inside the Soybean Inventory Rise in December

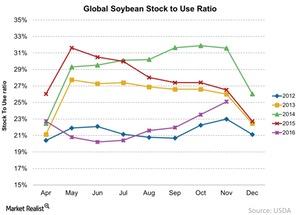

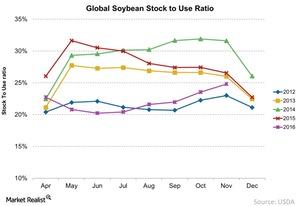

The global soybean stock-to-use ratio for soybeans rose to ~25.1% in December 2016, as compared to 24.8% in November 2016.

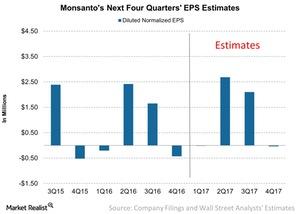

Can Monsanto Report Earnings Growth in Fiscal 1Q17?

For 2017, Wall Street analysts are estimating that Monsanto (MON) could report EPS of $4.70, which would translate into earnings growth of 5.3% year-over-year.

At What Valuation Is the Market Investing in Monsanto?

Monsanto’s (MON) forward PE valuation multiple has recently trended higher, and so has the price of its stock.

Soybean’s Stock-to-Use Ratio Rose with the Inventory

Unlike corn, the global soybean stock-to-use ratio is lower compared to the global stock-to-use ratio of 26.5% last year.

Soybean’s Stock-to-Use Ratio Rose in October

The global stock-to-use ratio for soybeans rose 1.6% to ~23.5% in October—compared to 22% in September. Soybean’s ratio is lower than last year.

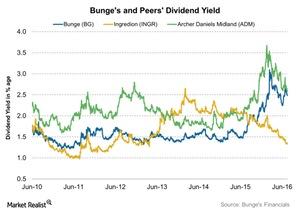

Bunge Consistently Returns Value to Shareholders

On May 24, Bunge announced that its board of directors approved a 10.5% increase in the company’s regular quarterly common share cash dividend.

What Could Explain Soybeans’ Low Stock-to-Use Ratio?

In June 2016, the global soybean stock-to-use ratio stood at 20.2%, which was at its lowest point compared to the past four years.

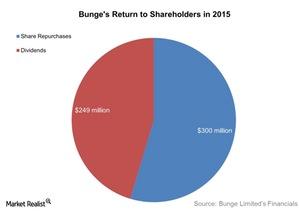

How Bunge Returns Value to Shareholders

Bunge (BG) paid $549 million to shareholders through dividends and share repurchases in 2015.

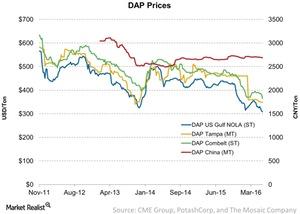

Last Week’s DAP Fertilizer Price Trends: Must-Knows

Ammonia is used to make phosphate fertilizers like DAP (diammonium phosphate) and MAP (monoammonium phosphate).

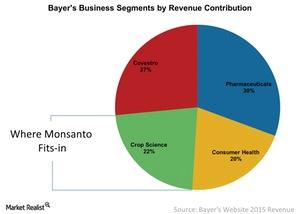

How Monsanto’s Business Fits into Bayer’s Portfolio

What’s in it for Bayer when it comes to acquiring Monsanto (MON)? The answer lies in Bayer’s business segments and geographic reach.

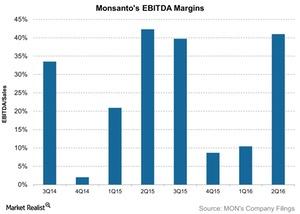

What’s Monsanto’s Outlook for the Next 12 Months?

For fiscal 2Q16, Monsanto reported EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.8 billion.

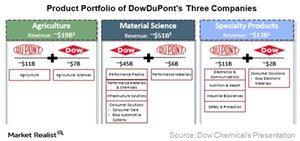

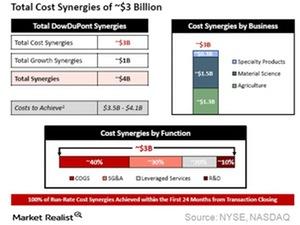

DowDuPont Will Spin Off into 3 Independent Public Companies

After the merger, DowDuPont will spin off into three independent and public companies—agriculture, material science, and specialty products.

Will the Dow Chemical and DuPont Merger Have Operational Synergy?

With corporate changes, the combined company is expected to generate total cost savings of $3 billion over the next two years after the merger.