What Intrepid’s Short-Interest Ratio Suggests ahead of 1Q16 Earnings

Over the one-year period, Intrepid Potash’s short-interest ratio had dropped to a low of 0.84%, but more recently, the ratio has gone up to 3.6%.

April 21 2016, Published 12:20 p.m. ET

Short-interest ratio

The short-interest ratio tells you the market’s sentiment for a company’s stock. This ratio, which is calculated by the number of shares sold short over the outstanding shares in the market, is also known as the float.

IPI’s short interest

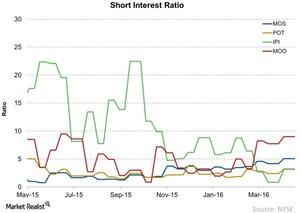

Over the one-year period, Intrepid Potash’s short-interest ratio had dropped to a low of 0.84%, but more recently, the ratio has gone up to 3.6%. When the company’s fundamentals were deteriorating in 2015, investors and traders were bearish, and IPI’s short interest ratio reached a high of 22%. Usually, a ratio higher than 5% is considered a bearish sentiment.

By comparison, Potash Corporation (POT) has a short-interest ratio of 3.2% while Mosaic (MOS) has a short-interest ratio of 5% as of April 19. The sentiment appears to be bearish on broader ETFs such as the VanEck Vectors Agribusiness (MOO), which invests about 30% of its portfolio in agricultural chemical companies like CF Industries (CF). Notably, MOO had a short-interest ratio of 9% as of April 20.

We should also note that when a stock is overvalued and fundamentals do not support the company’s valuation, investors and traders jump to short sell stocks—the opposite of buying stocks. Traders who short sell, make money when the share price decline.

Continue to the next part for a discussion of how IPI’s valuation multiple has evolved.