Adam Jones

I have been writing for Market Realist since 2014. I currently cover the cannabis sector, and I was drawn to the cannabis industry almost two years ago, when it was just emerging. I was fascinated by the variety of applications this single plant can have.

In addition, I like to explore different industries and am particularly interested in discovering good stocks. In the past, I've also covered the agricultural fertilizer and restaurant sectors.

When I'm not writing for Market Realist, I love reading books based on real-life events. I also enjoy reading biographies of people who have inspired the world in some way.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Adam Jones

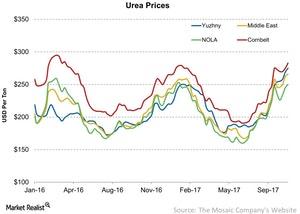

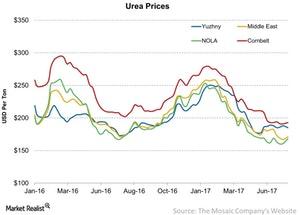

Urea Prices Moved Higher in Week Ended October 27

Last week continued to be a positive week for urea prices. Prices have risen lately as a result of excess capacities cooling off.

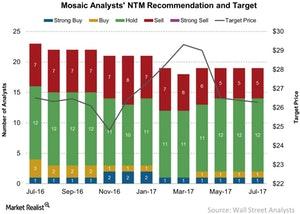

Mosaic on the Street: Analyst Ratings and Price Targets ahead of the 3Q17 Results

As on October 25, the consensus analyst rating for Mosaic stood at 3.0, which suggests an overall “hold” recommendation for the stock.

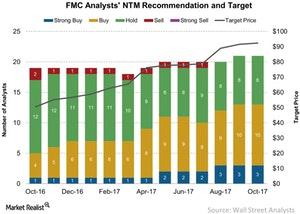

October Update: What Analysts Think about FMC

FMC (FMC) stock has risen 6.0% over the past month. The stock has significantly outperformed the benchmarks (SPY) (MOO) YTD with a 68.0% rise.

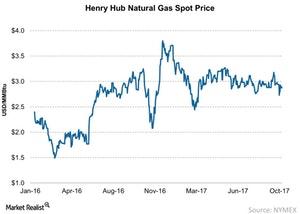

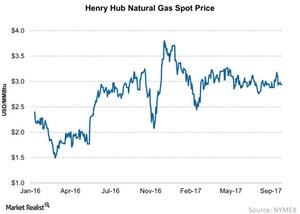

Nitrogen Input: Natural Gas Prices Fell Last Week

The natural gas prices at Henry Hub in the US fell 4.1% week-over-week from a weekly average of $2.96 per MMBtu to a weekly average of $2.84 per MMBtu.

Agribusiness Stocks: Analyst Ratings, Price Targets in October

We’re nearing the end of the year, and most agribusiness stocks have underperformed the benchmark indexes.

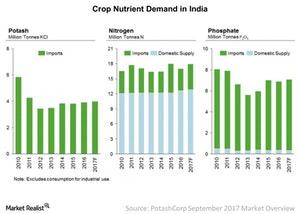

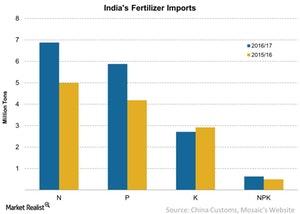

India Expects Fertilizer Consumption to Rise in 2017

India is another major market for NPK (nitrogen, phosphate, and potash) fertilizers. The country is partly self-sufficient in nitrogen fertilizers.

Phosphate Market Struggles, Hope from Demand Growth

Among the three NPK (nitrogen, phosphate, and potash) fertilizers, phosphate fertilizers have had the worst recovery.

Nitrogen Input: How Natural Gas Prices Moved Last Week

So far this year, Henry Hub natural gas prices have hovered around $3 per MMBtu (million British thermal units).

