IPI’s Potash Segment’s Price Realization Rose 22% in 2Q17

Intrepid Potash’s 2Q17 price realizations for its Potash segment were significantly better compared to 2Q16.

Aug. 8 2017, Updated 4:05 p.m. ET

Price realization

A common theme across fertilizer companies’ (MOO) earnings in 2Q17 showed that fertilizer prices remained under pressure except for potash fertilizers.

Intrepid’s 2Q17 price realizations

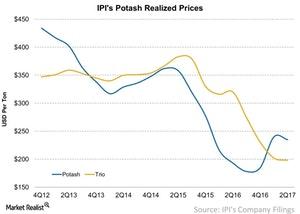

Intrepid Potash’s 2Q17 price realizations for its Potash segment were significantly better compared to 2Q16. In 2Q17, the Potash segment’s prices grew as much as 22% year-over-year to $235 per metric ton from $193 per metric ton.

Potash prices have been firming up this year, which lifted the sentiment for investors in potash companies (NANR) such as Intrepid Potash, PotashCorp (POT), Agrium (AGU), and Israel Chemicals (ICL). It might also explain why Intrepid Potash has gained positive momentum this year. You can track potash prices weekly at Market Realist. For the latest report, read How Fertilizer Stocks Performed Last Week.

Price realizations have been lower as a result of excess production capacity. While the above companies have little control over market prices, they have taken initiatives to control the cost of production. During the earnings call, Intrepid Potash’s management stated that it expects costs to be under pressure in 2H17 as well. The industry will likely continue to have excess capacity compared to market demand.

Next, we’ll discuss Intrepid Potash’s margins.