Adam Jones

I have been writing for Market Realist since 2014. I currently cover the cannabis sector, and I was drawn to the cannabis industry almost two years ago, when it was just emerging. I was fascinated by the variety of applications this single plant can have.

In addition, I like to explore different industries and am particularly interested in discovering good stocks. In the past, I've also covered the agricultural fertilizer and restaurant sectors.

When I'm not writing for Market Realist, I love reading books based on real-life events. I also enjoy reading biographies of people who have inspired the world in some way.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Adam Jones

Monsanto’s History Dates Back to 1901

In 1964, Monsanto introduced its first herbicide by the name of Ramrod. Four years later, in 1968, the company commercialized an herbicide called Lasso.

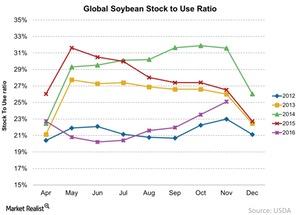

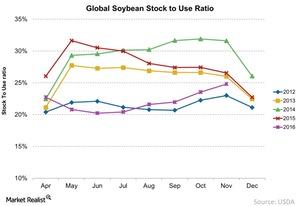

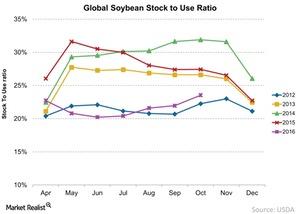

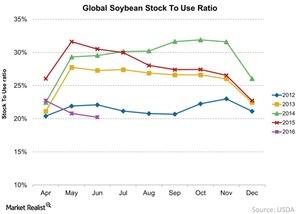

Inside the Soybean Inventory Rise in December

The global soybean stock-to-use ratio for soybeans rose to ~25.1% in December 2016, as compared to 24.8% in November 2016.

How Scotts Miracle-Gro’s Brands Overlap

Scotts’s products and brands The Scotts Miracle-Gro Company (SMG) sells many products that enable customers to grow and maintain lawns and gardens. Since growing lawns and gardens requires several elements, it’s not unusual that several players serve the market (FXZ). These include Central Garden & Pet (CENT), Spectrum Brands (SPB), and Seabord (SEB). The Scotts […]