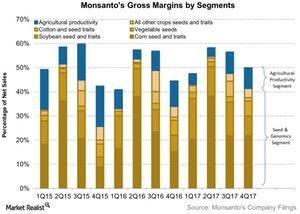

Monsanto’s 4Q17 Gross Margins by Segment

The Seed and Genomics segment’s gross margins expanded from 34.0% in 4Q16 to 41.4% in 4Q17.

MAP Prices Were Firm for the Week Ending September 15

In recent months, MAP prices in Brazil have been on a downward trajectory. However, MAP prices appear to have found firmness in recent weeks.

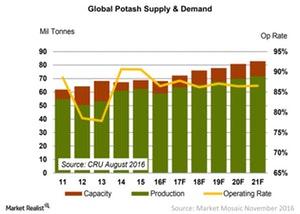

The Potash Capacity and Demand Landscape for 2017 and Beyond

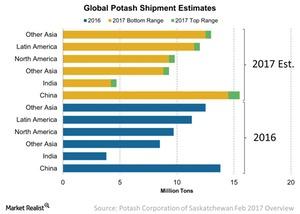

The market environment for potash has seen a better recovery than nitrogen and phosphate fertilizers have seen.

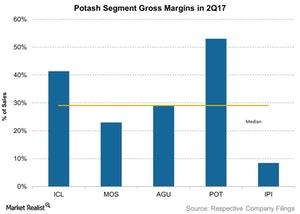

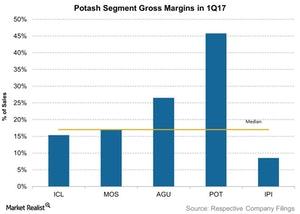

Inside the Potash Margins of 5 Major Fertilizer Companies

Given the growth in potash shipments and the increase in price realization, it’s natural that the margins of potash producers improved YoY in 2Q17.

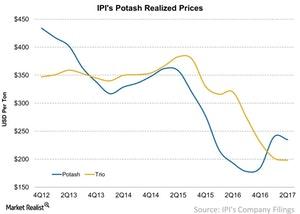

IPI’s Potash Segment’s Price Realization Rose 22% in 2Q17

Intrepid Potash’s 2Q17 price realizations for its Potash segment were significantly better compared to 2Q16.

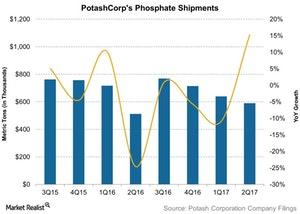

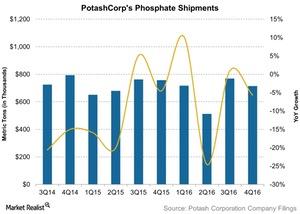

Shipments for PotashCorp’s Phosphate Segment See Strong Growth

PotashCorp’s (POT) phosphate segment contributed almost a fourth of overall sales for 2Q17. Sales were driven by shipments and price realizations.

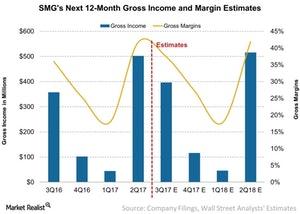

Scotts Miracle-Gro: Gross Margins Are Expected to Expand in 3Q17

Wall Street analysts expect gross income of $396 million in 3Q17, which will deliver a gross margin of 37% on 3Q17 sales estimates of $1.06 billion.

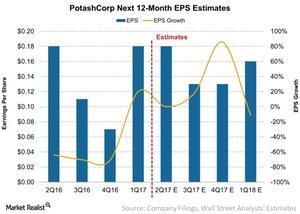

Will PotashCorp Report Flat Earnings Growth in 2Q17?

PotashCorp (POT) had lackluster earnings growth last year. However, the company reported EPS (earnings per share) growth in 1Q17.

Granular Urea versus Prilled Urea Last Week

Last week, granular urea prices moved higher, which helped bring some relief to urea producers. But the falling global ammonia prices remained a challenge.

