Adam Jones

I have been writing for Market Realist since 2014. I currently cover the cannabis sector, and I was drawn to the cannabis industry almost two years ago, when it was just emerging. I was fascinated by the variety of applications this single plant can have.

In addition, I like to explore different industries and am particularly interested in discovering good stocks. In the past, I've also covered the agricultural fertilizer and restaurant sectors.

When I'm not writing for Market Realist, I love reading books based on real-life events. I also enjoy reading biographies of people who have inspired the world in some way.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Adam Jones

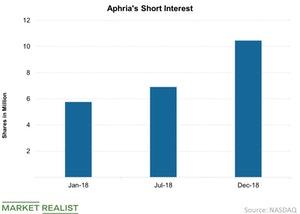

Gauging the Bullish-Bearish Sentiment on Aphria

The short interest position on a stock is one quick way to gauge the bullish and bearish sentiment on a stock.

Why Chipotle Has A Lot Of Room For Unit Growth

Unit growth isn’t the only factor that drives revenue. A restaurant can keep adding more restaurants. Eventually, it can capture newer markets. This is what Chipotle is doing.

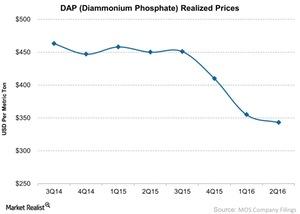

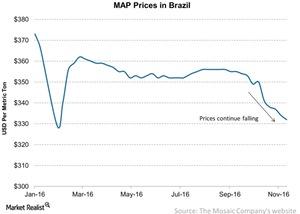

How Mosaic’s Phosphate Prices Fared in 2Q16

Phosphate fertilizer prices are key to Mosaic’s (MOS) Phosphate segment’s sales, earnings, and stock price.

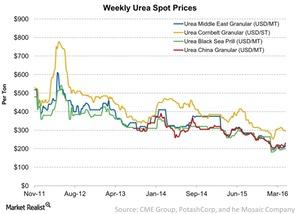

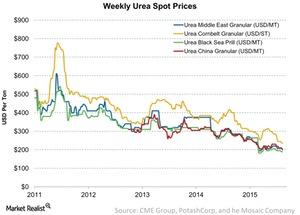

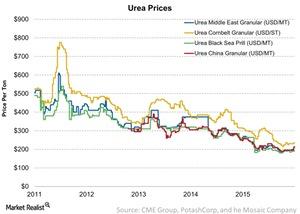

Tracking Urea Price Movement during the Week Ending April 22

In 2013, about 54% of global ammonia was upgraded to urea, according to FERTECON. But urea prices have rebounded from their lows at the beginning of 2016.

Urea Prices: The Continuing Decline Last Week

Granular urea prices in the Middle East declined 5% to $200 per metric ton in the week ended July 1. It was $210 per metric ton in the previous week.

Is This Why CF’s Stock Has Rallied?

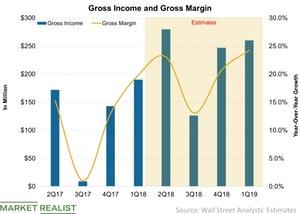

Like CF Industries’ (CF) sales, its margins are also expected to expand YoY (year-over-year) in Q2 2018 and the next four quarters.

Did Capacity Shutdowns in China Impact Urea Prices?

For the week ending October 28, the overall movement in urea prices was flat to positive. Granular urea prices rose 6.6% to $211 per metric ton in China.

Potash Prices Showed Weakness for the Week Ending April 21

Last week, potash prices continued to show weakness week-over-week. Prices were broadly flat to positive for the week ending April 21.

Analysts’ Ratings and the Next-12-Month Price Target for Mosaic

Of the 22 analysts surveyed, about 32% of them gave Mosaic (MOS) a “buy” rating. About 41% of analysts issued a “hold” rating, and only 27% issued a “sell” rating.