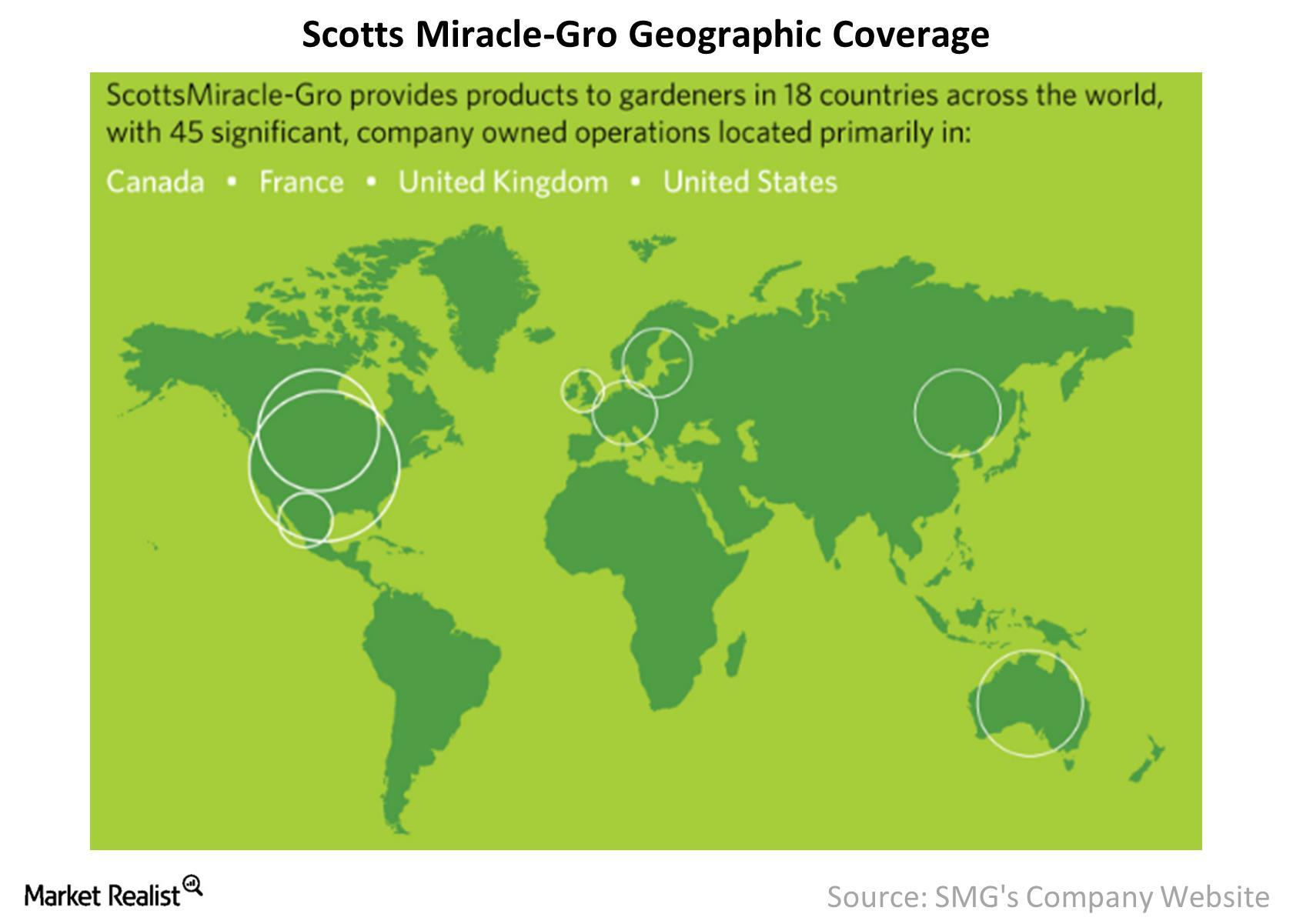

Overview: Scotts Miracle-Gro’s Brands in Different Countries

Categories of products The Scotts Miracle-Gro Company (SMG) has several products under its umbrella. In North America, which includes the United States and Canada, the company offers products to lawn and garden markets in the consumer segment. Some of the brand names include Scotts, Turf Builder, Miracle-Gro, Nature’s Care, and Ortho. The company is also […]

Key People at Scotts Miracle-Gro

Jim Hagedorn Jim Hagedorn is the current CEO of The Scotts Miracle-Gro Company (SMG). He is the son of Horace Hagedorn, who founded the Miracle-Gro company. When Scotts and Miracle-Gro merged in 1995, Jim Hagedorn joined as a director of the company. Since then, he has served Scotts Miracle-Gro as chief operating officer, president, and chairman […]

How Far Is Scotts Miracle-Gro’s Market Reach?

Beginnings in the United States The Scotts Miracle-Gro Company (SMG) began in the United States and initially focused on reaching out to customers within the country. Today, the company operates in 18 countries and has a market capitalization of $5.8 billion. Scotts Miracle-Gro is present in the United States, Europe, Canada, and the Asia-Pacific region. The […]

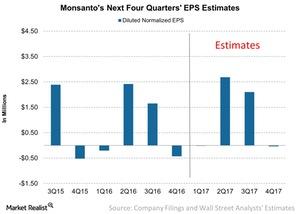

Can Monsanto Report Earnings Growth in Fiscal 1Q17?

For 2017, Wall Street analysts are estimating that Monsanto (MON) could report EPS of $4.70, which would translate into earnings growth of 5.3% year-over-year.

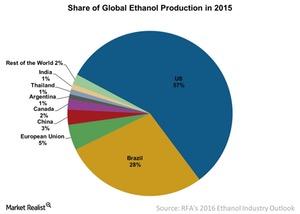

Why the US Ethanol Industry Matters from a Global Perspective

Fossil fuels are non-renewable, and a shortage can wreak havoc on the economy. It was the desire for alternative energy that gave rise to the ethanol industry.

