Habit Restaurants Inc

Latest Habit Restaurants Inc News and Updates

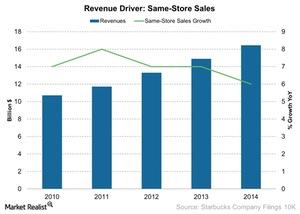

Starbucks’ Same-Store Sales Growth Is Declining

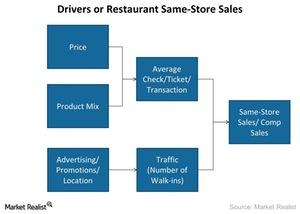

Same-store sales indicate the sales at the existing location over a period of time—usually one year. Same-store sales are driven by traffic and ticket.

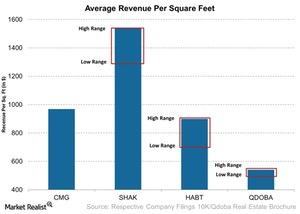

Chipotle’s Revenue Per Square Foot: Two Times More than Qdoba’s

Chipotle’s average restaurant size is about 2,550 square feet. With an average restaurant volume of $2.4 million, the revenue per square foot comes to $969.

Why Should You Care About Shake Shack’s AUV?

Shake Shack (SHAK) calculates its AUV (average unit volume) by dividing the total company-operated sales by the total company-operated units.

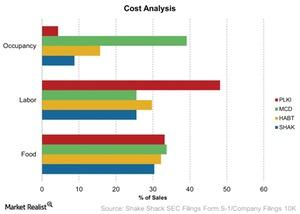

Understanding Shake Shack’s Three Key Costs

We’ve looked at Shake Shack’s (SHAK) revenues and drivers. It’s also important to understand how the company has been managing its key costs.

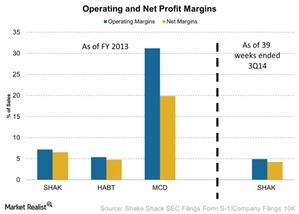

Analyzing Shake Shack’s Profitability

We’ll look at Shake Shack’s profitability in terms of its operating and net profit margins. In 2013, it had an operating profit of $5.9 million.