Wall Street Recommendations and Price Target for Mosaic

Mosaic (MOS) remains a painful investment for investors. The company has delivered losses of 18.7% year-to-date as of July 13.

India’s Fertilizer Imports and Why They Fell

For 2016, India’s imports of nitrogen fertilizers, which only included numbers for urea, fell 27.0% to 4.9 million metric tons.

Where Intrepid’s Potash Segment Margin Stands next to Peers

Intrepid Potash’s (IPI) gross margin for its Potash segment swung to positive territory in 1Q17, while its Trio margins were in the negative territory.

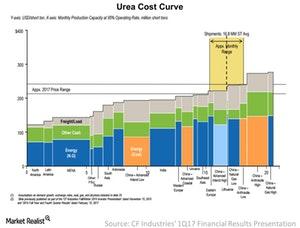

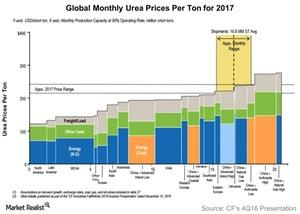

Understanding the Urea Cost Curve for CF Industries

Not only did CF Industries’ earnings fall year-over-year (or YoY) in 1Q17, its margins were also significantly lower YoY. To understand why, let’s dig deeper into the cost curve.

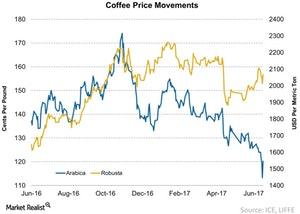

Coffee Futures: Arabica Down, Robusta Up in the Week Ended June 23

In this series, we’ll explore the price movements of five soft commodities—coffee, sugar, cocoa, orange juice, and cotton. Arabica coffee, which is considered superior in flavor and quality to Robusta coffee, has seen its futures price falling during the past six months.

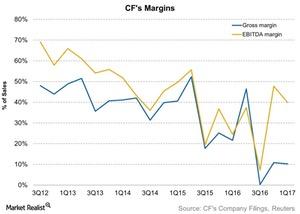

A Review of CF Industries’ Margin Trends

Over the past five years, CF Industries’ (CF) gross and EBITDA (earnings before interest, tax, depreciation, and amortization) margins have contracted.

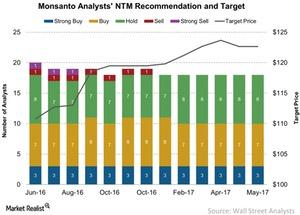

Monsanto’s Price Targets and Recommendations in June 2017

On June 9, Monsanto (MON) stock closed at $117.5 per share.

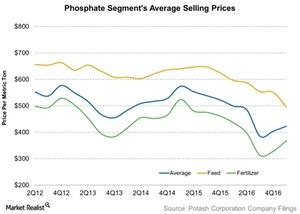

Understanding PotashCorp’s Phosphate Price Dive in 1Q17

PotashCorp’s average realized prices for phosphate fell ~15% to $423 per ton in 1Q17, as compared to $499 per ton in 1Q16.

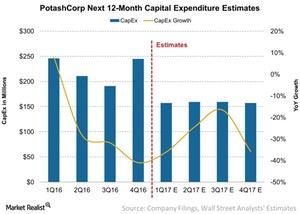

What Analysts Forecast for PotashCorp’s Capital Expenditure

In recent years, agricultural fertilizer companies like PotashCorp (POT), Agrium (AGU), Israel Chemicals (ICL), and CF Industries (CF) have incurred higher capital expenditures.

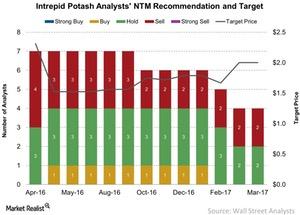

Analysts’ April Recommendations and Targets for Intrepid Potash

Intrepid Potash (IPI) has by far been the worst performer among potash fertilizer producers such as PotashCorp (POT), Agrium (AGU), and The Mosaic Company (MOS).