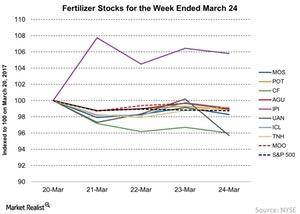

Fertilizer Stocks and Commodity Prices: Week Ending March 24

The week ending March 24, 2017, was broadly negative for agricultural fertilizer stocks. The VanEck Vectors Agribusiness ETF (MOO) fell 0.98%.

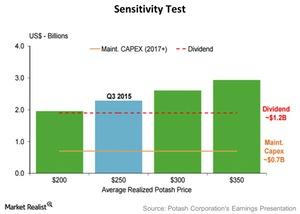

How Sensitive Is PotashCorp’s Dividend to Potash Prices?

In the last 12 months, PotashCorp (POT) has earned about 36% of its total sales from its Potash segment.

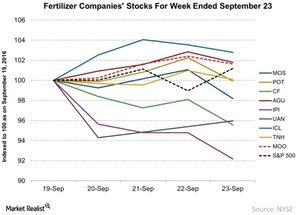

How Did Fertilizer Stocks Perform in the Week Ended September 23?

Last week was mostly negative for agricultural fertilizer (FXZ) stocks. However, the VanEck Vectors Agribusiness ETF (MOO) ended the week in positive territory.

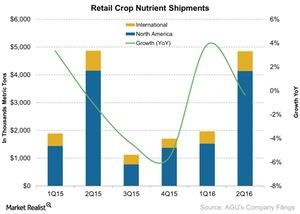

How Did Agrium’s Retail Shipments Perform in 2Q16?

Agrium’s (AGU) Retail segment’s shipments declined by 0.03% to 4.84 million tons in 2Q16, down from 4.86 million tons in 2Q15.

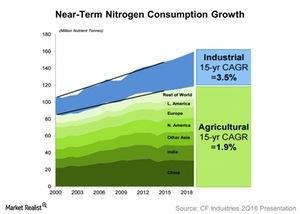

How Much Demand Will There Be for Nitrogen in the Near Term?

According to CF Industries, nitrogen prices could remain under pressure as new capacities come online in 2017. However, the company believes that things should improve in 2018.