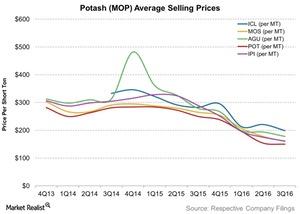

What Do Analysts Recommend for Fertilizer Stocks?

PotashCorp (POT) and Agrium (AGU), which are both awaiting mergers, have a “hold” recommendation with a price target of $17 and $96.8 per share, respectively, over the next 12 months.

At What Valuation Is the Market Investing in Monsanto?

Monsanto’s (MON) forward PE valuation multiple has recently trended higher, and so has the price of its stock.

What Were Potash Companies’ 3Q16 Realized Prices?

Potash’s selling price has been on the decline for the last few quarters and is key to the performances of potash producers (NANR).

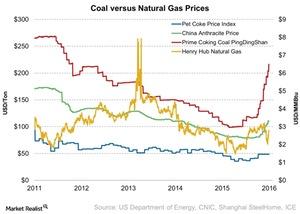

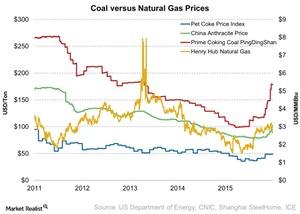

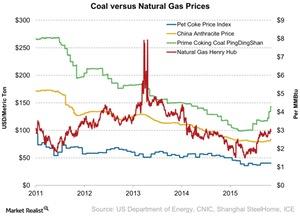

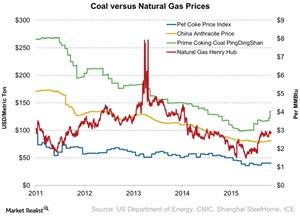

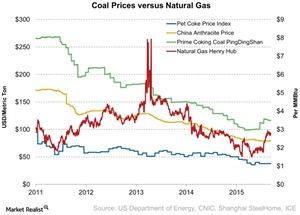

Rising Anthracite Prices Pressure Chinese Fertilizer Producers

Anthracite coal is used to produce nitrogen fertilizers. For the week ending November 18, average weekly anthracite coal prices in China rose 3.8%.

Soybean’s Stock-to-Use Ratio Rose with the Inventory

Unlike corn, the global soybean stock-to-use ratio is lower compared to the global stock-to-use ratio of 26.5% last year.

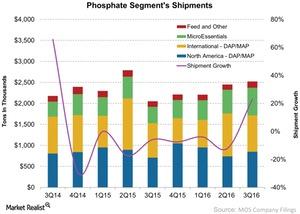

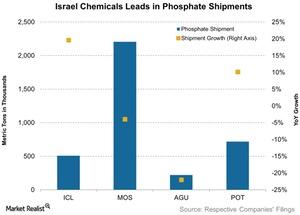

Mosaic’s Phosphate Shipments Will Likely Rise

The Phosphate segment’s shipments rose 23% to ~2.5 million tons from ~2 million tons in 3Q15—compared to guidance of 2.4 million–2.7 million tons.

Fertilizer Update: Are Market Dynamics Changing?

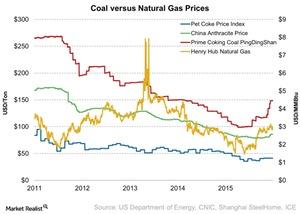

Producers in China primarily use coal as an input material to produce nitrogen, especially urea-based fertilizers. China is the world’s biggest urea exporter.

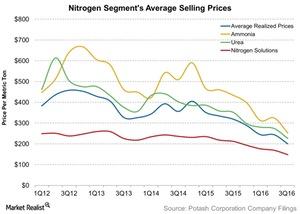

Why Did PotashCorp’s Nitrogen Prices Fall in 3Q16?

