McDonald's Corp

Latest McDonald's Corp News and Updates

McDonald's CEO Chris Kempczinski Isn't Hurting Financially as Layoffs Begin

As president and CEO of McDonald’s, Chris Kempczinski is by far the highest-paid employee at the company. What's his net worth amid company layoffs?

McFlation Impacts McDonald's — Big Mac Prices Going Up Around the World

Faced with inflation and rising operational prices, McDonald's has raised prices across the menu with Big Mac prices going up more than 20 percent.

Kentucky Residents Will Be Able to Get Krispy Kreme Doughnuts at McDonald's

Starting on March 21, 2023, many Kentucky residents will be able to get a Krispy Kreme doughnut to go with their McDonald’s coffee.

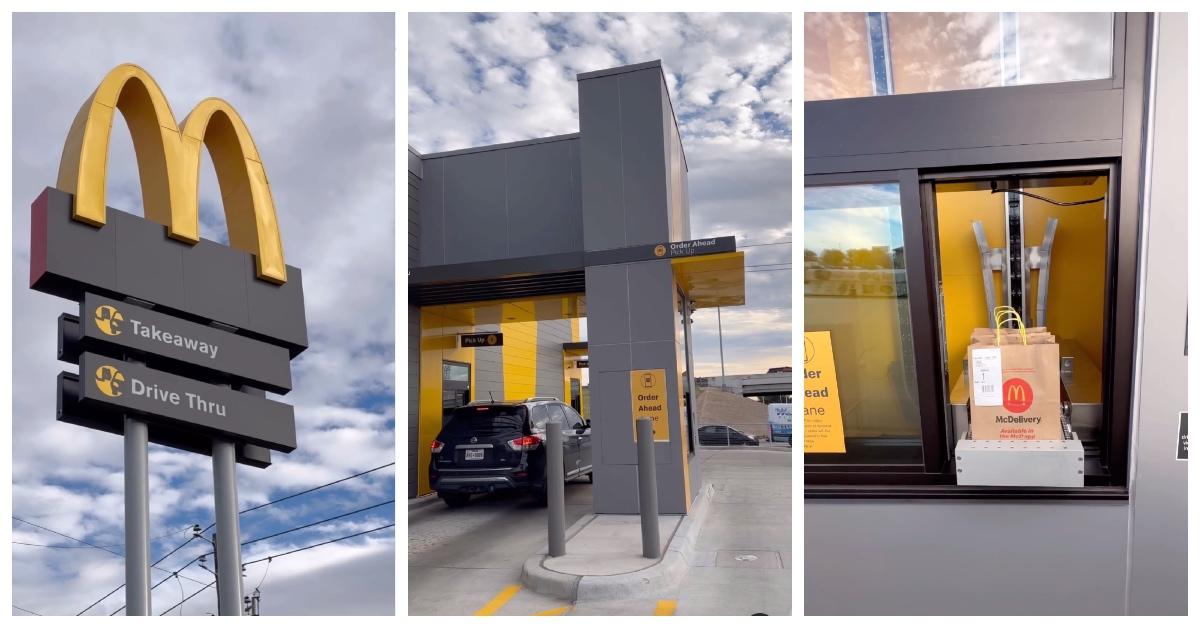

TikToker Shows Off McDonald’s Vending Machine Drive-Thru Concept

Say bye to the traditional drive-thru at McDonald’s and say hello to its vending machine drive-thru concept. TikToker tours a new McDonald's location.

McDonald's Worker Says Parents Shouldn't Make Kids Buy Their Own Food

A McDonald’s worker recently took to TikTok to share her thoughts on an issue she sees play out regularly — parents making their kids pay for their own meals.

How to Play McDonald’s Monopoly for Free and Maybe Win Cash

McDonald's Monopoly game event begins on September 7, 2022, and runs through October 18, 2022. This year, McDonald's is giving away £100k, a MINI electric car, and free food.

California’s FAST Act — Why McDonald’s and Other Food Chains Hate It

McDonald’s is fighting a proposed bill in California targeting fast food chains. What is the FAST Act? Let's see why McDonald's isn't a fan.

McDonald’s Is Losing Millions of Dollars, Will Close Permanently in Russia

In March, McDonald's decided to temporarily close its Russian restaurants, and it has been losing money since then. Now, the company announced plans to permanently exit Russia.

Steve Easterbrook’s Relationships Resulted in Him Losing Millions

Former McDonald's CEO Steve Easterbrook was fired in 2019, but new details later surfaced about his relationships with employees. McDonald's sued him for severance money.

Steve Easterbrook Pays McDonald’s $105M, His Net Worth Suffers

Steve Easterbrook was forced to repay McDonald's $105 million after he engaged in a consensual relationship with another employee. What's his net worth?

McDonald’s Will Be Giving Away a Limited Edition McRib NFT via Twitter

The McDonald’s McRib NFT is being created in celebration of the McRib’s 40th anniversary. Here are all the details.

McDonald’s Is Giving Educators Free Breakfast to Honor Them

McDonald’s is offering free breakfast to U.S. educators this week as a way to thank these “everyday heroes.”

McDonald Brothers Had 'No Regrets' About Selling the Chain for $2.7M

Why did the McDonald brothers sell the McDonald’s chain in 1961? Read about Richard and Maurice McDonald’s $2.7-million deal with Ray Kroc.

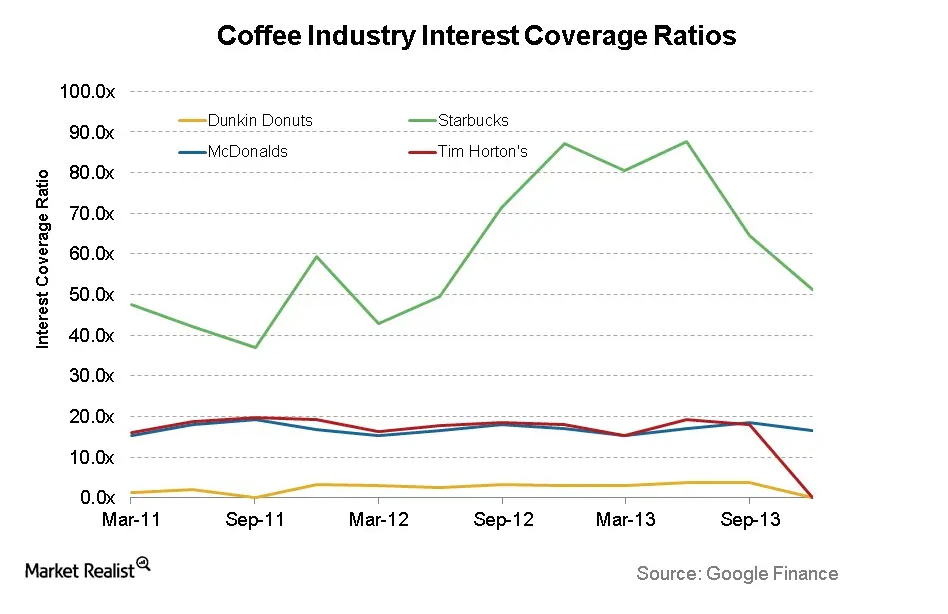

Opportunities and risks that Dunkin’ Brands investors must know

It’s no big secret that Dunkin’ Donuts has the highest relative leverage in the industry. Leverage comes with a number of risks— a substantial risk is the interest paid on debt.