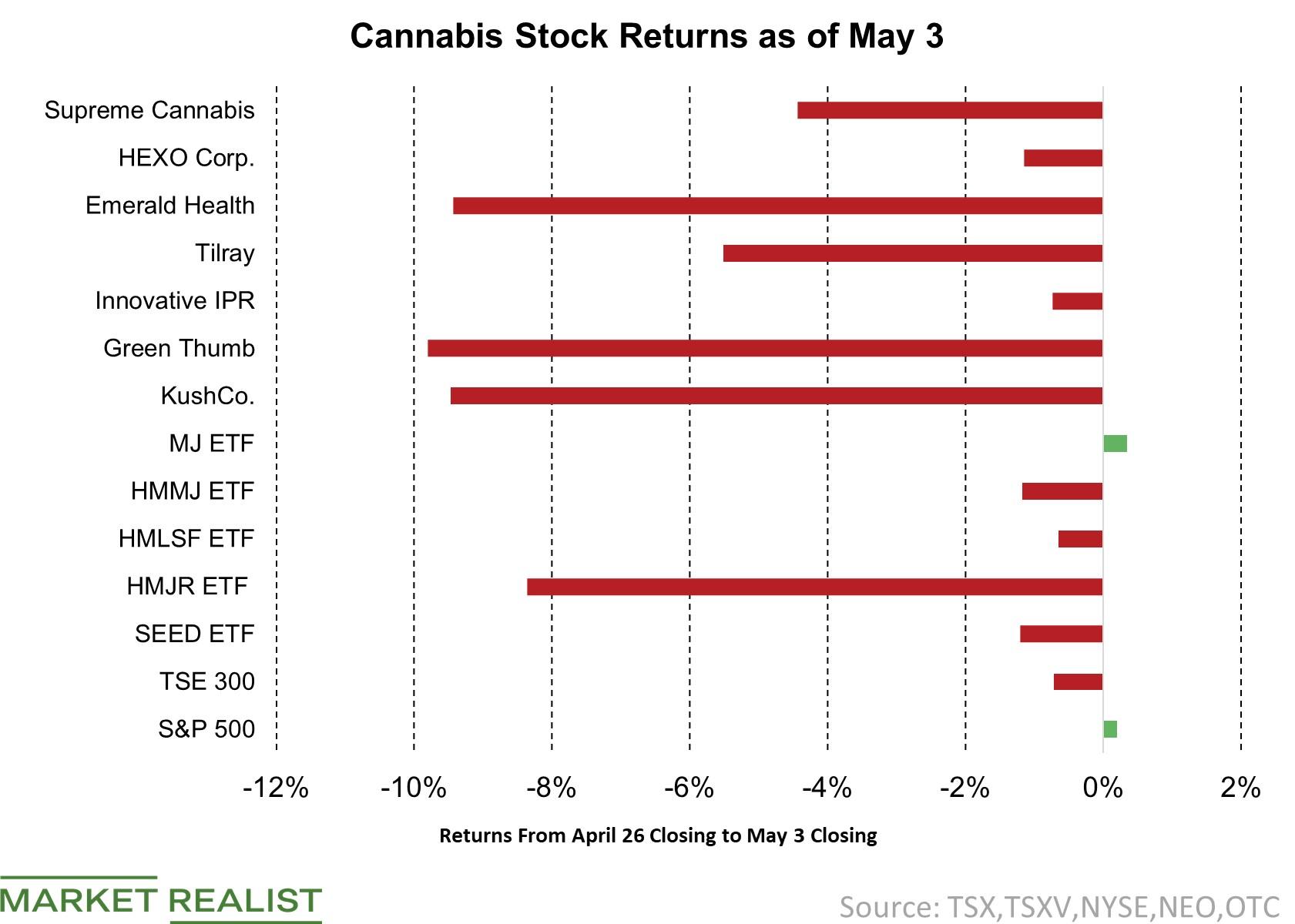

How Did Cannabis Stocks Perform Last Week?

Tilray (TLRY) stock fell as much as 5.5% last week, while Supreme Cannabis (SPRWF) fell ~4.4% in the week ending May 3.

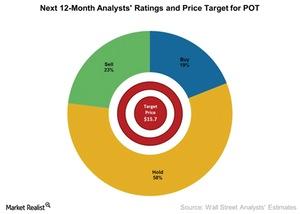

PotashCorp’s Price Target before It Reports Its 2Q16 Earnings

Since the beginning of 2016, analysts have revised their next-12-month price target for PotashCorp downward. The consensus price target now stands at $15.70.

DAP Prices See a Mixed Week for the Week Ending August 19

Average DAP prices in China were flat at 2,669 Chinese yuan per metric ton last week. DAP prices in Morocco remained unchanged at $340 per metric ton.

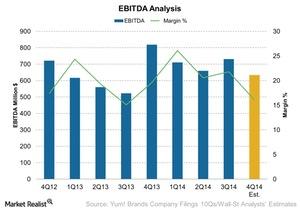

Why Yum! Brands Is Expected To Report Lower EBITDA

Wall Street analysts’ estimated EBITDA for the fourth quarter is $633 million—compared to $918 million in the same quarter last year.

When Will Yum! Complete the Separation of Its China Division?

On October 20, Yum! announced that it will separate its China division from the rest of its business. It’s expected to complete this by the end of 2016.

Starbucks Beats 1Q16 Expectations, Still Down Year-to-Date

Starbucks (SBUX) reported earnings per share of $0.46 for 1Q16, which exceeded Wall Street’s consensus estimates as well as management’s guidance of $0.45 per share.

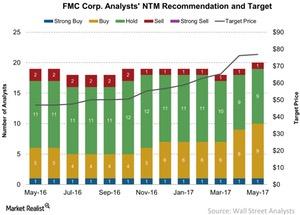

Analysts’ Price Target and Recommendations for FMC Corporation

Like Monsanto (MON), FMC Corporation (FMC) is in the business of crop protection products. The majority of FMC’s sales come from its Agricultural Solutions segment.Consumer Must-know: Chipotle Mexican Grill’s food costs

CMG reported $372 million in food costs in 3Q14. Food costs accounted for 34.3% of the revenue. It was an increase of 70 basis points year-over-year (or YoY).

