Adam Jones

I have been writing for Market Realist since 2014. I currently cover the cannabis sector, and I was drawn to the cannabis industry almost two years ago, when it was just emerging. I was fascinated by the variety of applications this single plant can have.

In addition, I like to explore different industries and am particularly interested in discovering good stocks. In the past, I've also covered the agricultural fertilizer and restaurant sectors.

When I'm not writing for Market Realist, I love reading books based on real-life events. I also enjoy reading biographies of people who have inspired the world in some way.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Adam Jones

Domino’s Wants to Entertain You at Its ‘Pizza Theater’

Domino’s plans to have all its stores remodelled according to the Pizza Theater design by the end of fiscal 2017.

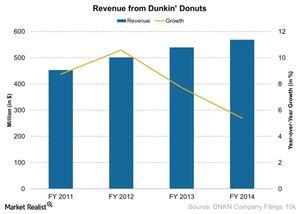

Dunkin’ Donuts’ National and International Sales

Dunkin’ Donuts’ combined revenue from national as well as international units was $569 million in 2014. Of that, $548 million came from the US market alone.

Domino’s Pizza Enjoys the Dual Benefits of Vertical Integration

Because Domino’s Pizza sells dough and ingredients to its own franchises, the company derives dual benefits from the supply chain segment.

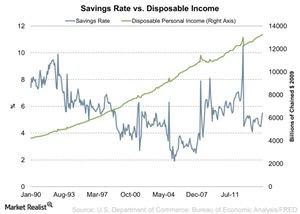

Higher Disposable Income: A Reason for Restaurants to Cheer

Disposable income increased by 40 basis points month-over-month in January. On a YoY (year-over-year) basis, disposable income increased 9.5%.

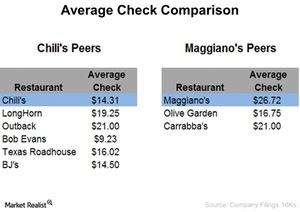

Average Checks at Chili’s and Maggiano’s – Why Do They Matter?

The average check at Chili’s in 2014 was $14.31, lower than its main peers. Maggiano’s average check was $26.72, the highest among its peers.

Domino’s Pizza Relies on its Supply Chain to Get It Right

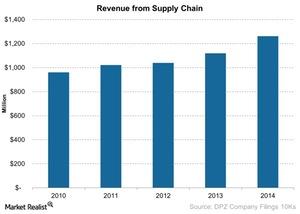

Supply chain segment In terms of revenue, the supply chain is Domino’s Pizza’s (DPZ) most important segment. In fiscal 2014, it contributed 63%, or $1.26 billion, toward the company’s total revenue. Domino’s international master franchises have the right to operate a supply chain in their respective regions. The facilities The supply chain segment consists of the […]

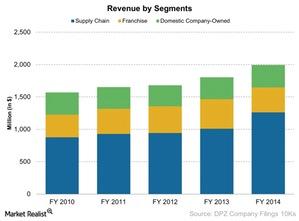

Which of Domino’s Pizza’s Three Business Segments Performs Best?

Of its three main business segments, Domino’s Pizza earns least revenue from its company-owned stores.

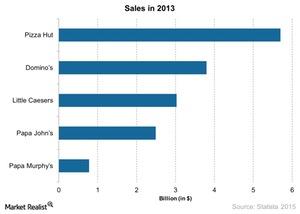

Domino’s: The Second-Largest Pizza Chain in the World

Domino’s (DPZ) is the second-largest pizza chain in the world, with a total of 11,629 restaurant units. Its total system sales in 2013 were $3.8 billion.