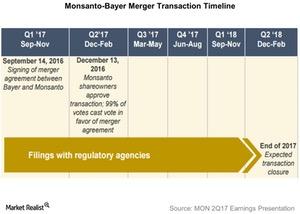

The Monsanto-Bayer Merger: Can This Seed Take Root?

Monsanto’s (MON) proposed merger with Bayer is expected to be completed by the 2Q18—but only if it gets the green light from antitrust authorities.

Urea Cost Curve Steepens: What It Means for CF Industries

Urea prices have fallen by an average of 14% annually over the past five years. The consistent fall has been due to falling energy costs, leading to lower production costs across the board.

Nitrogen Producers’ Realized Prices: A Key Comparison

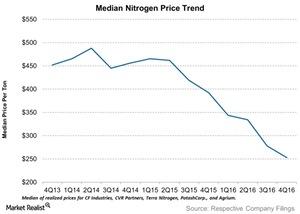

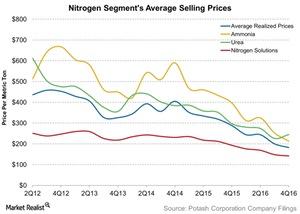

In 4Q16, the average price of ammonia for the five producers in our chart fell by an average of 38%.

Demand and Supply Outlook for Potash in 2017

According to PotashCorp, the outlook for potash appears positive in 2017. North America, Latin America (especially Brazil), India, and China have been running low on inventory.

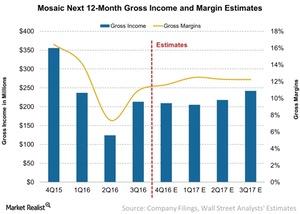

What Do Analysts Expect for Mosaic’s 4Q16 Gross Margin?

Wall Street analysts estimate that Mosaic (MOS) could report gross income of $209 million, which represents a 41% year-over-year fall from $355 million in 4Q15.

How PotashCorp’s Phosphate Shipments Performed in 4Q16

Overall shipments for PotashCorp’s Phosphate segment fell 6.0% in 4Q16 to 0.72 million tons, from $0.76 million tons in 4Q15.

PotashCorp in 4Q16: Nitrogen Prices Added Salt to the Wound

In 4Q16, the overall average nitrogen selling price fell 37.0% to $182 per ton, from $288 per ton in 4Q15.

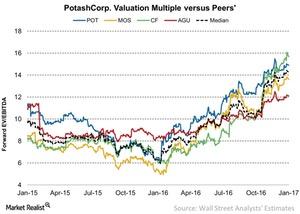

Comparing PotashCorp’s Enterprise Multiple with Its Peers

PotashCorp (POT), which is currently trading at an EV-t0-EBITDA multiple of 15.0x, is trading far above its low point of 6.0x a year ago.

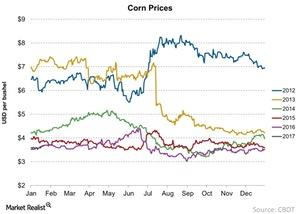

Why Corn Prices Moved Higher in January

Global corn prices are significantly lower than they’ve been for the past four years, considering the high global corn stock-to-use ratio last year.