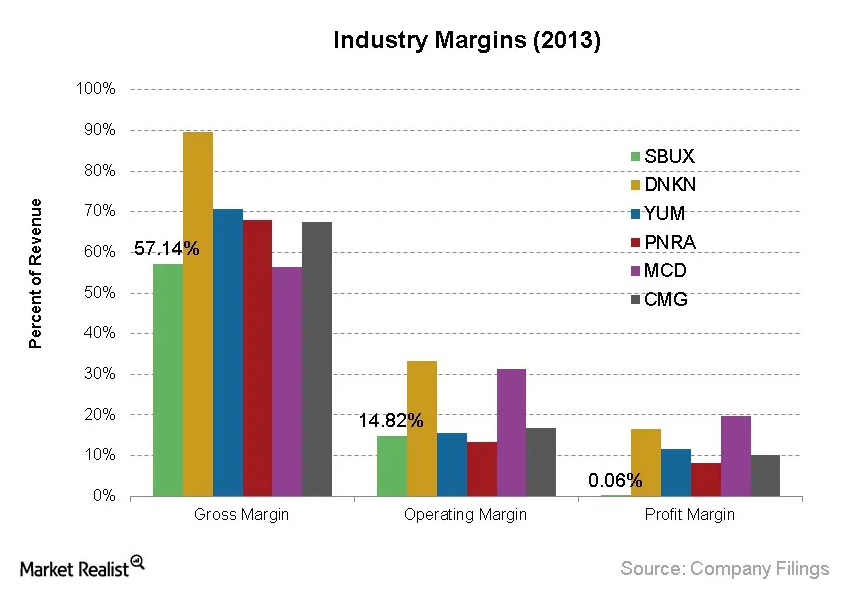

Understanding Starbucks’ cost structure and operating expenses

Starbucks’ main cost driver is its price per pound of coffee beans. The two most consumed coffee beans are Arabica and Robusta blends.

Why Chipotle Has A Lot Of Room For Unit Growth

Unit growth isn’t the only factor that drives revenue. A restaurant can keep adding more restaurants. Eventually, it can capture newer markets. This is what Chipotle is doing.

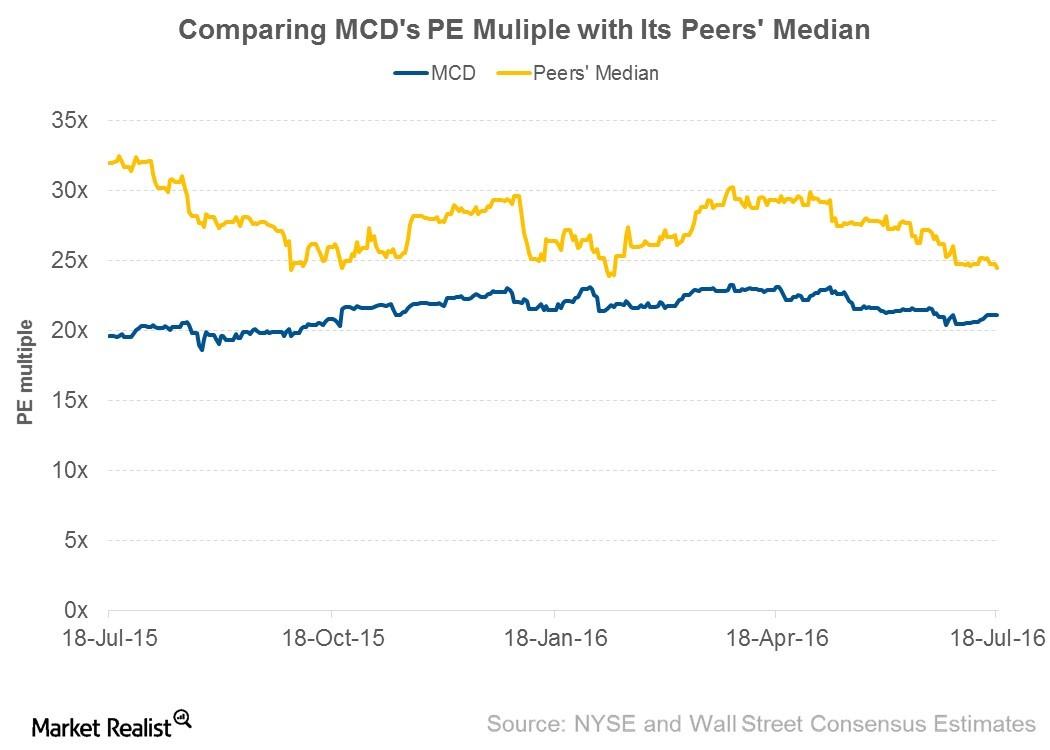

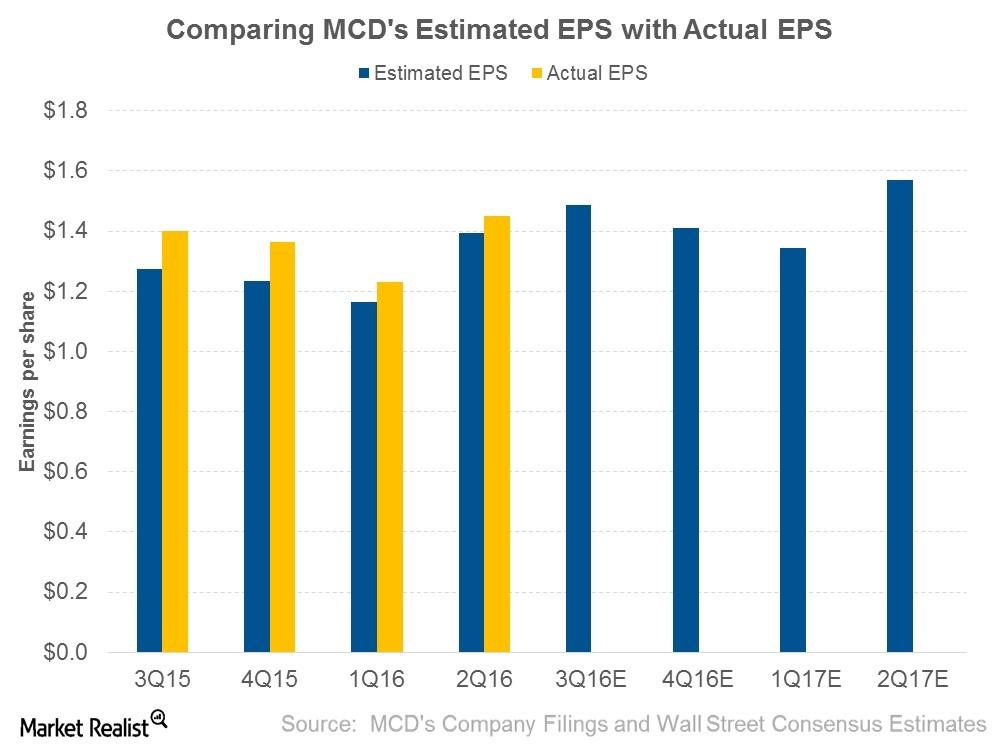

Can 2Q16 Results Drive McDonald’s Valuation Multiple Up?