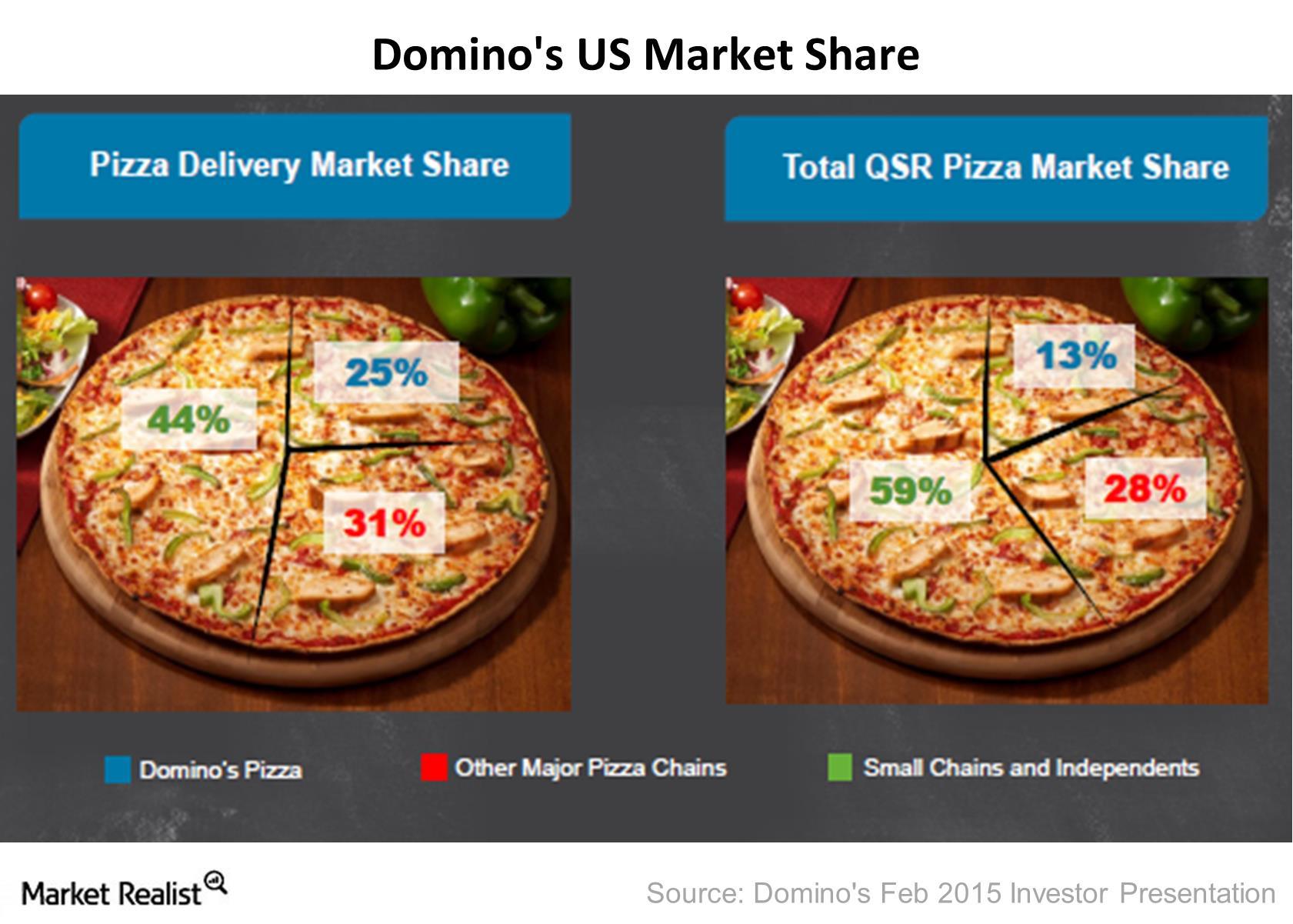

Domino’s Pizza: Serving 1.5 million Pies a Day

Domino’s Pizza had a 13% market share of the quick service restaurant industry in the US as of December 2014.

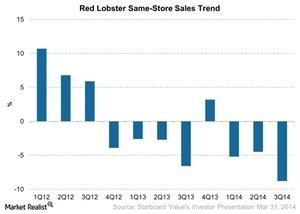

Why Darden Restaurants Sold Red Lobster

Activist investor Starboard Value opposed Red Lobster’s sale, stating that Darden management could do more to turn the undervalued brand around.

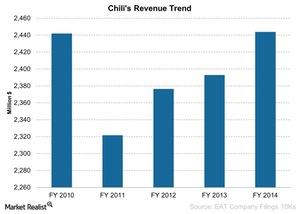

Why Chili’s Matters the Most to Brinker International

Chili’s is the most important restaurant under the Brinker (EAT) umbrella. Chili’s contributed 86%, or $2,443 million, to the company’s sales in 2014.

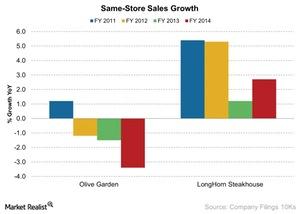

Olive Garden and LongHorn Steakhouse’s Same-Store Sales Growth

LongHorn Steakhouse’s same-store sales increased to 2.7% in 2014 year-over-year from 1.2% in 2013. This is lower compared to fiscal 2012 and fiscal 2011.