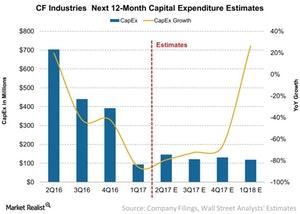

Capital Expenditure Expectations for CF Industries in 2Q17

CF Industries (CF) is expected to see a significant reduction in its capital expenditure (or capex) year-over-year (or YoY) in 2Q17 and for the next four quarters.

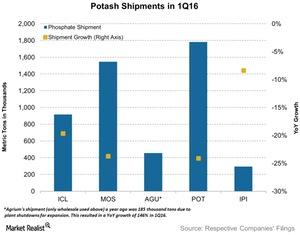

How Potash Shipments Performed in 1Q16

Mosaic (MOS) and PotashCorp (POT) were hit the hardest, with their respective shipments declining by 24% each to 1.5 million tons and 1.7 million tons year-over-year.

Top Developments in the Cannabis Industry’s Early Years

In the second half of 2018, the cannabis industry remained busy. As the cannabis sector experienced a boom, there was a lot of excitement among investors.

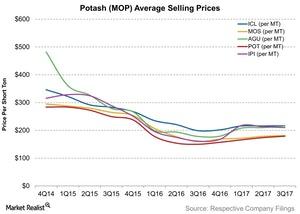

What 2017 Meant for Potash Producers

Potash fertilizers Most of the fertilizer companies we’ve discussed in this series sell all or some of the three NPK (nitrogen, phosphorous, and potassium) macronutrients. To learn more about these macronutrients’ key role in agriculture, read Agricultural Fertilizer Industry: Your Comprehensive Overview. In this part, we’ll look at what 2017 meant for potash producers. Price trends […]

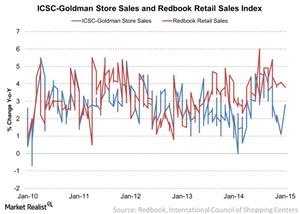

Retail Sales Reports From ICSC-Goldman And Johnson Redbook

The ICSC-Goldman and Johnson Redbook indices both report consumer spending data each week, but people consider the ICSC-Goldman index to be more consistent.

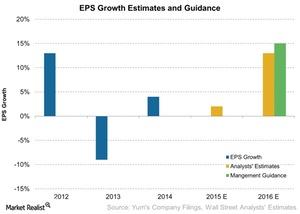

Must Know: Analysts’ Price Target for Chipotle Mexican Grill

About 47% of analysts have “buy” recommendations on Chipotle, 50% of analysts have “hold” recommendations, and 3% have “sell” recommendations on the company. Overall, the stock has a “buy” rating.

Comparing Cannabis Stocks’ EV-to-EBITDA Multiples

In this part, we’ll compare how these producers’ multiples compare with each other.Consumer Why Yum! Brands’ division in China is important

Yum! Brands’ (YUM) division in China includes its business in mainland China. It’s the combined revenues from all the brands—KFC, Pizza Hut, East Dawning, and the Little Sheep.