Valuation multiple Investors should look at valuation multiples when deciding whether to enter or exit a stock. Valuation multiples are driven by perceived growth, risk and uncertainties, and investors’ willingness to pay for a stock. There are various multiples to evaluate a stock. In this article, we’ll use the PE (price-to-earnings) ratio due to its […]

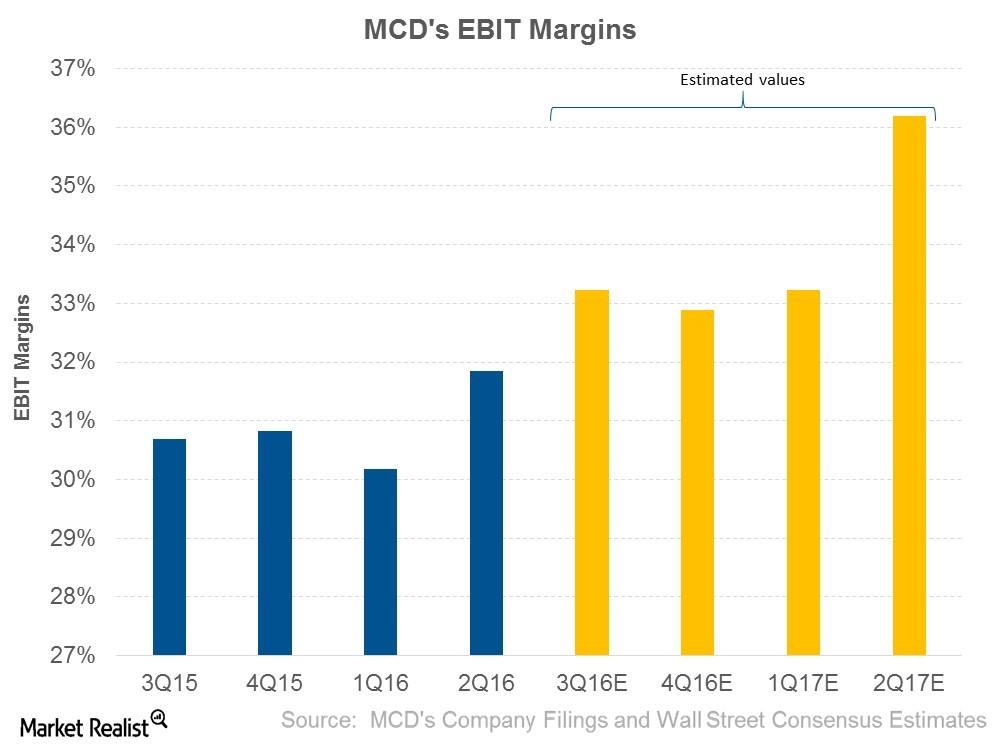

How Will McDonald’s Expand Its EBIT Margins?

Wall Street analysts are expecting McDonald’s (MCD) to post EBIT of $2.1 billion in 3Q16. This represents an EBIT margin of 33.2% compared to 30.7% in 3Q15.

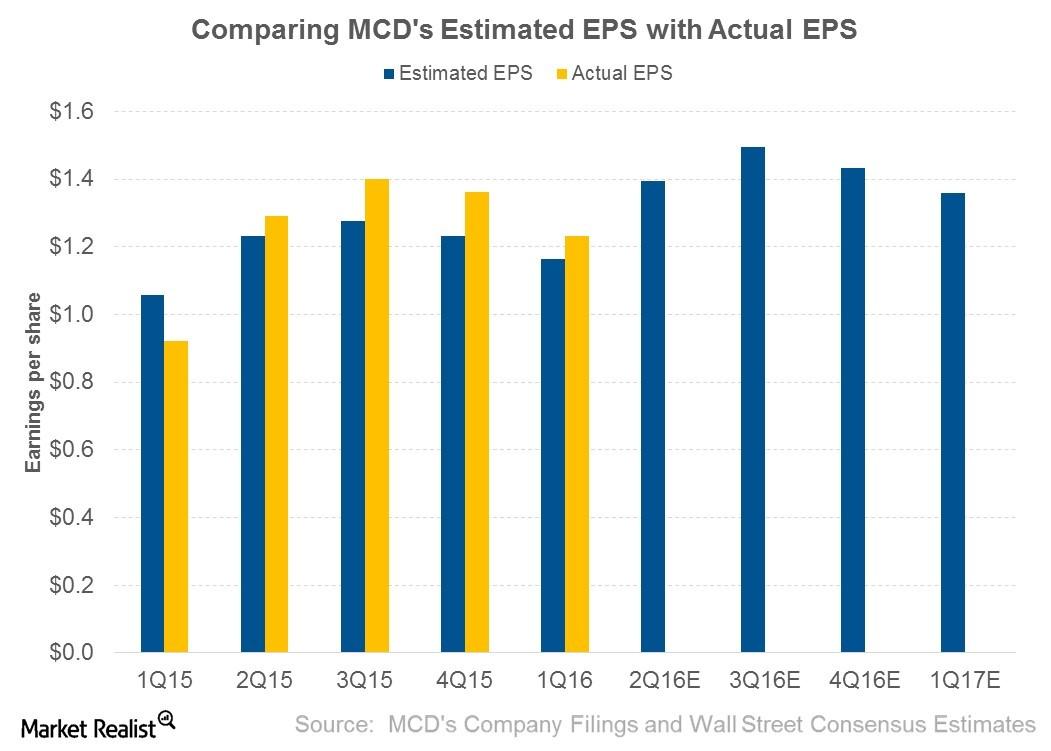

Will McDonald’s 2Q16 Earnings Beat Analysts’ Estimates?

So far in this series, we’ve discussed McDonald’s (MCD) estimated revenue, sources of revenue, and estimated EBIT (earnings before interest and tax) margins.

