Why Should You Care About Shake Shack’s AUV?

Shake Shack (SHAK) calculates its AUV (average unit volume) by dividing the total company-operated sales by the total company-operated units.

Feb. 2 2015, Updated 10:28 a.m. ET

What’s AUV?

Shake Shack (SHAK) calculates its AUV (average unit volume) by dividing the total company-operated sales by the total company-operated units. AUV helps restaurants—like Shake Shack, McDonald’s (MCD), The Habit (HABT), Yum! Brands (YUM), and Popeye’s (PLKI)—monitor how new company stores performed. Many of the companies are part of the Consumer Discretionary Select Sector SPDR (XLY).

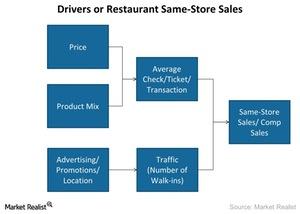

AUV is a result of traffic and ticket. “Traffic” means the number of customer walk-ins. “Ticket” means customers’ average transaction per visit. When AUV growth is greater than same-store sales growth, it often indicates that the new units are more profitable than the existing ones.

Shake Shack divides its AUV into three sub categories—Manhattan stores, non-Manhattan stores, and international stores.

Manhattan stores have higher AUV

At the end of fiscal year 2013, Manhattan stores had an AUV of $7.3 million—compared to $7 million in 2012. This was significantly higher than the AUV at non-Manhattan stores. Non-Manhattan stores had an AUV of $3.84 million in 2013. It increased from $3.79 million. The higher AUV in Manhattan is due to the higher population density in the area. The higher population density led to a higher customer count.

Management also stated that going forward, the company will add units outside Manhattan. This means that the overall AUV will be lower. The company expects it to be $2.8–$3.2 million.

Shake Shack plans to grow locations near high-density places—like tourist attractions, parks, schools, museums, and hospitals.

On the international front, AUV declined significantly to $6 million in 2013—compared to $9.6 million in 2012.

The payback period is the amount of time it takes to recover the initial investment. The payback period is 1.2 years for Manhattan locations. It’s 3.2 years for non-Manhattan locations.

In the next part of this series, we’ll discuss unit growth. Management stated that unit growth will bring in future revenue growth.