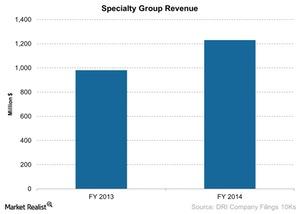

Darden’s Specialty Restaurant Group: The Capital Grille

As of fiscal 2014, revenue from Specialty Restaurant Group was $1,230 million, or 19.5% of the total revenue for Darden Restaurants.

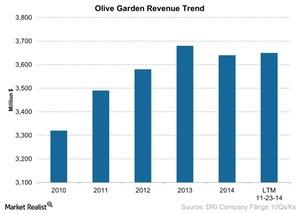

Olive Garden: Darden’s Most Important Brand

In 2014, Olive Garden contributed about 58% to Darden’s revenues as of fiscal 2014. Olive Garden gained importance after Darden sold Red Lobster in 2014.

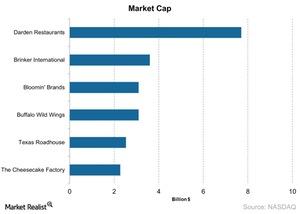

Business Overview of Darden Restaurants

As of 2014, Darden Restaurants owned 1,520 restaurants, excluding more than 700 Red Lobster locations.

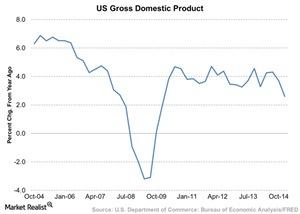

Why US Gross Domestic Product Growth Impacts Restaurants

The restaurant industry is part of the consumer discretionary sector. This sector does well when the economy is expanding.

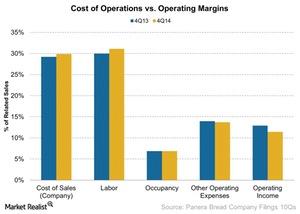

Panera Bread’s Cost Of Operations – Food Inflation And Labor

Labor expenses increased by 1.15% to 31.11% as a percentage of related sales from last year. The increase affected the company’s bakery operating margins.

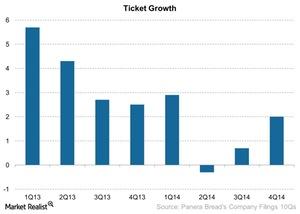

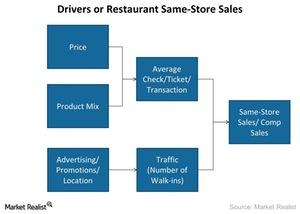

Panera Bread’s Traffic And Ticket Impact Same-Store Sales Growth

Traffic is the increase in the number of customers that visit the stores and make a transaction or purchase. Panera Bread’s traffic grew 1.3%.

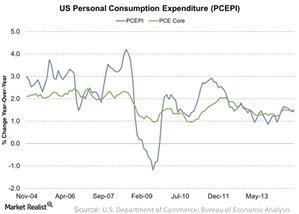

How Inflation Impacts The Restaurant Industry

Low inflation means low interest rates. This makes it affordable for restaurants to borrow and expand units.

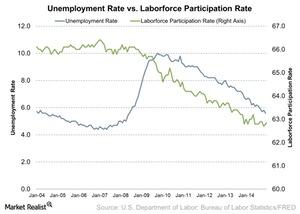

How Unemployment Rate, Labor Participation Affect Restaurants

The unemployment rate for December 2014 was 5.6%, showing a month-over-month decrease from 5.8% in November.

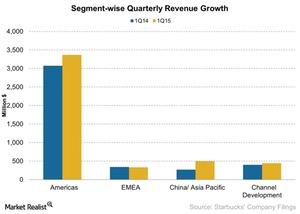

Starbucks China and Asia-Pacific Segment Reports Record Sales

The Starbucks China and Asia-Pacific segment grew 85% to $495 million, up from $266 million year-over-year.

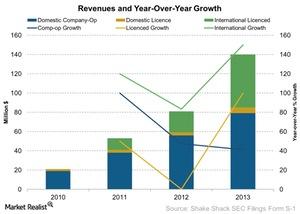

Where Does Shake Shack Get Its Revenue Sources?

Domestic means all of the restaurants in Shake Shack’s domestic market—the US. Revenue from this segment was $78.5 million in 2013.

Why Should You Care About Shake Shack’s AUV?

Shake Shack (SHAK) calculates its AUV (average unit volume) by dividing the total company-operated sales by the total company-operated units.

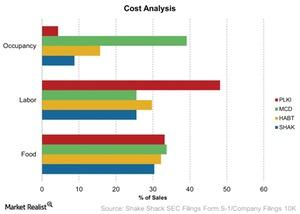

Understanding Shake Shack’s Three Key Costs

We’ve looked at Shake Shack’s (SHAK) revenues and drivers. It’s also important to understand how the company has been managing its key costs.