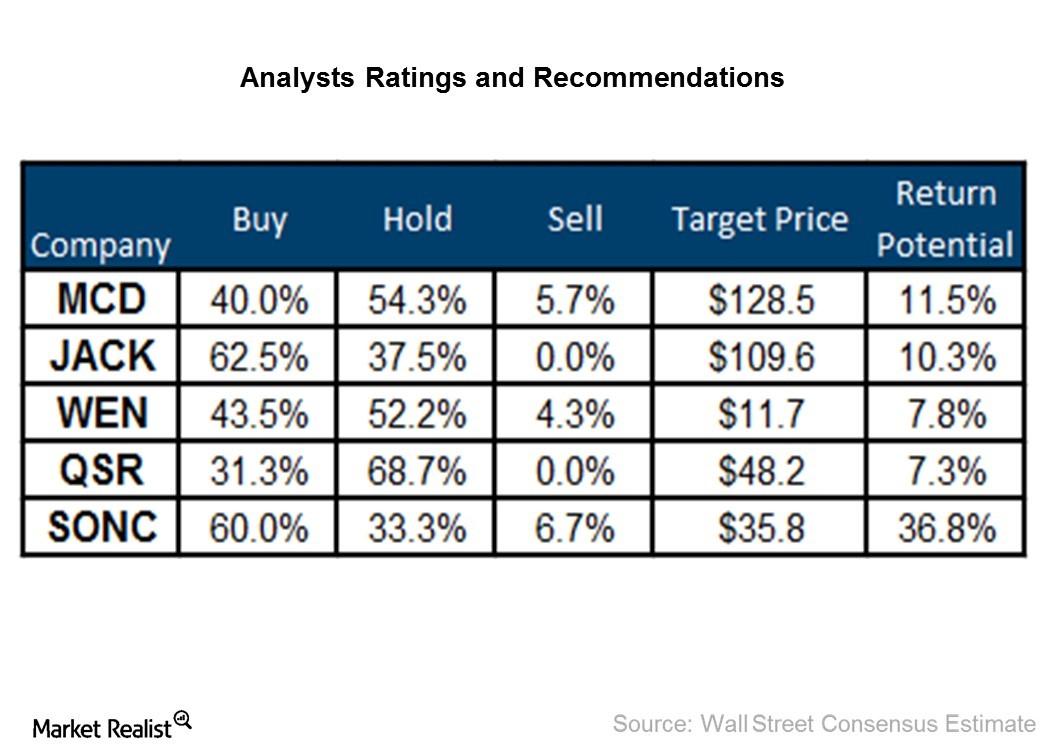

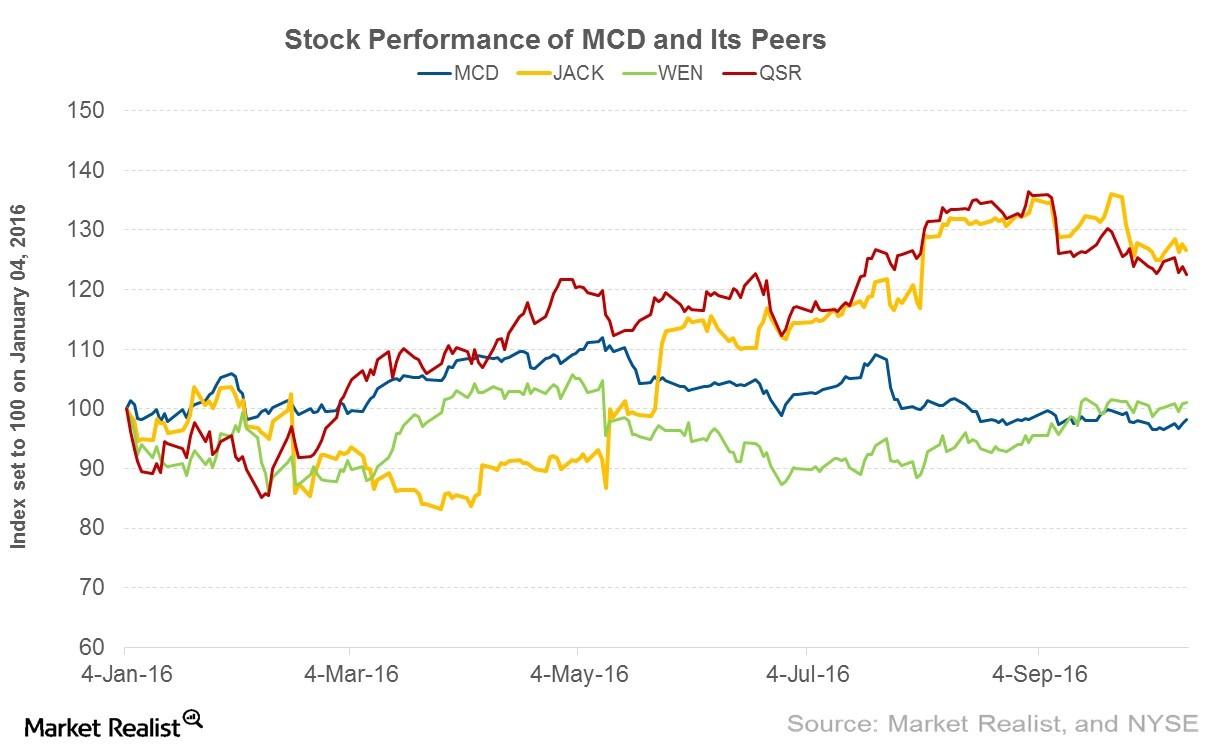

Which Fast Food Restaurants Do Analysts Favor?

Jack in the Box (JACK) and Restaurant Brands International (QSR) are analysts’ favorites among the companies we’ve reviewed in this series.

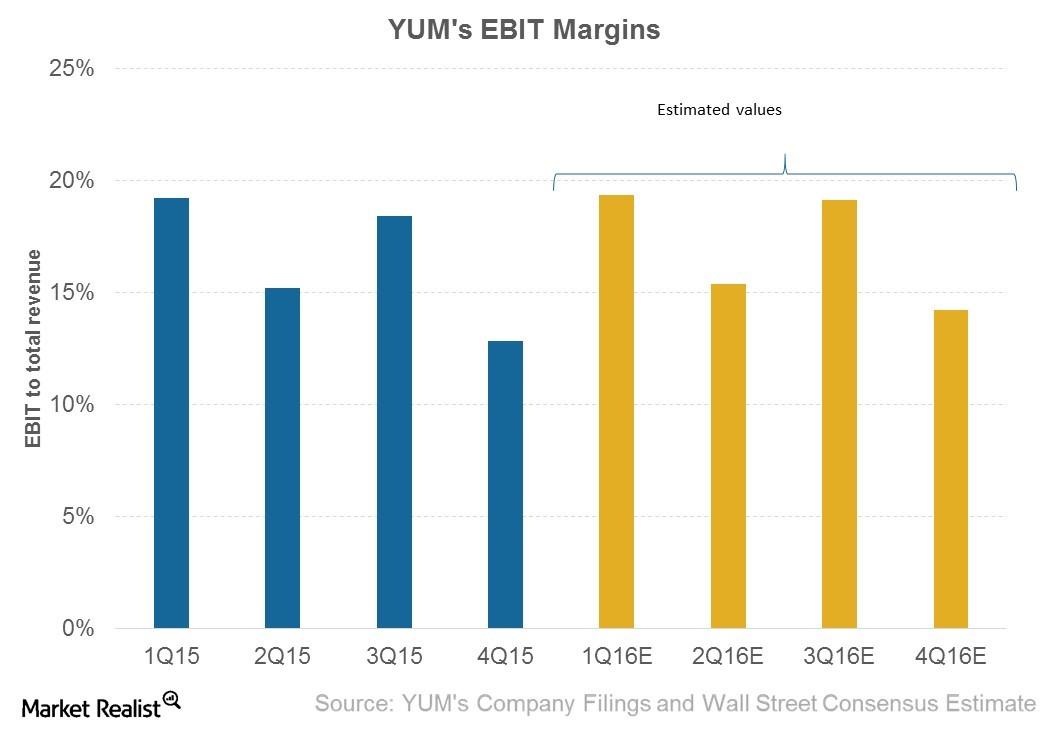

Could Yum! Brands’ Margins Increase in 1Q16?