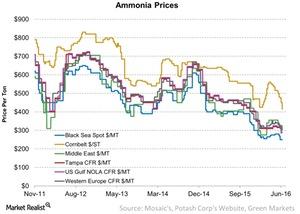

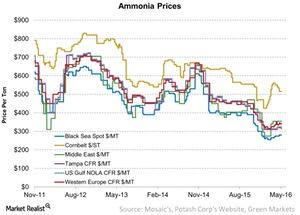

Nitrogen selling prices PotashCorp (POT) sells nitrogen fertilizers such as ammonia, urea, and nitrogen solutions. It competes with other natural gas–based nitrogen producers such as CF Industries (CF) and Terra Nitrogen (TNH), which primarily produce and sell nitrogen fertilizers. Agrium (AGU), which is a part of the PowerShares International Dividend Achievers ETF (PID), produces nitrogen fertilizers […]

Soybean’s Stock-to-Use Ratio Rose in October

The global stock-to-use ratio for soybeans rose 1.6% to ~23.5% in October—compared to 22% in September. Soybean’s ratio is lower than last year.

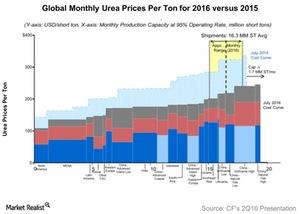

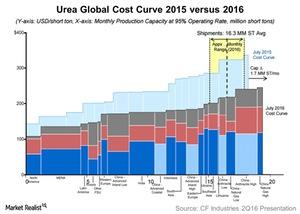

Cost Curves 101: What Nitrogen Investors Must Consider

Demystifying the cost curve Earlier in this series, we saw that prices of nitrogen have fallen over the years, despite its significance in crop growth and feeding the vast population. The lower prices are due to a flatter cost curve, which we’ll explain in this part. Flat cost curve In the chart above, we compare a […]

Coal Prices Remained Flat for the Week Ending October 7

Chinese producers primarily use coal to produce nitrogen, especially urea-based fertilizers, while producers in North America mostly rely on natural gas.

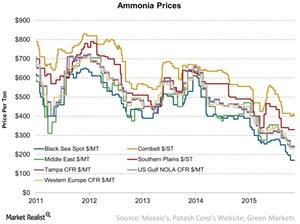

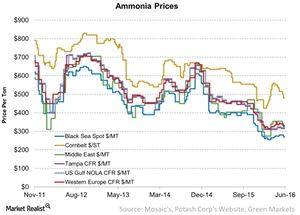

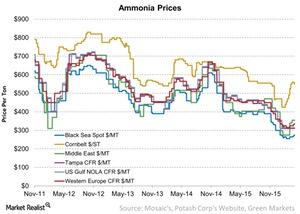

A Look at Ammonia Prices Last Week

The current levels of ammonia prices at several locations are below their comparative levels last year.

Urea Input: Anthracite Coal Prices Rose Last Week in China

Producers in China mainly use coal as an input material to produce nitrogen fertilizers, especially urea. China is impacted by price movements in coal.

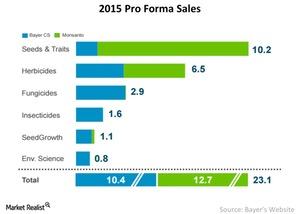

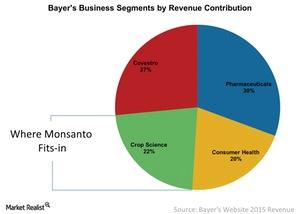

Synergies Monsanto and Bayer Could Exploit through a Merger

Monsanto’s business is the best fit for Bayer’s Crop Science segment—it contributes ~22% of Bayer’s revenue. The segment is similar to Monsanto’s business.

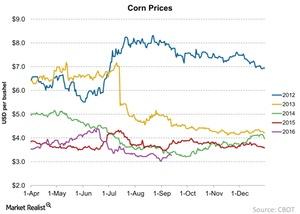

Why Corn Prices Are Still Declining in September

Corn prices on September 12 were 1.6% higher at $3.30 per bushel compared to $3.20 per bushel in August 2016.