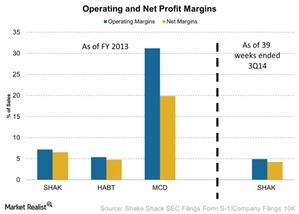

Analyzing Shake Shack’s Profitability

We’ll look at Shake Shack’s profitability in terms of its operating and net profit margins. In 2013, it had an operating profit of $5.9 million.

Starbucks Strategically Targets Its Teavana Business

By opening Teavana Fine Teas and Tea Bars, Starbucks has shown how it’s focused on generating revenues from relevant products.

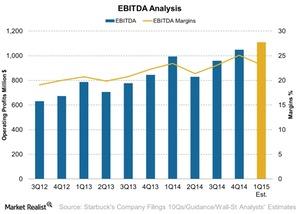

An Analysis Of Starbucks’s EBITDA

Starbucks’s EBITDA is lowest in second quarters, which shows the seasonality of the business. Adverse weather conditions can also affect EBITDA.

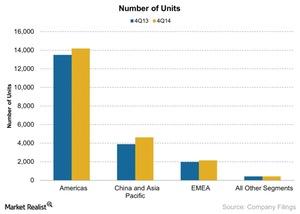

Starbucks’s Geographic Segment Update

The following are Starbucks’s geographic segments: Americas; China and Asia Pacific; and Europe, the Middle East, and Africa.

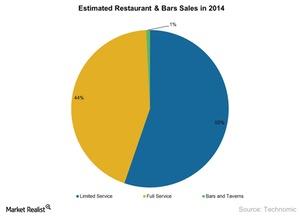

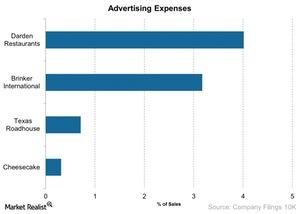

An overview of the US restaurant industry

Consumer confidence in the United States is at an all-time high in seven years, and people are spending more on food prepared outside the home.

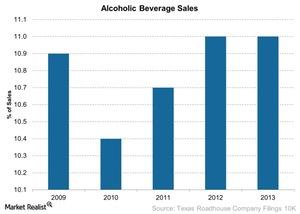

Pivotal Government Regulations That Affect Texas Roadhouse

In addition to the factors we’ve discussed, regulations can also affect the company’s profits. Let’s look at some of the regulations that apply to TXRH.

Understanding Texas Roadhouse’s Marketing Approach

A company can increase its marketing and promotional activities to bring in more customers and obtain operating leverage.

Why Texas Roadhouse Increased Its Menu Prices

The company increased its menu prices by 1.5% in early December of 2013, and in 2012, it increased menu prices by 2.2%.

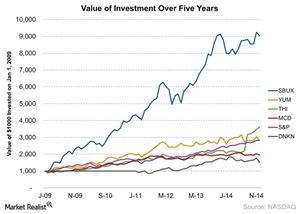

Starbucks’ 5-Year Stock Performance

Now, we’ll discuss SBUX’s stock performance over the past few years. SBUX returned $9,037 on $1,000 invested on January 1, 2009. The fourth quarter earnings announcement is approaching.

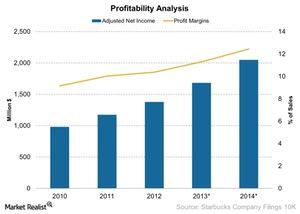

Starbucks’ Net Profit Margins Improve Over 5 Years

SBUX’s net income and net profit margins have been on an uptrend since 2010. At the end of fiscal year 2014, SBUX’s adjusted net income was $2.05 billion.

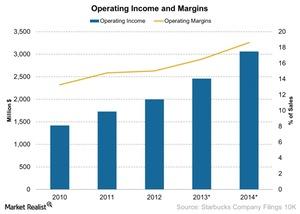

Starbucks’ Operating Profit Margin Increases

At the end of fiscal year 2014, SBUX’s operating income was $3.1 billion. Its operating profit margins increased to 19% in 2014—compared to 17% in 2013.

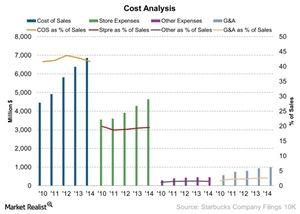

Starbucks’ Key Operating Costs

SBUX wants to grow sales. It’s also important to manage the operating costs. In this part of the series, we’ll take a look at four key operating costs.