With positive same-store sales growth expected in all three of YUM’s divisions, analysts are expecting the leverage to improve the company’s margins.

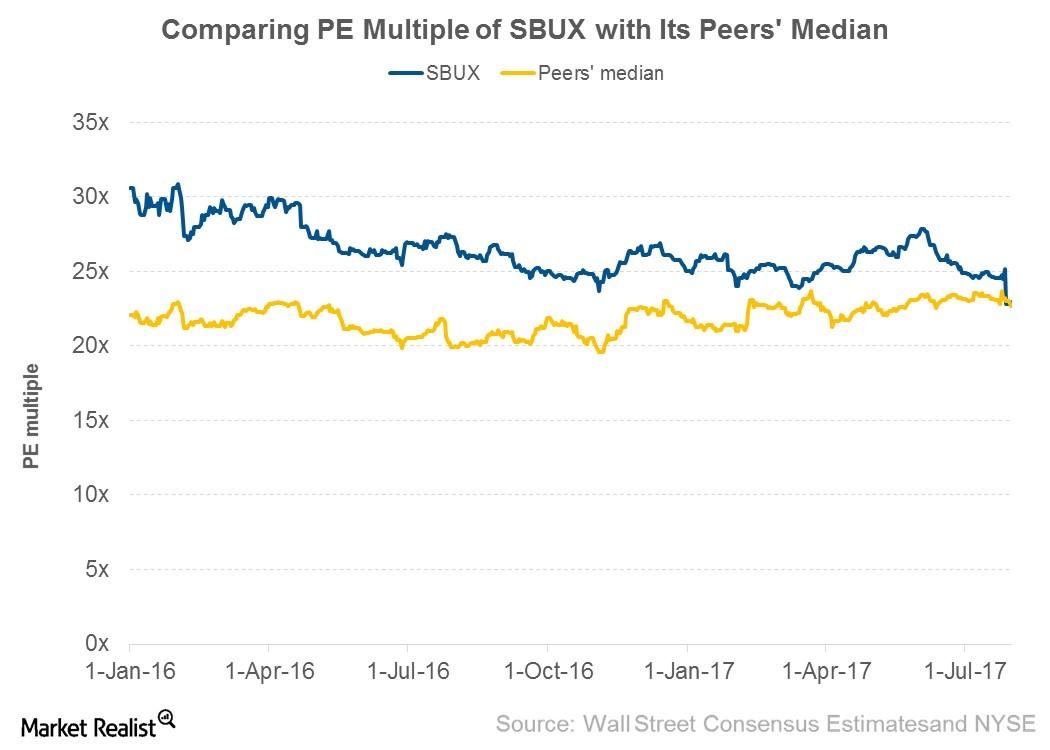

Weak Fiscal 3Q17 Sales Lower Starbucks’s Valuation Multiple

Valuation multiple We’ve used the forward PE (price-to-earnings) multiple for our analysis, due to its high visibility in Starbucks’s (SBUX) earnings. The forward PE multiple is calculated by dividing a company’s stock price by analysts’ earnings estimates for the next four quarters. Starbucks’s forward PE multiple Starbucks’ lower-than-expected SSSG (same-store sales growth) in fiscal 3Q17, lowering of […]

Can Investors Expect Momentum from McDonald’s 3Q16 Earnings?

McDonald’s (MCD) is scheduled to announce its 3Q16 results on October 21, 2016. As of October 13, 2016, it was trading at $115.40, a fall of 9.4% from July 25.

Can McDonald’s Beat Analysts’ Earnings Estimates Again in 3Q16?

In the last four quarters, McDonald’s has beaten analysts’ estimates. In 3Q16, analysts are expecting the company to post EPS of $1.48, a year-over-year rise of 6.1%.

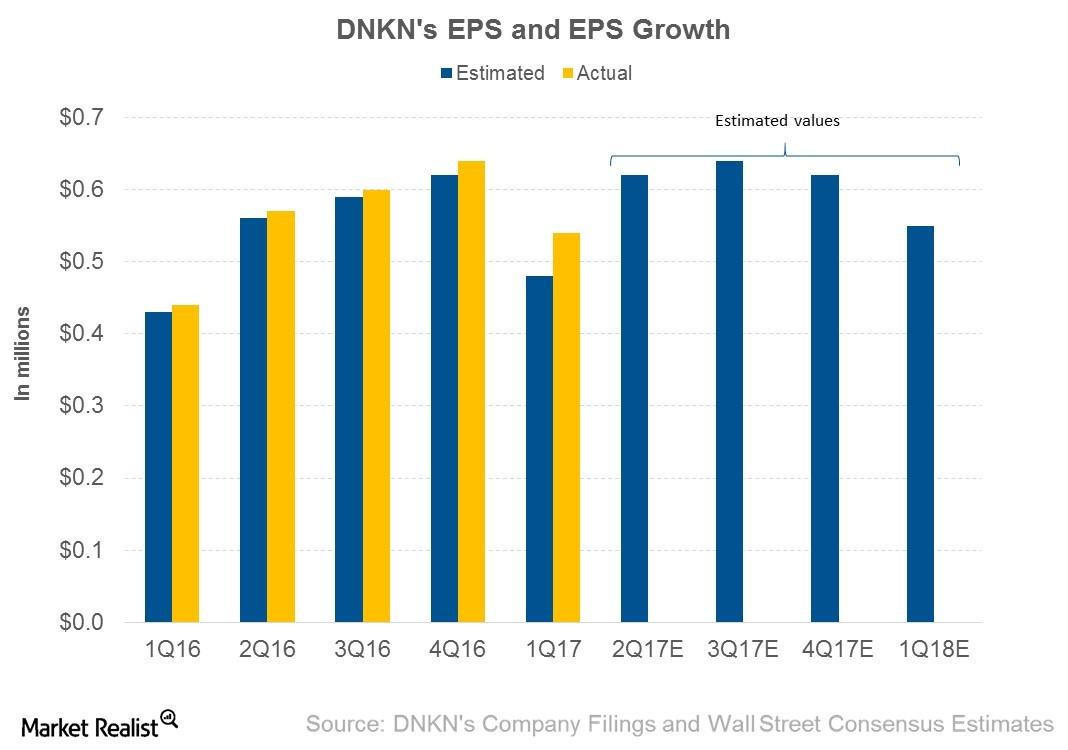

What Will Drive Dunkin’ Brands’ 2Q17 Earnings?

In 2Q17, analysts expect Dunkin’ Brands (DNKN) to post EPS (earnings per share) of $0.62, which represents a rise of 8.8% from its EPS of $0.57 in 2Q16.