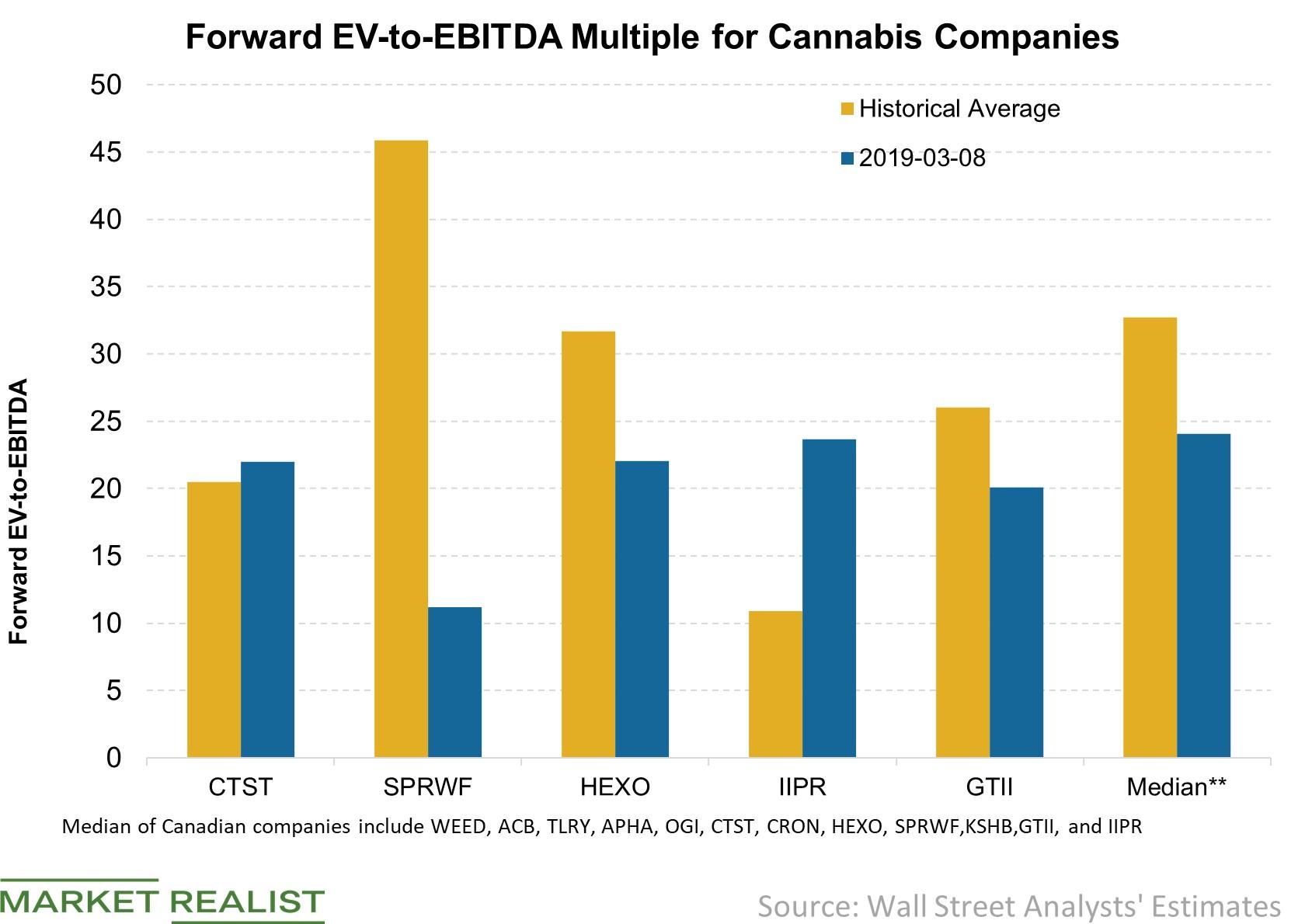

Revisiting Valuation Multiples for Cannabis Companies

Recreational cannabis is close to being legalized in Canada, and producers are running at full bore to capture a piece of the market.

