How Are Pet Coke, Coal, and Natural Gas Prices Trending?

The petroleum (or pet) coke index remained unchanged from the previous week during the week ending July 22, 2016.

July 27 2016, Updated 9:07 a.m. ET

Pet coke

The petroleum (or pet) coke index remained unchanged from the previous week during the week ending July 22, 2016.

While most North American producers use natural gas to produce nitrogen fertilizers, CVR Partners (UAN) mainly uses pet coke, a coal-like substance, as a hydrogen source. China primarily uses coal as a hydrogen source.

Pet coke price index

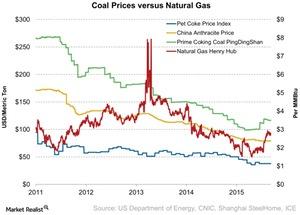

The commodities in the above chart are key hydrogen sources for nitrogen fertilizers. Their price movement affects fertilizer producers’ profitability. In the week ending July 22, 2016, the pet coke index remained unchanged at $37.80 per metric ton, compared to the previous week.

Anthracite coal prices in China were flat week-over-week at $79 per metric ton. Similarly, prime coking coal prices at Pingdingshan stood at an average of $116.6 per metric ton, unchanged from the previous week. However, the Chinese yuan strengthened by 0.05% compared to the US dollar during the week.

Supply-side impact

Earlier, we saw that natural gas prices declined last week. In contrast, prices were flat for coal and pet coke. These conditions are positive for natural-gas-based fertilizer producers such as CF Industries (CF), Terra Nitrogen (TNH), and Agrium (AGU). China is the largest exporter of urea.

Petroleum coke prices have been falling over the years, similar to what’s happened with natural gas. Last week, the price of petroleum coke was ~30% lower than the $53.88 per ton we saw during the same week in 2015. Similarly, coal prices in China have fallen by an average of 7.4% year-over-year.

For broad-based exposure to this industry, investors can consider the iShares Global Materials ETF (MXI). MXI invests 4.5% of its portfolio in agricultural chemical companies such as DuPont (DD).

In the next part of this series, we’ll look at phosphate fertilizer prices.