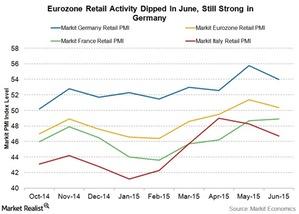

Eurozone Retail Activity Dipped In June, HEDJ Down 2.32%

The Eurozone’s Retail PMI (purchasing managers’ index) dipped to 50.4 in June from the 51.4 recorded in May.

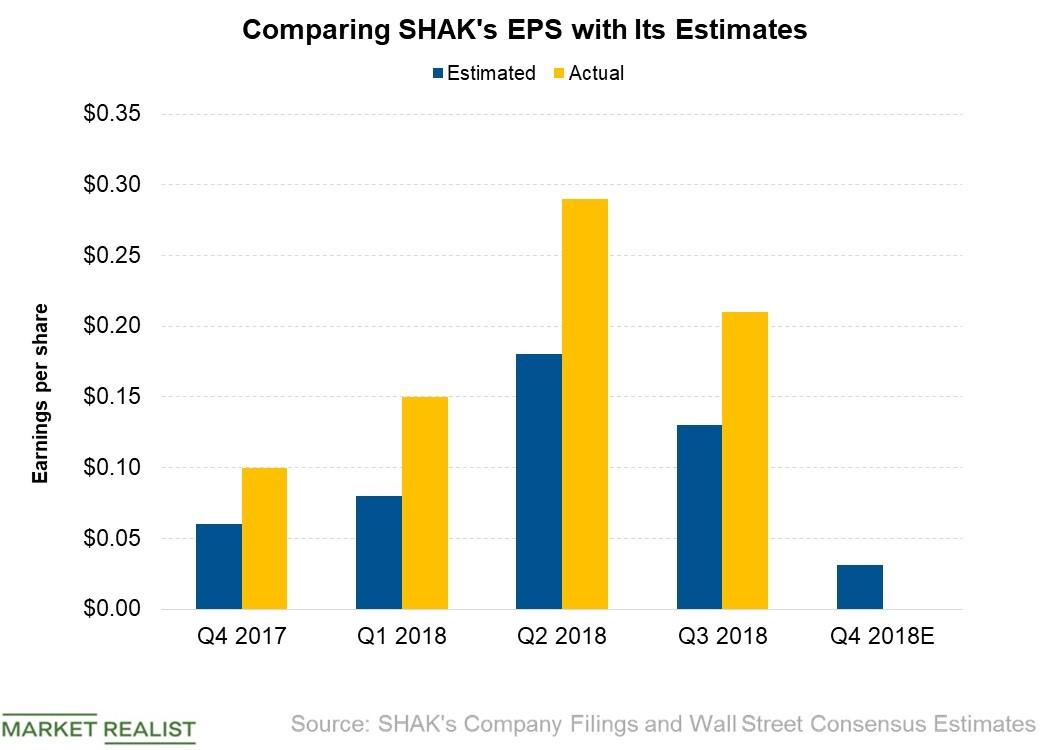

Why Analysts Expect Shake Shack’s EPS to Fall in Q4

In the fourth quarter, analysts expect Shake Shack (SHAK) to post adjusted EPS of $0.03, a fall of 69% from $0.10 in the corresponding quarter of 2017.

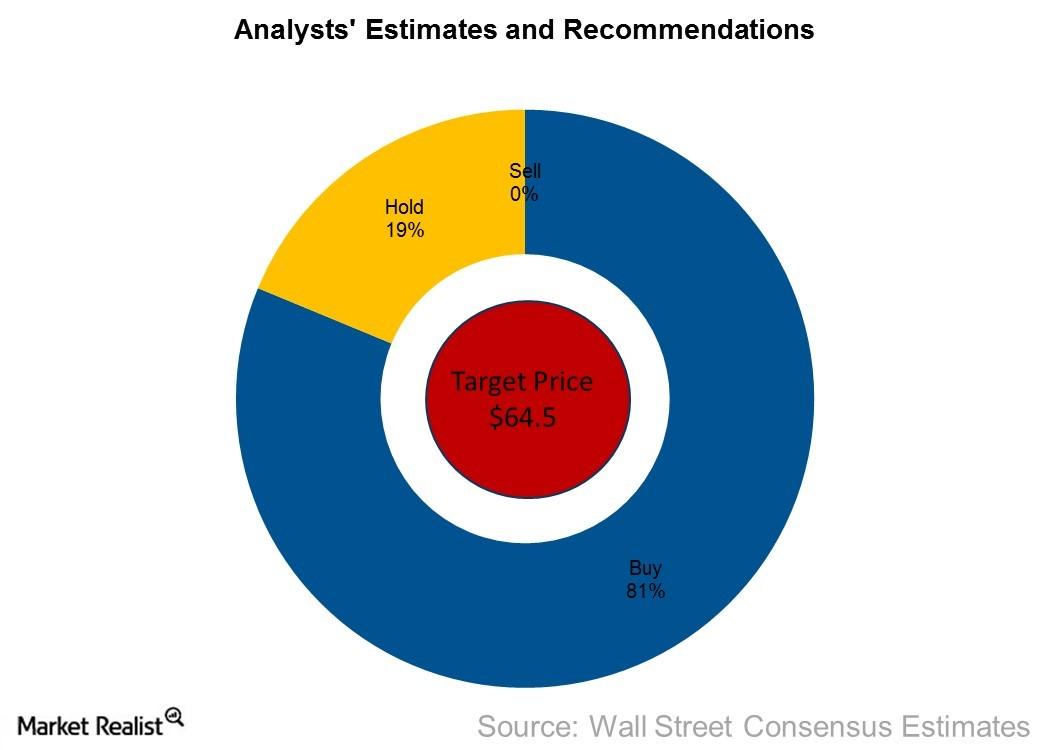

Why Analysts Are Recommending “Buy” for Starbucks

Target price On January 13, 2017, Starbucks (SBUX) was trading at $57.85. The company’s share price may already have been factored into the estimates we’ve discussed in this series. In this article, we’ll look at analysts’ recommendations and estimated target prices for the stock over the next 12 months. Despite Starbucks posting strong 4Q16 earnings […]

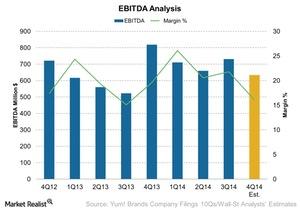

Why Yum! Brands Is Expected To Report Lower EBITDA

Wall Street analysts’ estimated EBITDA for the fourth quarter is $633 million—compared to $918 million in the same quarter last year.

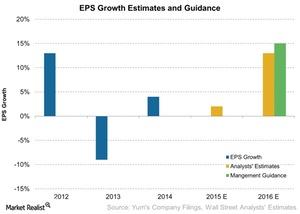

Why Investors Are Confident in YUM ahead of Its 3Q16 Results

Yum! Brands develops, operates, franchises, and licenses the Pizza Hut, KFC, and Taco Bell brands. It’s set to announce its 3Q16 results on October 5, 2016.

When Will Yum! Complete the Separation of Its China Division?