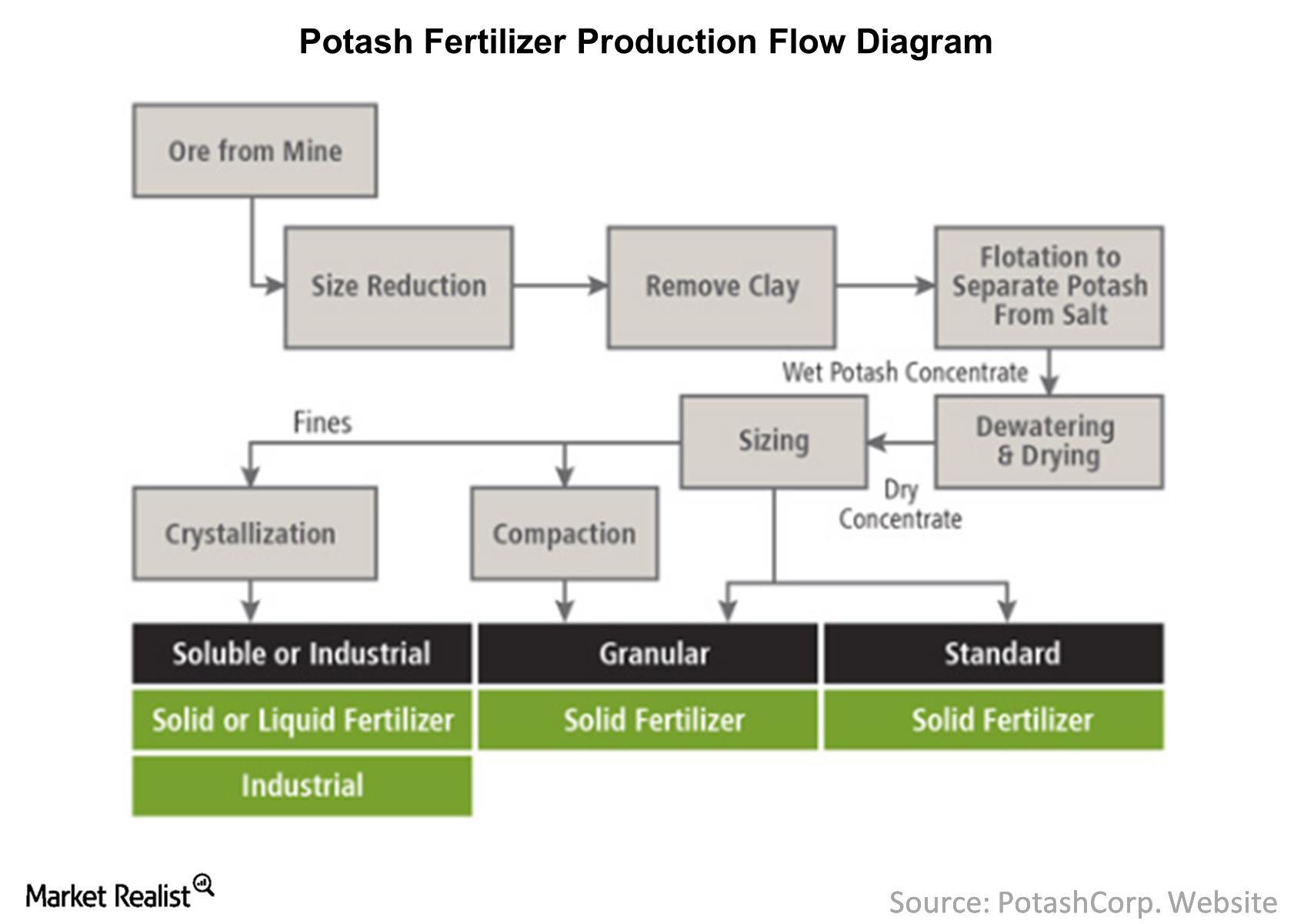

Potash Fertilizer Cost Drivers and Production Flow

Potash salts are the key cost of production for potash, so most producers have an integrated production.