Weekly Nitrogen Update: Anthracite Prices Fell in China

For the week ending September 9, average weekly anthracite coal prices in China fell 4.2% to $81.1 per metric ton—compared to the previous week.

Why Nitrogen Prices Have Fallen So Hard this Year

The global nitrogen fertilizer capacity is abundant, allowing it to fulfill the current market requirements. This has put pressure on nitrogen prices, which fell significantly over the past year.

Pet Coke and Coal Prices Moved Sideways Last Week

While most North American producers use natural gas to produce nitrogen fertilizers, CVR Partners (UAN) mainly uses pet coke as a hydrogen source.

Why Have Mosaic’s Potash Shipments Declined?

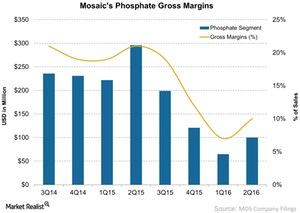

The gross margin rate for Mosaic’s Phosphate segment fell significantly in 2Q16, to 10% from 21% in 2Q15.

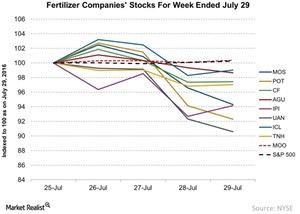

Which Fertilizer Stock Was the Top Loser Due to Price Movements?

Fertilizer prices are one of the key drivers for fertilizer stocks. So investors and analysts watch fertilizer prices closely.

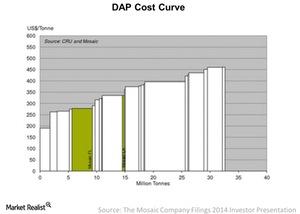

How DAP- and MAP-Producing Countries Stack Up on the Cost Curve

In 2014, the cost of production for DAP per ton ranged from $190 to $450 per metric ton, as we can see in the chart.