On October 20, Yum! announced that it will separate its China division from the rest of its business. It’s expected to complete this by the end of 2016.

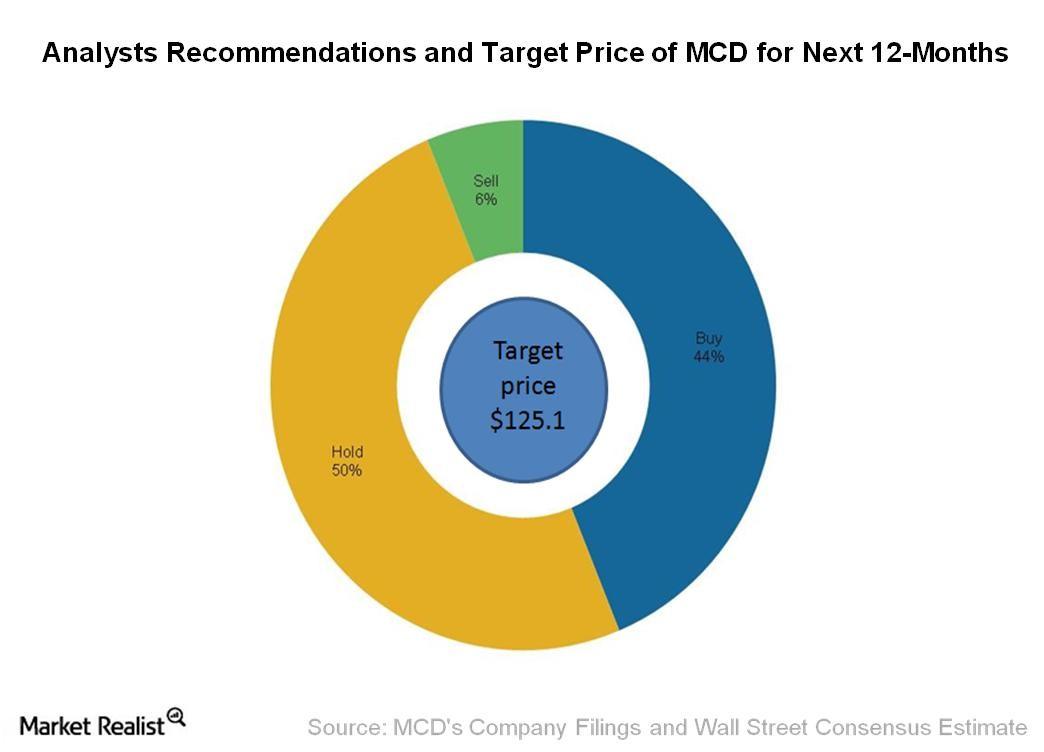

Analysts Revised the Price Target after McDonald’s Earnings

Wall Street analysts set a price target of $125.1 for the next 12 months with a return potential of 5% from the closing price of $119.2 on January 25.

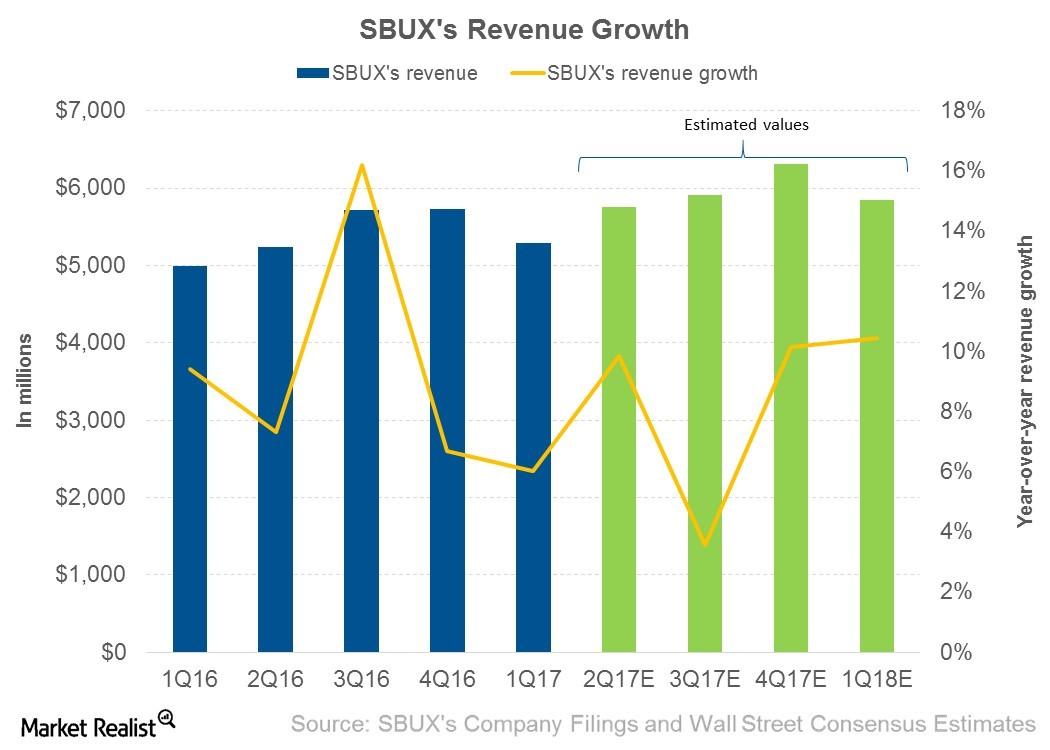

Why Investors Weren’t Impressed by Starbucks’s Fiscal 2Q17

Starbucks (SBUX) posted its fiscal 2Q17 earnings after the market closed on April 27, 2017. Its EPS was $0.45 on revenues of $5.3 billion.

What to Expect from Starbucks’s Revenue in Next 4 Quarters

In the next four quarters, analysts are expecting Starbucks (SBUX) to post revenue of $23.8 billion, which represents an increase of 8.4% from $22.0 billion in the corresponding quarters of the previous year.

BYND Leads Alt-Meat Market, Faces New Competitors

On Friday, investment bank UBS started coverage on Beyond Meat Stock (BYND). At 10:08 AM ET today, the stock was trading 4.4% lower at $76.5.Consumer Must-know: Chipotle Mexican Grill’s food costs

CMG reported $372 million in food costs in 3Q14. Food costs accounted for 34.3% of the revenue. It was an increase of 70 basis points year-over-year (or YoY).

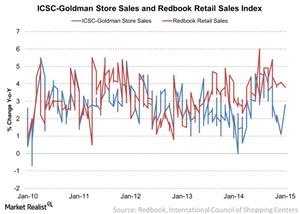

Retail Sales Reports From ICSC-Goldman And Johnson Redbook

The ICSC-Goldman and Johnson Redbook indices both report consumer spending data each week, but people consider the ICSC-Goldman index to be more consistent.