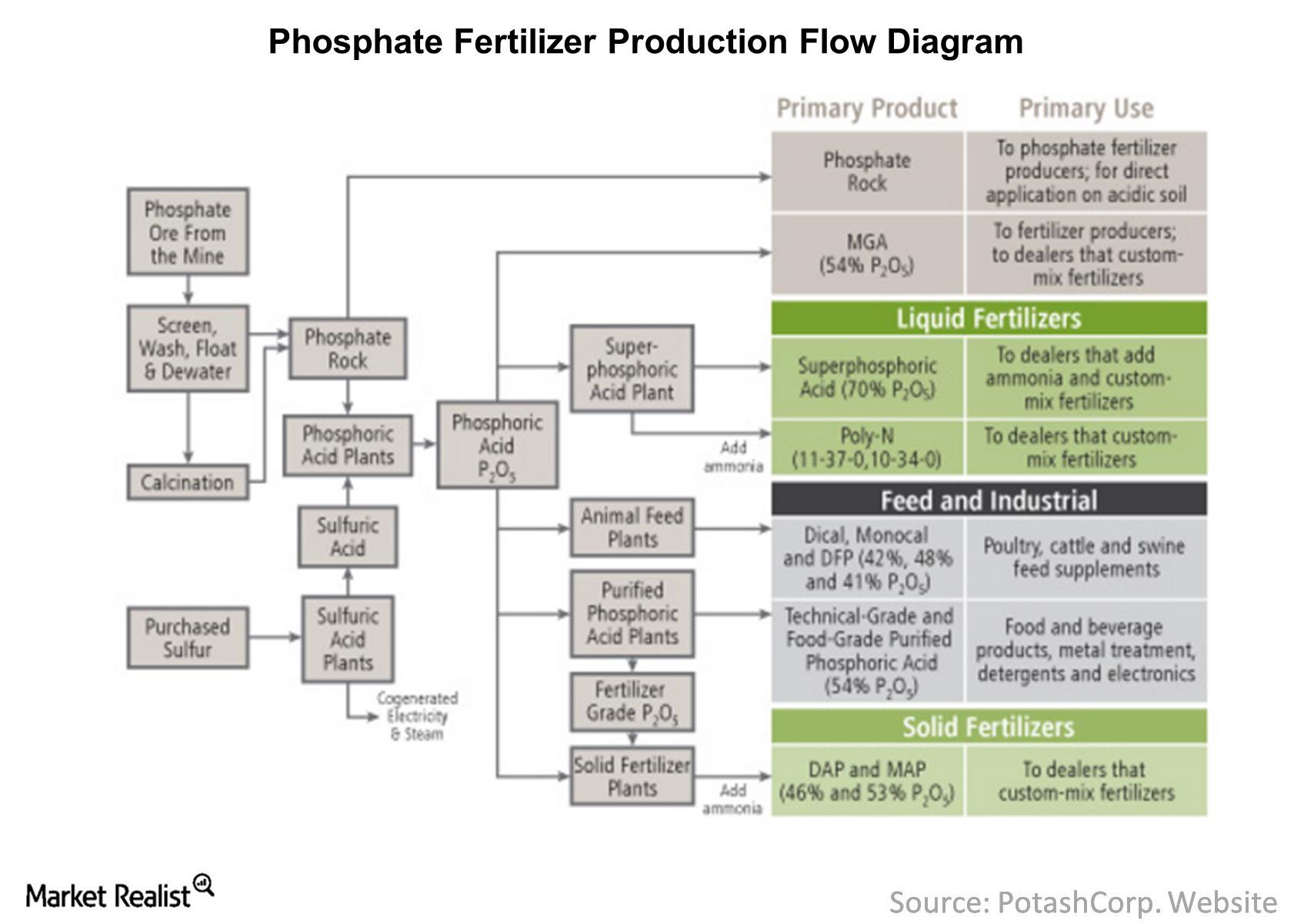

Phosphate Fertilizer Cost Drivers and Production Flow

Since phosphate rock is one of the major costs of production, companies such as Mosaic (MOS) have an integrated production process.

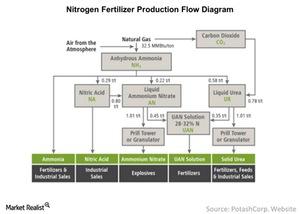

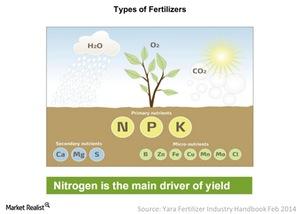

A Look at Nitrogen Fertilizer Cost Drivers and Production Flow

Energy as well as freight and handling can be the two biggest costs for nitrogen fertilizer production.