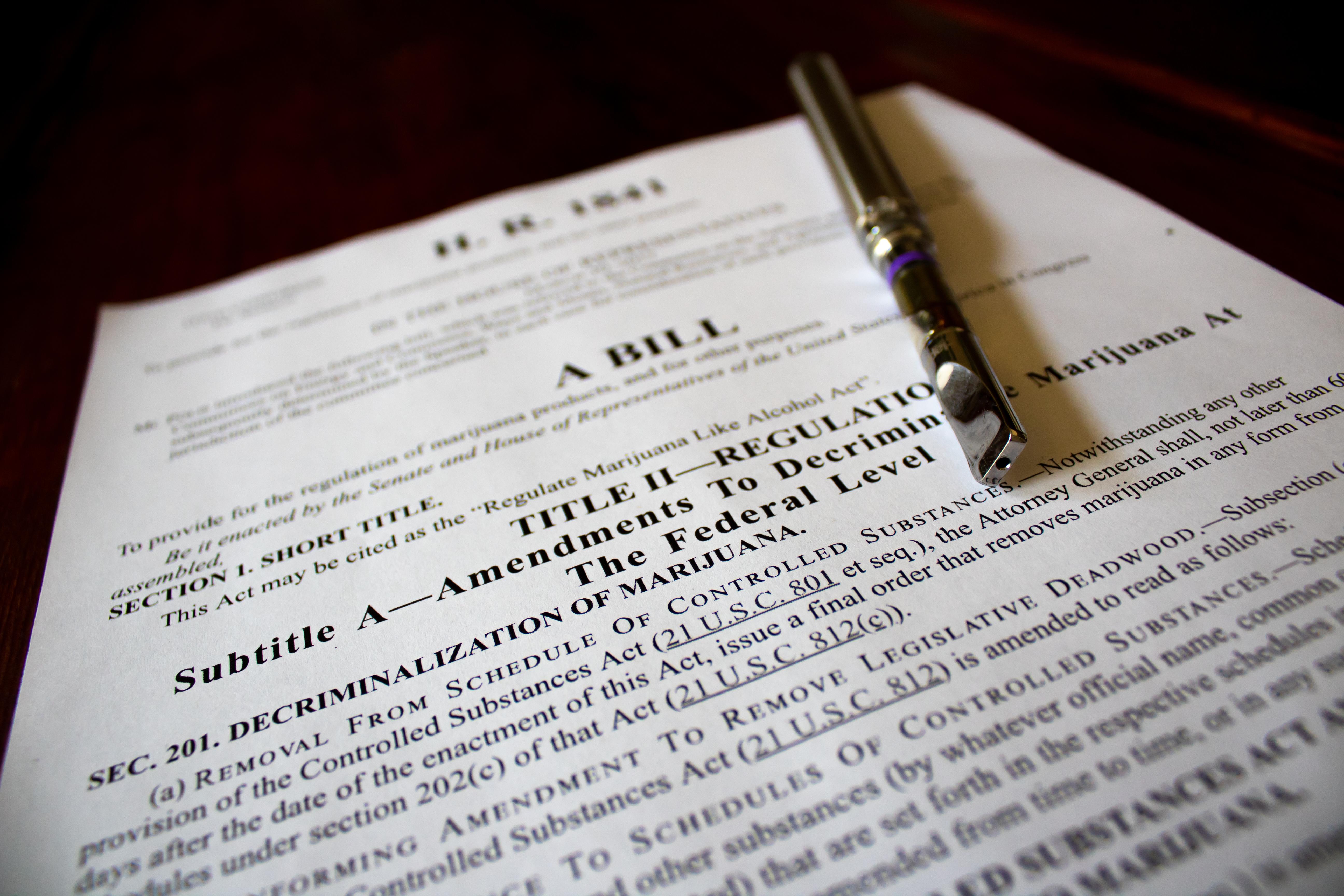

Marijuana Legalization: House Passes SAFE Act in US

Yesterday, the House passed the Secure and Fair Enforcement Banking Act, which aims to reduce cash transactions for legitimate marijuana businesses.

Comparing the Valuation Multiples of Cannabis Stocks

In this part of our cannabis valuation series, we’ll discuss the multiples of the remaining cannabis stocks and compare them to the peer (MJ) median of 24x.

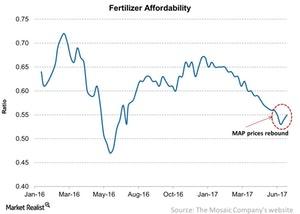

Fertilizer Affordability Pressure Eased Last Week

While the Fertilizer Affordability Index was below one, it’s still higher compared to the average levels observed since January 2016.