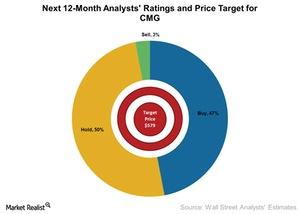

Must Know: Analysts’ Price Target for Chipotle Mexican Grill

About 47% of analysts have “buy” recommendations on Chipotle, 50% of analysts have “hold” recommendations, and 3% have “sell” recommendations on the company. Overall, the stock has a “buy” rating.Consumer Why Yum! Brands’ division in China is important

Yum! Brands’ (YUM) division in China includes its business in mainland China. It’s the combined revenues from all the brands—KFC, Pizza Hut, East Dawning, and the Little Sheep.Consumer Analyzing Burger King’s shifting business model focus in 2Q14

Franchise revenues include royalties and franchise fees. Royalties are calculated as a percentage of franchise restaurant revenues, which are driven by same-store sales.

McDonald’s Risks, Strengths, and Weaknesses

The restaurant industry is susceptible to a wide array of risks of macro and micro factors. As a huge global brand, McDonald’s faces several risks.Consumer Must-know: Dunkin’s major costs of operations

Dunkin’ Brands Group (DNKN) has three major costs of operations. The costs of operations include general and administrative expenses, cost of products sold, and occupancy expense. Dunkin’s general and administrative expenses accounted for $56 million in the second quarter. This was 30% as a percentage of sales—compared to $62 million, or 34%, as a percentage of sales.Earnings Report Starbucks’ strategy: Aggressive unit growth

Unit growth is a key driver that Starbucks is aggressively pursuing to grow the company’s sales. In the last 12 months, Starbucks has added 1,599 net new restaurants, or 8% growth in units.

An In-Depth Overview of Panera Bread

Panera Bread is a limited-service fast-casual restaurant company. In July 2017, JAB acquired Panera in a $7.5 billion deal and took it private.

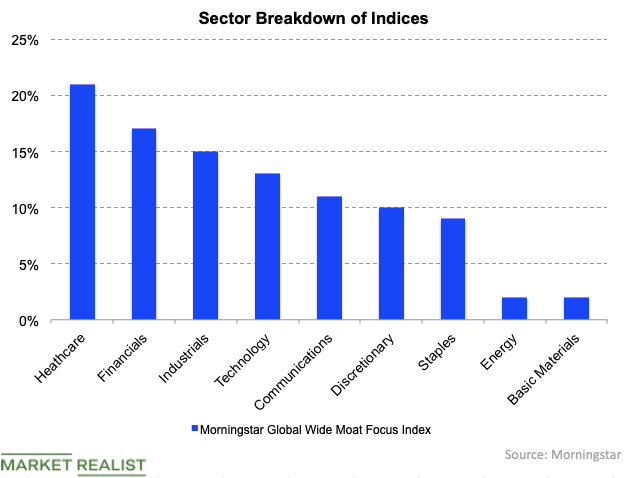

How to Invest in Global Wide Moat Stocks

The Morningstar Global Wide Moat Focus Index has global exposure, unlike the Morningstar International Moat Index (MOTI).

Analyzing Shake Shack’s Fine-Casual Concept

Shake Shack is conceptualized as a “new fine-casual” restaurant format. The fine-casual restaurant is a hybrid of the fine dining and fast-casual dining formats.

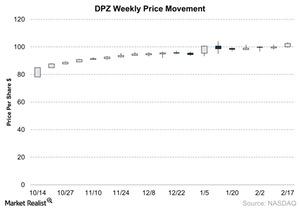

Domino’s Stock Jumps 21% Since Last Earnings Release

Year-to-date, Domino’s stock is up 8.7%, as of February 20. It has rocketed 21% since the company’s last earnings release in October 2014.Consumer Must-know: Yum! Brands’ segments by business models

For six months ending June 2014, China’s division reported revenue of $3 billion, or 52% of Yum! revenues. China only represents 15% of the more than 40,000 Yum! restaurant units.

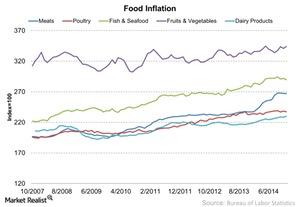

How Food Inflation Impacts The Restaurant Industry

Food inflation can squeeze a restaurant’s operating margins, but a restaurant can adjust the menu pricing and pass the cost on to customers.

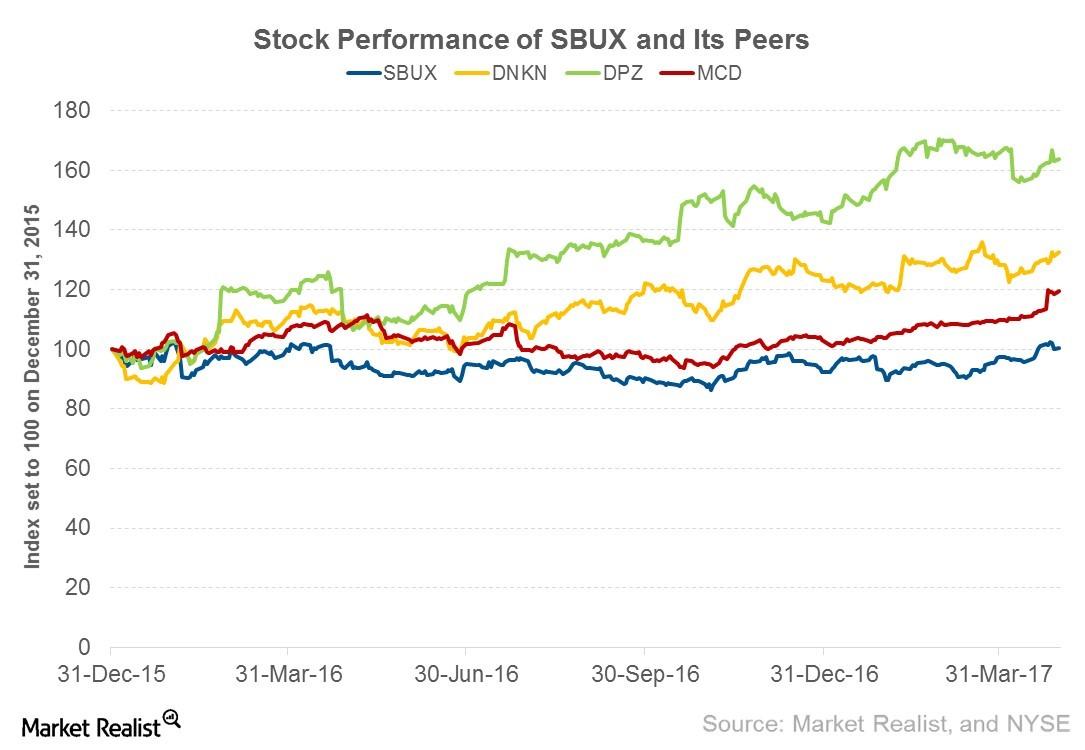

What’s Behind the Decline in Starbucks Stock Price

After posting its fiscal 2Q17 earnings on April 27, 2017, Starbucks (SBUX) stock rose 5.3% to reach $64.57 on June 2, 2017. The aggressive expansion plans in the CAP (China and Asia-Pacific) region and its implementation of technological advancements led Starbucks stock price to rise. However, since then, the stock has seen downward momentum.