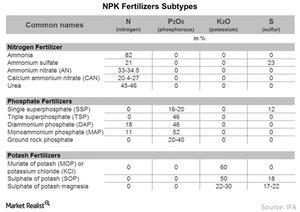

The Most Common NPK Fertilizers: Why Combinations Are Important

Fertilizers are commonly labeled using a convention that includes the amount of NPK available in the mix.

Breaking Down Types of Key Fertilizers Used Today

There’s a constant need to bring up the fertility levels necessary to grow crops, and that need is fulfilled by fertilizers.

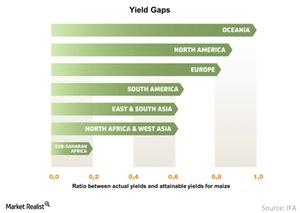

Fertilizers: A Key Part of Increasing Crop Yields

Increasing crop yield on available farmland could be the best solution to the problem of increasing crop production.

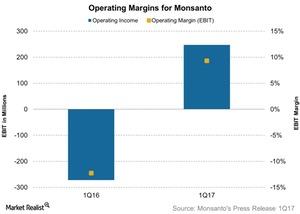

Why Monsanto’s Operating Margins Improved in 1Q17

Monsanto reported operating income or EBIT of $247 million, which rose from -$272 million in fiscal 1Q16.

Scotts Miracle-Gro’s Century-Old History

The history The Scotts Miracle-Gro Company (SMG) dates back to 1868. Conceived by Orlando McLean Scott, it aimed to give farmers weed-free and clean fields. In 1907, Scott’s son, Dwight, saw an opportunity in lawns playing a role in the American lifestyle. Therefore, the company started selling grass seeds, which replaced lower quality grass starters […]

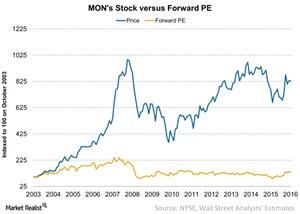

How Monsanto’s Stock Has Tracked Its Historical Price-to-Earnings

The price-to-earnings ratio is a popular multiple investors use to determine the value of their investments in companies such as Monsanto (MON).

Company Overview: A Look at Monsanto’s Key Executives

In 2016, Monsanto (MOO) had 21,000 employees. Let’s take a look at some of the company’s key executives.

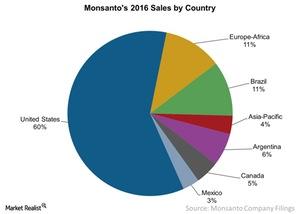

What Geographic Segments Contribute to Monsanto’s Sales?

Including the United States, Mexico, and Canada, Monsanto’s total North American sales contribution stood close to 68% of its 2016 sales.