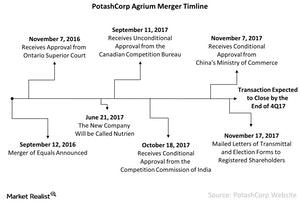

An Update on the PotashCorp-Agrium Merger

On September 12, 2016, PotashCorp and Agrium announced their intention to combine in a merger of equals. But China and India have set conditions.Consumer Analyzing Burger King’s shifting business model focus in 2Q14

Franchise revenues include royalties and franchise fees. Royalties are calculated as a percentage of franchise restaurant revenues, which are driven by same-store sales.Consumer Must-know: Dunkin’s major costs of operations

Dunkin’ Brands Group (DNKN) has three major costs of operations. The costs of operations include general and administrative expenses, cost of products sold, and occupancy expense. Dunkin’s general and administrative expenses accounted for $56 million in the second quarter. This was 30% as a percentage of sales—compared to $62 million, or 34%, as a percentage of sales.

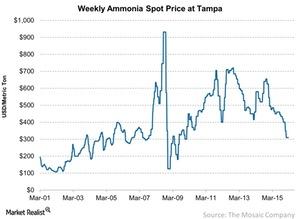

Why Ammonia Prices Will Benefit Phosphate Producers

The average price of ammonia for the week ending March 11 stood at $310 per metric ton, remaining unchanged from the previous week.Cannabis Marijuana Legalization Continues: Wisconsin Steps Up!

Marijuana laws are pretty strict in Wisconsin. Although cannabis is spreading its roots across US states, it’s still illegal at the federal level. President Trump and his administration want states to decide. Florida, New York, and Minnesota are all gearing up to legalize adult-use cannabis. Now, Wisconsin is pushing to legalize medical marijuana. Let’s see […]

Fertilizers Were Affordable for the Week Ending June 23

According to the Fertilizer Affordability Index, 2017 has been one of the most affordable years for fertilizers. Mosaic issues the index.

CF Industries: A Good Fit for Top 10 Agricultural Chemicals List?

Over the past ten-year period, CF Industries has risen 186.0% and significantly outperformed the S&P 500 Index’s rise of 69.2% over the same period.

Why Medical Cannabis Lacks Scientific History

Legal cannabis for medical purposes has been available for several years, yet you’ll often hear people say that cannabis lacks science.

Cannabis Roundup: ACB, HEXO, and CTST Lead the Pack

On March 13, during the first half of the day, the overall cannabis sector traded higher.Earnings Report Starbucks’ strategy: Aggressive unit growth

Unit growth is a key driver that Starbucks is aggressively pursuing to grow the company’s sales. In the last 12 months, Starbucks has added 1,599 net new restaurants, or 8% growth in units.

How Do Recent Potash Prices Compare with Their 15-Year Average?

The average weekly price of MOP (muriate of potash) in Vancouver remained unchanged for the week ended May 20, 2016.

How Cannabis Stocks Fared Last Week

Tilray was the top performer in the cannabis sector last week with a rise of 49% as a result of better-than-expected second-quarter earnings and guidance.Consumer Why Tim Hortons introduced a mobile app and loyalty cards

Along with introducing new products like those we discussed in the previous part of this series, Tim Hortons (THI) is also testing different revenue channels and payment methods.

Fertilizers Were More Affordable in Week Ended November 25

For the week ending November 25, fertilizer affordability fell to 0.65x from 0.66x week-over-week.

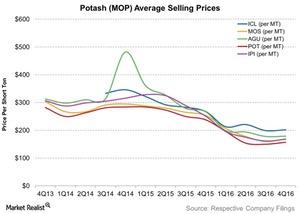

Potash on the Barrel: Prices for Five Major Producers

On average, potash prices for these five producers fell ~33% YoY in 4Q16. Excess supply and weak demand added downward pressure.

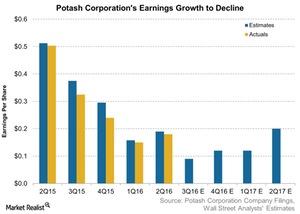

History’s Not on POT’s Side when It Comes to Earnings Growth

When we look at the past five quarters, we see that PotashCorp has missed all its earnings estimates.