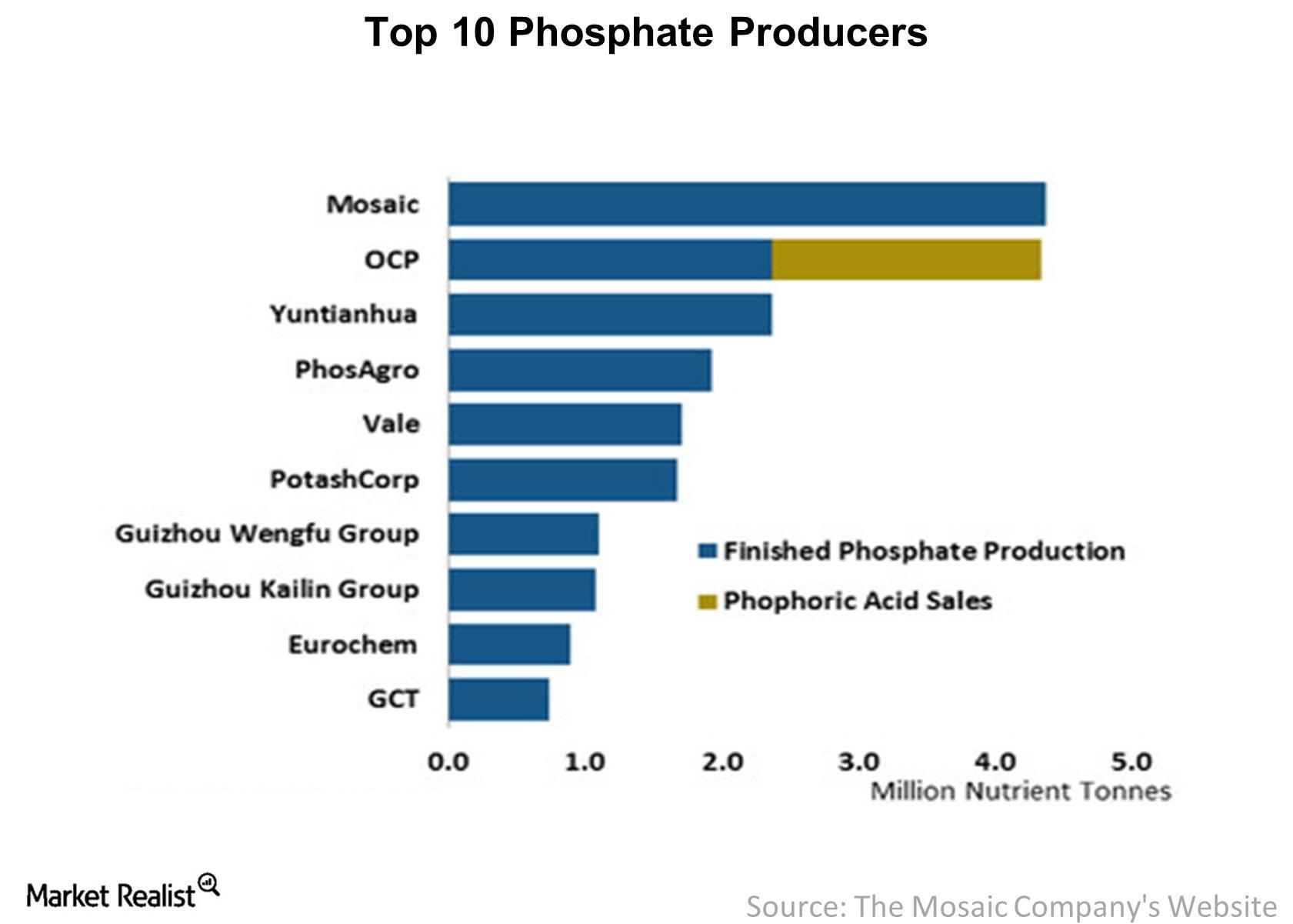

Phosphate Consumption Outlook and Top Producers to Serve the Market

The Mosaic Company (MOS), which acquired CF Industries’s (CF) phosphate business in 2014, is the largest producer of phosphate globally.

How Are Pet Coke, Coal, and Natural Gas Prices Trending?

The petroleum (or pet) coke index remained unchanged from the previous week during the week ending July 22, 2016.

Why Do Ammonia Prices Keep Falling?

Ammonia prices in the Southern Plains had the steepest fall of 10.5% last week, continuing the previous week’s trend.

What Could Explain Soybeans’ Low Stock-to-Use Ratio?

In June 2016, the global soybean stock-to-use ratio stood at 20.2%, which was at its lowest point compared to the past four years.

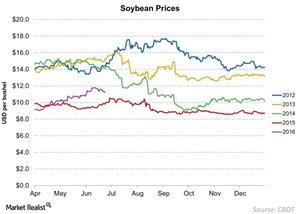

Why Are Soybean Prices Rising?

On June 26, 2016, soybean prices stood at $11 per bushel, compared to ~$10 per bushel on June 26, 2015.

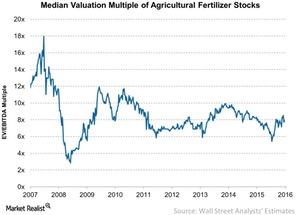

How Do Valuation Multiples Compare among Fertilizer Companies?

To date, the median valuation of fertilizer stocks is around 7.9x. That’s at the midpoint of the nine-year average of 8.2x.

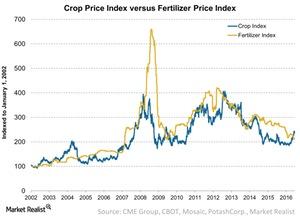

Agricultural Chemical Companies: Crop and Fertilizer Price Impact

Investors in the fertilizer industry (XLB) must actively track the relationship between crop prices and fertilizer prices. This, in turn, impacts agricultural chemical companies.

How Phosphate Shipments Performed in 1Q16

Israel Chemicals, which shipped 0.5 million metric tons during the recent quarter, saw the largest jump in shipment growth—20% year-over-year.