A Closer Look At Texas Roadhouse’s Steak-Focused Menu

In the last part of this series, we briefly covered Texas Roadhouse’s (TXRH) steak-focused menu. Let’s look at it in more detail in this article.

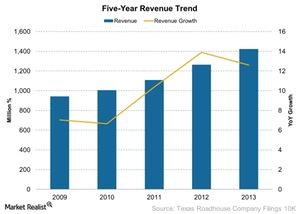

A Must-Read Business Overview Of Texas Roadhouse

In this overview of Texas Roadhouse, we’ll look at the company’s financial performance, value drivers, competition, unit growth, and other key information.

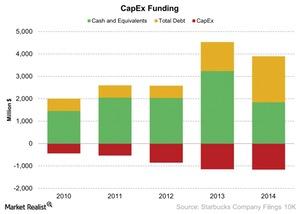

Starbucks Is Expanding By Taking On Debt

SBUX’s total debt increased from $1.3 billion to $2 billion. It issued long-term debts in 4Q13 and 1Q14. This increased the interest expense by $36 million.

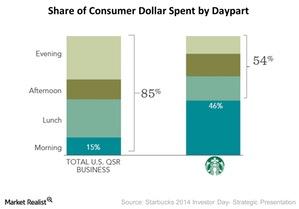

Starbucks Is Expanding Dayparts To Grow Sales

SBUX is also expanding its offerings in different dayparts. The expanded offerings cater to a wider customer base. They increase the wallet share.

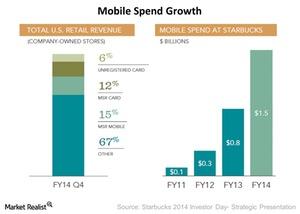

Analyzing Starbucks’ Successful Mobile Ecosystem

Once the card is registered on the Starbucks (SBUX) website, the data is available on other ecosystems—for example, a mobile app. It helps a customer keep track of rewards.

Starbucks Gets Help From Its Rewards Program

One of the ways a customer can become a My Starbucks Rewards member is by using the My Starbucks Rewards card. The card is available at the checkout counter.

Starbucks Has Seven Growth Strategies

SBUX recognizes its limitation in attracting customers. As a result, SBUX is exploring other growth strategies. It’s looking at other beverage businesses.

A Business Overview Of Starbucks Corporation

Starbucks Corporation (SBUX) is a limited-service café. It operates more than 20,000 restaurants across 65 countries around the world. It employs more than 191,000 people.

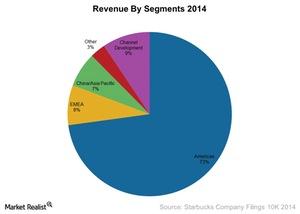

Why The Americas Segment Is Important For Starbucks

The America’s segment includes revenues mainly from the US, Mexico, and Canada. This segment accounted for 73% of SBUX’s revenues in 2014.

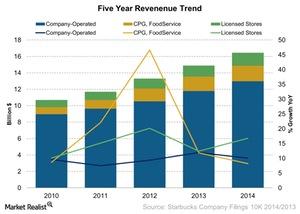

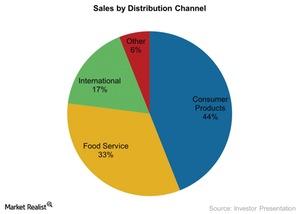

Starbucks’ Coffee Has Three Revenue Sources

Consumer packaged goods, or CPG, include the sale of SBUX’s coffee and tea-related products—like single-serve tea and coffee products. It also includes several beverages at retail stores.

McDonald’s List Of Initiatives That Will Bring A Turnaround

McDonald’s list of initiatives includes simplifying its menu and possibly offering locally relevant menu items. This could be quite a gamble.

The Long List Of Tyson Foods Customers

Tyson Foods customers are a diversified lot. They’re spread across 130 countries. Only Wal-Mart represented more than 10% of the company’s 2014 sales.

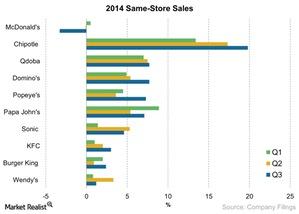

McDonald’s Says “Strong Competitive Activity” Impacting Sales

According to McDonald’s management, “strong competitive activity” is affecting its sales. Other fast food chains don’t seem to be feeling the competition.

The Vast Expanse Of The Tyson Foods Product Portfolio

The Tyson Foods product portfolio includes a variety of products such as value-added chicken, beef, and pork, pepperoni, pizza crusts, and much more.