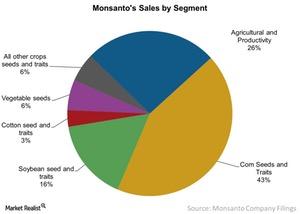

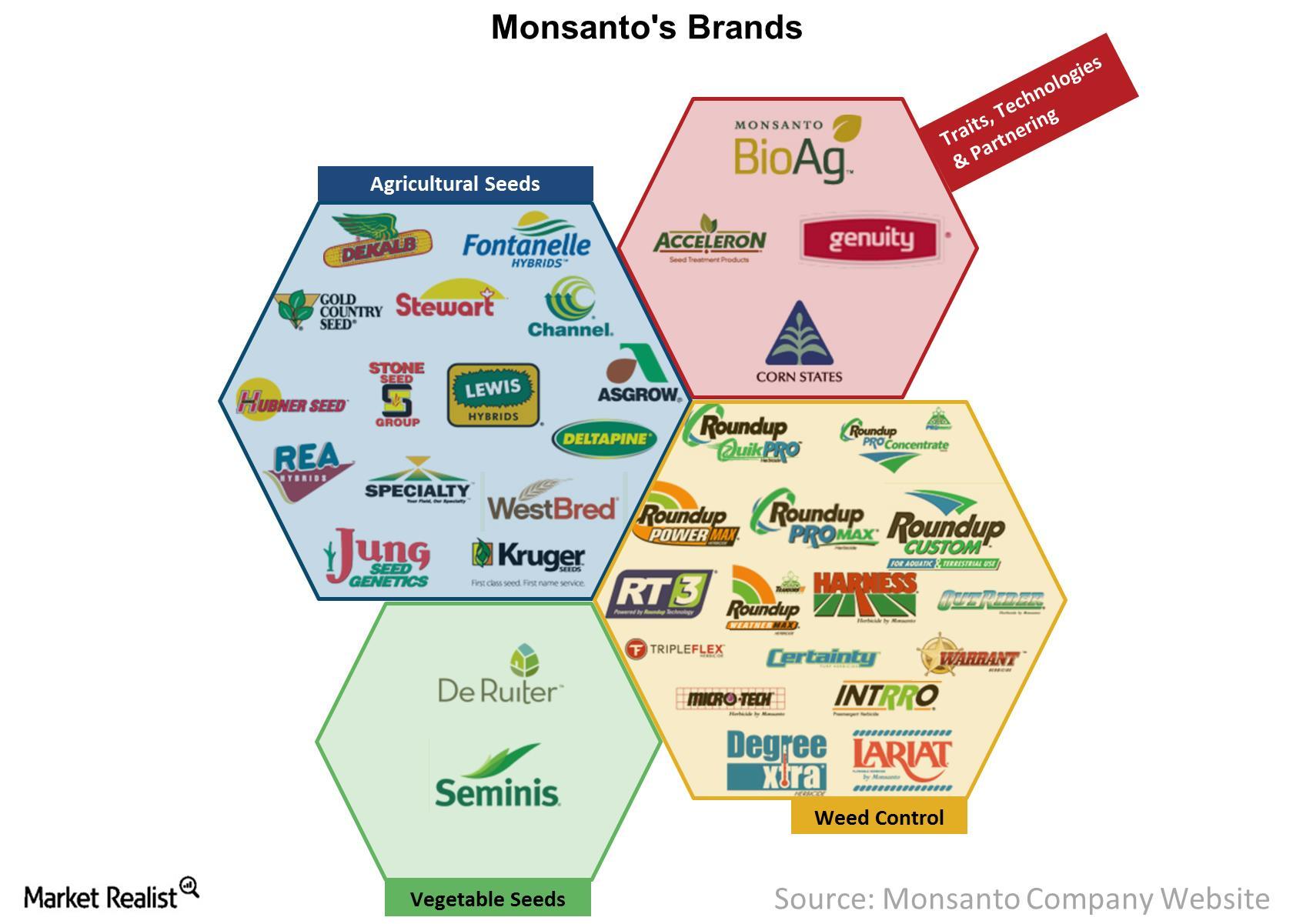

This Segment Has Become Important for Monsanto in the Last Decade

Monsanto (MON) conducts its global sales through two broad segments known as the Seeds & Genomics and Agricultural Productivity segments.

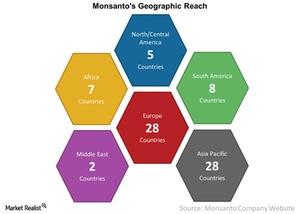

Monsanto Has a Huge Presence in Over 150 Countries

For over 100 years, Monsanto (MON) has been spread across several countries, with some of its brands being sold and used in over 150 countries.

Understanding Monsanto’s Products and Brands

Back in 1901, Monsanto’s (MON) first product was saccharin. However, the company’s Agricultural Chemicals business only arrived in 1945.