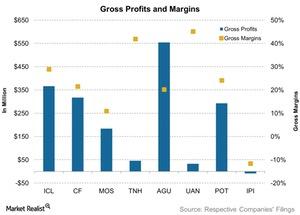

How Fertilizer Companies’ Gross Margins Were Pressured in 1Q16

The fertilizer industry moves in cycles and with most companies experiencing a decline in margins, the industry seems to be in the bottom cycle.

How Did Ammonia Prices Move Last Week?

Last week, nitrogen producers CF Industries (CF), CVR Partners (UAN), Terra Nitrogen (TNH), and PotashCorp (POT) ended in the red.

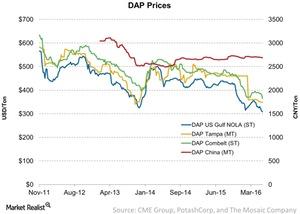

Last Week’s DAP Fertilizer Price Trends: Must-Knows

Ammonia is used to make phosphate fertilizers like DAP (diammonium phosphate) and MAP (monoammonium phosphate).

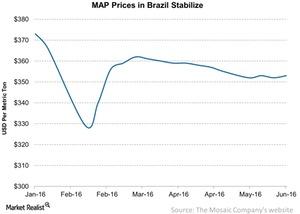

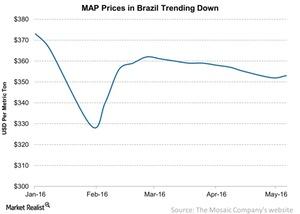

Why MAP Fertilizer Prices Continue to Stabilize

Last, average MAP prices in Brazil inched up to $353 per metric ton from $352 per metric ton the previous week.

Urea Prices: Still a Concern for Nitrogen Fertilizer Stocks

As most global ammonia production is upgrading to urea, ammonia prices may affect urea prices.

Ammonium Phosphate Prices: A Comparison

MAP (monoammonium phosphate) is the second-most used phosphate fertilizer after DAP (diammonium phosphate).

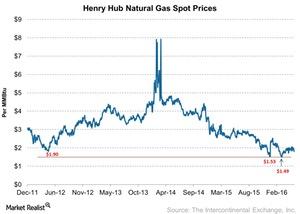

How Do Natural Gas Price Forecasts Impact Fertilizer Companies?

Natural gas is the key raw material for the production of nitrogen fertilizers such as ammonia and urea.

How Monsanto’s Business Fits into Bayer’s Portfolio

What’s in it for Bayer when it comes to acquiring Monsanto (MON)? The answer lies in Bayer’s business segments and geographic reach.

How Did Ammonia Prices Trend Last Week?

Ammonia prices for Tampa CFR (cost and freight) moved down 1.6% to $315 per metric ton compared to $320 per metric ton in the previous week.

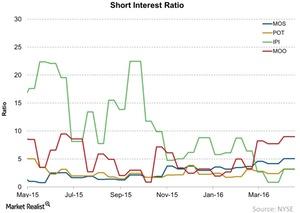

What Intrepid’s Short-Interest Ratio Suggests ahead of 1Q16 Earnings

Over the one-year period, Intrepid Potash’s short-interest ratio had dropped to a low of 0.84%, but more recently, the ratio has gone up to 3.6%.

Ammonia Prices in the International Market Inch Up

In the international market, ammonia at the Black Sea, Ukraine, inched up to $275 per metric ton FOB, a rise of 1.9% from the previous week.

What’s Monsanto’s Outlook for the Next 12 Months?

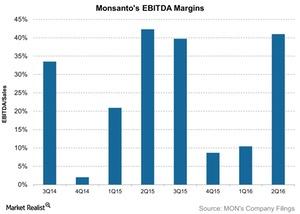

For fiscal 2Q16, Monsanto reported EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.8 billion.

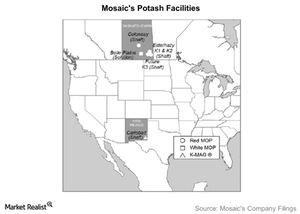

An Overview of Mosaic’s Potash Segment Operations

Mosaic’s Potash segment generated $2.5 billion in net sales, excluding intersegment sales, in 2015. This accounted for 28% of the company’s total net sales.